Disclaimer: This policy brief is based on Banco de España Occasional Paper No 2509. The opinions and analyses in this policy brief are the responsibility of the authors and, therefore, do not necessarily coincide with those of the Banco de España or the Eurosystem.

Abstract

In a liquidity stress scenario, banks may need to urgently monetise assets to meet deposit outflows. This can be done by either selling the assets or using them as collateral in financing operations with the central bank. The sale of assets classified at amortised cost will result in the materialisation of any accumulated unrealised losses, adversely affecting the banks’ profitability. Alternatively, central bank financing prevents the materialisation of unrealised losses, which, however, limit the amount of financing that can be obtained through this mechanism, as it is based on the market value of the collateral provided. In this case, the increase in interest expenses will also impact banks’ profitability. All these negative effects on profitability ultimately affect solvency and can exacerbate the initial liquidity crisis. Thus, there is a link between liquidity stress and solvency deterioration in which unrealised losses play a significant role. In this context, we develop an analytical tool to assess the potential impact of unrealised losses on Spanish banks’ solvency under liquidity stress.

The crisis of some mid-sized banks in the United States and of Credit Suisse in March 2023 was linked to structural and governance factors that led to significant liquidity outflows, forcing these entities to quickly monetize assets to try to meet these outflows. This ultimately affected their solvency and generated turmoil in the international financial system. The banking sector in the euro area, and particularly in Spain, faced these turbulences with high capital and liquidity positions, which significantly limited their impact.

Leaving aside these banks’ idiosyncratic factors and the supervisory differences between the United States and the euro area, that episode highlights the nexus between liquidity and solvency: as is well known, doubts emerging about a bank’s solvency can trigger a liquidity crisis, with sudden and intense fund outflows that can ultimately exacerbate its initial solvency crisis. The nexus also operates in the opposite direction: a sudden liquidity crisis may require the hasty monetisation of assets to absorb fund outflows, which can negatively impact the bank’s financial situation and thus its solvency, exacerbating the initial liquidity crisis.

The existence of unrealised losses in investments in fixed-income instruments is one of the channels through which this impact can materialize in scenarios of rising interest rates and severe liquidity stress. Unrealised losses usually appear due to an increase in interest rates, resulting in a deterioration of the present value of these assets. In a scenario of severe liquidity stress, these latent losses can become realised if the associated assets are sold, or they can limit access to financing if these assets are used as collateral. This would cause a deterioration in banks’ profitability, which is how the liquidity crisis ultimately weakens solvency.

In general, the impact on banks’ financial situation of the valuation losses or gains of debt instruments depends on their accounting classification, which is based on the purpose of these investments. In certain cases, for example, when they are held primarily for trading, banks must record them at their fair (or market) value at all times. That means that losses or gains resulting from valuation changes are directly reflected on the balance sheet, either through profit or loss or directly reducing equity. In the case of debt securities that banks hold to collect the associated contractual cash flows, no trading activities are conducted on them and, consequently, are recorded at amortized cost. In that case, any changes in their market value are not immediately recognized. As a result, changes in market value, either losses or gains, remain unrealised, and unrecognised in the accounts, as they will not materialize if the bank holds the investment to maturity. Typically, this accounting classification is permanent, although banks can make reclassifications if they justify them to the supervisory authority.

In a liquidity stress situation, banks might be forced to rapidly monetize assets. Under these circumstances, government debt holdings become an attractive option due to the availability of organized and highly liquid markets where they can be sold readily. These characteristics also make them suitable as collateral in financing operations. For these reasons, these are the type of debt holdings considered in this analysis.

After credit, debt securities holdings are the second most important investment for Spanish banks. At December 2023 these investments accounted for 14.3% of consolidated assets, a year-on-year increase of 8.3% as a result of a growing trend – both in absolute terms and as a percentage of assets – that began in 2022. The great majority of these investments in debt securities were government debt holdings, which accounted for 80.8% of the total at end-2023, amounting to more than €480 billion.

Besides, the weight of government debt holdings classified at amortised cost on the balance sheets of Spanish banks has grown substantially in recent years, from 39.3% of the total at December 2019 to 53.8% at end-2021. In the period following the outbreak of the COVID-19 pandemic, the Eurosystem provided vast amounts of long-term funding, part of which was used by banks to purchase government debt. This explains much of the rapid increase in sovereign debt holdings held at amortised cost since early 2022, which reached 63.4 % at end-2023.

The growth in the volume of sovereign debt classified at amortised cost, together with the rapid and substantial increase in monetary policy rates in 2022 and 2023, led to a build-up of unrealised losses on banks’ balance sheets that they could have been forced to realise had they needed to liquidate some of these assets under hypothetical scenarios of large liquidity outflows. In this period, unrealised losses represented, on average, 7.2% and 5.3% of the book value of this portfolio in December 2022 and December 2023, respectively, with notable heterogeneity observed among entities, which would be partly related to their level of solvency and liquidity. These figures are similar to the European average on all types of debt holdings classified at amortised cost (6.1%), according to data provided by the European Banking Authority.

