References

Aikman, D., Chichkanov, P., Douglas, G., Georgiev, Y., Howat, J. and King, B. (2019). “System-wide stress simulation”. Mimeo, Bank of England.

Alogoskoufsy, S., di Iasio, G., King, B., Nicoletti, G., Takeyama, A. and Vause, N. (2019). A model for system-wide stress simulations. Mimeo, Bank of England and ECB.

Abad, J., D”Errico, M., Killeen, N., Luz, V., Peltonen, T., Portes, R., and Urbano, T. (2017). “Mapping the interconnectedness between EU banks and shadow banking entities”. National Bureau of Economic Research working paper 23280.

Adam, T. and Guettler, A. (2010). “The Use of Credit Default Swaps by U.S. Fixed-Income Mutual Funds.” Working Paper No. 2011-01, Washington, D.C.: FDIC Center for Financial Research, November 19, 2010.

Adrian, T., and Shin, H. S. (2010). “Liquidity and leverage”. Journal of Financial Intermediation, 19(3), 418-437.

Baranova, Y., Coen, J., Lowe, P., Noss, J. and Silvestri, L. (2017). “Simulating stress across the financial system: the resilience of corporate bond markets and the role of investment funds”, Bank of England Financial Stability Paper No. 42.

Blackrock (2017). “Macroprudential policies and asset management”. Blackrock Viewpoint, February 2017, retrieved at: https://www.blackrock.com/corporate/literature/whitepaper/viewpoint-macroprudential-policies-and-asset-management-february-2017.pdf

Bley, A. and J. P. Weber (2017). “Capital Markets Union: deepening the Single Market makes sense, but don’t expect too much”. Vierteljahrshefte zur Wirtschaftsforschung, DIW Berlin, Volume 86, 01.2017.

Borio, C. E. (2004). “Market distress and vanishing liquidity: anatomy and policy options”. BIS Working Papers N.158.

Branzoli, N., and Guazzarotti, G. (2017). “Liquidity transformation and financial stability: evidence from the cash management of open-end Italian mutual funds”. Bank of Italy Temi di Discussione (Working Paper) No, 1113.

Brunnermeier, M. K., and Pedersen, L. H. (2008). “Market liquidity and funding liquidity”. The Review of Financial Studies, 22(6), 2201-2238.

Chen, Q., Goldstein, I., and Jiang, W. (2010). “Payoff complementarities and financial fragility: Evidence from mutual fund outflows”. Journal of Financial Economics, 97(2), 239-262.

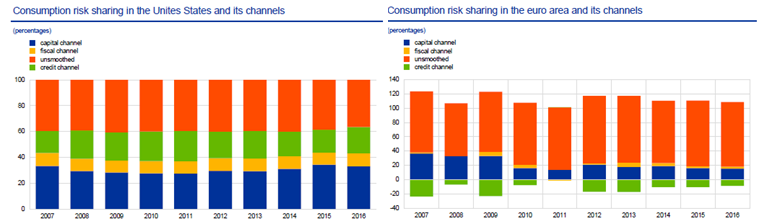

Cimadomo, J., Hauptmeier, S., Palazzo, A. A., and Popov, A. (2018). “Risk sharing in the euro area”. In: ECB Economic Bulletin, Issue3 / 2018, 85-98.

Cominetta, M., Lambert, C., Levels, A., Ryde n, A., and Weistroffer, C. (2018). “Macroprudential liquidity tools for investment funds – A preliminary discussion”. Macroprudential Bulletin.

Diamond, D. W. and Dybvig, P. H. (1983). “Bank runs, deposit insurance, and liquidity”. Journal of Political Economy, 91(3), 401-419.

Doyle, N., Hermans, L., Molitor, P., and Weistroffer, C. (2016). “Shadow banking in the euro area: risks and vulnerabilities in the investment fund sector”. ECB Occasional Paper Series, No. 174.

Downs, D. H., Sebastian, S., Weistroffer, C., and Woltering, R.-O. (2016). Real estate fund flows and the flow-performance relationship. The Journal of Real Estate Finance and Economics, 52(4), 347-382.

Edelen, R. M. (1999). Investor flows and the assessed performance of open-end mutual funds. Journal of Financial Economics, 53(3), 439-466.

Edward, F. R. (1999). “Hedge funds and the collapse of long-term capital management”. Journal of Economic Perspectives, 13(2), 189-210.

ESRB (2018). Public comment on IOSCO report: leverage.

ESRB (2017). “Recommendation of the European Systemic Risk Board of 7 December 2017 on liquidity and leverage risks in investment funds”. (ESRB/2017/6), published on 14 February 2018.

