This policy note is based on the Latvijas Banka Working Paper 2025/8 and Eesti Pank Working Paper 2025/08. The views expressed are those of the authors and not necessarily those of the institutions they are affiliated with.

Abstract

This Policy Brief examines the effects of macroeconomic and budget balance shocks on public debt trajectories in the euro area. A positive GDP shock leads to a persistent decline in the debt-to-GDP ratio, while a positive GDP deflator shock reduces the debt ratio only temporarily. A positive primary balance shock, reflecting discretionary austerity, lowers the debt ratio considerably, albeit with a lag of around one year. Fiscal austerity is more effective in reducing debt after periods of economic expansion than after recessions, and more effective when the initial public debt is low than when it is high. Moreover, a positive GDP shock reduces the debt stock to a larger extent when the debt stock is large than when it is low. Finally, the response of debt to a positive budget balance shock is more persistent and statistically significant when the shock is large.

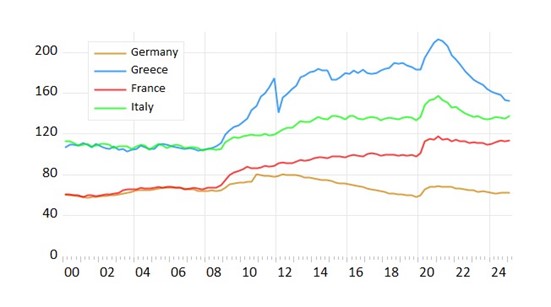

Many European economies have experienced substantial fiscal strain and seen their stocks of public debt grow in the years since the euro was introduced in 1999 (see Figure 1). The debt has grown despite the provisions of the Stability and Growth Pact and numerous changes in the fiscal and macroeconomic governance frameworks of the EU.

The European economies have meanwhile endured numerous macroeconomic shocks, including the global financial crisis, the European debt crisis, the Covid-19 lockdowns, and spiking energy prices after the Russian invasion of Ukraine. These developments raise the question how various macroeconomic shock have affected the trajectories of public debt in the euro area.

Figure 1. General government gross debt, per cent of GDP, 2000q1-2025q1

Source: Eurostat

In Tkacevs and Staehr (2025), we revisit the impact of macroeconomic and budget balance shocks on public debt in the euro area. There have been other papers in the field recently, including Cherif and Hasanov (2018), Patel and Peralta-Alva (2024) and Serio (2024), but none of them focus on the euro area.

We use a quarterly panel dataset comprising 11 of the first 12-euro area countries, with Ireland excluded because of the extreme volatility in its data. We employ a two-step methodology where structural shocks are identified using a structural VAR model in the first stage, and those shocks are used in panel local projections in the second stage to produce impulse responses for public debt and other variables of interest.

Our approach makes it easy to model state-dependencies and non-linearities, which are key themes in our paper. Some studies have considered state-dependence (Auerbach and Gorodnichenko, 2017) and non-linearities (Ben Zeev et al., 2023), but the studies typically focus on fiscal multipliers and only rarely consider the dynamics of debt. We take these ideas further by considering a number of different state-dependencies and non-linearities.

