This policy brief is based on IMF Working Paper 25/142. The views expressed are those of the authors and not necessarily the views of the IMF, its Executive Board, or IMF management.

Abstract

We present new evidence on the impact of fiscal variables on long-term interest rates and term premia in the United States. To alleviate endogeneity problems, we follow the seminal methodology by Laubach (2009) and resort to long-term projections of interest rates and fiscal variables. After incorporating an additional 20 years of data into our sample, the estimated effects of debt and deficits on interest rates show little change from Laubach’s findings. However, we show that the link between long-term rates and fiscal variables is not stable over time. It was close to zero during the years of relative fiscal prudence around the turn of the century and it has been increasing since fiscal positions have started to deteriorate markedly.

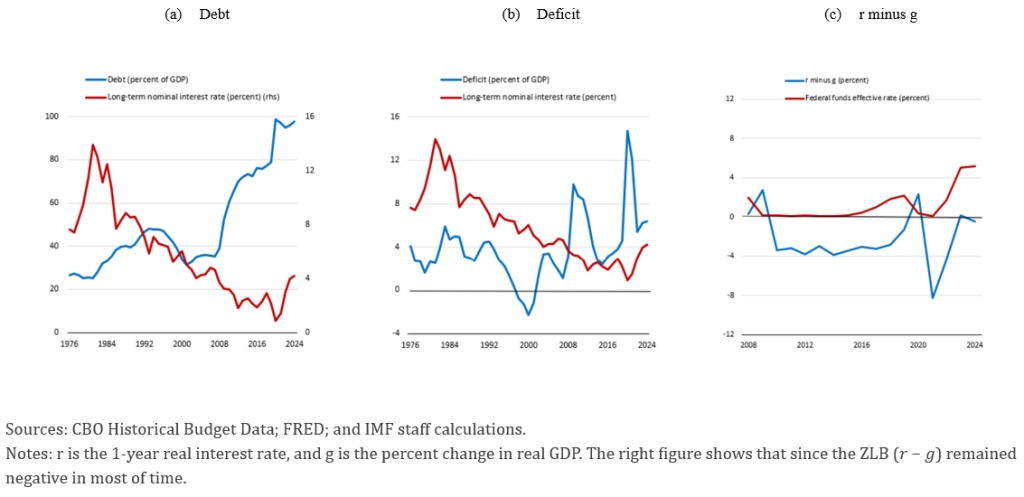

Since the 1980s, US long-term interest rates have been on a declining trend, while debt and deficits have consistently increased in most of these years. This trend has become more pronounced in the decade following the Global Financial Crisis (GFC), characterized by a continuous rise in debt-to-GDP levels in the United States, a sharp deterioration in fiscal deficits, and nominal interest rates reaching historically low levels. For a prolonged period of time real interest rates remained significantly below real GDP growth rates (see Figure1). This pattern of high debt and exceptionally low rates has contributed to a more benign perspective regarding the costs associated with worsening fiscal positions (e.g., Blanchard 2019, Mankiw 2022, and Bernanke and Blanchard 2023).

Figure 1. Fiscal Variables and Interest Rates Over Time

Do these patterns imply that long-term interest rates have become less sensitive to increases in debt and deficit over time?

To answer this question and assess the impact of debt and deficits on long-term interest rates we follow the approach first proposed by Laubach (2009). In his seminal paper, Laubach emphasized the importance of examining the relationship between long-term expectations of interest rates and fiscal variables to mitigate endogeneity issues. The rationale is that deficits, debt, and interest rates expected to prevail several years in the future are little affected by short-term factors related to the current state of the business cycle, thus reducing confounding effects including those induced by counter-cyclical monetary policy and automatic fiscal stabilizers.

The Congress Budget Office (CBO) reports its own forecasts of fiscal variables for various time horizons. For our analysis, we use, specifically, the 5-year-ahead projections of debt, deficits and GDP throughout the analysis. Another challenge to accurate identification arises from the fact that forecasts of long-term interest rates can influence projections of long-term debt and deficits, potentially resulting in inflated coefficients for the effects of debt and deficits on interest rates. That is, in the absence of a credible fiscal rule, higher projected interest rates will “automatically” translate into higher projected debt levels. To mitigate this, our analysis not only experiments with a host of additional controls but also considers the impact of primary deficits. Furthermore, we conduct a robustness check by using bond term premium data from the Federal Reserve Board, calculated using the methodology established by Adrian, Crump, and Moench (2013), as an alternative dependent variable.

