This SUERF Policy Brief summarizes BCL working paper 160, June 2022. This article uses data from the Luxembourg Observatoire de l’Habitat and the Luxembourg Household Finance and Consumption Survey (3rd wave). This article should not be reported as representing the views of the BCL or the Eurosystem. The views expressed are those of the authors and may not be shared by other research staff or policymakers in the Banque centrale du Luxembourg or the Eurosystem.

For aggregate housing and wealth statistics to be reliable, they need to cover the entire housing stock. This requires hypothetical values for properties that are not currently on the market for sale or for rent. To achieve such values, we impute hypothetical sales and rent prices in the Luxembourg Household Finance and Consumption Survey using hedonic models estimated on observable market data. These imputations replace estimates reported by survey participants. We find that participants’ tendency to over- or under-report housing values is correlated with their tenure length, tenure type, dwelling type, as well as their income and wealth. We detect large regional variation in price-to-rent, price-to-income and rent-to-income ratios. A microsimulation using these imputed values reveals significant affordability concerns: only 18% of renters could theoretically afford to purchase the dwelling they currently occupy at market prices.

Real estate is generally the most important asset held by households. Determining total wealth, as well as its distribution across individuals, households, groups of households or countries, requires accurate estimates of the current value of housing assets. In addition, macroeconomic housing statistics need the estimated value of the housing stock to reflect current market conditions. However, at any given time housing values are only observed for the small share of the housing stock that is available for sale or rent. A comprehensive macro-economic analysis, however, requires estimating the impact of evolving market conditions on the value of the entire stock of residential real estate held by the household sector.

Wealth surveys may be used to close this gap, but they rely on the accuracy of guesses by homeowners and renters regarding the current sales or rent price of their dwelling, although this is not currently on the market. Given detailed information on individual households, wealth surveys can provide insights into aggregate housing statistics as long as owners and renters accurately report current market values. However, previous studies have shown that while housing values reported by owner-occupiers in surveys may track changes well, they often misreport levels (Agarwal, 2007; Lepinteur and Waltl, 2021).

In this study, we use data from the Luxembourg Household Finance and Consumption Survey (LU-HFCS). This survey is part of the harmonised European HFCS wealth survey. We have extended the Luxembourg version by including questions on detailed physical and location characteristics of the household residence. In addition, we estimate hedonic models using comprehensive data on advertised dwellings for sale and rent collected by the Luxembourg Housing Observatory. These advertisements provide housing values that reflect current market conditions and supply-side sentiment, but also detailed information on dwelling characteristics. This allows us to match responses from the 2018 LU-HFCS to market data. For both owners and renters, we use the hedonic models to impute “objectified” current market sales and rent prices for each dwelling in the LU-HFCS. We compare the resulting objectified values to the responses provided in the survey.

The goal of this article is thus to assess the reliability of market sales prices and rents reported by owners and renters. We characterise the deviation of reported from imputed prices and link them to the characteristics of the surveyed household. Further, we analyse the magnitudes of deviation, and demonstrate how objectified sales prices and rents can serve to construct macroeconomic statistics and conduct micro-simulations.

Every dwelling is unique given its combination of physical and locational characteristics: “comparable” homes recently sold or rented only provide an indication for the market value of a dwelling that is not currently on the market. Therefore, to estimate aggregate wealth, the HFCS always asks owner-occupiers to estimate their home’s current market price. Renters, instead, are asked to report the monthly rent they currently pay. Both values may diverge from current market conditions.

Our analysis is based on 1,616 households participating in the 3rd wave of the HFCS conducted in Luxembourg in 2018 (Chen et al., 2020). Individual answers are weighted to obtain results that are representative for the entire population of households residing in Luxembourg. Owner-occupiers represent 69% of our sample. The survey includes an additional set of questions on physical and locational characteristics of the household’s main residence. Furthermore, the 3rd wave of the LU-HFCS was innovative in asking owner-occupiers to report a hypothetical monthly rent and asking renters to report a hypothetical current sales price.

