References

Baier, S. and J. Bergstrand. 2007. “Do Free Trade Agreements Actually Increase Members’ International Trade?” Journal of International Economics, 71(1): 72-95.

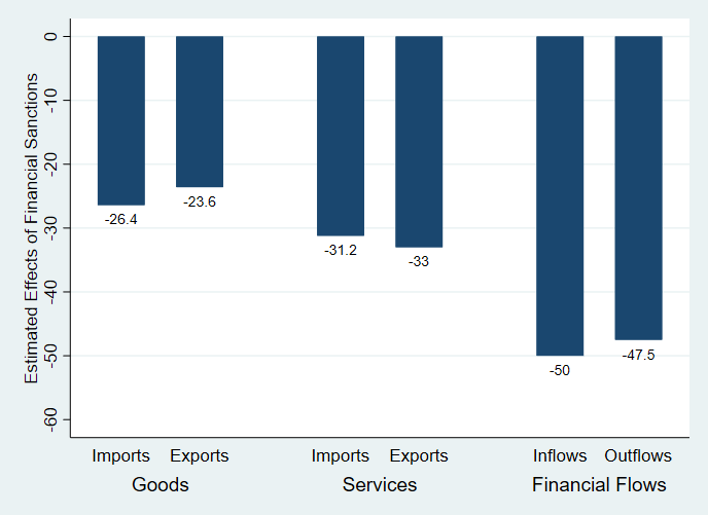

Besedeš, T., S. Goldbach, and V. Nitsch. 2017. “You’re Banned! The Effect of Sanctions on German Cross-Border Financial Flows,” Economic Policy. 32(April): 263-318.

Besedeš, T., S. Goldbach, and V. Nitsch. 2021. “Cheap Talk? Financial Sanctions and Non-Financial Activity,” European Economic Review. 134, 103688.

Besedeš, T., S. Goldbach, and V. Nitsch. 2022. “Smart or smash? The effect of financial sanctions on trade in goods and services,” Bundesbank Discussion Paper No. 28/2022.

Efing, M., S. Goldbach, and V. Nitsch. 2018. “Freeze! Financial sanctions and bank responses,” Bundesbank Discussion Paper No. 45/2018.

Felbermayr, G., A. Kirilakha, C. Syropoulos, E. Yalcin, and Y.V. Yotov. 2020. “The Global Sanctions Database,” European Economic Review. 129, 103561.