ESRB (2016). Macroprudential policy beyond banking: an ESRB strategy paper, July.

European Central Bank (2017). “Financial Integration in Europe 2017”.

European Central Bank (2018), Financial Stability Review, November 2018.

European Central Bank (2019), Financial Stability Review, May 2019.

Elliott, D. (2014). “Systemic Risk and the Asset Management Industry.” Economic Studies at Brookings, Brookings Institution, Washington.

Feroli, M., Kashyap, A. K., Schoenholtz, K. L., and Shin, H. S. (2014). “Market tantrums and monetary policy”. Chicago Booth Research Paper, (14-09).

Financial Times (2018). “‘Go anywhere’ bond funds spark debate around liquidity risk”. Financial Times November 19, 2018.

Financial Times (2019). “BoE governor Mark Carney calls for change to fund regulation”. 26 June 2019.

FSB (2018). “Global Shadow Banking Monitoring Report 2017”. March 2018.

FSB (2017). “Policy Recommendations to Address Structural Vulnerabilities from Asset Management Activities”. 12 January 2017.

Geanakoplos, J. (2010). “The leverage cycle”. NBER Macroeconomics Annual, 24(1), 1-66.

Goldstein, I. and Pauzner, A. (2005). “Demand –deposit contracts and the probability of bank runs”. The Journal of Finance, 60(3), 1293-1327.

Goldstein, I., Jiang, H., and Ng, D. T. (2017). “Investor flows and fragility in corporate bond funds”. Journal of Financial Economics, 126(3), 592-613.

Gorton, G., and Metrick, A. (2012). “Securitized banking and the run on repo”. Journal of Financial Economics, 104(3), 425-451.

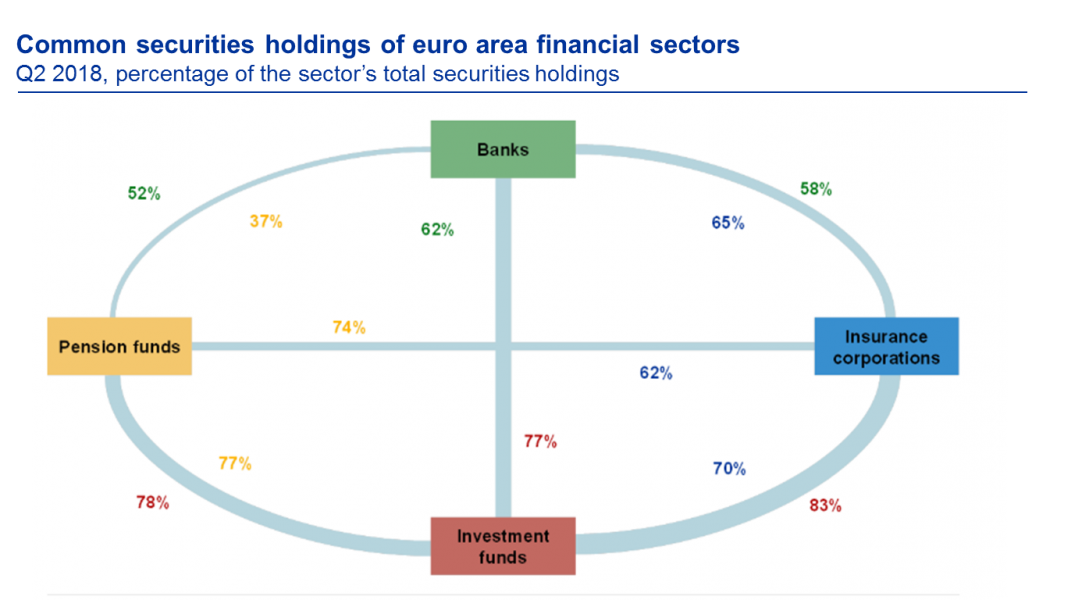

Inhoffen, J. (2019). “Stability implications of financial interconnectedness under the Capital Markets Union”. DIW Roundup 129: Politik im Fokus.

International Monetary Fund (2015). “Global Financial Stability Report”, April 2015. Washington, DC: International Monetary Fund.

IOSCO (2018a). “Recommendations for Liquidity Risk Management for Collective Investment Schemes”, Final Report.

IOSCO (2018b). “IOSCO Report: Leverage”, Consultation Paper.

Jank, S. and Wedow, M. (2015). “Sturm und Drang in money market funds: When money market funds cease to be narrow”. Journal of Financial Stability, 16, 59-70.

