The discussion on the impact of climate change and related mitigation policies is gaining momentum in academic and policy circles alike. This column presents new evidence on the trade-offs across different green policy designs and cross-country coordination through the lens of an estimated two-country, two-sector DSGE model with carbon emission externalities. Three relevant policy implications emerge: i) fiscal policy should focus on reducing emissions by levying taxes on polluting production activities; ii) monetary policy should provide support to the economy when the costs of the environmental transition materialize; iii) international cooperation is crucial to make climate policy compatible with political incentives and effectively reduce emissions. In the model, the implementation of mitigating policies changes the structure of the economy by modifying the volatility of output and inflation. The central bank then has to modify its optimal reaction function to accommodate the green transition.

The discussion on the impact of climate change and of potential mitigation policies has gained momentum both in academia and policy circles over the last decades. Heatwaves, floods and natural disasters are raising the awareness that the long-neglected costs of adverse climatic events might materialize sooner than expected. Scientific studies, endorsed by international agreements, have estimated that countries should cut their emissions by about 50% over the next twelve to fifteen years in order to keep the increase in temperature below 1.5 degree.

In spite of the wide and growing empirical literature that tries to quantify the impact of climate change on the real economy (Hsiang et al. (2017), Nordhaus (2017) and Tol (2009)) and on the financial sector (Allen et al. (2020) and Pagliari (2021)), few structural models with intertemporal allocation choices and welfare implications have been developed in this field. In our recent paper (Ferrari & Pagliari (2021a)), we aim at filling this gap by setting up and estimating a two-country DSGE model featuring “green” and “brown” firms and an environmental externality to assess a wide range of containment policies in the US and the euro area.

The introduction of climate externalities in a standard model gives rise to a new trade-off (Heutel (2012))2. Firms producing final goods also generate a negative externality, i.e. CO2 emissions, that rises temperatures and increases the number of adverse climatic events that damage the economy. This emissions externality creates a negative feedback loop between production and emissions, which eventually dampens the beneficial impact of “expansionary” shocks on to the economy. Moreover, the model features an externality problem as polluting firms do not suffer any direct cost for emissions.

In our model, we consider two types of firms, “brown” and “green”. The former are the sole responsible for emissions production. The latter, on the other hand, engage in emissions-free activities by making use of costlier technologies. Brown firms are allowed to abate a share of their emissions, by employing a costly technology. In the baseline setting, brown firms are not incentivized to adopt the abatement technology, in that they do not internalize the emissions costs. The externality problem presents also a cross-country dimension, as brown firms’ production in each country contributes to global CO2 levels, thus impacting the severity of climate adverse events. This in turn generates an additional coordination problem in the model as policies implemented by one country would not affect the other economy’s emission, thus limiting their overall efficacy. Moreover, countries could decide to act strategically and shift the entire policy burden to the foreign economy, so to reap the most benefits from containment policies without bearing any direct costs.

According to the model’s results, adverse climate events induced by higher emissions entail a loss of steady state output by 1.2% and 0.4% in the US and the euro area respectively. In addition, US emissions have been on the rise again since 2017, following some important changes in domestic government spending and a reduction in negative emissions shocks from external economies. This increase has spilled over on the euro area as well, where emissions have risen due to the expansion in US consumption.

Against our theoretical backdrop, we evaluate three containment policies that have been largely discussed (IMF (2019) and NGFS (2020)): monetary policy interventions, domestic emission tax and a tariff on brown imported goods. We also consider a fiscal-monetary policy mix, whereby the government imposes an emission tax and the central bank re-assesses its optimal reaction function to accommodate the green transition. We assess these policies by looking at how they impact households’ welfare. Households are indeed the ultimate “principal” agents whom policy makers have to respond to. If households are better-off when a certain policy is put in place, then that policy is deemed “incentive-compatible”. Each policy alternative entails some costs. Reducing emissions through monetary policy, for instance, could imply a less efficient setting of the policy rate and, hence, welfare losses. An emission tax, on the other hand, would hurt the brown sector, and also aggregate production and employment if the green sector cannot compensate. Import tariffs might increase brown domestic production, because of trade diversion from foreign brown demand. Moreover, exchange rate adjustments might limit the overall effectiveness of the tariff. From a cross-country perspective, containment policies can be implemented: i) in isolation by each country; ii) in coordination, with each country targeting global welfare; iii) via strategic interactions, with each country maximizing domestic welfare by adapting its policy response to the other country’s actions. The latter case involves solving for the Nash equilibrium of a policy game between countries (Ferrari & Pagliari (2021b)).

