This policy brief is based on Bank of Italy, Working Paper No 1482. The views expressed are those of the authors and do not involve the responsibility of the Bank of Italy.

Abstract

What are the macroeconomic implications of shifting to greener technologies in the transition towards a low-emission economy? We identify shocks to the composition of US innovation entailing a move towards greener technologies by exploiting granular data on the universe of patents granted in the United States. The rebalancing towards greener tech is costly in the short run – lowering output and raising inflation – but Pareto-improving in the medium run, when the recessionary effects dissipate, the emissions intensity of output declines persistently, and energy production shifts towards renewables. These effects are independent of variations in national and international climate policy commitments.

The transition to a low-carbon economy has emerged as a global policy priority, but empirical evidence on the aggregate implications of this process for output and consumer prices remains limited. One reason is that the literature has mainly focused on public policies for the transition, such as carbon taxes and cap-and-trade systems that, while effective in reducing emissions in some jurisdictions, may still fail to reach the emission targets at the global scale if not accompanied by an outright shift towards greener technologies in production.

In a recent paper (Ferriani, Gazzani, and Natoli 2025), we shed light on this crucial issue by investigating the aggregate trade-offs that arise from shifting the innovation paradigm towards greener technologies. By leveraging on granular U.S. patent data, we examine how the economy reacts to a technological reallocation towards greener technologies.

To build our indicator of recomposition towards greener technological innovation, we rely on monthly U.S. patent data from PatEx and PatentsView, two datasets that provide detailed information on patent filings. Green technologies are identified using the Y02 classification, which includes patents related to climate change mitigation.

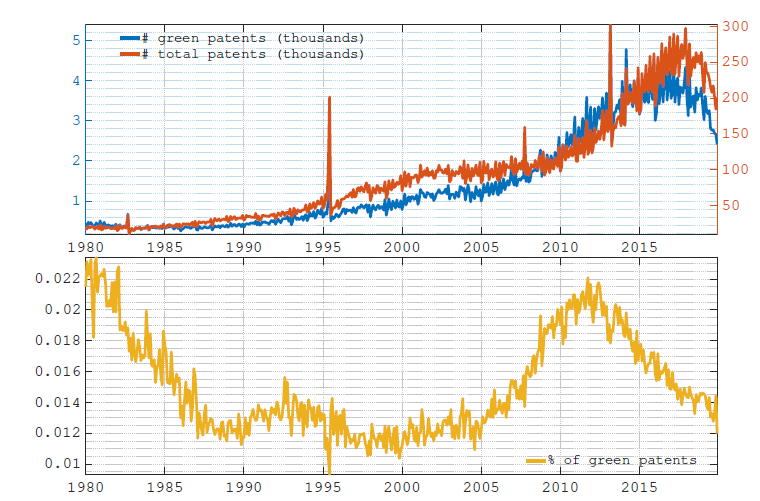

We focus on the share of green patents filed each month relative to total filings, using the filing date as a proxy for when information about new technologies becomes available for the first time. This approach allows us to track changes in the weight of green innovation on the whole technological progress over time and study its macroeconomic consequences at business cycle frequency. Figure 1 displays the dynamics of green versus total patent filing activity (top panel) and the ratio of green to total patents (gpt, bottom panel) from 1980 onward.

To address potential endogeneity concerns in patenting with respect to the economy dynamics, we purge our measure of the influence of oil prices and changes in credit conditions. The resulting series, that we label , is orthogonal to a comprehensive set of monetary and fiscal policy shocks, and serves as a clean indicator of recomposition towards greener innovation.

Figure 1. Total patent filing and share of green patents

Note: Total vs green patent filing activity (upper panel) and share of green patents over total patents (lower panel); data only refers to granted patents.

Source: USPTO PatEx and PatentsView.

We use the exogenous fluctuations in the incidence of green patents within a Vector Autoregressive (VAR) model of the U.S. economy, estimated over the 1980–2019 period, to gauge the macroeconomic effects of green technology recomposition shocks.