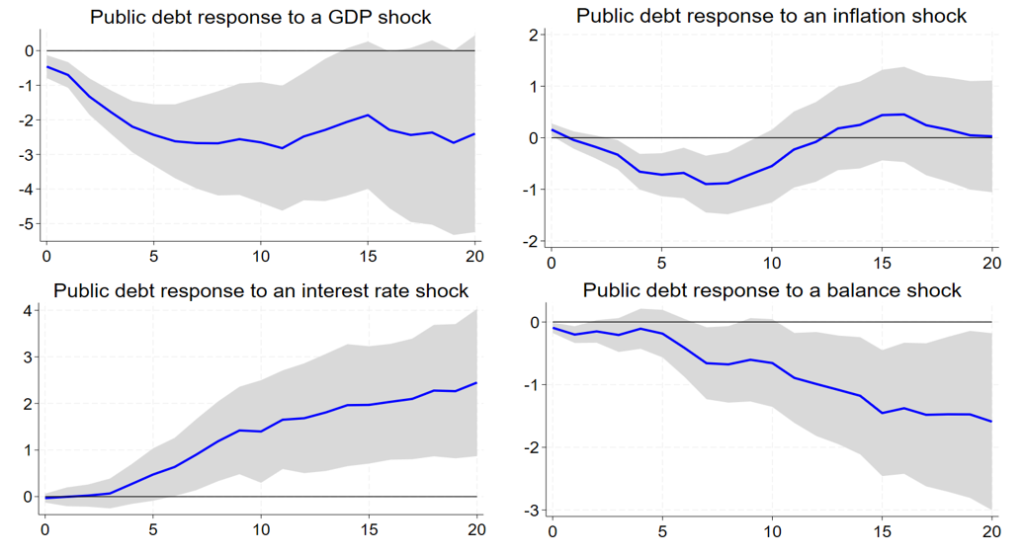

Our analysis shows that shocks to GDP, inflation, interest rates and the primary budget balance have very different impacts on public debt trajectories in the euro area (Figure 2). A positive GDP shock leads to a lasting reduction in the public debt-to-GDP ratio, with most of the improvement happening within the first year. Higher inflation, captured as a positive shock to the GDP deflator, also lowers the debt ratio at first, but this effect fades over time as governments adjust their fiscal policies. An interest rate shock increases the debt ratio over time, but the effect is small in the short term. A fiscal austerity shock results in a persistent decline in the public debt-to-GDP ratio, though the initial impact is limited because austerity tends to slow economic growth.

Figure 2. Response of the public debt-to-GDP ratio to macroeconomic and budget balance shocks (percentage points)

Source: Authors’ estimates

Note: The charts show the change in the public debt ratio in percentage points of GDP in response to an increase of 1 percentage point in GDP growth, GDP deflator inflation, the implicit interest rate, and the primary balance ratio to GDP. The horizontal axis shows quarters. The 90% conference bands are constructed using Driscoll-Kraay standard errors.

The debt stock may respond differently under different circumstances or economic conditions when the shock hits the economy.

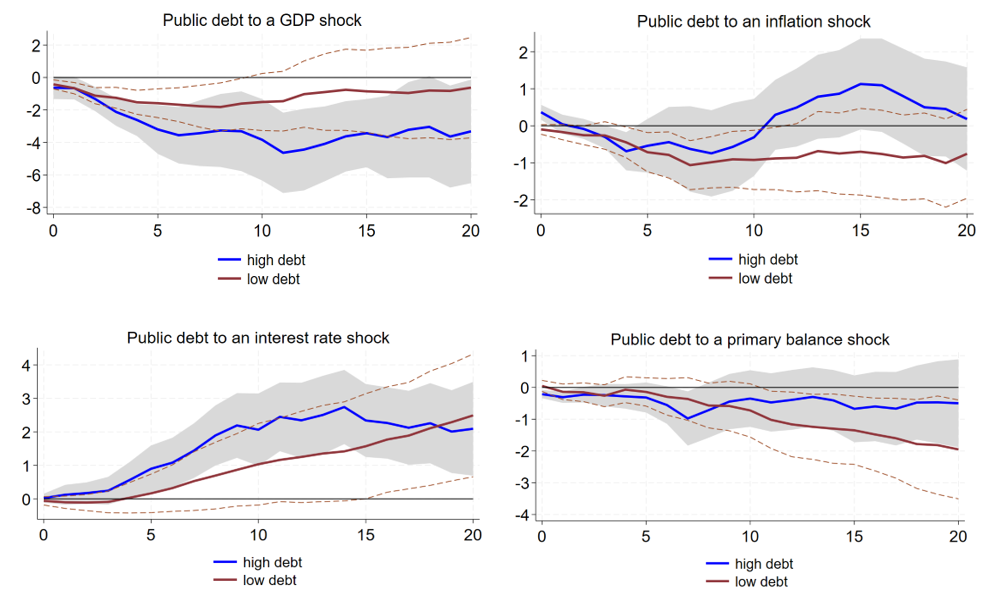

We explore whether the initial level of public debt matters for how it responds to shocks (Figure 3). A positive GDP shock lowers the public debt ratio both when the initial debt is low and when it is high. The effect is particularly strong and remains statistically significant over all the 20 quarters considered when initial debt levels are high. The dynamics of how inflation shocks impact public debt differ in the two cases, but the confidence intervals are large. Fiscal austerity measures have little impact when initial debt is large, as the response then is statistically insignificant. However, when initial debt levels are low, austerity is more effective and leads to a noticeable and significant decline in public debt in the longer term. These findings remain robust in all cases even when we use alternative thresholds for distinguishing between cases of low and high debt levels.