Our quantitative results show that monetary policy alone is not effective in reducing emissions, regardless of whether actions are taken in isolation or in coordination with the other economy. Monetary policy, indeed, cannot change the incentives for brown firms to switch to greener production strategies. The resulting reduction in emissions is therefore limited, while the deviation from the optimal policy path generates welfare losses.

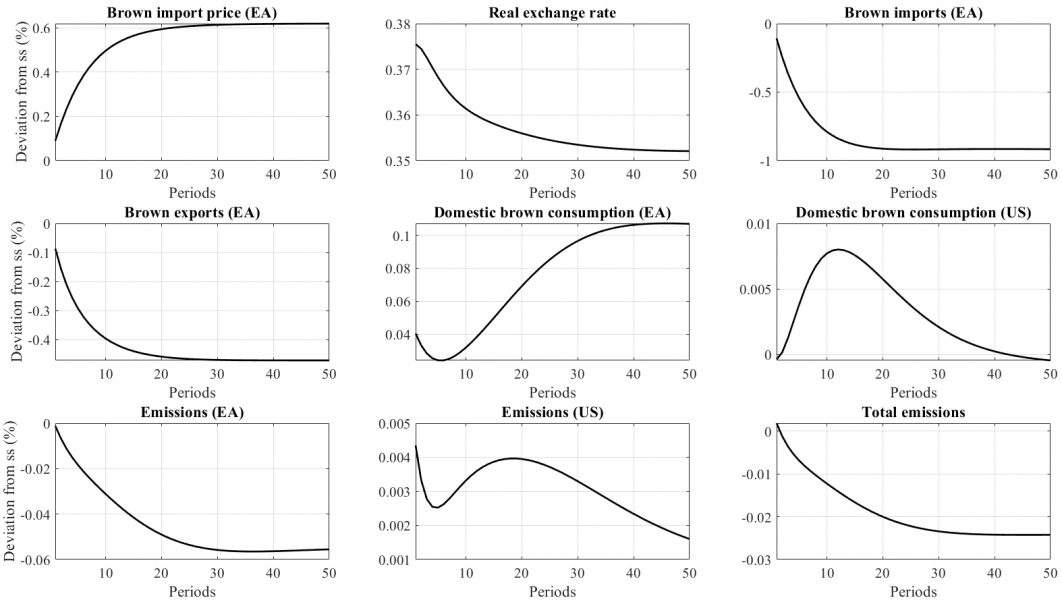

Tariffs are equally ineffective as their impact on production is completely offset by real exchange rate adjustments that make domestic brown production increase (Figure 1). This in turn leads to a very limited effect on aggregate emissions.

Figure 1: Effect of a EA tax on US brown imports

Notes: Reaction to the permanent introduction of the optimal tariff in the euro area on US brown imports. Variables are expressed in percent deviations from the steady state. Responses are computed with a second-order accurate approximation of the model. Results are qualitatively similar, despite with different magnitudes, when considering a US tax.