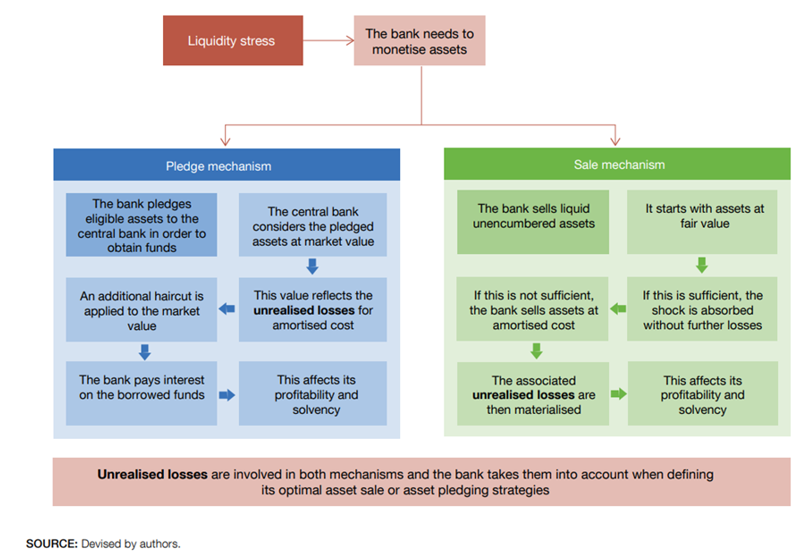

In this context, our work builds on existing literature about the impact of rising interest rates on the value of banks’ assets. In particular, we develop an analytical tool aimed at assessing the consequences for financial stability derived from this urgent monetization of assets under two possible mechanisms to obtain liquidity: i) sale of assets in the secondary market; and ii) pledge of assets in funding operations with the Eurosystem. Figure 1 describes the main features of both mechanisms.

This set up allows us to examine the extent to which these mechanisms can exacerbate or mitigate the propagation of a liquidity crisis to a more broad-based deterioration of banks’ financial position and, ultimately, their solvency.

Figure 1. Mechanisms for obtaining liquidity under stress scenarios

On the one hand, the sale mechanism allows banks to obtain liquidity by selling part of their assets. Although this mechanism entails the realisation of any unrealised losses accumulated in debt holdings classified at amortised cost, there are reasons to choose this option. Among them, the need to reduce assets amid sudden fund outflows with uncertain recovery, the willingness to avoid the potential stigma associated with resorting to non-market financing facilities, or the lack of operational preparedness to quickly resort to Eurosystem financing.

On the other hand, pledging assets in the Eurosystem allows banks to obtain liquidity by using assets as collateral in financing operations. For this, they need to have unencumbered assets (such as sovereign bonds) that are eligible as collateral in lending operations. These refinancing operations are part of the central bank’s regular operations and are implemented via the marginal lending facility, which is permanently open for overnight refinancing. These loans can subsequently be replaced or complemented by main refinancing operations (MROs), with a maturity of one week, as well as by longer-term operations (LTROs), with a maturity of three months. These assets are considered at market value, reflecting, if any, the accumulated unrealised losses. Additionally, the central bank applies valuation haircuts based on the liquidity and residual maturity of the instrument as well as additional discount factors based on the solvency of the instrument issuer. This mechanism avoids selling assets and thus the potential materialisation of unrealised losses, though it implies the payment of interest on the financing obtained, which also has a negative financial effect on banks.

The stylized simulation exercise carried out illustrates the impact on solvency of the urgent monetisation of assets through the two mechanisms for obtaining liquidity described above. The reference date for the exercise is December 2023 and the analysis is conducted on the 10 significant Spanish banks. For each mechanism, an optimisation criterion is defined to determine the order in which the assets are sold or pledged. This criterion seeks to reflect the optimality decisions that a bank subject to a liquidity stress scenario would tend to follow. For the sale mechanism, this criterion aims to minimize the total realized loss (for example, first selling assets classified at fair value, and then assets classified at amortised cost with the smallest unrealised loss), while for the pledging mechanism, the ordering seeks to optimise the financing obtained (i.e., minimising the volume of pledged assets).

Regarding the liquidity stress scenario considered, a different volume of net outflows is considered for each bank based on their situation as of December 2023, considering the composition of their funding sources and, for each of these sources, different outflow percentages. These percentages are calibrated based on past stress liquidity episodes that affected certain Spanish banks.

