Disclaimer: The views expressed are those of the authors only and do not necessarily represent those of the Oesterreichische Nationalbank or the Eurosystem.

Since the introduction of the Single Supervisory Mechanism (SSM) in 2014, systemically important banks in the euro area are directly supervised by the ECB. From a static and dynamic perspective, we examine how this fundamental shift towards unified supervision under the SSM affects the competitive position of SSM banks. A clear pattern emerges. In euro area countries that were heavily affected by the sovereign debt crisis, competition for SSM banks decreased. In the other countries, the SSM either had no impact on the competitive position of SSM banks or competition increased. Our results also suggest that the effects of the SSM on competition are unlikely to be permanent.

The European Union introduced the Single Supervisory Mechanism (SSM) in 2014 in response to the financial crisis of 2007 – 2009 and the sovereign debt crisis of 2010 – 2012. The objectives of the SSM are to establish a common approach to day-to-day supervision, harmonized supervisory actions and corrective measures, and to ensure the consistent application of regulations and supervisory policies.

Before the SSM, all banks in the euro area were supervised by their national authorities. In the SSM, about 110 “significant banks”, which we call SSM banks for simplicity, are now directly supervised by the ECB. These banks collectively hold about 82% of all banking assets in the euro area, which corresponded to a value of around 21,000 billion euros in 2015. For comparison, in 2015 the nominal GDP of the USA was 16,310 billion euros, and the nominal GDP of the euro area was 11,150 billion euros.

In the supervision of SSM banks the ECB cooperates with national authorities. However, within the SSM, national supervisors operate independently of their national board of directors. Decisions concerning SSM banks are made by the ECB’s Supervisory Board and approved by the Governing Council. Consequently, supervision under the SSM is likely to be more rigorous and consistent than supervision by national authorities. Moreover, the shift from national supervision to direct supervision by the ECB is the only fundamental regulatory change that applies exclusively to SSM banks.

In Raunig and Sigmund (2023), we empirically investigate how the shift to direct and uniform supervision under the SSM affects the competitive position of SSM banks.

From a theoretical perspective, the SSM could have an impact on the competitive position of SSM banks because tougher and more rigorous supervision could potentially increase costs. However, stricter supervision might also reduce costs by mitigating information asymmetries between the banks and the market. In addition, stricter supervision under the SSM could boost confidence in SSM banks, potentially increasing demand for their services. Increased confidence may also help weaker SSM banks staying in the market by preventing deposit outflows and enabling participation in the interbank market. Therefore, it is essential to empirically assess the net impact of the SSM on the competitive position of banks operating under the SSM.

Examining the impact of the SSM on competition is also important from a policy perspective because the financing conditions for millions of consumers and firms in the euro area might be affected. Finally, from a financial stability perspective, it is important to know whether the SSM increases or decreases competition for SSM banks, as tensions exist between bank competition and financial stability.

We investigate the impact of the SSM on the competitive position of SSM banks using annual balance sheet data of euro area banks for the period 2004—2019. Our data comes from the SNL Financial’s database and include banks from Austria (AT), Belgium (BE), Cyprus (CY), Germany (DE), Spain (ES), Finland (FI), France (FR), Greece (GR), Ireland (IE), Italy (IT), Luxembourg (LU), Malta (MT), Netherlands (NE), Portugal (PT), Slovenia (SI), and Slovakia (SK). In total, our sample contains more than 2,600 banks at the unconsolidated level. Of these, 116 are SSM banks.

We examine the impact of the SSM on the competitive position of SSM banks from both a static and a dynamic perspective. In the static analysis, we examine whether the SSM affects the market power of SSM banks. In the dynamic analysis, we investigate impact of the SSM on the intensity of competition and potential long-run effects of the SSM on profitability.

The traditional static view of competition, dating back to Adam Smith and Augustin Cournot, focuses on prices and output in equilibrium. Equilibrium outcomes where prices are above marginal costs are interpreted as indication of market power or collusive behavior, leading to welfare losses.

The dynamic view of competition goes back to Joseph Schumpeter. From this perspective, equilibria are far less important. Competition is seen as a dynamic process in which many forms of non-price competition also play a role. In particular, firms that successfully introduce new products can generate monopoly rents. However, when competition works properly, these rents erode over time due to imitation by competitors, the entry of new firms, or the threat of entry.