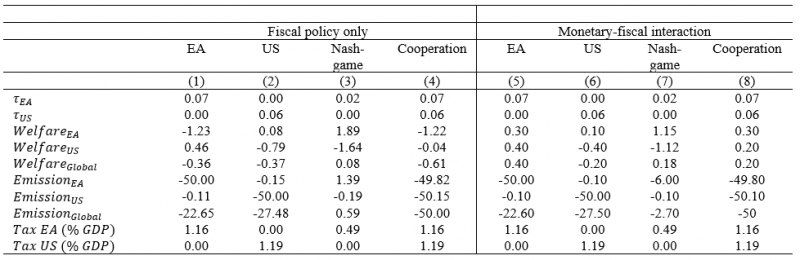

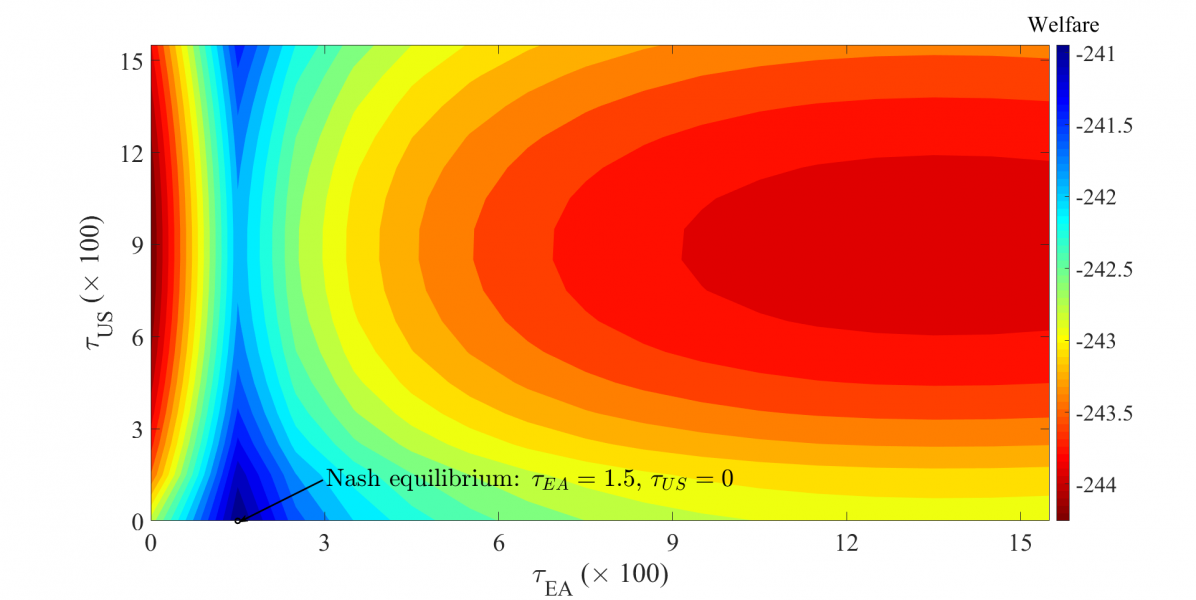

Taxes on domestic brown production, on the other hand, can effectively reduce emissions, while also entailing welfare costs (Table 1). An emission tax in the order of around 1.2% of GDP, for instance, would reduce global emission by 50%, due to an increase of both investments into green firms and abatement shares chosen by brown firms to internalize the pollution costs. The same tax would nonetheless decrease welfare in both countries, especially in the euro area where the estimated costs of climate events are lower than in the US. The environmental tax is hence neither Pareto-improving nor palatable from a political economy standpoint, even when implemented in cooperation (column (4) in Table 1).3 Consequently, countries might decide to act strategically and try to shift all the costs of the green transition to their neighbor while reaping the benefits of climate change mitigation. The outcome of this choice, which is the solution to the Nash game, is ineffective in reducing emissions, since each country waits for the opponent to move first (Figure 2). In our particular case, the euro area would be the only one to introduce a tax amounting to 0.5% of GDP, whereas the US would not introduce any taxation. Under the same scenario, general equilibrium effects would rise global emissions, thus completely missing the climate objective.4 All in all, fiscal policy by itself would be effective in tackling climate change, but it would not be incentive-compatible.