Figure 3. Response of the public debt-to-GDP ratio to macroeconomic and budget balance shocks when debt is high or low (percentage points)

Source: Authors’ estimates

Note: The charts show the change in the public debt ratio in percentage points of GDP in response to an increase of 1 percentage point in GDP growth, GDP deflator inflation, the implicit interest rate, and the primary balance ratio to GDP. The horizontal axis shows quarters. Red lines represent IRFs for the low debt state when the public debt ratio is below 80 per cent of GDP; blue lines represent IRFs for the high debt state when the public debt ratio is above 80 per cent of GDP. The dashed lines and shaded areas represent 90% confidence intervals constructed using Driscoll-Kraay standard errors.

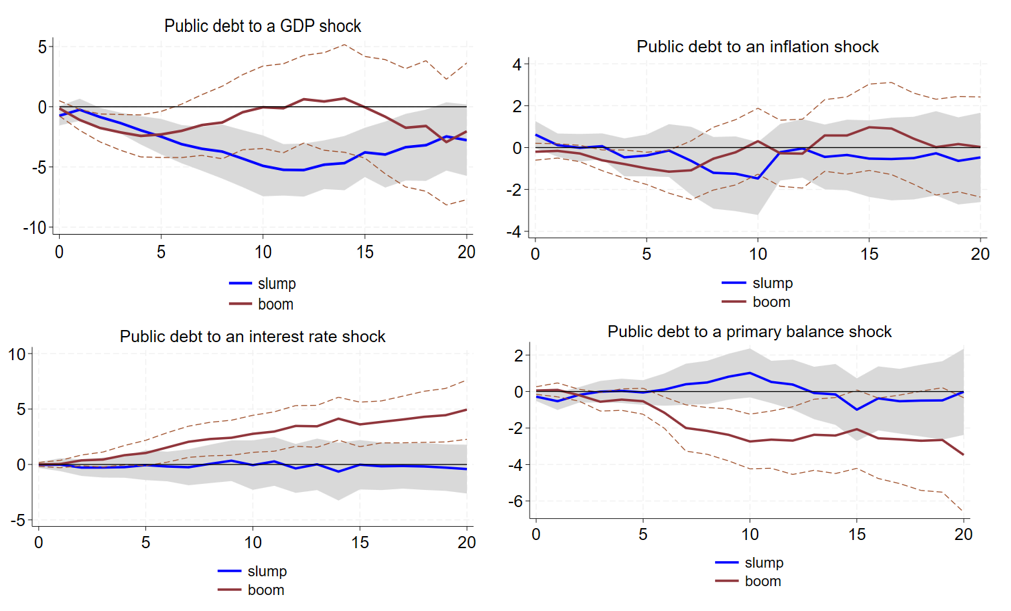

We next compare how public debt reacts to shocks when the economy was initially in a boom and when it was in a slump (Figure 4). Fiscal austerity is more effective at reducing debt when the economy is expanding, while the impact is limited during recessions. This finding suggests that countercyclical fiscal policies that tighten during booms and support growth during slumps may be the preferable strategy for ensuring debt sustainability. It may also be noted that higher interest rates tend to push public debt up more strongly during booms than during downturns.

Figure 4. Response of the public debt-to-GDP ratio to macroeconomic and budget balance shocks during booms and slumps (percentage points)

Source: Authors’ estimates

Note: The charts show the change in the public debt ratio in percentage points of GDP in response to an increase of 1 percentage point in GDP growth, GDP deflator inflation, the implicit interest rate, and the primary balance ratio to GDP. The horizontal axis shows quarters. Red lines represent IRFs for the boom state, while blue lines represent IRFs for the recession state. The dashed lines and shaded areas represent 90% confidence intervals constructed using Driscoll-Kraay standard errors

