References

Atradius (2020). 2020 insolvencies forecast to jump due to Covid-19. Atradius Economic Research.

Banerjee, Ryan, and Boris Hofmann (2020). Corporate zombies: Anatomy and life cycle. BIS Working Paper No. 882.

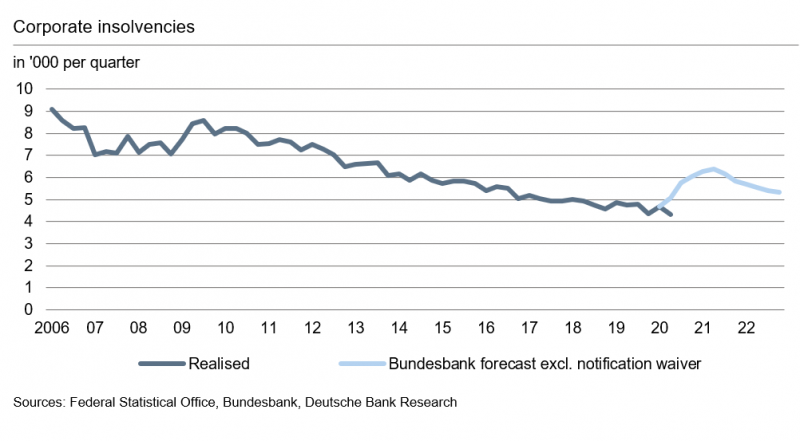

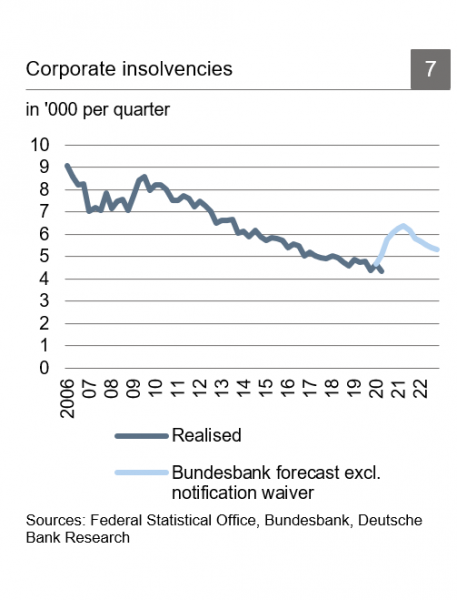

Bundesbank (2020). Potentially sharp rise in insolvencies in the corporate sector. Financial Stability Review 2020, p. 36-46.

Creditreform (2020). Insolvenzen in Deutschland, 1. Halbjahr 2020.

Deutsche Bank Research (2020). Global Macro Outlook: Virus curve flattening, markets stabilizing, slow recovery. June 2020.

ifo (2020). Unerwünschte Nebenwirkung der Corona-Maßnahmen: Zombies? 31. Ökonomenpanel von ifo und FAZ. October 2020.

IW Köln (2020). 4.300 Zombieunternehmen bis Jahresende.

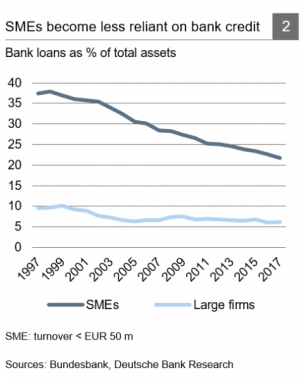

Schildbach, Jan (2020). Government measures to support liquidity of German companies – who is most at risk? Deutsche Bank Research. Focus Germany. Under corona siege – Update. March 18, 2020, p. 29-32.