I document the effects of the Covid-19 pandemic on industrial activity specifically through how it has shaken business confidence for 11 Euro area countries. Using household confidence as an instrument for business confidence, I find that a 3 standard deviation fall in confidence – such as what happened in April 2020 – can lead to about a 15-18% decline in industrial production growth. These results highlight the importance of clear communication and management of expectations in crises.

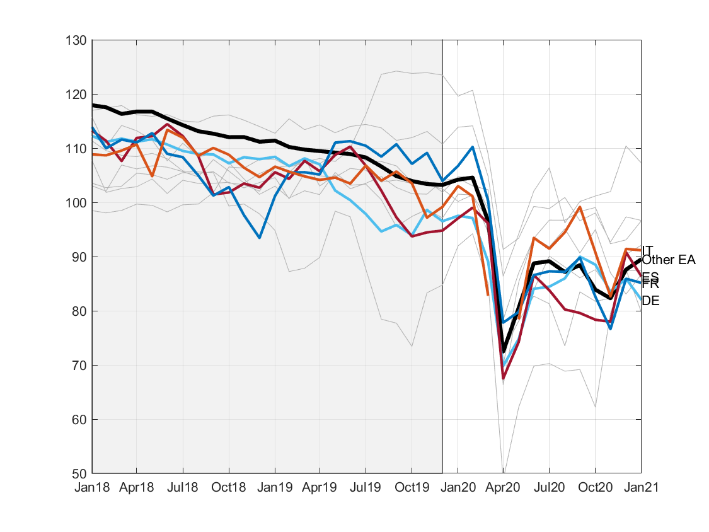

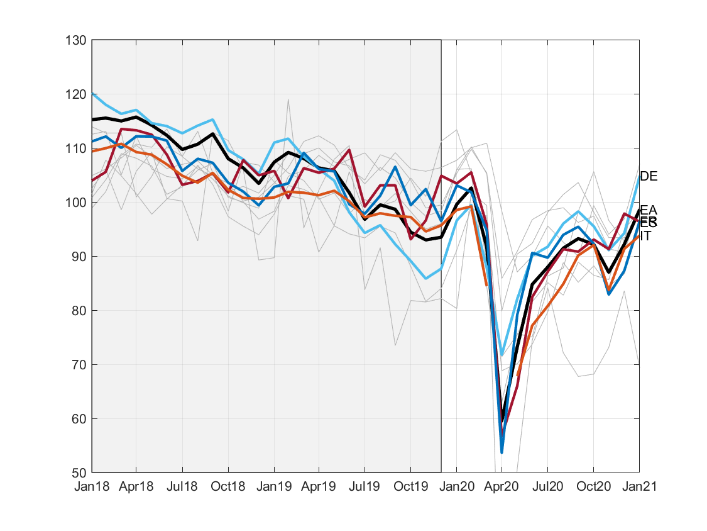

An important channel through which pandemics, and crises in general, affect economic activity is through the way they change agents’ expectations about future economic conditions.2 This also holds true for the ongoing Covid-19 pandemic which has gripped the world since early 2020. Take for instance how business and consumer confidence indicators, a summary measure of how optimistic or pessimistic firms and households are about the state of the economy, sharply dropped in April 2020 for many countries in Europe.3 A fall in confidence of this magnitude, about 3 standard deviations, was last seen during the Global Financial Crisis. Figure 1 illustrates how confidence has evolved before and during the Covid-19 pandemic in the Euro area. Along with the sharp fall in confidence during the first wave in Spring of 2020, we also observe a smaller drop in confidence following the second wave of infections towards the end of 2020.

Figure 1. Confidence indices for 11 Euro area countries4

| (a) Consumer confidence | (b) Business confidence |

|

|

Economic activity also fell sharply. The year-on-year change in the volume of industrial production fell by about 23 percent in the Euro area last April 2020. While industrial activity has since started to recover, the pandemic continues to be a major concern in 2021. To what extent did the fall in confidence contribute to the fall in industrial activity? This is the key question addressed in a recent working paper (Ambrocio, 2021) which I summarize in this Policy Brief.

