We study exchange rate pass-through (ERPT), i.e. the impact of exchange rate movements on inflation, focusing on sectorally disaggregated euro area import prices. Our results are based on estimating sector-specific VAR-X models. The impulse response functions allow to study both the extent and the dynamics of ERPT, found to be heterogeneous across sectors. We investigate to what extent sector-specific characteristics explain the heterogeneity of ERPT. Across various model specifications that include import penetration, market integration, competition and value chain integration as explanatory variables, we find that higher market concentration and higher backward integration in global value chains decrease pass-through, in line with previous findings in the literature.

Exchange rate pass-through (ERPT) is the degree to which exchange rate movements affect domestic prices. ERPT is important for policymakers and a key ingredient of forecasting models of inflation and the trade balance, with direct implications also for monetary policy transmission. Moreover, the degree to which exchange rate movements influence domestic economic variables is important for understanding macroeconomic dynamics. Along with academics, policymakers are also interested in the role of ERPT in understanding international price adjustment mechanisms, e.g., in reconciling with economic theory the observation that the relative stability of import prices does not reflect the high volatility of nominal exchange rates. Evidence of a potential “disconnect” between exchange rates and prices would also imply a greater degree of insulation and thus greater effectiveness of monetary policy. Specifically, the main interest focuses on whether ERPT is complete, defined as a one-to-one response of import prices to exchange rate changes, and if so over which time horizon. Existing empirical evidence suggests that pass-through is incomplete even in the long run.

The theoretical literature offers two main explanations as to why ERPT may be incomplete. One stresses nominal rigidities as the main cause of the non-responsiveness of import prices to exchange rate changes, while the other ascribes incomplete ERPT to real rigidities related to market and industry characteristics. To study the potential heterogeneity of exchange rate responses across industrial sectors the analysis uses sectoral data on euro area import prices for 28 industries and their possible determinants. The impulse response function based on the structural VAR-X models offer insights on the extent, the dynamics and the potential heterogeneity across sectors of ERPT.

For each of the 28 sectors the endogenous sectoral variables are the import price index, the domestic producer price index (PPI) and the corresponding foreign PPI (to proxy foreign costs). The nominal effective exchange rate of the euro area against the 38-country group of trading partners is common to all sectors. The sample covers monthly observations starting between 2000 and 2005 depending on when the import prices of each sector became available, and ends in 2016. To account for economy-wide supply- and demand-side effects, international commodity prices or measures of the business cycle as well as “demand-shifters” are included as exogenous variables.2 The exogenous variables are included to capture, to some extent, the fact that quantities and exchange rates are jointly determined (across sectors and countries) in relation to general equilibrium dynamics.

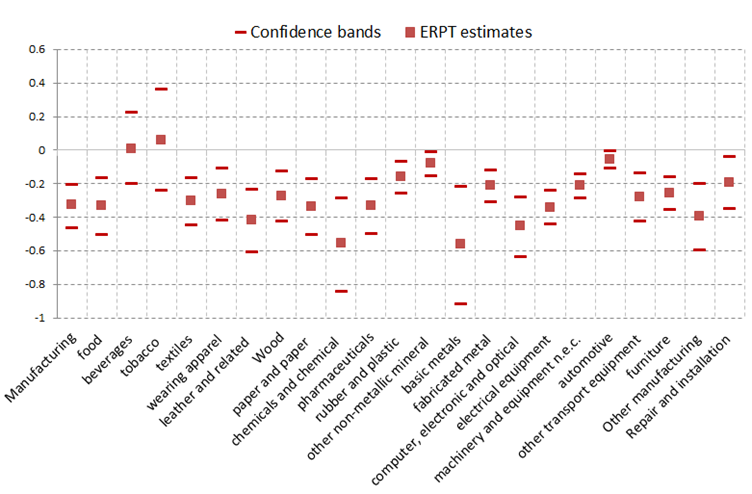

The dynamic measure of ERPT over different horizons is defined as the cumulated impulse response function of import prices to a shock in the nominal effective exchange rate. The results indicate that in general adjustment is less than full but relatively fast: the adjustment is effectively completed after one year. Finally, the point estimates mostly cluster around -0.2 but in some cases differ significantly across sectors (Figure 1).

The next step is to investigate if industry-specific characteristics – like domestic competition or various dimensions of openness to trade – correlate with this heterogeneity.

Figure 1: 24-month ahead exchange rate path through (ERPT) point estimates by NACE Rev. 2 sectors

Notes: ERPT estimates shown in the figure refer to the accumulated response of the sector-level import price index to a one-standard deviation appreciation in the nominal effective exchange rate of the euro against a group of 38 trading partners over 24 months following the shock.