In our static analysis, we estimate the Lerner index, the most popular measure of market power, for each bank in our sample and examine how the SSM affects the Lerner index of SSM banks. Following common practice in the banking literature, we use a translog cost function. We improve on previous studies by estimating a system of equations with bank-specific fixed effects to obtain more stable estimates of the Lerner indices.

In our dynamic analysis, we investigate whether the intensity of bank competition has changed since the introduction of the SSM. To this end, we examine the dynamics of bank profit rates using the persistence of profits approach of Mueller (1986), in which profit rates, defined as deviations from the average profitability in each period, are modeled as a reduced-form autoregressive process. We estimate long-run profit rates and the speed of convergence of short-run profit rates to long-run profit rates. When profit rates converge rapidly competition is intense, when profit rates converge slowly competition is less intense.

The dynamic analysis also reveals whether the assumption of long-run equilibrium that underlies the static view of competition is plausible. In long run equilibrium, deviations of bank profit rates from long-run profit rates should be purely random. If not, the estimated SSM effects on the Lerner index should be interpreted as disequilibrium effects rather than equilibrium effects.

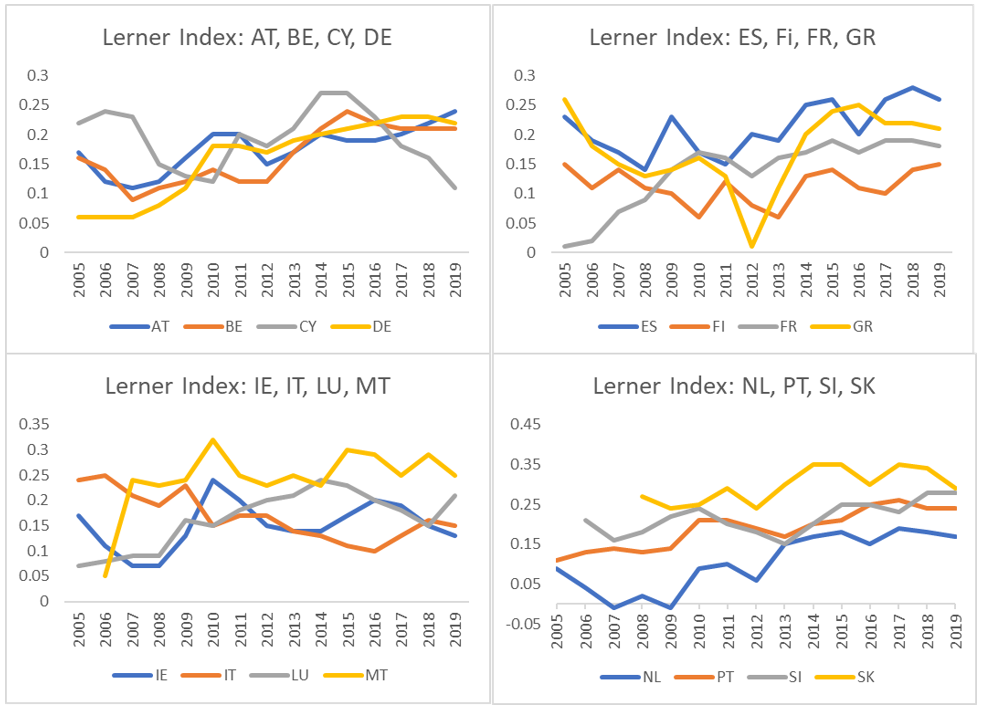

Before we discuss the effects of the SSM, we present estimates of the overall degree of bank competition in euro area countries in our sample in Figure 1. Our yearly country-specific Lerner indices are unweighted averages of our yearly estimates of the individual Lerner indices for the banks in a country.

A Lerner index of zero implies perfect competition and a Lerner index of one implies monopoly or collusion. Most of the Lerner indices range between 0.01 and 0.30, indicating that the banking sector is rather competitive in most countries. During the financial crisis of 2007-2009, Lerner indices fell in many countries, reflecting depressed profitability in the banking sector. In the Netherlands, the Lerner index even went negative due to large losses. After the crisis, the Lerner indices returned to pre-crisis levels in most countries.

In our dynamic analysis, we find statistically significant profit persistence in the pre-SSM period for all countries. Profit rates do not erode quickly and do not fluctuate randomly around long-run profit rates. Hence, the banking sectors in the countries in our sample are not in long-run equilibrium. Banks with above-average profit rates remain more profitable for some time, and banks with below-average profitability remain less profitable for a certain period.

