This policy brief is based on Deutsche Bundesbank, Discussion Paper No 05/2025 “Bank lending and firm internal capital markets following a deglobalization shock”. The views expressed in this brief are those of the authors and do not necessarily reflect the views of the Deutsche Bundesbank or the Eurosystem.

Abstract

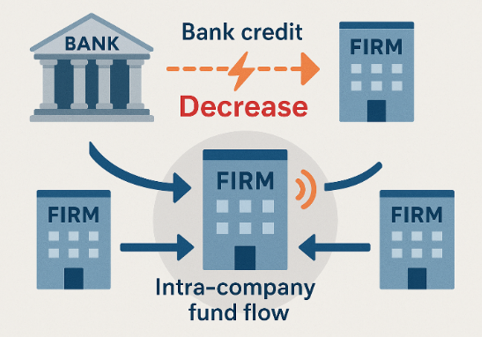

The Brexit referendum in June 2016 abruptly increased political and economic uncertainty. We show that German banks reduced lending to firms in the United Kingdom (UK) after the referendum, which reduced firms’ employment and investment. However, multinational corporations were able to mitigate this decline in external financing by using internal capital markets operated within their international corporate structures.

In recent years the pace of globalisation slowed and protectionist tendencies and geopolitical tensions have gained ground (Caldara and Iacoviello, 2022). Events such as Brexit or the trade conflict between the United States and China during Donald Trump’s first presidency contributed to higher economic uncertainty with the potential for greater market fragmentation. A deglobalisation shock like the outcome of the Brexit referendum raises new questions about economic resilience. One important question is whether external financial markets and internal capital markets amplify or mitigate such shocks. This is all the more pressing given the new US Administration’s trade policy stance, the worldwide measures and countermeasures taken in connection with this, and the turmoil this has caused.

In a new study (Imbierowicz, Nagengast, Prieto, and Vogel, 2025), we show that German banks reduced their lending to UK firms by an average of 20% following the Brexit referendum (and thus before the UK actually exited the EU). Our analyses show that well-capitalised and sound banks reduced their lending to UK firms even more. This behaviour likely reflects prudence and stable risk management practices. Furthermore, less profitable firms were hit especially hard as they received fewer new loans and were able to less frequently extend existing credit lines.

In further analyses, we look at the importance of multinational corporations’ internal capital markets. Our findings show that non-UK subsidiaries played a key role. They secured more external financing and routed these funds internally to support UK subsidiaries within their multinational corporation. Accordingly, despite the uncertainty the Brexit referendum caused, multinational corporations may support their UK subsidiaries to preserve long-term investments and operations. Internal capital markets thus offer financial flexibility and stability in times of crises. This is also evident when we examine the outcome of the bank credit supply shock on the real economy. UK firms in larger and regionally diversified groups were able to almost fully offset the drop in external financing. They kept their investment and employment levels stable after the Brexit referendum. By contrast, firms of smaller groups found it difficult to mitigate external financing constraints. Our findings therefore show that internal capital markets are an important buffer against the real economic damage external financing constraints caused due to a deglobalisation event.

We additionally show that the Brexit referendum shock did not only affect firms in the UK but changed banks’ overall lending behaviour. German banks with higher exposure to UK borrowers also reduced their lending to non-UK firms more after the Brexit referendum. Although UK firms’ probability of default did not increase significantly after the referendum, banks ended lending relationships with UK firms more often and issued generally smaller loans in both size and number. These findings suggest that banks adjusted their lending not because of specific risks but because they were more uncertain about future developments in the UK and the future success of firms. However, especially sound and prudent banks, which reduced their credit supply to UK borrowers, simultaneously increased their lending outside the UK. Additionally, the decrease in bank lending was less pronounced for borrowers that were part of German groups. This shows that banks value familiarity in times of uncertainty and adjust their lending accordingly.

Our study shows that a deglobalisation shock like the Brexit referendum caused an immediate credit crunch for firms in the UK. However, multinational groups in the UK could mitigate these negative effects by using internal capital markets. Our findings show that international integration can amplify the negative effects of deglobalisation due to supply-side international financial frictions. On the contrary, international integration can also mitigate these negative effects because multinational corporations may use firm-internal capital markets. Thus, greater real economic integration has positive effects and can build resilience. Overall, our findings show that uncertainty about future developments plays a key role in the adjustments made by banks and firms.

Caldara, D. and M. Iacoviello (2022). Measuring Geopolitical Risk. American Economic Review 112: 1194-1225.

Imbierowicz, B., A. Nagengast, E. Prieto and U. Vogel (2025). Bank lending and firm internal capital markets following a deglobalization shock. Journal of International Economics 157, 104119.