As recent bank runs (Silicon Valley Bank, Signature Bank, First Republic Bank, Credit Suisse) have highlighted, the current two-tiered monetary system — where both the central bank and private banks create money — is too fragile for the digital age. The State (central bank) should exclusively issue money, thus severing the link between ‘money creation’ and the extension of private bank credit. Central bank digital currencies make possible the design of a monetary system that eliminates bank runs, shields the payment system from the financial system, and reduces the need for government intervention in the financial sector. Monetary policy would likely be more effective and financial cycles dampened.

After the global financial crisis of 2008, significant tightening of global regulatory standards, massive amounts of quantitative easing to save the system, and the delayed movement to ‘interest-rate normality,’ the multi-trillion-dollar question is this: Why is the banking system still fragile and is it fit for the digital age?

The collapse of Silicon Valley Bank (SVB) gave us a glimpse into bank runs in the digital age. What should have been a routine risk control exercise for the 16th largest U.S. bank was turned by incompetent management and untimely communication into a bank run. It was the first bank run of the digital age and billions of dollars were withdrawn in a day. Other mid-size banks that were similarly situated also lost deposits. To prevent a system-wide crisis of trust, the regulators temporarily guaranteed all deposits and rolled out an emergency facility for banks to meet their liquidity needs.

Rapidly rising interest rates were expected to create challenges for financial institutions and corporations that had become accustomed to low borrowing costs. But problems at a mid-sized U.S. bank were not expected to threaten yet another systemic breakdown. Instead of another round of hand wringing and political posturing, followed by minor tweaks to a malfunctioning system, we need to start rethinking the basic structure of our monetary and financial system.

Systemic fragility, an agglomeration of risks in the complex interaction of financial institutions, markets, and the real economy, is difficult to measure. Risks arise in individual institutions and markets. Complacency reigns among private and public players. Preemptive corrective actions are not taken. And then a sudden reassessment takes place. The triggers can be almost anything.

SVB’s failure sparked a re-examination of banks not only in the United States, but also in Europe and the rest of the world. Credit Suisse, the 24th largest international bank by assets, buffeted by scandals and indifferent management for at least a decade, looked wobbly, and had to be forced by the Swiss Government to merge with its domestic rival Union Bank of Switzerland (UBS). A disorderly failure of Credit Suisse could have unleashed global contagion. Banks around the world, large and small, are now being subjected to a re-evaluation by nervous markets and citizens.

Modern banks have three characteristics: high leverage (solvency concerns), maturity transformation (liquidity concerns), and importantly, some of their liabilities are treated like money and are critical to the functioning of the payment system. Despite their inherent instability, banks are an integral part of the current monetary system. It is characterized by a two-tier structure: The central bank provides central bank money in the form of cash to the public and reserves to commercial banks; in turn, when banks make loans or buy assets, they create money in the form of demand deposits that are used as a means of payment (McLeay et al., 2014). As a result, money creation and credit creation are intricately linked. Any disruption to the payment system can cause much immediate pain to depositors and create cascading stress in the real economy.

This public-private partnership, where the central bank and private banks create different components of money (cash vs. demand deposits), has largely evolved by historical accident as banking developed over centuries. The arrangement has proven to be problematic time and again, and it has now become a fragile anachronism in our fast-paced economy. It is a fair-weather arrangement and, as we just saw, even minor disturbances can destabilize it and undermine public trust.

All these characteristics were on display in the SVB case. When doubts emerged about SVB’s liquidity position and solvency, the digital bank run started with customers quickly moving their deposits into other banks (mostly larger, safer, too-big-to-fail banks), into nonbanks (such as money market funds), and into State-issued liabilities (cash, government securities).1 Clients whose access to funds in SVB could have been suspended, scrambled to find alternative sources to meet cash needs. To restore confidence, policymakers decided to provide government insurance for all deposits, not just for those under the insurance limit.2

Money required for payments and legally discharging debts is a public good and should not be issued by private banks. It needs to be provided exclusively by the State (central banks) whose credibility ultimately backstops the system. The medium of exchange in a dynamic economy need not be tied to bank assets that are exposed to credit, market, and liquidity risks, as well as the vagaries of maturity transformation. The link between money creation and credit creation must be severed.