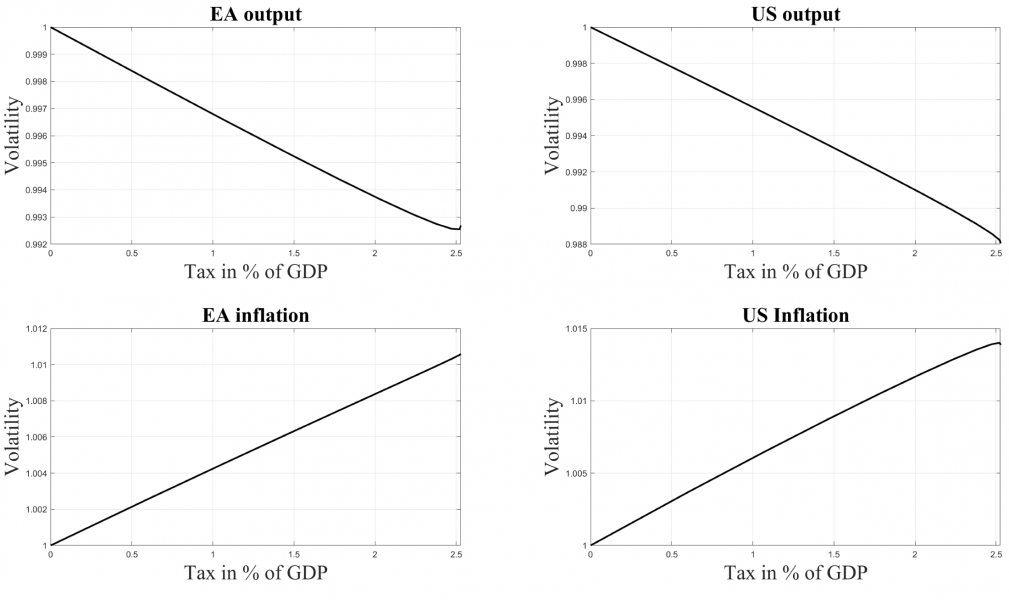

In our last policy experiment, we consider an interaction between monetary and fiscal policies within the cross-country coordination scenario. In this case, each central bank “accommodates” the green transition by adapting its monetary policy stance to the new environment so to reduce the related social costs. Under this configuration, hitting the climate objective also brings about welfare gains in both countries. Therefore, containment fiscal policies can be efficiently implemented only when two conditions are met: i) countries do coordinate; ii) monetary policy supports the new fiscal stance. In this context, central banks would optimally modify their reaction function to react less to inflation and more to output, compared to the framework without environmental taxes. Such choice directly derives from the structural changes induced by the carbon tax, which makes inflation more volatile vis-à-vis output (Figure 3). The monetary adjustment then makes the “green” steady state of the economy incentive-compatible.

Table 1: Optimal fiscal policy and monetary-fiscal interaction

Notes: Global welfare is the average of welfare in the two countries. Welfare and emissions are expressed in percent deviation from the stochastic steady state of the estimated model without policies. The second order stochastic steady state of variables differs from the deterministic steady state because of the contribution of future shocks on their asymptotic mean. The updated parameters of the monetary policy functions in columns (5)-(8) are not reported because of space limitations, can be found in Table 7 of Ferrari & Pagliari (2020).

Figure 2: Payoffs of the non-cooperative game

Notes: Payoffs are computed for each country as the welfare given by the combination of the tax implemented by the US (τUS) and the euro area (τEA) with tax revenues transferred to households. The Nash equilibrium of the game is given by the intersection between the optimal response functions of the two countries.

Figure 3: Standard deviation of output and inflation for different level of the environmental tax

Notes: Second-order consistent standard deviation of output and inflation in the euro area and the US for different levels of the environmental tax. Standard deviations are standardized to 1 in the model with no taxation in both countries.

