Disclaimer: The analyses, opinions, and findings expressed in this policy brief are those of the authors and do not necessarily reflect those of the Banco de Portugal or the Eurosystem. The analysis was conducted exclusively during Ana’s tenure at Banco de Portugal, and therefore any views expressed are solely those of the author(s) and cannot be taken to represent those of the Bank of England or to state Bank of England policy. This policy brief should therefore not be reported as representing the views of the Bank of England or members of the Monetary Policy Committee, Financial Policy Committee or Prudential Regulation Committee.

Affiliation of Ana Pereira at the time when the paper was written: Banco de Portugal and Lisbon School of Economics & Management (UL).

References

Clerc, Laurent, Alexis Derviz, Caterina Mendicino, Stephane Moyen, Kalin Nikolov, Livio Stracca, Javier Suarez, and Alexandros P. Vardoulakis (2015). “Capital Regulation in a Macroeconomic Model with Three Layers of Default.” International Journal of Central Banking, 11(3), 9–63.

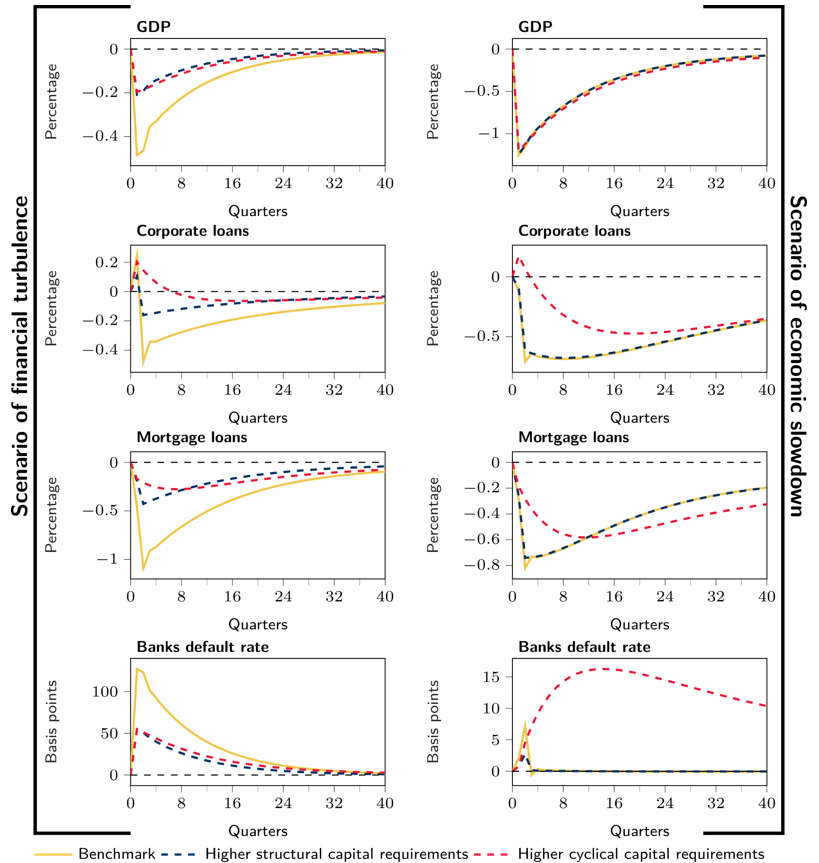

Lima, Diana, Duarte Maia, and Ana Pereira (2023). “Structural and cyclical capital instruments in the 3D model: a simulation for Portugal.” Banco de Portugal Working Paper, No. 15.