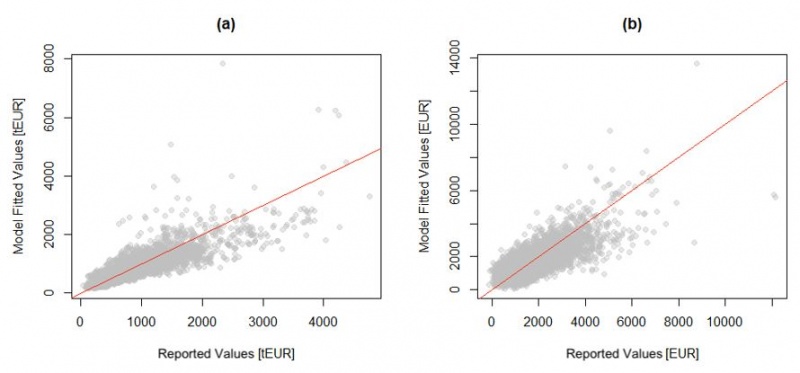

The Luxembourg Housing Observatory collects a rich set of advertised sales and rent data. We match the housing characteristics available for market data with those reported in the survey. We estimate hedonic imputation models by regressing logged sales or logged monthly rent prices on price-determining characteristics (Rosen, 1974). Standard Pearson correlation coefficients indicate a significant link between imputed and reported values for both sales (87.19%) and rent (85.83%) prices (Figure 1).

Figure 1: Correlation between imputed and reported prices

Notes: The figure depicts reported versus imputed market data for (a) sales and (b) rents prices.

Source: Authors’ calculations based on Housing Observatory data on advertisements available between 1 January and 31 December 2018.

We then use these individual imputed values to compile several macroeconomic statistics: aggregate (housing) wealth, distributional break-downs, national and regional price-to-rent ratios, price-to-income ratios and rent-to-income ratios, as well as housing affordability measures. This exercise leads to four main results:

First, the median value of net wealth reported by Luxembourg’s owner-occupiers is about EUR 50,000 lower than an estimate based on “objectified” values of their residential real estate. The differences between reported and imputed values are substantial for households in the lowest net income quintile but are not significant in the top income quintile. Similar large differences are also observed for various wealth quintiles. Overall, both the income and wealth distributions become narrower, slightly lowering measured wealth inequality.

For purely illustrative purposes, we modify the wealth and income distribution in other HFCS countries to match the differences identified in Luxembourg. This exercise provides an indication of how important reporting issues could be in this domain. We conclude that data for countries with large shares of owner-occupiers and expensive housing stocks may be prone to substantial “corrections” in net wealth measures.

Second, we focus on the differences between reported and imputed values for owner-occupiers. We find a positive Pearson correlation coefficient of ρ = 38.13% between deviations for the rent and for the sales price. A smaller deviation for the sales price usually means a smaller deviation for the rent, suggesting a certain ‘talent’ for appraising.

We characterise survey participants who tend to under- or over-report the value of their home using a multinomial logistic regression. The reliability of the self-reported value depends on knowledge about the local housing market and ability to adapt general trends to the specificities of their own home.

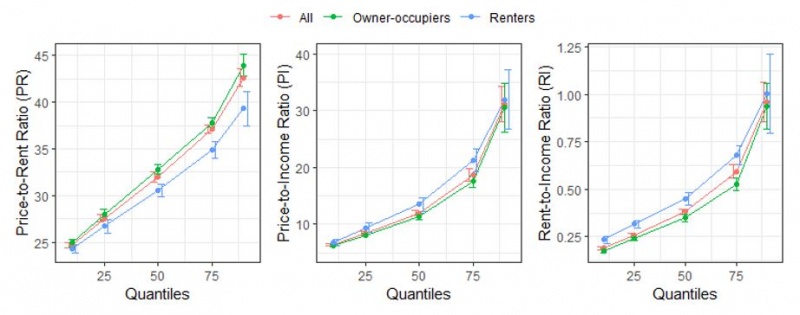

Third, for every surveyed dwelling we calculate the price-to-rent ratio, price-to-income ratio and rent-to-income ratio to obtain representative values for the entire housing stock. In general, these indicators face two main challenges: i) they usually fail to be representative for the entire housing stock and may compare prices of very distinct properties; ii) data on individual household income is hardly ever available to calculate ratios at a dwelling level. Our imputed housing and rent values overcome these shortcomings and allow us to aggregate individual ratios to obtain results that are representative for the population as a whole.