Central bank digital currencies (CBDCs) offer an opportunity for fundamental change (Gnan and Masciandaro, 2018; European Central Bank, 2020; Bank for International Settlements, 2022). Consider a financial system where the CBDC and cash (both direct liabilities of the central bank) are the only forms of ‘money’ and where private entities are not allowed to issue short-term money-like instruments, such as demand deposits. All legal payments are made with the CBDC or cash.

More precisely, private financial institutions could no longer issue liabilities that promise a fixed value and are payable in full, on demand, in central bank money (CBDC or cash). That is, liabilities of private financial institutions would not be considered equivalent to the CBDC. The entire money supply would consist of central bank money.3 Money market funds (MMFs) would not be allowed to promise fixed net asset values, and would lose any check writing privileges since fund shares would have to be converted into CBDC to make payments.

In order to enable CBDCs to fully substitute for demandable deposits, we assume that there are no restrictions on the size of CBDC balances held in digital wallets, nor are there any maximum limits on transaction amounts.4 Such restrictions would reduce consumer welfare, make CBDCs much less attractive, and would probably be difficult to sustain politically.

The payment system—envisaged as a two-stage hybrid system designed as a public-private partnership—would run exclusively on the CBDC as the medium of exchange: (i) the central bank issues the CBDC, which is freely exchangeable into cash; and (ii) retail customers hold their CBDC in digital wallets at private payment interface providers (PIPs). The PIPs, for a fee, provide the user interface to retail customers, anti-money laundering and know-your-customer (AML/KYC) screening, and the handling of money transfers (European Central Bank, 2019). The payment system would be less costly, more inclusive and stable. Importantly, the payment system would be separated from lending and risk taking since the CBDC in digital wallets are not PIP liabilities, but rather central bank liabilities.5

PIPs would be separate legal entities, though they may be subsidiaries of other types of financial institutions. A more complicated question is whether PIPs would need to be legally separate from nonfinancial businesses, including from online retail and credit platforms. Besides the traditional reasons for separating financial and nonfinancial corporations, digitalization and network effects raise new competition and data protection issues.

Central banks would pay interest on CBDC balances.6 This interest rate could serve as an important new central bank policy tool. Interest paid on CBDC balances would also be beneficial for economic efficiency reasons. In an efficient monetary system, as Friedman (1960) pointed out, the medium of exchange should yield a rate of return similar to other risk-free short-term assets.

Without their ability to create money by issuing demand deposits, banks would become genuine intermediaries facing a ‘funding-in-advance’ constraint. They would have to raise funds (in central bank money) in advance at various tenors (term-deposits, bonds, equity) to make loans and buy assets — just like nonbank financial intermediaries do today. Untethered from short-term deposits, they would have greater flexibility to match assets and liabilities, subject to prudential rules on capital, liquidity, duration gaps, and risk management.

There would be much less need for government intervention and subsidization of finance. The new structure would stabilize the monetary system by eliminating the possibility of bank runs. Lender-of-last-resort facilities of central banks and government deposit insurance of money-like liabilities of private credit institutions would become unnecessary. The privileged access for banks to cheap insured deposit funding — a key distortion in the current financial system — would be eliminated. Even the largest credit-extending institutions would become much less systemically important because the monetary and payment system would be shielded from the broader financial system.