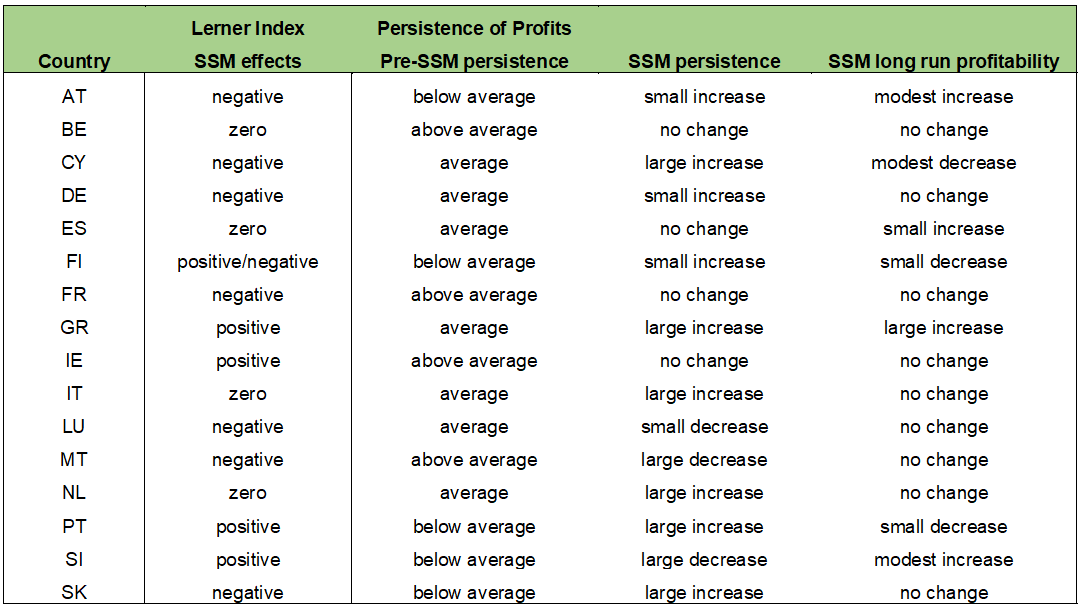

We now discuss the impact of the SSM on the competitive position of SSM banks. Table 2 summarizes our main findings.

From a static perspective, the SSM has led to a reduction in the market power of SSM banks in most countries. The competition-enhancing effects are particularly strong in Cyprus, Finland, France, Luxembourg, Malta, and Slovakia. In contrast, the market power of SSM banks increased in Greece, Ireland, Portugal, and Slovenia. Note that these four countries faced major difficulties during the sovereign debt crisis.

In our dynamic analysis of bank profit rates, we find that in most countries the persistence of profit rates of SSM banks increased only moderately, remained unchanged, or even decreased. The exceptions are Cyprus, Greece, Italy, Netherlands, Portugal, and Slovakia. In these countries the persistence of SSM banks’ profit rates notably increased. Again, these are all countries in which banks faced serious problems during the sovereign debt crisis.

In sum, the results reveal the following pattern. In countries less affected by the sovereign debt crisis, the SSM has enhanced competition for SSM banks. In countries severely affected by the sovereign debt crisis, the SSM often reduced competition for SSM banks. Profit persistence implies that the SSM effects are disequilibrium effects.

We think that the anticompetitive impact of the SSM in “crisis countries” is largely a consequence of stabilizing effects of the SSM. Stricter supervision under the SSM increased the soundness of SSM banks, which in turn promoted trust in SSM banks (Raunig and Sigmund, 2022). This allowed SSM banks with depressed profitability to remain in the market, leading to increased profit persistence, or improved the profitability of SSM banks, resulting in higher Lerner indices.

We argued, the SSM effects should be interpreted as disequilibrium effects. This brings us to the question of whether the SSM has a lasting impact on the competitive position of SSM banks. Except for Greece, we find essentially no SSM effects on long-run profit rates of SSM banks. This suggests that the SSM effects on competition are unlikely to be permanent.

Mueller, D.C. (1986). Profits in the long run. Cambridge University Press.

Raunig, B. and Sigmund, M. (2022). The ECB Single Supervisory Mechanism: Effects on Bank Performance and Capital Requirements, OeNB Working Paper No 244.

Raunig, B. and Sigmund, M. (2023). Watching over 21,000 Billion Euros: Does the ECB Single Supervisory Mechanism Affect Bank Competition in the Euro Area? OeNB Working Paper No 250.