This Brief is based on this SSRN research paper. The views expressed are those of the author and not necessarily those of the institutions the author is affiliated with.

Abstract

This paper examines a design flaw embedded in Sovereign Bond-Backed Securities (SBBS), the proposed European financial instrument designed to serve as a eurozone-wide safe asset. While SBBS are structured to create a reference European debt security based on the current fragmented sovereign debt markets and accepted worldwide, their tranching design has a critical vulnerability that emerges under situations of financial stress. In particular, we show how an arbitrage-driven investment opportunity repackaging junior and senior tranches of SBBS that arises during macrofinancial crises may have spillover effects on the sovereign CDS markets and generate systemic risk for the stability of the Eurozone and for some of its component states. We conclude by suggesting safeguards and legal provisions that policymakers should consider if SBBS are to be implemented without jeopardising financial stability.

The world has a growing need for safe assets. Defined in academic literature as instruments that may provide limited or no cash flow but can retain face value and liquidity during crises, these assets play a stabilising role in financial markets. Since the end of the Second World War US Treasuries have been perceived by financial markets as safe assets that you can rely on in times of crises and market volatility, as gilts payable in gold sterling were one century before for example. Within the European context, German bunds have fulfilled the same role in contemporary times. The current state of affairs creates at least two problems in Europe: one, the natural fragmentation of European debt markets does not allow European assets to compete with US Treasuries and two, within Europe sudden movements of capital flows intra Eurozone can concentrate Euros in assets from countries perceived as safe havens at the expense of other countries perceived as more risky; this may generate sudden capital account movements intra Eurozone and, in extreme cases, assets prices and financial markets disruption. Sovereign Bond-Backed Securities (SBBS) have been proposed to address these issues as a compromise between advocates of mutualised European debt and those firmly opposed.

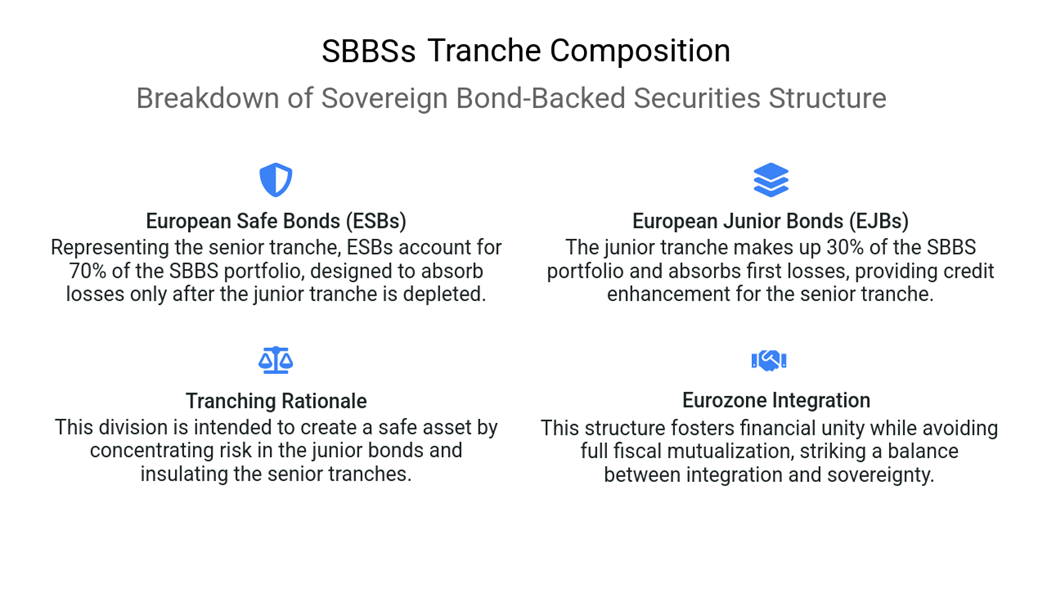

Sovereign Bond Backed Securities would be a debt instrument issued in Euros by a newly created European Debt Agency – or by the private sector, for example an investment bank. They would be designed to minimize default risk and issued in large quantities to create a truly European “safe asset” aimed at becoming a global reference investible instrument. The European Debt Agency set up ad hoc for the issuance of Sovereign Backed Securities – or its private sector equivalent – would purchase a group of sovereign bonds – weighted by the share of its Eurozone GDP – financed with the issuance of 1) European Safe Bonds – ESBs, senior tranche – and 2) European Junior Bonds – EJBs, junior tranche. The junior tranche – European Junior Bonds – would amount to 30% of the value of the acquired sovereign bonds portfolio and the senior tranche would represent 70% percent of that value. Both junior and senior tranches would be fully collateralized by the sovereign debt portfolio. Potential losses from sovereign defaults would be first borne by junior bonds; if these were wiped out, losses would then start impacting the senior tranche, those called European Safe Bonds – ESBs. European Safe Bonds seem to possess several desirable benefits.