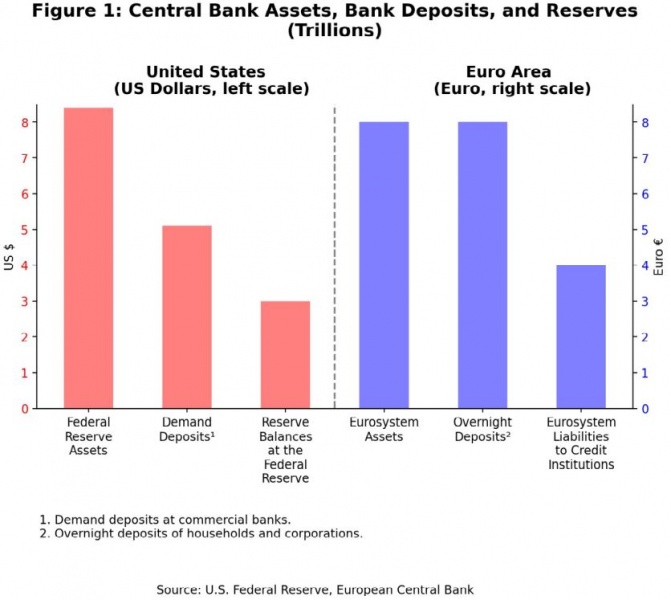

Even though in the United States, more than half the credit to the real economy is provided by nonbank financial institutions, a concern often raised about CBDCs is that the loss of demand deposits would severely reduce the availability of credit (Adalid et al., 2022; Infante et al, 2022). As an empirical matter, the current role of demand deposits as a funding source has been declining and should not be overstated. Based on Federal Reserve data, demand deposits ($5.1 trillion in February 2023, equivalent to about 19.5 percent of 2022 U.S. GDP) funded only 22 percent of commercial bank assets in the United States.7 Moreover, if all demand deposits at commercial banks were converted into CBDC, the Federal Reserve’s balance sheet would merely increase from about $8.4 trillion to $10.5 trillion, net of the reduction in bank reserve balances of $3.0 trillion.8

The situation in Europe is broadly similar, although banks tend to play a much larger role in the financial system than in the United States (Figure 1). In the Euro Area, overnight household and corporate deposits, which comprise deposit accounts without agreed maturities, including savings and other accounts, amounted to €8 trillion in February 2023 (equivalent to 59 percent of 2022 GDP).9 The Euro area’s monetary measure M1 was equal to 82 percent of annual GDP, largely in line with M1 in the United States at 74 percent of GDP.

Central banks would “back-up” their CBDC issuance with a range of high-quality assets, including government paper. They could also provide and, if needed, ‘recycle’ funds into the financial system by investing in high-quality private assets or by lending to financial institutions against good collateral (Brunnermeier and Niepelt, 2019; Niepelt, 2020).

Since banks would lose their “specialness” in the new financial structure and become true financial intermediaries without the capability to create money, the question arises: Does linking money creation and credit creation have benefits that we would give up in the new system?

In theory, positive synergies between deposit taking and lending might arise from three considerations. First, demandable debt may have beneficial incentive effects on lending decisions. To ensure that banks make prudent lending decisions that external creditors cannot directly assess, creditors may want to keep banks “on a short leash” by having the right to withdraw funding on short notice. From this perspective, the banks’ fragile funding structure acts as a commitment device to incentivize banks to properly screen borrowers and effectively monitor their loans (Calomiris and Kahn, 1991, and Diamond and Rajan, 2001).

Second, as Diamond and Dybvig (1983) argue, demand deposits provide intertemporal risk sharing to depositors who may not know with certainty when they might need money in the future. A demand deposit contract, in theory, allows them to benefit from higher returns on illiquid assets even when, it turns out, they have liquidity needs and may withdraw their money at short notice. Obviously, this risk sharing service stems from the maturity transformation that banks perform, but in doing so also creates the potential for bank runs.

Third, the ability to create money might give banks an advantage in providing contingent lines of credit since credit lines do not need to be prefunded in the current system (Piazzesi and Schneider, 2020). Banks can create money when needed: at the moment the lines are drawn, the funding is created by simply crediting the borrowers’ demand deposit accounts.

In reality, these arguments for positive synergies are not convincing. The hypothesis that fragile funding structures in banking and the associated threat of bank runs provide strong incentives for prudent bank behavior is questionable, as illustrated recently again by the failure of Silicon Valley Bank and the problems at Credit Suisse. Even sophisticated uninsured depositors with large sums at risk are not able to exert discipline on banks by withdrawing their funds preemptively before a run or crisis takes place. They neither have the information and expertise needed to make a judgment on a bank’s viability, nor do they have the incentives to do so.

By allowing retail access to CBDCs, central banks through PIPs can provide better Diamond-Dybvig-type risk sharing than current commercial bank demand deposits. Since central banks that issue CBDC do not face any liquidity constraints, they would be able to provide higher returns on CBDC compared to demand deposits in private banks. In this context, even though money market mutual funds that invest in short-term government paper and high-quality private short-term securities could offer higher returns, unlike CBDCs they would not promise a fixed net asset value.

