Does expansionary monetary policy foster capital misallocation? In a recent study we tackle this question both theoretically and empirically. We show how unexpected monetary policy expansions increases the investment of high-productivity firms relatively more than that of low-productivity ones, decreasing capital misallocation and increasing aggregate productivity. This has profound implications for the optimal design of monetary policy.

Firms’ investment decisions are one of the key transmission channels of monetary policy. However, financial constraints may limit firms’ investment, thus preventing markets to allocate capital efficiently, which affects aggregate productivity negatively. This opens the door to the possibility of monetary policy affecting productivity by influencing the allocation of capital across firms, through its heterogeneous impact on the investment decisions of individual firms. This interaction raises important questions. First, what are the channels through which monetary policy affects capital misallocation and endogenous TFP? Second, how do these channels modify the optimal conduct of monetary policy? To answer these questions, in González et al. 2021 we introduce a framework that combines the workhorse model of monetary policy – the New Keynesian model – with a tractable model of firm heterogeneity, in which capital misallocation arises from financial frictions.

In our model, a reduction in real rates – holding everything else constant – crowds in low productivity firms by reducing their financing costs, thus increasing misallocation. However, this result provides an incomplete picture of the effect of monetary policy on misallocation, because in general equilibrium also other prices change in response to monetary policy, and, in turn, these changes affect capital misallocation. When accounting for all price changes in response to a surprise reduction in interest rates, we find that high-productivity firms’ profits increase relative to those of low-productivity firms. This allows them to invest and grow faster, and thus gain market share. Since this effect offsets the negative one, misallocation decreases and productivity increases.

Using firm-level data for the quasi-universe of Spanish firms, we test this theoretical mechanism empirically. In a reduced form estimation, we assess whether high productivity firms increase their investment relatively more than less productive ones, following an expansionary monetary policy shock. Using firms´ marginal revenue product of capital as proxy for productivity, we find that firms whose marginal revenue product of capital is one standard deviation above their average, increase their investment rate by an additional 29pp in response to a 1pp surprise decrease in interest rates. This confirms our model’s predictions.

Which are the implications for monetary policy design? We analyze optimal monetary policy, assuming that the interest rate is the only policy instrument and that the central bank can commit to a future policy path. If the central bank is not bound by any past promises, the optimal strategy is to tolerate a temporary increase in inflation in order to achieve a persistent rise in productivity, brought about by a more efficient allocation of capital. This contrasts with the prescriptions of the textbook New Keynesian model, which recommend price stability in this situation.

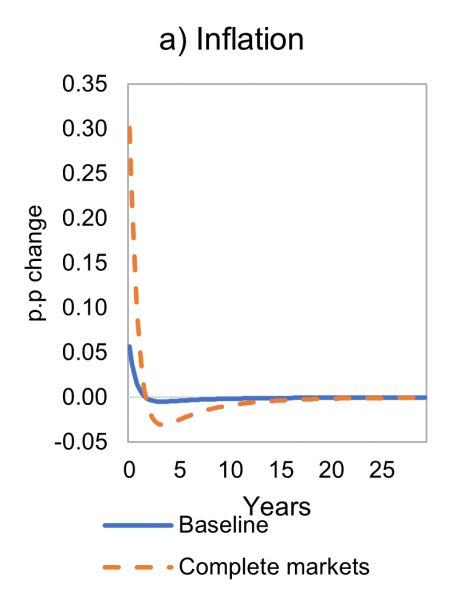

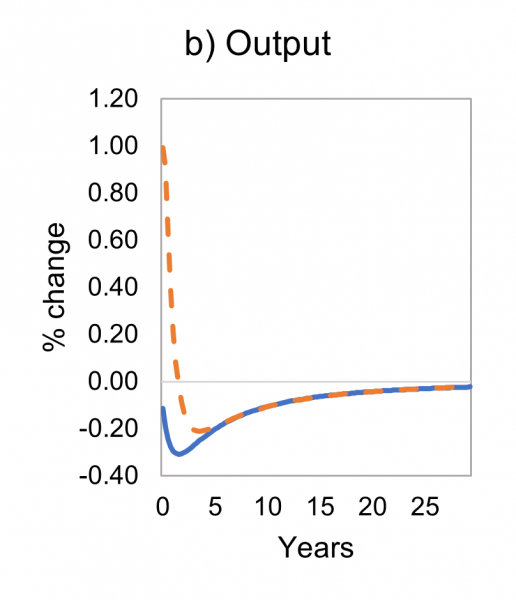

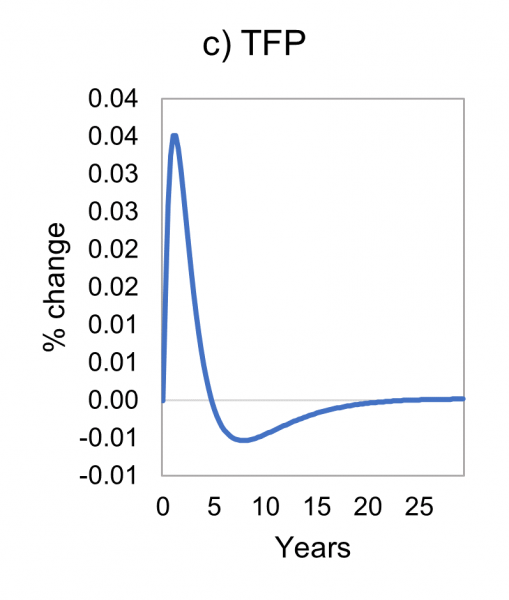

A more interesting case is when the central bank is bound by a commitment to an optimal policy rule. In this case we study the optimal response to inflationary pressures due to a rise in input prices (cost-push shock) (see Figure 1). The prescription in the standard New Keynesian model is that the central bank should “lean against the wind” (Gali, 2008), by tightening the monetary policy stance but tolerating some inflation to minimize the reduction in the output gap (see dashed orange line in panel a and b). Once financial frictions are incorporated, the central bank should instead “lean with the wind”: it should loosen monetary policy despite the rise in inflation (solid blue line, panel a), as the increase in demand boosts high-productivity firms’ investment and thus increases TFP (solid blue line, panel c), amplifying the expansionary demand effect on output (solid blue line, panel b).

Figure 1. Optimal response to a cost-push shock

The figure shows the optimal response with pre-commitments (in deviations from steady state) to a 10% decrease in the elasticity of substitution, which implies an increase of mark-ups from 11% to 12.5%. This cost-push shock is mean reverting with a yearly persistence of 0.8. The baseline economy is the solid blue line, and the complete markets economy the dashed orange line.

|

|

|

There has been a longstanding debate whether expansionary monetary policy fosters capital misallocation by channeling resources towards low productivity firms. We find that expansionary monetary policy, through a range of general equilibrium effects, boosts in particular highly productive firms’ investment. The resulting increase in aggregate productivity have important implication for the design of optimal monetary policy: central banks should “lean with the wind” to maximize the expansionary demand effect on output.

Gali, J. (2008). Monetary policy, inflation, and the business cycle: An introduction to the new keynesian framework. Princeton University Press.

González, B., Nuño, G., Thaler, D., & Albrizio, S. (2021). Firm Heterogeneity, Capital Misallocation and Optimal Monetary Policy. Documento de Trabajo 2145, Banco de España.