This methodology leads to an aggregate volume of net outflows of € 506 billion. To cover these outflows, banks would first use their cash and excess reserves in central banks, covering up to € 362 billion. To meet the remaining liquidity outflows (€ 144 billion), banks would use one of the asset monetisation mechanisms described above. In the case of pledging assets to obtain funding from the Eurosystem, the related interest costs would amount to € 1,533 million per quarter, equivalent to 10 basis points (bp) of the banks’ solvency ratio. Over the course of one year, the funding cost would exceed € 6 billion, equivalent to 42 bp of the banks’ average CET1 ratio. Under the asset sale mechanism, and in the absence of market tensions that could make it necessary to sell assets at a discount, the banks would obtain gains of € 101 million. This would be attributable to significant debt holdings at amortised cost whose market value at December 2023 exceeded their book value, and these assets would be the first to be sold, generating this gain.

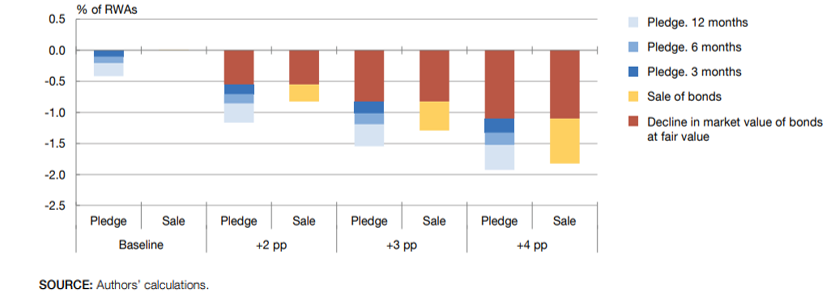

Furthermore, to study a broader potential impact of unrealised losses on the deterioration of solvency, in addition to the liquidity stress scenario, three hypothetical scenarios of interest rate increases are also defined. These scenarios consider additional interest rate hikes in the form of parallel increases across all maturities of 2 percentage points (pp), 3 pp, and 4 pp from the baseline level. This would reduce the market value of the debt instruments held by banks, both those classified at amortised cost (thereby increasing unrealized losses) and those classified at fair value.

Figure 2 shows the main results of these simulation exercises. Under these additional scenarios, the drop in the market value of bonds recorded at fair value would result in an initial impact on banks’ solvency (brown bars) of €4 billion -approximately 30 bp in terms of risk weighted assets (RWAs)- for each percentage point increase in interest rates. This impact is not due to the interaction of liquidity and solvency risks. In addition to these losses, the liquidity stress scenario considered would lead to reductions in the CET1 solvency ratio that could reach an additional 72 bp under the asset sale mechanism in the most severe interest rate hike scenario (yellow bar in the +4 pp category on the horizontal axis). With smaller interest rate increases (for example, a 2 pp increase), this loss would moderate significantly to 28 bp (green bar in the +2 pp category on the horizontal axis).

Figure 2. Solvency impact of the pledge and sale mechanism for government bonds under liquidity stress and interest rate hike scenarios. Spanish significant banks. Consolidated basis.

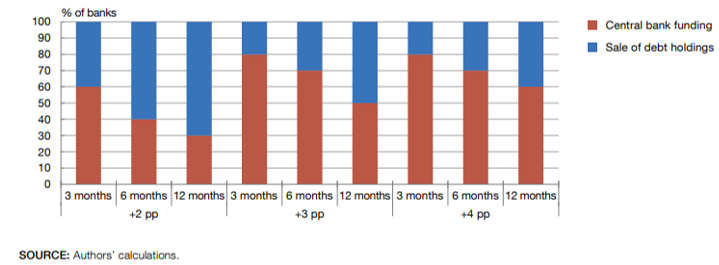

Given the differing composition of the banks’ sovereign bond portfolios, the unrealised losses materialised in the event of sale vary widely across banks, therefore affecting its impact on solvency. Figure 3 shows, for the different scenarios considered, the proportion of banks for which each mechanism (pledging or sale) would have a smaller impact on capital. As can be seen, the percentage of banks for which the pledge mechanism is the better option grows as the interest rates increase and decreases with the duration of the stress episode. The reasons for these relationships are clear: in the first case, higher interest rates increase unrealised losses, making the sale option more costly; in the second case, extending Eurosystem’s funding over time entails a higher borrowing cost under the pledge mechanism.

Figure 3. Distribution among banks of the mechanism with the smaller solvency impact under different scenarios of liquidity crisis duration and interest rate hikes. Spanish significant banks. Consolidated basis.

In a situation of low unrealised losses, as was the case in December 2023, the asset sale mechanism would be the least burdensome option given the existence of unrealised gains in part of the bond portfolio at amortised cost. In periods of monetary tightening, when banks accumulate greater unrealised losses on their balance sheets, obtaining liquidity by pledging assets with the central bank could be a less harmful option, especially given the short duration that typically characterizes liquidity crises. In this context, the use of assets as collateral in financing operations with the central bank avoids the materialisation of unrealised losses and can reduce the financial cost of asset monetisation. Therefore, this mechanism can largely prevent liquidity stress situations from ultimately weakening banks’ solvency.