The relative ease of providing contingent credit lines in today’s monetary system has negative effects. The absence of a prefunding requirement leads banks to overissue credit lines during financial upswings with little forethought about the risk of widespread drawdowns during cyclical downturns. In the new system, credit lines would need to be prefunded—at least in part—in anticipation of being drawn down. This prefunding requirement would reveal the true cost of providing credit lines (which in the current system are subsidized because of the privilege given to private banks to create money) and would thus lead to more efficient lending decisions.

More generally, the fact that much of information-intensive lending—which in the past was thought to be the domain of commercial banks—has over the years migrated to nonbanks, which cannot issue money, suggests that fragile bank funding through demand deposits is not a necessary condition for effective credit intermediation. Hence, separating money creation from credit extension would imply no loss of economic efficiency in credit allocation, while providing benefits in terms of improved financial stability and less volatile financial cycles.

It is worth noting that a variety of leveraged nonbank financial institutions can also face run-type risks since they fund long-term assets with short-term debt (for example, real estate investment trusts). Liquidity risks stem from difficulties to roll over their funding, including during system-wide flights to safety, as happened at the onset of the recent Covid pandemic (Sengupta and Xue, 2020). Even prime money market funds (MMFs), whose liabilities are not strictly speaking short-term debt, faced stress from large scale redemptions during the pandemic despite reforms that included floating net asset values, liquidity fees, and gated redemptions. The lesson is to make more use of equity (lower leverage) and other mechanisms for absorbing risks, and have contingent arrangements in place for funding in extreme circumstances.10

Financial systems are prone to large boom-bust cycles (Borio, 2012; Schularick and Taylor, 2012). The forces driving these swings include backward-looking risk management and regulation, as well as competitive pressures that promote strongly procyclical and coordinated behavior as a result of strategic complementarities (Aikun, Haldane, and Nelson, 2015).

The ability of banks to create money, and hence the absence of incentives to pre-fund credit extension, has been an enabling factor in the buildup of bank leverage in upswings. Moreover, creating money when expanding credit rapidly, as experience has repeatedly shown, encourages highly unstable funding patterns based on short-term liabilities. In other words, under the current system financial cycles are fueled by the ease with which funding can be created endogenously. When the cycle turns, this can have severe consequences for the financial sector and the real economy.

In downswings, the cyclical incentives go into reverse and the contractionary dynamics are amplified by pressures arising from fragile funding patterns. The ‘near-money’ liabilities of deposit-taking institutions may be threatened by runs. Financial intermediaries scramble for liquidity, triggering further knock-on effects through fire sales of assets.

Under the new monetary system, financial cycles would have lower amplitudes as the ability of traditional banks to create money endogenously would be eliminated. Tighter control on money creation and hence credit extension, and closer monitoring and restraints on the volume and riskiness of short-term claims issued by nonbanks, would dampen cyclical incentives further.

Monetary policy is likely to become more effective since central banks would have at their disposal a new policy tool, namely the interest rate paid on CBDCs. In response to severe shocks, the CBDC interest rate could be reduced to zero or even lower, thus avoiding the need for quantitative easing measures (Bordo and Levin, 2018). Policy makers would directly influence the quantity of money in circulation, unlike the current system in which the central bank has only indirect and limited control.

The new system based on central bank digital currencies (CBDCs) would be less complex. Money, a public good, would be exclusively created by the central bank. The payment system would be jointly operated by the central bank and private entities using central bank liabilities as the sole medium of exchange. Transactions data in payment interface providers (PIPs) would be protected by privacy laws and access would be given only under specific conditions. Credit extension, capital allocation, and other functions of the financial system would be performed by private institutions in competitive markets with far less government intervention. Licensing requirements for financial intermediaries, the separation of ‘banking’ and commerce, and anti-trust policies will have to be adapted for the new financial structure. It is time to separate the creation of money and the extension of credit by private financial institutions. This can now be accomplished by CBDCs and available payment technologies, and would lay the groundwork for a fundamental redesign of the monetary and financial system to make them fit for the digital age.

