References

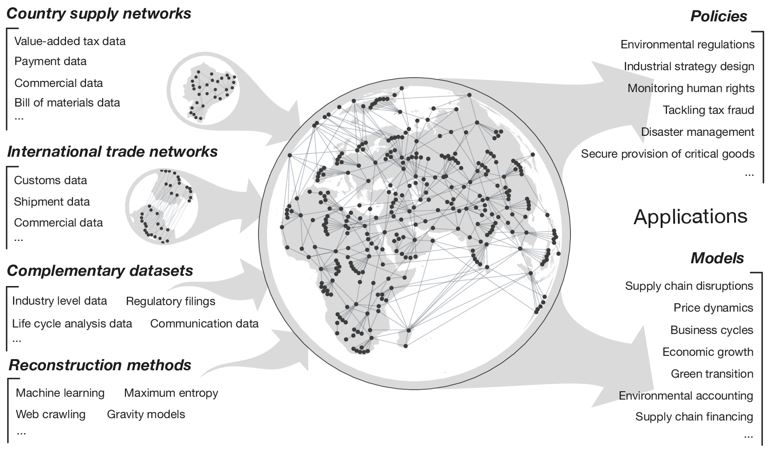

Pichler, A., Diem, C., Brintrup, A., Lafond, F., Magerman, G., Buiten, G., Choi, T.Y., Carvalho, V.M., Farmer, J.D., & Thurner, S. (2023). Building an alliance to map global supply networks. Science, 382(6668), 270-272.

O. Celasun, N.-J. H. Hansen, A. Mineshima, M. Spector, J. Zhou, Supply bottlenecks: Where, why, how much, and what next? Working Paper WP/22/31, International Monetary Fund, 17 February 2022.

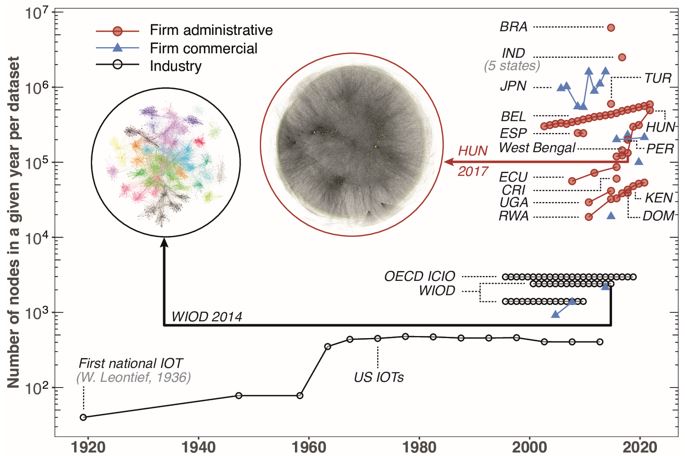

A. Bacilieri, A. Borsos, P. Astudillo-Estevez, F. Lafond, Firm-level production networks: What do we (really) know? Working paper 2023-08, Institute for New Economic Thinking, University of Oxford, Oxford, May 2023.

Carvalho, V. M., Nirei, M., Saito, Y. U., & Tahbaz-Salehi, A. (2021). Supply chain disruptions: Evidence from the Great East Japan earthquake. The Quarterly Journal of Economics, 136(2), 1255-1321.

Diem, C., Borsos, A., Reisch, T., Kertész, J., & Thurner, S. (2022). Quantifying firm-level economic systemic risk from nation-wide supply networks. Scientific reports, 12(1), 7719.

Diem, C., Borsos, A., Reisch, T., Kerte sz, J., & Thurner, S. (2024). Estimating the loss of economic predictability from aggregating firm-level production networks. PNAS Nexus, in press.

Alexopoulos, A., Dellaportas, P., Gyoshev, S., Kotsogiannis, C., & Pavkov, T. (2020). Detecting network anomalies in the Value Added Taxes (VAT) system. A TARC Policy Analysis Report.

Dhyne, E., Kikkawa, A. K., Mogstad, M., & Tintelnot, F. (2021). Trade and domestic production networks. The Review of Economic Studies, 88(2), 643-668.

Duprez, C., & Magerman, G. (2018). Price updating in production networks (No. 352). NBB Working Paper.

Brintrup, A., Wichmann, P., Woodall, P., McFarlane, D., Nicks, E. and Krechel, W., 2018. Predicting hidden links in supply networks. Complexity, 2018, pp.1-12.

Mungo, L., Lafond, F., Astudillo-Estévez, P. and Farmer, J.D., 2023. Reconstructing production networks using machine learning. Journal of Economic Dynamics and Control, 148, p.104607.

Stangl, J., Borsos, A., Diem, C., Reisch, T., & Thurner, S. (2024). Reducing employment and economic output loss in rapid decarbonization scenarios using firm-level production networks. Nature Sustainability, in press.

Tabachová, Z., Diem, C., Borsos, A., Burger, C., & Thurner, S. (2023). Estimating the impact of supply chain network contagion on financial stability. arXiv:2305.04865.