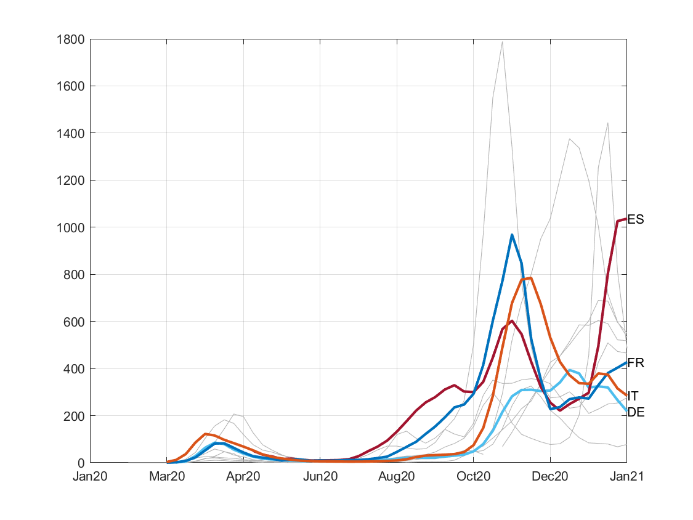

There are numerous challenges to ascertaining the relative importance of confidence as a transmission channel of Covid-19 to economic activity. Many things were simultaneously taking place. First, there are direct effects of the pandemic as the disease incapacitates personnel and disrupts the day-to-day activities of those infected. Due to the scale of infections, this is not likely to be a major channel. For instance, the second wave of infections in late 2020 was an order of magnitude more severe in terms of the number of cases (see Figure 2, panel a) but the impact on industrial activity was relatively benign especially in comparison to what took place during the first wave of infections.

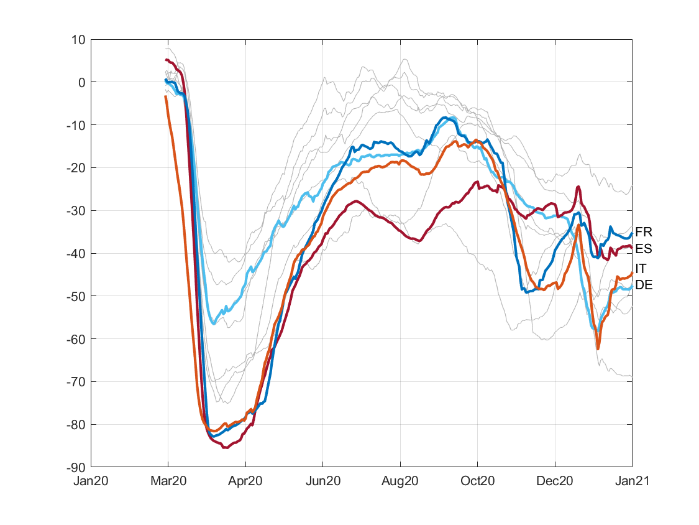

While the direct effects on economic activity due to infections may not be quite large, other indirect effects such as those due to the implementation of containment policies restricting free movement – stay-at-home policies – may have had a larger impact. For instance, data from Google Community Mobility Reports (depicted in Figure 2, panel b) also indicates a much larger drop in movement during the first wave of infections. Further complicating identification are the various economic stimulus measures put in place to combat the economic side effects of the pandemic.

Figure 2. Covid-19 cases and mobility5

| (a) Covid cases (14-day) | (b) Google mobility -Transport (14-day) |

|

|

In order to obtain estimates of the causal effect of confidence on activity, all of these issues need to be accounted for. Multivariate analysis, pooling information regarding the experience of many countries that are relatively similar to each other (e.g. members of the Eurozone), can help address most of these challenges. One could then exploit variations in the degree and timing of changes in confidence as well as in other related factors across these countries to estimate the impact of confidence on economic activity. In these analyses, it is essential to account for the effects of the other potential channels by including measures capturing them in the analysis framework. Specifically, one would need to obtain estimates of the effects of confidence on activity conditional on the effects of general economic conditions, the direct effects of Covid-19, and the other indirect effects of Covid-19 through policies such as stay-at-home measures and economic stimulus packages.

