Very little is known about how traditional risk metrics behave under intraday trading. We fill this void by examining the finiteness of the returns’ moments and assessing the impact of their infinity in a risk management framework. We show that when intraday trading is considered, assuming finite higher order moments, potential losses are materially larger than what the theory predicts, and they increase exponentially as the trading frequency increases; a phenomenon we call superkurtosis. Hence, the use of the current risk management techniques under intraday trading impose threats to the stability of financial markets, as capital ratios are severely underestimated.

This paper challenges existing literature by showing that the burst of high frequency trading using highly sophisticated computer algorithms and fast information transmission technologies calls for a measure of certain risk metrics in higher frequencies than the daily one.

Highly sophisticated algorithms and fast computer technology have given rise to a new class of trading known as High Frequency Trading (or intraday trading). While such trading might have numerous advantages, like offering ample liquidity in the market, transmitting any information into prices instantaneously pushing markets to be more efficient, and creating a marketplace for small (retail) as well as large investors (institutions), it sets out its own unique challenges (see for example the Final Project Report from The Government Office for Science, London – 2012). Chiefly, it has been criticised as liable to cause large market crashes which may be amplified by the influx of algorithmic trading and the order clustering caused by unintended trading strategy coordination.

As a consequence of the issues discussed above, market participants are required to measure and report several market risk metrics, and to take them into account when calculating their regulated capital requirements. For example, on January 16th, 2016 the Basel Committee on Banking Supervision published a document that revised standards for minimum capital requirements for Market Risk. In addition, the Basel Committee had also produced three consultative papers on the Fundamental review of the trading book, namely (i) Fundamental review of the trading book, May 2012, (ii) A revised market risk framework, October 2013 and (iii) Fundamental review of the trading book: Outstanding issues, December 2014. Furthermore, ECB imposes capital requirements (via the Capital Requirements Regulation) on institutions who engage in intraday trading. Such requirements are based on risk metrics or asset volatility.

However, standards set by regulators are based on risk metrics that are calculated – at most – at daily frequency. Given that intraday trading takes place at higher frequencies, this leaves the market risk, generated by such trading activity, largely as a dark pool. This occurs primarily due to the fact that typical risk metrics users assume that the moments of asset returns at intraday frequency are finite (as in the case of lower frequency returns, e.g., daily). However, such assumption may not hold true for asset returns at higher frequency (intraday trading).

Indeed, very little is known about market risk associated with intraday trading; similarly, only little analysis has been conducted on how traditional risk metrics such as Value-at-Risk or Expected Shortfall behave at such high frequency trading. Thus, the Superkurtosis paper investigates the abovementioned issue and provides a first look at the misestimation of the potential losses that can be realized when trading at high frequency.

To do so, we develop a methodology to assess whether high order moments of asset returns are finite or not. Subsequently, we assess the impact of having infinite moments in a risk management framework, calculating the excess potential losses, based on the Value-at-Risk, when the “false” assumption of finiteness of moments does not hold. Our playfield is the foreign exchange market, and in particular three highly liquid currency pairs, namely the EUR/USD, GBP/USD and CAD/USD. We obtain 1-minute data of the front-month futures contracts for the period 3rd January 2000 until 5th August 2015. We also use 1-minute daily data for the period 3rd January 2005 until 5th August 2015.

Indeed, we find that that the distribution of the asset returns that are traded intraday do not have finite moments of order higher than 3, implying that mainly the kurtosis is infinite at intraday frequencies, whereas all moments are finite at daily frequency. A phenomenon that we call Superkurtosis. We illustrate the consequences of neglecting this feature, calculating the excess potential losses incurred by (and the short survival of) an investor who ignores this issue. In particular, we show that potential losses can be up to 50 times higher than what would have been anticipated by the Value-at-Risk, when the infinite kurtosis of asset returns is not taken into consideration. A series of robustness tests and simulations confirm our key findings.

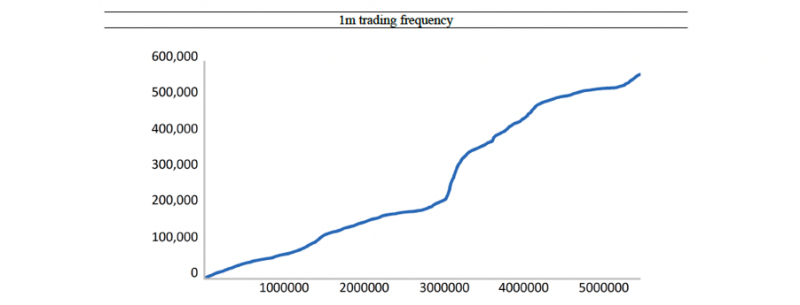

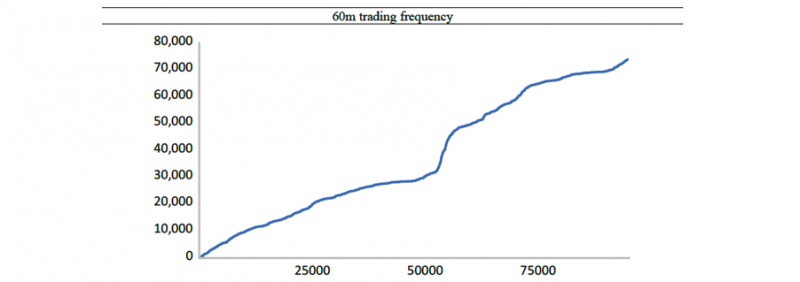

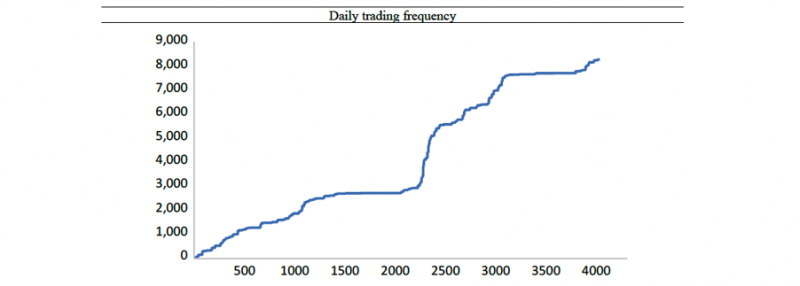

Figure 1: Traders’ potential capital losses in $ terms, on the EUR/USD futures exchange rate, above the anticipated losses from the 95% VaR

Hence, our findings entail that employing traditional risk measures for market participants who engage in intraday trading imposes serious threats to the stability of financial markets, given that capital ratios may be severely underestimated. In this sense, if capital requirements, which are designed to mitigate the losses incurred in extreme events, are mis-measured, then they do not solve the underlying problem that arises from a potential underestimation of actual risks that arise from intraday trading. An immediate conclusion from our findings is that central banks, and banking supervisory authorities, should make use of more appropriate risk metrics that reflect the presence of Superkurtosis in intraday asset returns.