References

Andolfatto, D. (2021): “Assessing the Impact of Central Bank Digital Currency on Private Banks,” Economic Journal, 131, 525–540.

BIS (2018): “Central bank digital currencies”, Bank for International Settlements.

Bordo, M. D. and A. T. Levin (2017): “Central Bank Digital Currency and the Future of Monetary Policy”, NBER Working Paper.

Camera, G. (2017): “A perspective on electronic alternatives to traditional currencies”, Sveriges Riksbank Economic Review, 1, 126-148.

Chiu, J. and S. M. Davoodalhosseini, and J. Jiang and Y. Zhu, (2023): “Bank Market Power and Central Bank Digital Currency: Theory and Quantitative Assessment”, Journal of Political Economy 2023 131:5, 1213-1248.

Davoodalhosseini, M. and F. Rivadeneyra (2018): “A Policy Framework for E-Money: A Report on Bank of Canada Research,” Bank of Canada Discussion Paper.

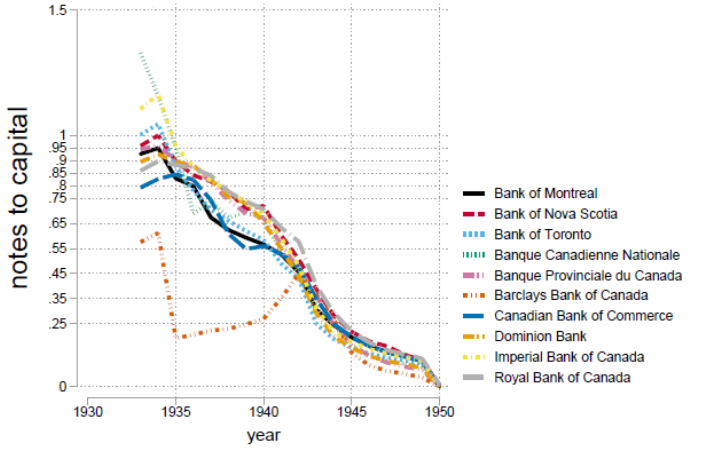

Grodecka-Messi A. and X. Zhang (2023): “Private bank money vs central bank money: A historical lesson for CBDC introduction”, Journal of Economic Dynamics and Control, Volume 154, 104707.

Engert, W. and B. Fung (2017): “Central Bank Digital Currency: Motivations and Implications”, Bank of Canada Discussion Paper.

Keister, T., Sanches, D., (2023): “Should central banks issue digital currency?” Rev. Econ. Stud, Volume 90, Issue 1, Pages 404–431.

Mancini-Griffoli, T., M. S. M. Peria, I. Agur, A. Ari, J. Kiff, A. Popescu, and C. Rochon (2018): “Casting Light on Central Bank Digital Currency”, IMF Staff Discussion Note, 18/08.

Mersch, Y. (2017): “Digital Base Money: an assessment from the ECB’s perspective,” Speech by Yves Mersch, Member of the Executive Board of the ECB, at the Farewell ceremony for Pentti Hakkarainen, Deputy Governor of Suomen Pankki – Finlands Bank, Helsinki, 16 January 2017 [acessed 12-03-2019].

Stevens, A. (2017): “Digital currencies: Threats and opportunities for monetary policy”, NBB Economic Review.

Whited, T. M., Wu, Y., Xiao, K. (2022): “Central bank digital currency and banks.” Available at SSRN 4112644.

Williamson, S.D. (2021): “Central bank digital currency and flight to safety”, J. Econ. Dyn. Control 104146.

Söderberg, G. (2018): Why did the Riksbank get a monopoly on banknotes?”, Sveriges Riksbank Economic Review, 3, 6-16.