Aside from accounting for these other channels through which the pandemic could affect economic activity, another challenge is that confidence may simply be a reflection of economic conditions. In econometric analysis, this is referred to as reverse causality. In a recent working paper (Ambrocio, 2021), I attempt to overcome this challenge by using variations in household confidence, either in the home country or in neighboring countries, as instruments for business confidence. The use of neighboring country household confidence as an instrument for business confidence is motivated by recent work highlighting spillovers in sentiment and confidence across national borders possibly through shared news and media (Levchenko and Pandalai-Nayar,2020; Brzoza-Brzezina and Kotlowski, 2020). First, households and businesses form views about the Covid-19 pandemic from largely the same set of information disseminated by news media and government institutions. This means that variations in business confidence due to the pandemic can be approximated with household confidence. Second, households are unlikely to pay close attention to domestic economic developments in real-time. This is especially true for households in neighboring countries who would be even less incentivized to do so. These imply that household expectations are unlikely to be subject to the reverse causality bias and would be suitable instruments to capture business confidence.

Looking at monthly data in 2020 for 11 Euro area countries, I find that temporary disruptions in industrial production due to the Covid-19 pandemic may have largely taken place through an expectations channel as reflected in business confidence. Using household confidence as an instrument for business confidence, I find that a three standard deviation drop in business confidence, such as what took place in April 2020, can account for up to a 15-18 percent fall in industrial production growth on average for Euro area countries. For comparison, the actual fall in industrial production growth was about 23 percent in the Euro area last April 2020. These estimated effects are on top of and conditional on the impact of general economic conditions as well as the direct and indirect effects of Covid-19 through stay-at-home policies and government stimulus measures.

These results indicate that the initial reaction to the pandemic, and specifically how it had shaped confidence, was an important aspect to the economic transmission of the health crisis. In light of the key role that the expectations channel plays in transmitting health crises to economic outcomes, the messaging and communication aspect of policy responses would also have similarly pronounced roles in crisis management. These results suggest that assuaging fears and managing expectations using prompt, clear, and effective communication reflecting policymakers’ awareness of the situation and their responses to it are essential components to crises management.

Ambrocio, G., 2021. Euro Area Business Confidence and Covid-19. Bank of Finland Research Discussion Papers 4/2021.

Baldwin, R., Weder di Mauro, B. (Eds.), 2020a. Economics in the Time of Covid-19. VoxEU.org ebook. CEPR Press.

Baldwin, R., Weder di Mauro, B. (Eds.), 2020b. Mitigating the COVID Economic Crisis: Act Fast and Do Whatever it Takes. VoxEU.org ebook. CEPR Press.

Brzoza-Brzezina, M., Kotlowski, J., 2020. International Confidence Spillovers and Business Cycles in Small Open Economies. Empirical Economics.

Levchenko, A., Pandalai-Nayar, N., 2020. TFP, News, and ”Sentiments”: The International Transmission of Business Cycles. Journal of the European Economic Association 18 (1), 302–341.

gene.ambrocio(at)bof.fi. The views expressed in this Policy Brief are those of the author and do not necessarily reflect the views of the Bank of Finland.

See e.g. Baldwin and Weder di Mauro (2020a, b).

These indicators are based on surveys conducted in the first two weeks of each month and may be better interpreted as the views of households and firms at the beginning of the month (or end of previous month). They have also been standardized such that 100 represents the historical average and a 10 point change is one standard deviation.

Data obtained from the monthly European Commission harmonized business and consumer surveys. Germany (DE) is light blue, France (FR) is dark blue, Spain (ES) is red, and Italy (IT) is orange. The 7 other countries (Belgium, Estonia, Greece, Ireland, Lithuania, Latvia, and Malta) are light gray. The black line is the average for the eight other Euro area countries in panel (a) and the overall Euro area average in panel (b). The gray areas reflect the period 2018-2019 which are included for comparison.

Data obtained from the European Centre for Disease Prevention and Control and Google Community Mobility Reports. Panel (a) reports 14-day average confirmed cases per 100,000 population in 11 Euro area countries. Panel (b) reports 14-day averages of the Google mobility index in the Transport category for the same 11 Euro area countries. Germany (DE) is light blue, France (FR) is dark blue, Spain (ES) is red, and Italy (IT) is orange. The 7 other countries (Belgium, Estonia, Greece, Ireland, Lithuania, Latvia, and Malta) are light gray.