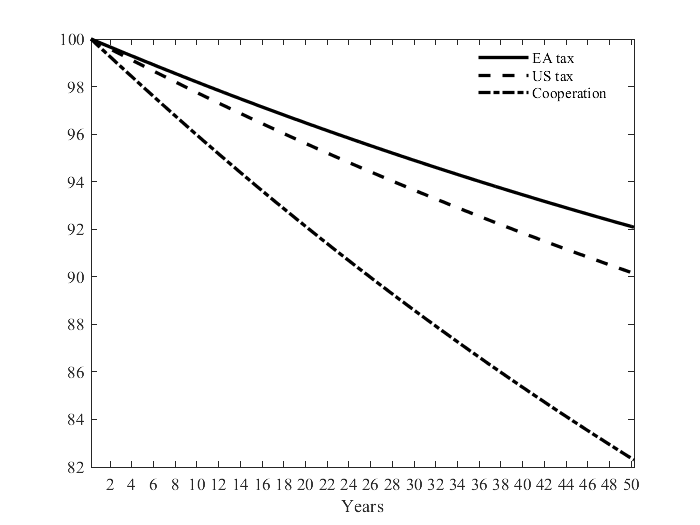

The results so far presented show how a sustainable reduction in emissions compatible with the Paris agreement can be attained when countries coordinate to implement a mix of fiscal and monetary measures aimed at incentivizing and accommodating the economic transition towards a greener production. Under this particular configuration, containment policies could deliver a reduction in the total stock of emissions by around 18% over a 50-year horizon (Figure 4). If, on the contrary, countries acted independently and non-cooperatively, individual incentives would prevent them from implementing an appropriate level of climate-mitigating policies to meet the emissions reduction target. The non-cooperative equilibrium, indeed, features an environmental tax which is too low to achieve the climate objective, but it can yet lead to moderate welfare losses.

Figure 4: Transition of global emissions stock for different policy configurations

Notes: transition of emissions stock between the equilibrium without containment policy to the equilibria reported in Columns (5), (6) and (7) of Table 1. Emission stock is normalized to 100 when the policy is implemented.

Allen, T. et al., 2020. Climate-Related Scenarios for Financial Stability Assessment: an Application to France. Banque de France Working papers, Issue 774.

Annicchiarico, B. & Di Dio, F., 2015. Environmental policy and macroeconomic dynamics in a new Keynesian model. Journal of Environmental Economics and Management, 69(C), pp. 1-21.

Benmir, G., Jaccard, I. & Vermandel, G., 2020. Green asset pricing. European Central Bank Working Paper Series, Volume 2477.

Bron, B. & Pfeifer, J., 2021. Uncertainty-driven Business Cycles: Assessing the Markup Channel. Quantitative Economics, 12(2), pp. 587-623.

Dietrich, A. M., Müller, G. J. & Schoenle, R. S., 2021. The Expectations Channel of Climate Change: Implications for Monetary Policy. CEPR Discussion Papers, Volume 15866.

Ferrari, M. & Pagliari, M. S., 2021. DSGE Nash: a toolkit to solve Nash Games in MacroModels. MIMEO.

Ferrari, M. & Pagliari, M. S., 2021. No country is an island: international cooperation and climate change. European Central Bank Working Paper Series, Issue 2568.

International Monetary Fund, 2019. Fiscal Monitor: How to Mitigate Climate Change.

Heutel, G., 2012. How should environmental policy respond to business cycles? Optimal policy under persistent productivity shocks. Review of Economic Dynamics, Volume 15, pp. 244-264.

Hsiang, S. et al., 2017. Estimating economic damage from climate change in the United States. Science, 356(6345), pp. 1362-1369.

Nordhaus, W. D., 2015. Climate Clubs: Overcoming Free-Riding in International Climate Policy. American Economic Review, 105(4), p. 1339–70.

Nordhaus, W. D., 2017. Revisiting the social cost of carbon. Proceedings of the National Academy of Sciences, 7(1518-1523), p. 14.

Pagliari, M. S., 2021. LSIs’ exposures to climate change related risks: an approach to assess physical risks. European Central Bank Working Paper Series, Volume 2517.

Network for Greening of the Financial System, 2020. Climate Change and Monetary Policy: Initial takeaways.

Tol, R. S. J., 2009. The Economic Effects of Climate Change. Journal of Economic Perspectives, 23(2), pp. 29-51.

Villeroy de Galhau, F., 2021. The role of central banks in greening the economy, 2021.

Other examples are Dietrich et al. (2021), Benmir et al. (2020), Annicchiarico & Di Dio (2015).

Emissions taxes lead to a decrease in total capital, appreciation of the currency and a reduction in trade. All in all, these dynamics are not compensated by the welfare gains due to the decrease in emissions.

For a limited taxation in the euro area, the euro exchange rate depreciates, leading to more demand for both brown and green goods which adds to the domestic wealth effect of the tax, as revenues are transferred to households. As the tax is small, the price effect of the tax does not compensate for the increase in domestic and export demand leading to an increase of emissions.