This policy brief is based on the ECB working paper “Pricing of green bonds- drivers and dynamics of the greenium”, Pietsch and Salakhova (2022). The views expressed are those of the authors and do not necessarily reflect the views of the ECB or the Eurosystem.

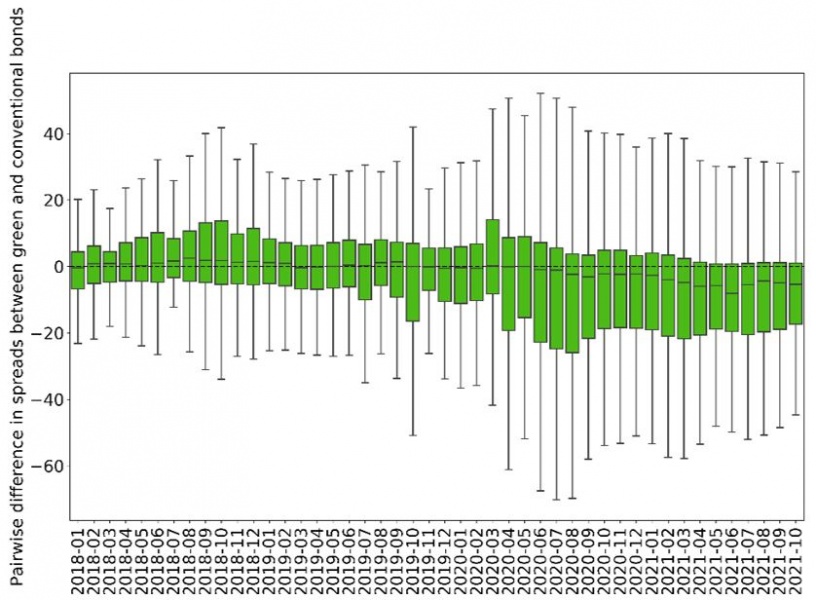

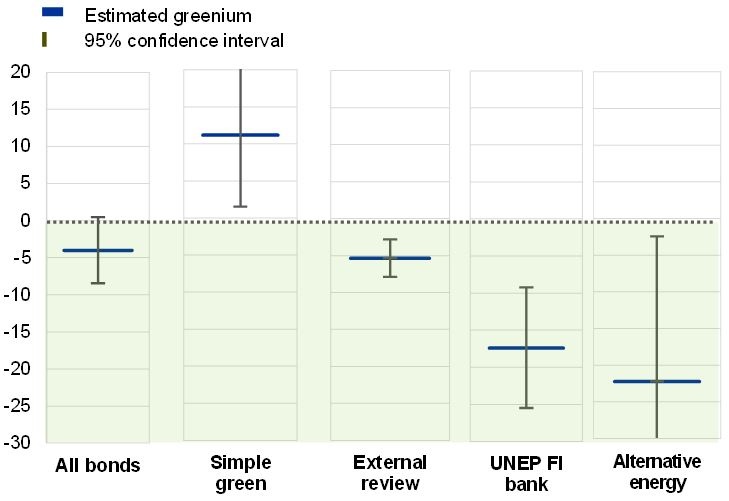

Our study analyses the difference in Option-adjusted spreads between green bonds and a set of similar conventional bonds. The option-adjusted spread adjusts the z-spread of a bond for its embedded options and is a measure of a bond’s yield-to-maturity in excess of the risk-free benchmark yield curve.

Opinion of the European Central Bank of 5 November 2021 on a proposal for a regulation on European green bonds. See also, Special Feature “Climate-related risks to financial stability” in Financial Stability Review of May 2022.