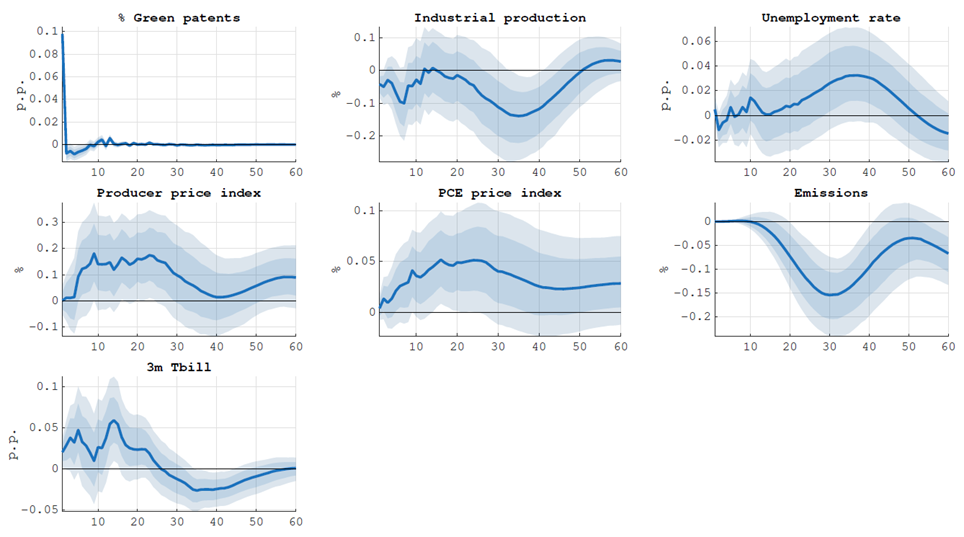

Results are reported in Figure 2. In the short run, a shift towards a greener technology mix leads to a decline in carbon emissions, a drop in output, and a rise in both producer and consumer prices. The shock can thus be interpreted as a temporary negative supply-side disturbance. However, such stagflationary effects are short-lived, with economic activity recovering within five years. Although emissions decline more gradually than output, its carbon emissions intensity (i.e., the quantity of emissions per unit of production) eventually falls

Figure 2. Monthly VAR – IRF to a green technology recomposition shock

Note: Baseline IRFs to a green technology recomposition shock. Shaded areas denote 68% and 90% confidence bands; the horizon is in months.

In other words, the technological recomposition results in a Pareto improvement in the medium run, as the adverse output effects dissipate while the decline in emission intensity persists over time. Quantitatively, our green technology recomposition shock accounts for a significant share of the variance in carbon emissions (10%) while explaining a more modest portion of the volatility in macroeconomic aggregates. This further supports the interpretation of our shock as one affecting the composition – rather than the level – of technological innovation. Importantly, our results are unaffected by if we control for (national and international) climate policy indicators, as well as changes in public attention on climate change.

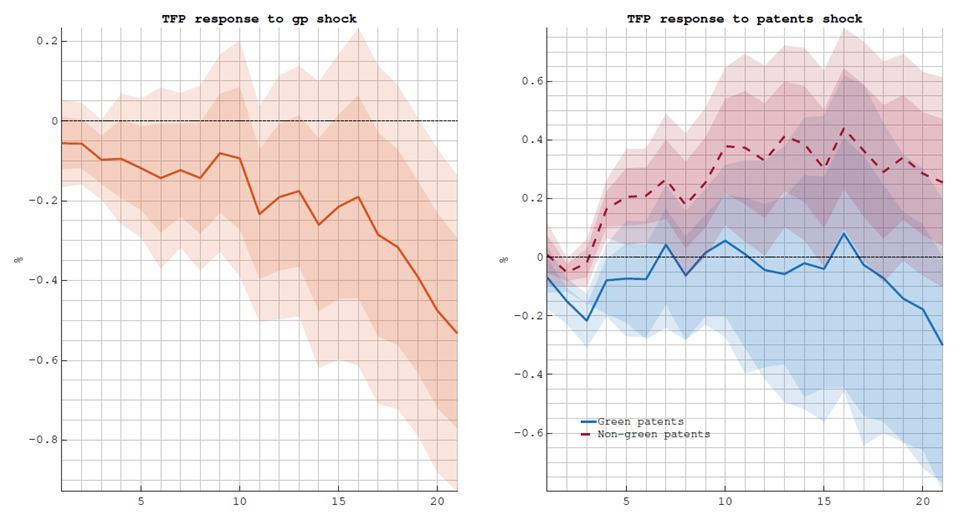

We show that the root of the negative supply-side effect lies in the adverse impact on aggregate productivity (TFP), consistent with the view that green (emission-constrained) technologies are, overall, less mature than brown ones. Consequently, increasing their weight in firms’ technology mix temporarily reduces production efficiency. The left panel in Figure 3 shows a delayed negative response of TFP to a shock, validating the interpretation of the shock as a negative supply disturbance. The right panel corroborates this finding by displaying the heterogeneous effects of green and non-green patenting on TFP. An increase in the number of brown patents exerts a lagged positive influence on TFP; conversely, a rise in the number of green patents does not produce any significant effect.

Moreover, by linking the patenting activity of a subsample of quoted firms to their financial performance, we show that financial markets positively reward new green patents (see also Hege et al., 2023). Thus, positive equity returns may explain why firms decide to switch to green innovation despite the negative impact on productivity.

Figure 3. TFP response to green recomposition and patent shock

Note: TFP response to a green recomposition shock estimate with local projections. Shaded areas denote 68% and 90% confidence bands; the horizon is in quarters.

Our study sheds light on the macroeconomic and environmental implications of a shift toward a low-carbon technology. The progress towards a more sustainable future is costly, as reallocating technological development to greener innovation acts as a negative supply-side shock in the short term: output falls while unemployment and consumer prices rise. However, these costs are significantly outweighed by medium-term economic and environmental gains. The results of our analysis have important policy implications and suggests that while short-term economic adjustments may pose challenges, the adoption of greener technologies emerges as an important complement of policy measures such as carbon taxes that may enhance long-term synergies to achieve emissions reduction.

Ferriani, F., Gazzani, A., and Natoli, F. (2025). “The macroeconomic effects of a greener technology mix.” Bank of Italy, Temi di Discussione.

Miranda-Agrippino, S., Hoke, S. H., and Bluwstein K. (2020): “Patents, News, and Business Cycles,” CEPR Discussion Papers 15062.

Hege, U., Pouget, S., and Y. Zhang, Y. (2023): “The Impact of Corporate Climate Action on Financial Markets: Evidence from Climate-Related Patents,” Working paper