First, they increase the supply of safe assets offering banks a major, liquid investible instrument beyond national debt hence avoiding overexposure from national lenders to their Sovereign; second, the European “safe haven premium”, traditionally captured by Germany might be indirectly shared by all countries weighted in the portfolio of sovereign bonds; third, European Safe Bonds should mitigate sudden capital flows intra Eurozone in times of high stress given that capital flows would move from perceived risky assets to perceived safer assets instead of from perceived risky countries to perceived safer countries; fourth, given that European Safe Bonds would be issued at different maturities they would create the first European yield curve, very helpful when designing and implementing monetary policy and a number of private sector driven debt finance techniques.

Overall – and probably as important – it seems that these proposals avoid the political controversy around Eurozone debt mutualization while keeping some of its potential benefits: “bundling” national sovereign debt instruments through a structured product, a sovereign debt securitization with several financial parts combined designed to generate a European safe asset accepted worldwide.

However, despite its good points Sovereign Bond Backed Securities have a critical flaw in terms of 1) their design and 2) their market behaviour in times of high macroeconomic and financial stress – for example a 2008 moment – that, combined, may represent a major systemic risk for Eurozone countries perceived at that time as vulnerable and, potentially, for the stability of the currency area.

First, looking at their design, the problem with a bundled sovereign debt structured product made of several combined parts is that these can be changed, enhanced, eliminated or modified by the private sector depending on the risk – reward payoff at each point in time. This task, if done at a large enough scale in moments of market stress may have a major and unexpected impact on apparently non connected securities – for example, the Sovereign Credit Default Swaps markets.

Second, the price behaviour of European Safe bonds and European Junior Bonds – the two tranches of the proposed asset class – at the worst point of a 2008 style financial crisis might be very different to that modelled assuming a set of rational choices implemented by market operators in a predictable environment.

Indeed, there is a sizeable risk that temporarily and based on pure market psychology grounds – which might be very important at that point in time – the sovereign exposures contained in the securitizations and considered “toxic” by market operators might depress the prices of both tranches junior and senior – and in particular those of its more risky junior tranche – below the cost of buying the portfolio of sovereign bonds bundled on them excluding those sovereign bonds labelled as “toxic”.

There is ample evidence of this behaviour in the fall of the prices of private sector securitizations between 2009 – 2011 – and in particular of the valuations of their junior tranches – far below the price of their “nontoxic” components, just to recover their theoretical values once the Great Financial Crisis was over. Hence, an arbitrage opportunity might arise in the securities of what would be the second most important and liquid sovereign debt market in the world, boosted for its junior tranche by the design of the securitization, during the most acute phase of a macrofinancial crisis. If private market operators – for example hedge funds – could eliminate the “toxic exposures” dragging down the prices of both tranches of Sovereign Bond Backed Securitizations, these would immediately revaluate and with the right leverage – or even without it – generate substantial profits.

If we consider Sovereign Backed Bonds as a structured product made of different pieces that can be enhanced, changed or eliminated, hedge funds could buy the securitization at a discount and repackage it in a different security that includes 1) the European Safe Bond or the European Junior Bond tranche and 2) a short position on the “toxic exposures” that it contains, hence eliminating them. This could be repackaged in a new security with a new ISIN issued by a Special Purpose Vehicle, sponsored by an investment bank, a hedge fund or a group of them.

The price of this new security, that we will call EB-R “European Bond Repackaged” should immediately surge once the “toxic” exposures are eliminated, generating an arbitrage profit for those involved, which may be remarkable if leverage is employed.

Given the size of this European safe assets market – the second biggest fixed income market of the world – the scale of repackaging of European Safe Bonds and – even more intensely given its higher level of profitability – European Junior Bonds might be very important.

The question is how to eliminate the “toxic exposures”, or how to short them? In other words, how to short sovereign bonds which will be already under heavy pressure on their own in a distressed market characterized by its illiquidity on a compared basis? The European options and futures market on sovereign debt is quite small and illiquid to accommodate the potential sell pressure of repackaging ESBs and EJBs.

As a consequence, the only viable option to neutralize these perceived “toxic exposures” in repackaged ESBs and EJBs would be to short the Sovereign Credit Default Swap market, consequently transmitting all the pressure of the second biggest debt market in the world at the worst possible time – in a moment of major financial distress – to sovereign debt spreads.