Laubach (2009) strategy addresses some of the identification issues, however, numerous conceivable long-term factors jointly determine fiscal variables and interest rates. Therefore, we extend this approach by augmenting the set of control variables that could conceivably affect long- term interest rates and fiscal variables at the same time—such as population growth forecasts, risk aversion, medium-term real GDP growth forecasts, and international purchases of US debt.

For the entire 50-year sample period (1976-2025) we examine, the estimated effects of debt and deficits on long-term interest rates are statistically and economically significant. Remarkably, the magnitudes are quite similar to those found in Laubach’s original study, despite roughly doubling the sample size. A 10 percent of GDP increase in expected debt is associated with an increase in long-term rates of between 20 and 30 basis points, while a 1 percent of GDP increase in the fiscal and primary balances is associated with a decrease in long-term rates of approximately 20 to 30 basis points.

In addition, including additional control variables is crucial; most are statistically significant, improving the overall fit of the regressions and markedly enhancing the precision of the effects of the fiscal variables.

In line with the predictions of the standard neoclassical model, we find that expected real growth is associated with higher interest rates. A greater global appetite for US bonds, proxied by a higher share of foreign holding of Treasuries is associated with lower interest rates. Population growth is associated with higher long-term interest rates, suggesting that its effect on saving is more than offset by an anticipated larger demand for capital. In contrast, we do not find significant effects for the measures of risk aversion.

A key contribution of our study is to show that the relationship between long-term rates and fiscal variables has evolved over time.

We begin by analyzing different subsamples, focusing on the periods preceding the Global Financial Crisis (GFC) and the COVID-19 pandemic. Checking if our specifications yield similar results for the pre-GFC period is an important robustness check, as this is the period used in the original Laubach (2009) paper. During this period, interest rates were consistently above zero and debt did not increase uninterruptedly. We also look at the period 1976-2019 years. The post-2020 years were exceptional in several ways and have been characterized by: (a) the rapid decline and subsequent recovery of output, (b) unprecedented fiscal expansion and inflation surges. It is therefore worth examining whether excluding this atypical period alters our findings.

When we restrict the sample to the pre-GFC period, our results barely change. The estimated coefficients for fiscal balances and debt (around -0.25 and 0.03, respectively) are also very close to those first reported by Laubach (2009). The estimations for the pre-COVID period are also very similar in magnitude for long-term rates but the size of the coefficients linking fiscal balances to term premia are larger.