Adalid, Ramón, Álvaro Álvarez-Blázquez, Katrin Assenmacher, and others, 2022, “Central Bank Digital Currency and Bank Intermediation,” European Central Bank, ECB Occasional Paper 293, May.

Admati, Anat, and Martin Hellwig, 2013, The Bankers’ New Clothes — What’s Wrong with Banking and What to Do About It, (Princeton, NJ: Princeton University Press).

Aikman, David, Andrew G. Haldane, and Benjamin Nelson, 2015, “Curbing the Credit Cycle”, The Economic Journal, pp. 1072-1109, June.

Bank for International Settlements, 2022, “The Future Monetary System,” BIS Annual Economic Report, Chapter III, June.

Bindseil, Ulrich, 2020, “Tiered CBDC and the Financial System,” European Central Bank, ECB working paper 2351, January.

Bindseil, Ulrich, Panetta, Fabio, and Ignacio Terol, 2021, “Central Bank Digital Currency: Functional Scope, Pricing and Controls,” European Central Bank, ECB Occasional Paper 286, December.

Bordo, Michael and Andrew Levin, 2018, “Central Bank Digital Currency and the Future of Monetary Policy.” In: Michael Bordo, John Cochrane, and Amit Seru (eds.), The Structural Foundations of Monetary Policy, (Stanford, CA: Hoover Institution Press).

Borio, Claudio, 2012, “The Financial Cycle and Macroeconomics: What Have We Learnt?” Bank for International Settlements, BIS working paper no. 395, December.

Brunnermeier, Markus, K., and Dirk Niepelt, 2019, “On the Equivalence of Private and Public Money,” Journal of Monetary Economics 106, pp. 27-41.

Calomiris, Charles W., and Charles M. Kahn, 1991, “The Role of Demandable Debt in Structuring Optimal Banking Arrangements,” American Economic Review, Vol 81, No.3, pp. 497-513.

Cipriani, Marco, Michael Holscher, Patrick McCabe, Antoine Martin, and Richard Berner, 2023, “Mitigating the Risk of Runs on Uninsured Deposits: The Minimum Balance at Risk,” Liberty Street Economics, Federal Reserve Bank of New York, April 14.

Cochrane, John H., 2014, “Toward a Run-Free Financial System,” in: Martin Bailey and John Taylor (eds.), Across the Great Divide: New Perspectives on the Financial Crisis, Chapter 10, (Stanford, CA: Hoover Institution Press).

Diamond, Douglas, and Philip Dybvig, 1983, “Bank Runs, Deposit Insurance, and Liquidity,” Journal of Political Economy, Vol. 91, No. 3, 401-419.

Diamond, Douglas, and Raghuram Rajan, 2001, “Liquidity Risk, Liquidity Creation, and Financial Fragility: A Theory of Banking,” Journal of Political Economy, Vol. 109, No. 2, pp. 287–327.

Economist, 2023, “America’s Banks Are Missing Hundreds of Billions of Dollars: How the Federal Reserve Drained the Financial System of Deposits,” March 25.

Ennis, Hubert M., Jeffrey M. Lacker, and John A. Weinberg, 2022, “Money Market Fund Reform: Dealing with the Fundamental Problem,” Federal Reserve Bank of Richmond, Working Paper WP 22-08R, August.

European Central Bank, 2019, “Exploring Anonymity in Central Bank Digital Currencies,” In Focus, No. 4, December.

European Central Bank, 2020, Report on a Digital Euro, October.

Friedman, Milton, 1960, A Program for Monetary Stability, (New York: Fordham Press).

Gnan, Ernest, and Donato Masciandaro (eds.), 2018, Do We Need Central Bank Digital Currency? Economics, Technology, and Institutions, SUERF Conference Proceedings, 2018/2.

Infante, Sebastian, Kyungmin Kim, Anna Orlik, Andre F. Silva, and Robert J. Tetlow, 2022, “The Macroeconomic Implications of CBDC: A Review of the Literature,” Finance and Economics Discussion Series 2022-076, (Washington, D.C.: Federal Reserve Board).

