References

Balassa, B. (1965). Trade Liberalisation and ‘Revealed’ Comparative Advantage. Manchester School, 33(2), 99–123.

Buckley, P. J., Strange, R., Timmer, M. P., & de Vries, G. J. (2020). Catching-up in the global factory: Analysis and policy implications. Journal of International Business Policy, 3(2), 79–106.

https://doi.org/10.1057/s42214-020-00047-9.

Galgóczi, B. (2017) Why Central and Eastern Europe Needs a Pay Rise. ETUI Research Paper – Working paper 2017.01, Available at SSRN: https://ssrn.com/abstract=2965393.

Koopman, R., Wang, Z., & Wei, S. (2014). Tracing Value-Added and Double Counting in Gross Exports. American Economic Review, 104(2), 459–494.

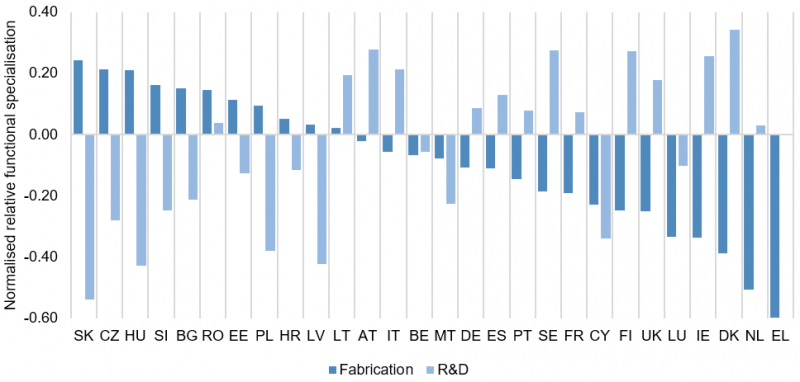

Kordalska, A., Olczyk, M., Stöllinger, R., & Zavarská, Z. (2022). Functional Specialisation in EU Value Chains: Methods for Identifying EU Countries’ Roles in International Production Networks. WIIW Research Reports, 461, 1–51.

Kordalska, A., & Olczyk, M. (2023). Determinants of Functional Specialisation in EU Countries. WIIW Working Papers, 228(May), 1–46.

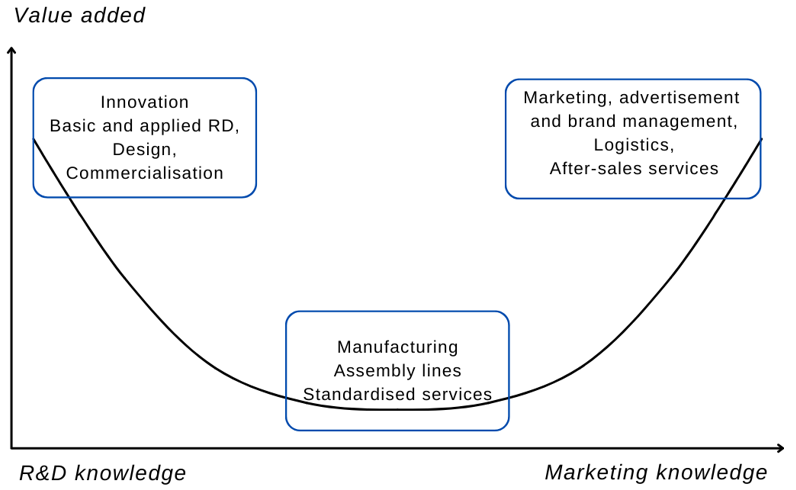

Shih, S., (1996). Me-Too is not my Style: Challenge Difficulties, Break Through Bottle- necks, Create Values, The Acer Foundation, Taipei.

Stöllinger, R. (2021). Testing the Smile Curve: Functional Specialisation and Value Creation in GVCs. Structural Change and Economic Dynamics, 56, 93–116.

Timmer, M., Miroudot, S., & De Vries, G. (2019). Functional specialisation in trade. Journal of Economic Geography, 19(1), 1–30.

World Bank. (2017). Global Value Chain Development Report 2017: Measuring and Analysing the Impact of GVCs on Economic Development. Washington, DC: World Bank.

https://openknowledge.worldbank.org/handle/10986/29593.

Ye, M., Meng, B., & Wei, S. J. (2015). Measuring smile curves in global value chains. Inst. of Developing Economies, Japan External Trade Organization.