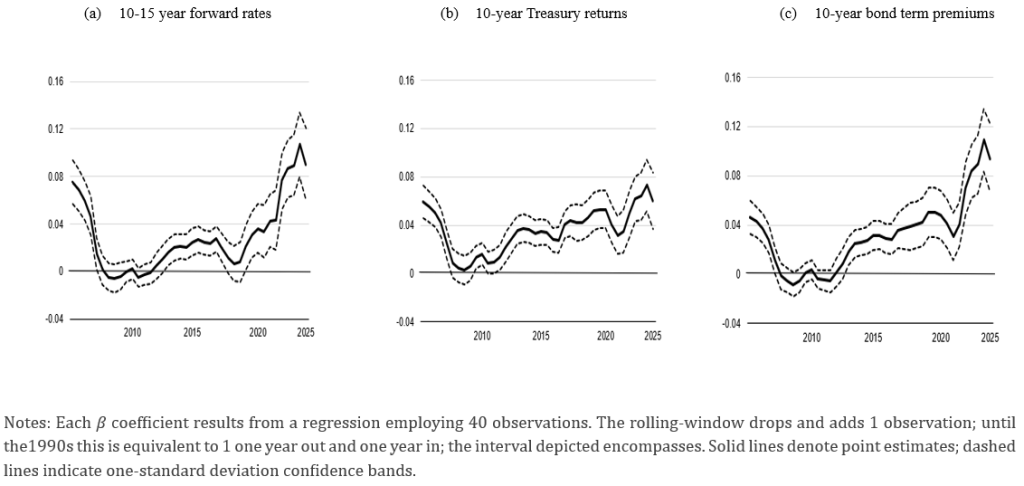

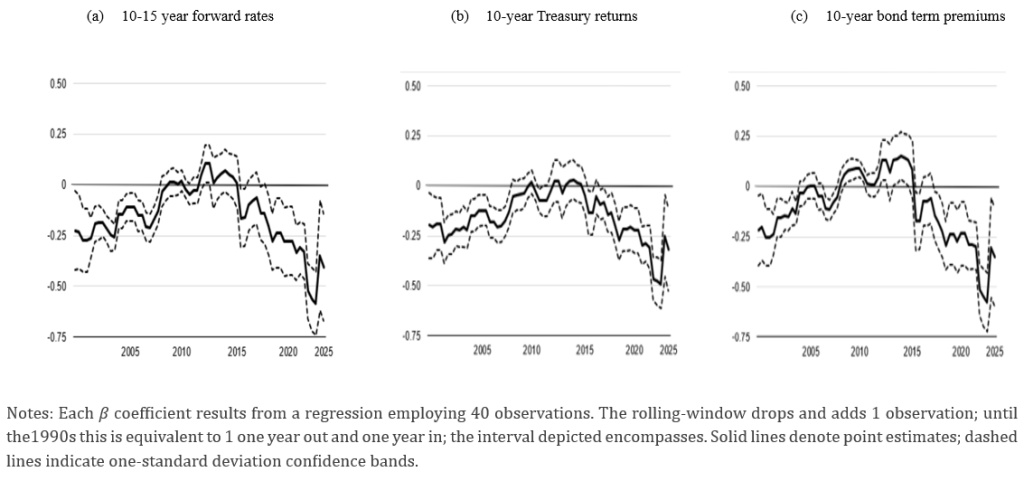

Finally, we conclude our analysis by applying rolling-windows regressions to investigate how the parameters of interest evolved over time. For all regressions we run, the number of observations is set equal to 40. This means each coefficient is estimated using approximately 20 years of data ending at the date displayed in the chart. As before, we experiment with both debt and balances and test the implications for forward rates and term premia.

Figure 2-3 depict our findings. Overall, the estimates reveal that the magnitude of the coefficients linking fiscal forecasts to long-term interest rates and term premia were close to zero in the twenty or so years ending between 2005 and 2010. Interestingly, this period coincides with low projected debt and deficits. Subsequently, the effects begin to increase as fiscal positions significantly deteriorate, even in the context of persistently low short-term interest rates.

Figure 2. Debt and Long-Term Interest Rates: Rolling-windows Regressions

Figure 3. Fiscal Balance and Long-Term Interest Rates: Rolling-windows Regressions

For academics and policymakers alike, understanding how fiscal policy in the United States impacts long-term interest rates is crucial. This has arguably become even more important in an environment of increasing debt levels.

Our study confirms that higher debt and deficits translate into higher long-term interest rates. For the entire 50-year sample period (1976-2025) we examine, the estimated effects of debt and deficits on long-term interest rates are statistically and economically significant, with magnitudes similar to those found in previous studies. All else being equal, long-term rates rise by 20 to 30 basis points in response to a 1 percentage point increase in the projected deficit-to-GDP ratio, and by the same amount in response to a 10 percentage points increase in the projected debt-to-GDP ratio.

We also show that the relationship between long-term rates and fiscal variables has evolved over time. It has weakened markedly for a brief period of time since the late 1970s: around the turn of the century, when US ran fiscal primary surpluses and debt to GDP was at levels unimaginable today.

Interestingly, as the fiscal position deteriorates, the estimated effects increase even when the years of very low short-term interest rates enter the estimation sample. Low interest rates are not tantamount to low effects; low deficits and debt seem to be. The results imply that projected higher deficit and debt in the United States is likely to further increases long-term interest rates.

Adrian, T., R.K. Crump, and E. Moench. 2013. “Pricing the Term Structure with Linear Regressions.” Journal of Financial Economics 110 (1): 110–138.

Bernanke, B. and O.J. Blanchard. 2023. What Caused the US Pandemic-Era Inflation? Working Paper Series WP23-4. Peterson Institute for International Economics.

Blanchard, O.J. 2019. “Public Debt and Low Interest Rates.” American Economic Review, 109 (4): 1197–1229.

Laubach, T. 2009. “Evidence on the Interest Rate Effects of Budget Deficits and Debt.” Journal of the European Economic Association 7 (4): 858–885.

Mankiw, N.G. 2022. “Government Debt and Capital Accumulation in an Era of Low Interest Rates.” Brookings Papers on Economic Activity 53 (1 (Spring)): 219–231.