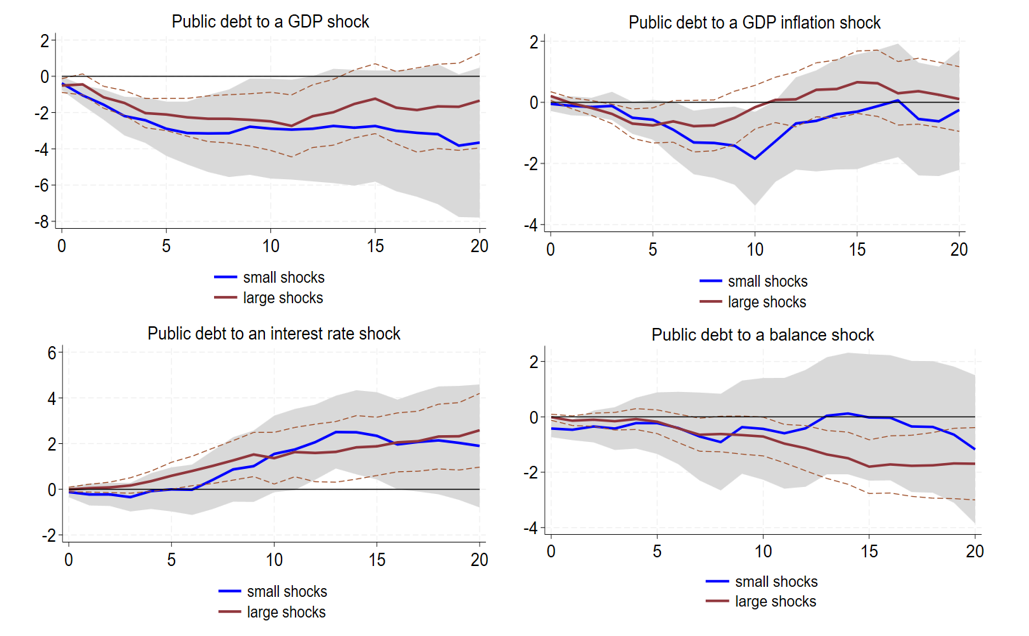

We also examine how the size of the shocks influences the dynamics of public debt. The main differences are for inflation and budget balance shocks (Figure 5). Small inflation shocks lead to a more prolonged reduction in public debt than large shocks do. Moreover, large improvements in the budget balance have a stronger and more lasting impact in reducing debt than small shocks have.

Figure 5. Response of public debt in percentage points to small and large macroeconomic and budget balance shocks

Source: Authors’ estimates

Note: The charts show the change in the public debt ratio in percentage points of GDP in response to an increase of 1 percentage point in GDP growth, GDP deflator inflation, the implicit interest rate, and the primary balance ratio to GDP. The horizontal axis shows quarters. Red lines represent IRFs for large shocks that exceed 1 standard deviation; blue lines represent IRFs for small shocks that are below 1 standard deviation. The dashed lines and shaded areas represent 90% confidence intervals constructed using Driscoll-Kraay standard errors.

The findings in Tkačevs and Staehr (2025) contribute to ongoing debates on debt sustainability and fiscal governance in the euro area, issues that are of particular importance given the revisions to the fiscal rules in 2024 that seek to ensure the dynamics of debt remain sustainable while preserving flexibility in fiscal policymaking. A key insight of the paper is that while fiscal policy is essential for managing public debt, macroeconomic conditions, particularly changes in economic growth and interest rates, also play decisive roles. Moreover, the dynamics of public debt depend on the state of the economy and the initial level of debt as well as on the size of shocks. These state-dependent and non-linear effects have received limited attention in the literature, yet our results suggest they are of importance. This underscores the importance of designing fiscal policy frameworks that are responsive to country-specific economic conditions.

Auerbach, A. J. and Y. Gorodnichenko (2017). Fiscal stimulus and fiscal sustainability. Fostering a Dynamic Global Economy, Proceedings of the 2017 Jackson Hole Economic Policy Symposium.

Ben Zeev, N., V. A. Ramey, and S. Zubairy (2023). Do government spending multipliers depend on the sign of the shock? AEA Papers and Proceedings 113, 382-87.

Cherif, R. and F. Hasanov (2018). Public debt dynamics: the effects of austerity, inflation, and growth shocks, Empirical Economics, 54, 1087-1105.

Patel, N. and A. Peralta-Alva (2024). Public debt dynamics and the impact of fiscal policy, IMF Working Paper, WP/24/87, International Monetary Fund.

Serio, Mario Di (2024). Public debt determinants: a time-varying analysis of core and peripheral euro area countries. Finance Research Letters, 69, #106101.

Tkačevs, O. and K. Staehr (2025). The Effects of Macroeconomic and Budget Balance Shocks on Public Debt Trajectories in the Euro Area. Latvijas Banka Working Paper series, 8/2025; Eesti Pank Working Paper series, 2025/8.