Khandani, A. E., and Lo, A. W. (2011). “What happened to the quants in August 2007? Evidence from factors and transactions data”. Journal of Financial Markets, 14(1), 1-46.

Lane, P. (2018). “Remarks by Mr Philip R Lane, Governor of the Central Bank of Ireland, at the Bank of Spain-SUERF Conference “Financial Disintermediation and the Future of the Banking Sector”. Madrid, 30 October 2018.

Manconi, A., Massa, M., and Yasuda, A. (2012). “The role of institutional investors in propagating the crisis of 2007–2008”. Journal of Financial Economics, 104(3), 491-518.

McDonald, R. and Paulson, A. (2015). “AIG in Hindsight”. Journal of Economic Perspectives, Vol. 29, No 2, 2015, 81-106.

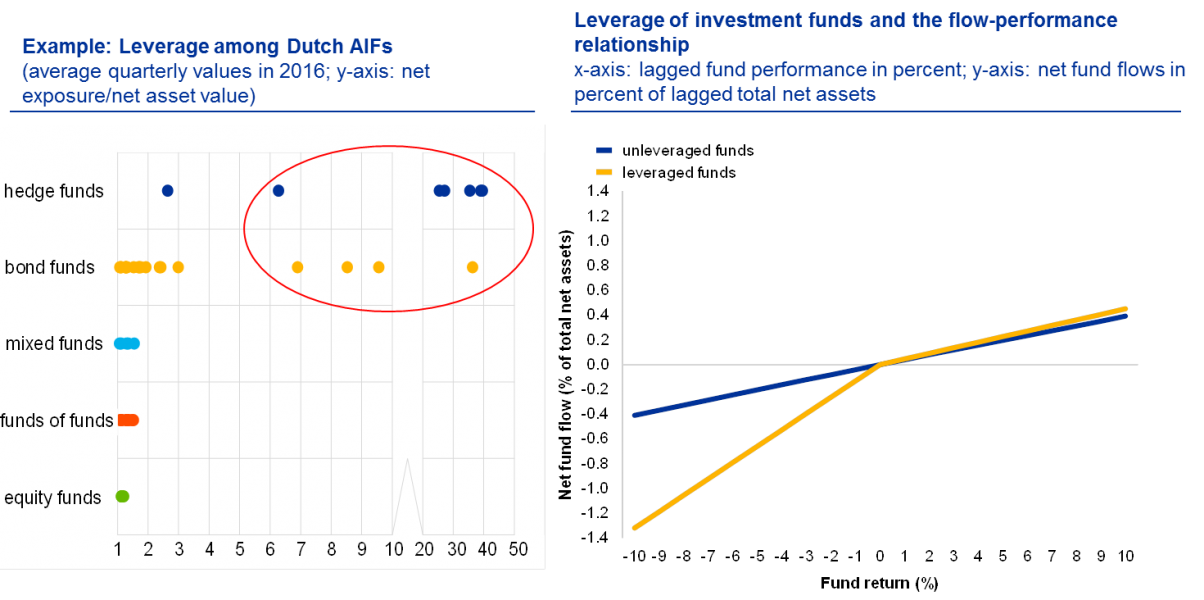

Molestina Vivar, L., Wedow, M., Weistroffer, C. (2019). “Burned by leverage? Procyclical flows and fragility in mutual bond funds”. Forthcoming.

Montagna, M., and Kok, C. (2016). “Multi-layered interbank model for assessing systemic risk.” ECB working paper series n. 1944.

Montagna, M., Covi, G., and Torri, M. (2019). “Economic shocks, financial contagion and systemic risk in the Euro Area” ECB working paper series, forthcoming.

Nanda, V., Narayanan, M., and Warther, V. A. (2000). Liquidity, investment ability, and mutual fund structure. Journal of Financial Economics, 57(3), 417-443.

Schularick, M., and Taylor, A. M. (2012). “Credit booms gone bust: Monetary policy, leverage cycles, and financial crises, 1870-2008”. American Economic Review, 102(2), 1029-61.

Stein, J. (2014). “Comments on “Market Tantrums and Monetary Policy”. Speech at the 2014 US monetary policy forum, New York, New York.

van der Veer, K., Levels, A., Lambert, C., Molestina Vivar, L., Weistroffer, C., Raymond, C., and de Sousa van Stralen, R. (2017). “Developing macroprudential policy for alternative investment funds”. ECB Occasional Paper Series.

Ziya Gorpe, M., Covi, G., and Kok, C. (2019). CoMap: Mapping Contagion in the Euro Area Banking Sector (No. 19/102). International Monetary Fund.