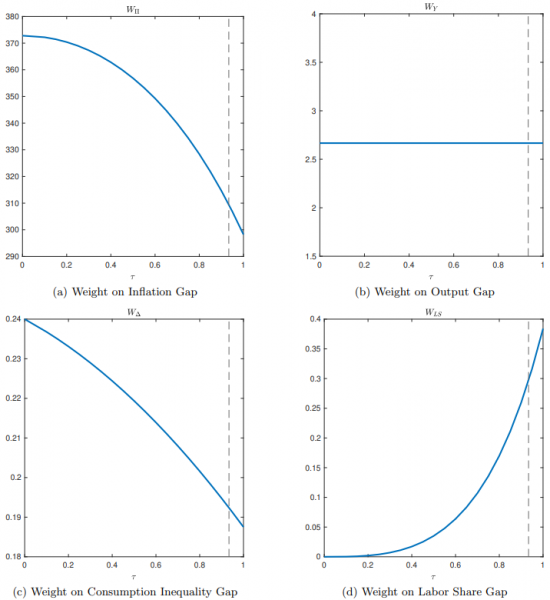

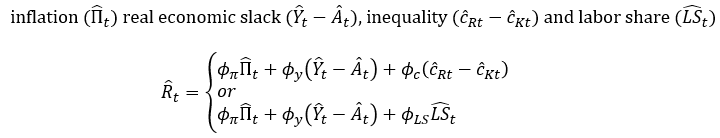

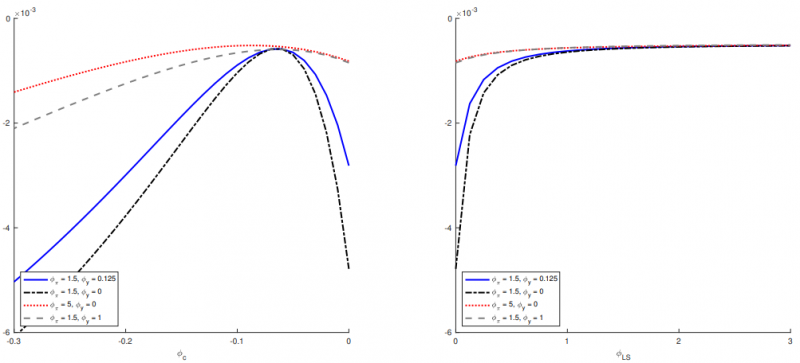

We compare the welfare against the standard rule (i.e.. where Φc = ΦLS= 0). Figure 3 reports the implied welfare as a function of the reaction parameters to the third targeting objective (x-axis) and under different parametrizations for the standard Taylor coefficients (different lines). The left panel refers to the rules reacting to inequality while the right panel corresponds to rules that react to the labor share. We find that augmenting the Taylor rule with a labor share objective generally improves welfare (by up to 80%). Under such a rule, the policy rate should be set lower than otherwise following a positive TFP shock. The mechanism is simple: a policy of lower interest rates leads to higher wages (and lower profits) on the margin, and thereby disproportionately benefits the Keynesian agent, who rely more on labor income. Such a policy is beneficial not only because it lowers inequality, but also because it improves inflation and output by avoiding an excessive tightening of the policy rate. Interestingly, targeting the labor share alone seems sufficient to achieve most of the welfare improvement. This policy is also easier to implement compared with a rule that targets consumption inequality, which requires more information. More generally, we find that augmented Taylor rules targeting the labor share gap also deliver higher welfare when cost-push and demand shocks are considered in addition to the technology shock. These gains are robust to the underlying magnitude of inequality. This contrasts with the gains from targeting consumption inequality, which are very sensitive to the specific amount of inequality in the economy.

Figure 3: Welfare under Augmented Taylor rules

Note: The figures illustrate how welfare depends on the Taylor rule parameter on consumption inequality (left chart) and labor share (right chart) with fixed parameters on inflation and the output gap. The lines represent a different configuration of parameters assigned to the output gap and inflation. The left chart shows how the welfare gains from targeting consumption inequality are very sensitive to the particular parameter on consumption inequality. On the other hand, the right chart shows how increasing the parameter on the labor share improves welfare more generally.

Should inequality factor into central banks’ decisions? We answer this question using a stylized Two-Agent New Keynesian Model. We find that there are economically small aggregate welfare gains in targeting consumption inequality if the central bank already implements optimal monetary policy ignoring inequality. A central bank should place a non-zero optimal social weight on the consumption inequality gap. However, the welfare gains of taking inequality explicitly into account is only about 1.2 percent of the loss under optimal monetary policy. On the other hand, if the central bank implements monetary policy through a standard Taylor rule, then augmenting it with either an inequality target or a labor share target can lead to higher welfare. Beyond targeting inflation and output gaps, the central bank can achieve higher welfare if it places a small negative weight on consumption inequality. This means that following a positive TFP shock that increases consumption inequality, the central bank should reduce the policy rate. This would reduce the welfare loss by about 79 percent compared to that of a standard Taylor rule. Interestingly, targeting the labor share appears preferable to targeting consumption inequality, as it delivers more robust improvements in welfare and is easier to implement operationally.

Bilbiie, Florin O (2008). “Limited asset markets participation, monetary policy and (inverted) aggregate demand logic”. Journal of Economic Theory 140.1, pp. 162–196

Debortoli, Davide and Jordi Gali (2017). “Monetary policy with heterogeneous agents: Insights from TANK

Models”. Mimeo

De Giorgi, Giacomo and Luca Gambetti (2017). “Business cycle fluctuations and the distribution of consumption”. Review of Economic Dynamics 23, pp. 19–41

Niels-Jakob H. Hansen, Alessandro Lin and Rui C. Mano (2023). “Should inequality factor into central banks’ decisions?”, Temi di Discussione 1410, Bank of Italy Working Papers Series

The model assumes a simplistic wealth distribution in steady-state and no aggregate savings in equilibrium. It also abstracts from heterogeneity in the extensive margin of labor which is known to be another important driver of inequality over the cycle, although the assumption of tech-biased wage income could be thought of as capturing this channel in reduced form.

See for instance http://www.federalreserve.gov/monetarypolicy/files/FOMC20160603memo04.pdf.

The term t.i.p. is a collection of terms that are independent from policy and/or are determined at t=0, more details in the paper.