The OECD writes that aggregate statistics “provide only a general indication of the extent to which housing is (un)affordable for a (median) household, they are ill suited to support policy makers in targeting housing supports to different groups” (OECD, 2021, Box 1.1). Our micro-data yields more disaggregated indicators that reveal substantial differences (Figure 2). For example, the price-to-rent ratio is about 32 at the median for the combined sample of renters and owner-occupiers. However, it ranges from 25 at the 10th quantile to 43 at the 90th quantile. We find substantial variation across regions. In particular, the Luxembourg Canton including the capital displays very high ratios suggesting pronounced affordability concerns.

Figure 2: Prices versus Rents versus Income

Notes: The figures depict price-to-rent ratios, price-to-income ratios and rent-to-income ratios across their respective distributions relying on imputed prices and rents. The bars indicate a 90% confidence interval. Ratios are depicted separately for renters, owner-occupiers and the combined sample.

Fourth, we perform a micro-simulation to assess whether renters could theoretically purchase their current dwelling given their socio-economic situation, current housing market conditions and the institutional setting in Luxembourg. The latter accounts for mortgage market regulations, taxes and fees payable as well as subsidies and tax credits granted.

Using concepts operationalized by Gan and Hill (2009), purchase affordability considers whether a household is able to borrow enough funds to purchase a home (wealth effect). Repayment affordability considers the monthly financial burden imposed on a household repaying its mortgage debt (income effect). Both criteria need to be fulfilled for a household to become a homeowner.

Only 18.1% of all renting households meet both affordability criteria. These renters are usually younger, placed at the top of the wealth and income distribution, and do not live in Luxembourg City. The share drops to 15.3% if we also require that households face lower mortgage payments than their current rent. In sum, the vast majority of renters in Luxembourg could not purchase their current dwelling at market conditions.

Surveys routinely ask owner-occupiers to estimate the current market value of their home and ask renters to report their monthly rent. The reliability of the resulting market valuations depends on owners’ knowledge of the local housing market and their ability to apply it to their own home. Instead, reported rent is usually far from current market conditions because many tenants are on long-term rent contracts that are rarely updated in Europe’s heavily regulated rental markets. Thus, survey data may be misleading when assessing housing markets. However, survey data can provide detailed household information that is representative for the entire population inhabiting the current housing stock. Market data, instead, is limited to the part of the housing stock that is currently available for sale or rent.

We thus propose a feasible approach to combine market and survey data. For this purpose, we collect several additional dwelling characteristics in the LU-HFCS, which we use to evaluate hedonic models estimated on market data to obtain more objective current market values for the entire residential housing stock in Luxembourg.

This article demonstrates how a multi-purpose country-representative survey can be combined with observable market data to obtain objectified sales and rent prices. Linking survey observations to real estate market data can allow policy-makers and researchers to micro-simulate policy outcomes (e.g., targeted support for home-ownership or for renting), stress-test households’ portfolios in hypothetical scenarios, or simply extend housing statistics forward or backwards in time.

Agarwal, S. (2007). The impact of homeowners’ housing wealth misestimation on consumption and saving decisions. Real Estate Economics, 35(2): 135–154.

Chen, Y., Mathä, T. Y., Pulina, G., Schuster, B., and Ziegelmeyer, M. (2020). The Luxembourg Household Finance and Consumption Survey: Results from the third wave. BCL Working Papers, 142.

Gan, Q. and Hill, R. J. (2009). Measuring housing affordability: Looking beyond the median. Journal of Housing Economics, 18(2): 115–125.

Lepinteur, A. and Waltl, S. R. (2021). Tracking owners’ sentiments: Subjective home values, expectations and house price dynamics. LISER Working Papers, 2021-02.

OECD (2021). Building for a better tomorrow: Policies to make housing more affordable. Employment, Labour and Social Affairs Policy Briefs, Available at: http://oe.cd/affordable-housing-2021.

Rosen, S. (1974). Hedonic prices and implicit markets: Product differentiation in pure competition. Journal of Political Economy, 82(1): 34-55.

E-mail: denisa.naidin@liser.lu

E-mail: sofie.waltl@liser.lu

E-mail: michael.ziegelmeyer@bcl.lu