McLeay, Michael, Amar Radia and Ryland Thomas, 2014, “Money in the Modern Economy,” Quarterly Bulletin, Bank of England, Q1, pp. 14-27.

Niepelt, Dirk, 2020, “Reserves for All? Central Bank Digital Currencies, Deposits, and Their (Non-) Equivalence,” International Journal of Central Banking, 62, pp. 211-238, June.

Omarova, Saule, 2021, “The People’s Ledger: How to Democratize Money and Finance the Economy,” Vanderbilt Law Review, 74 (5), pp. 1231- 1300, October.

Panetta, Fabio, 2022, “The Digital Euro and the Evolution of the Financial System,” Statement at the Committee on Economic and Monetary Affairs, European Parliament, June 15.

Piazzesi, Monica, and Martin Schneider, 2022, “Credit Lines, Bank Deposits or CBDC? Competition & Efficiency in Modern Payment Systems,” Stanford University working paper.

Schularick, Moritz, and Alan M. Taylor, 2012, “Credit Booms Gone Bust: Monetary Policy, Leverage Cycles, and Financial Crises, 1870 – 2008,” American Economic Review, 102(2), pp. 1029-1061.

Sengupta, Rajdeep, and Fei Xue, 2020, “The Global Pandemic and Run on Shadow Banks,” Economic Bulletin, Federal Reserve Bank of Kansas City, May.

Silva, Andre, and Christian Zimmermann, 2021, “Savings Are Now More Liquid and Part of M1 Money,” FRED Blog, Federal Reserve Bank of St. Louis, May 20.

United States Government Accountability Office, 2023, Money Market Mutual Funds: Pandemic Revealed Unresolved Vulnerabilities, Report to Congressional Committees, GAO-23-105535, February.

For the banking system as a whole, deposits do not decline when they are shifted around, except when, for example, money market mutual funds use the Federal Reserve’s reverse repo facility to deposit money at the central bank in exchange for securities (Economist, 2023).

The Federal Deposit Insurance Corporation (FDIC) covers checking accounts, savings accounts, time deposits, negotiable order of withdrawal (NOW) accounts, money market deposit accounts, and some other official items issued by banks. The standard insurance amount is $250,000 per depositor, per insured bank. The coverage can exceed $250,000 if the accounts are held in different ownership categories. A whole industry now exists to transfer deposits between banks to take advantage of this protection.

Omarova (2021) proposes replacing demand deposits by CBDCs, but the focus of her paper is on directing credit allocation via the central bank balance sheet.

The ECB is considering imposing limits on CBDC account balances of about €3000 – €4000 per person (Bindseil et al., 2021; Panetta, 2022).

Note that PIPs are not narrow banks, but are merely service providers that operate the payment system on a central bank platform.

In principle, the interest rate could depend on the size of CBDC balances (Bindseil, 2020).

Federal Reserve Board Data Releases H.6; H.4.1; and H.8.

The demand deposit data refer only to U.S. commercial banks. After a reclassification of monetary aggregates in 2020 by the Federal Reserve, the M1 measure of the money stock tripled and is now almost at the level of M2; checkable accounts at thrifts and credit unions are now subsumed under “other liquid deposits,” which also include savings accounts and money market deposit accounts (Silva and Zimmermann, 2021). According to the last available datapoint of the old series, in January 2021 all demand deposits and checkable accounts (including those at thrifts and credit unions) amounted to $4.7 trillion; bank reserves at the Federal Reserve were $3.2 trillion; and the Federal Reserve’s balance sheet was $7.4 trillion. Converting all demand deposits into CBDC (net of reserves) would have thus increased the Fed’s balance sheet by $1.5 trillion in early 2021.

European Central Bank, “Monetary Developments in the Euro Area,” February 2023.

Admati and Hellwig (2013) make a persuasive case for higher equity in leveraged credit institutions. A higher equity cushion also makes debt less information-sensitive and hence less subject to runs. Cochrane (2014) provides a general analysis of run-prone liabilities and possible remedies for bank and nonbank financial institutions. For recent discussions in the United States on reform of money market funds, see for example, Ennis et al. (2022), Cipriani et al. (2023), and United States Government Accountability Office (2023).