ERPT = −1 means complete pass-through. Confidence intervals with coverage probability of 68%.

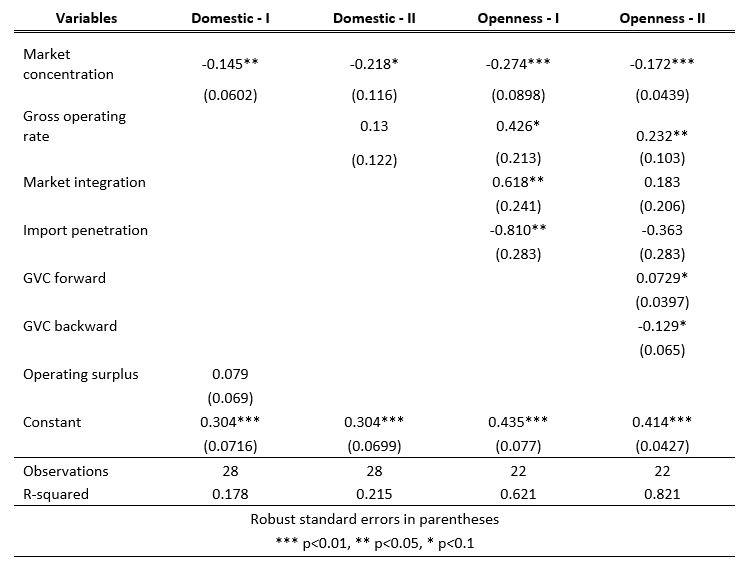

The degree of ERPT in stylized theoretical trade models is typically related to industry characteristics that are difficult to measure and quantify empirically. Nevertheless, we compute proxies for domestic market characteristics, such as concentration and intensity of competition, and of integration in international trade for each sector. These measures serve as explanatory variables in cross-section regressions where the 24-month ahead sectoral ERPT point estimates are the dependent variable.

More specifically, market concentration in any considered sector is proxied by the average value added produced per enterprise in the sector and domestic competition in the sector is proxied using gross and net operating surplus. With respect to integration in international trade, the ratio of foreign to domestic firms is proxied by the ratio of imports to valued added in each sector, referred to as import penetration. The greater market penetration by foreign firms, the stronger is ERPT expected to be. The proxy for market integration is the ratio of exports plus imports to value added, again calculated for each sector. Moreover, international production is increasingly organised within global value chains (GVCs), where different stages of the production process are located in different countries. Participation in GVCs is measured by distinguishing a “backward-looking” measure that tracks foreign value added included in a country’s exports from a “forward-looking” measure based on a country’s domestic value added that is contained in the exports of other countries.

Across various model specifications (Annex Table 1), higher market concentration and higher backward integration in global value chains decrease pass-through, in line with previous findings in the literature. Market concentration and import penetration both reduce import price pass-through, also documented in Amiti et al. (2019), while market integration increases it. The specification shown in column (4) adds the two measures of GVC integration., This renders the coefficients to the more general measures of openness (those not based on GVC integration) insignificant, whilst both GVC measures, backward and forward, are significant. In line with theory, e.g. Amiti et al. (2014), backward integration in GVCs reduces ERPT, whilst forward GVC integration increases it, i.e., an increasing content of a country’s exports in other countries’ exports leads to stronger import price ERPT. One hypothesis that emerges from this last finding is that globally integrated upstream sectors could be facing reduced price elasticities of demand. A deeper investigation of the mechanism behind this result would require firm-level data.

Annex

Table 1: Cross-section regression results: Sector-specific determinants of ERPT

Amiti, Mary, Oleg Itskhoki, and Jozef Konings. “Importers, exporters, and exchange rate disconnect.” American Economic Review 104.7 (2014): 1942-78.

Amiti, Mary, Oleg Itskhoki, and Jozef Konings. “International shocks, variable markups, and domestic prices.” The Review of Economic Studies 86.6 (2019): 2356-2402.

Osbat, Chiara, Yiqiao Sun, and Martin Wagner. “Sectoral exchange rate pass-through in the euro area.” ECB Working Paper Series No. No. 2634 (2021).

This paper should not be reported as representing the views of the European Central Bank (ECB), the Bank of Slovenia or the Eurosystem. The views expressed are those of the authors only.

See Osbat, Sun and Wagner (2021) for a detailed description of the modelling approach and specification.