Given the size of the proposed Sovereign Backed Bonds market, this “financial transformation” activity would be of a high scale, putting a major amount of extra pressure on sovereign debt of “risky countries” completely disconnected from any fundamental macro or fiscal data. Moreover, the selling pressure leaking to the Sovereign Credit Default market could create its own demand, attracting traders from around the world to short even more an asset class perceived as doomed just on pure market technical grounds, disconnected from any fundamental analysis.

How would the process of repackaging operate internally in both tranches of the Sovereign Bond Backed Security?

The junior tranche – the one whose price would fall the most during a financial panic – acts as the initial transmission channel, starting the process that spreads later to the senior tranche – European Safe Bond – when its price falls enough to make the “repackaging” activity profitable1.

How might this happen? The “repackaging” activity in the junior tranche and its subproduct in the form of Sovereign CDS shorts would damage the prices of those sovereign bonds whose yields are referenced to the national CDS markets which is experiencing the sell pressure – the perceived “toxic” bond exposures. As these bonds whose price is falling are contained in the portfolio of sovereigns backing European Safe bonds and European Junior bonds, prices of ESBs and EJBs might depress even more, enhancing the profits of further repackaging of the Junior bond tranche and making profitable the repackaging of the ESB – the senior tranche. This would put further pressure on the credit default swap markets of those countries affected. At some point the process may become self-sustaining2.

The consequences for the sovereign debt of those Eurozone countries perceived as “toxic” are easy to imagine. Eventually, if the selling pressure was big enough, the dynamic described above could make the subscription and sale of public debt of those countries very difficult at any price. Furthermore, it is possible that corporate debt and banking debt from private firms based in the countries affected could see their access to financial markets severely impaired – something which authorities were already worried about during the Great Financial Crisis – effectively also cutting the private sector of affected countries from external funding. The impact of this happening to several of the major economies of the Eurozone would very likely be systemic for the currency area.

Different solutions might be tested to optimize a financial product that, beyond the flaw described above, has a number of interesting qualities. For example, a legal provision in the bond prospectus could make the whole Sovereign Bond Backed agreement null and void in the case of repackaging, hence distributing the agreed cash flows to the owner of the financial instrument in exchange for its very existence. That is a task – an important task – for the public policy decision maker if these bonds become in the near or midterm, a tangible reality in Europe.

SBBS may offer a politically palatable and economically beneficial path toward a European safe asset. However, their structured nature contains a critical flaw that opens an arbitrage opportunity during financial crises. The profitable SBBSs “repackaging” activity conducted by hedge funds and other market operators during such periods could, through the Sovereign CDS market amplification channel, generate systemic risk for the stability of the Eurozone and for some of its component states. Policymakers should tread carefully. Without strong safeguards, SBBS could transform from an instrument of integration into a catalyst of fragmentation.

Brunnermeier, M., Garicano, L., Lane, P. et al. (2011). “ESBies: A Proposal for Sovereign-Bond Backed Securities for the Euro Area,” European Safe Bonds Working Group.

European Systemic Risk Board (2018). “Sovereign Bond-Backed Securities: A Feasibility Study.”

Gennaioli, N., Martin, A., & Rossi, S. (2014). “Sovereign Default, Domestic Banks, and Financial Institutions,” Journal of Finance, 69(2).

IMF (2020). “Safe Assets: Financial System Cornerstone or Achilles’ Heel?”

Shin, H. S. (2010). Risk and Liquidity, Oxford University Press.

Or, if the price of ESBs was low enough to generate this arbitrage opportunity, enhancing its profitability.

May this reaction reach an equilibrium point? Theoretically that state would be reached when the buying pressure on ESBs and EJBs for repackaging purposes neutralizes 1) the negative pricing impact of the falling sovereign CDS market generated by the offloading of shorts during the repackaging process on those “toxic” sovereign bonds prices constitutive of ESBs and EJBs and 2) the negative market psychological impact which would be one of its derivatives. Given that a “repackaging event” takes place by definition at the depths of a financial crisis – when this sort of arbitrage becomes profitable – and that the liquidity of sovereign CDS markets might become greatly diminished by the selling pressure from repackaging, by short positions taken by traders on pure market technical grounds and by the natural situation of panic in financial markets during such challenging times, it is arguable that an equilibrium point might never be reached. In other words most or all of the European Junior Bonds and European Safe Bonds might be consumed via “repackaging” before the process stops, generating as a sub product an enormous pressure on the sovereign credit default swaps of those countries deemed as “toxic”.