This policy brief is based on IMF Staff Discussion Note, 2025/003. The views expressed here are those of the authors and do not represent those of the IMF, its management or executive directors.

Abstract

Trade-offs between price and financial stability can emerge when inflation is above target and financial stress is rising. Central bank liquidity tools and other financial stability policies may, under some circumstances, allow central banks to maintain their inflation fighting stance, while addressing financial stress. However, challenges in deploying these tools and specific country characteristics may make it difficult to achieve price and financial stability at the same time. In such circumstances, central banks should account for financial stress increasing downside risks to activity, allow for slower disinflation using monetary policy flexibility, and communicate that deviations from the medium-term inflation target are temporary. Countries with weak central bank credibility, high exposure to exchange rate movements, and limited fiscal space face extra challenges in managing these trade-offs and might have to rely on foreign exchange interventions, macroprudential policies, capital flow measures, and international liquidity tools.

In the low inflation environment following the global financial crisis (GFC), price and financial stability objectives were well-aligned. Policy easing supported aggregate demand, kept inflation from dropping further below target, and reduced financial stability risks by strengthening financial intermediaries’ balance sheets. The rise in inflation in the post-pandemic period confronted central banks with potential trade-offs between price and financial stability, as perhaps most clearly illustrated by the collapse of the Silicon Valley Bank (SVB) and other U.S. regional banks in the spring of 2023.

Our new IMF Staff Discussion Note (Bouis et al., 2025) examines the channels through which monetary policy tightening can generate or exacerbate financial stress, explains when tradeoffs arise (including by reviewing several historical case studies in the U.S. and other countries), and develops a conceptual framework to guide central banks on how they should manage these tradeoffs.

Monetary policy tightening when inflation is high can generate or amplify financial stress by influencing asset prices, financial conditions, and asset quality. As central banks raise policy rates, bank balance sheets often deteriorate, and borrowers face more difficulties in repaying their loans.

Financial stress becomes more likely when policy rates rise in the presence of key vulnerabilities. When debt levels are high, rising interest rates can significantly increase repayment burdens and default risks, especially if asset prices fall. This may lead to deleveraging and a downward spiral in asset values. Public debt also poses risks if domestic banks are heavily exposed to government bonds, which may lose value as rates increase. Leverage among financial intermediaries intensifies stress, as firms facing funding or margin pressures may be forced into fire sales, spreading losses across the system. Similarly, maturity and liquidity mismatches expose institutions to losses during rate hikes, as they struggle to meet obligations or sell assets at fair value. These risks are magnified when the affected institutions are systemically important or intricately linked to others.

Financial instability is also more likely to occur if rate hikes follow an extended period of low interest rates, as this environment encourages excessive risk-taking and inflates asset prices. Sudden or prolonged tightening can then trigger abrupt market corrections and uncover hidden vulnerabilities.

Our paper applies a conceptual framework grounded in a stylized macroeconomic model with banks and banking panics based on Capelle and Teoh (2025) and on earlier work by Gertler, Kiyotaki, and Prestipino (2020) to think about conventional interest rate policy in times of high inflation and rising financial stress and guide the use of other tools to ease tensions between price and financial stability objectives.

When the financial system is well-capitalized, liquid, and hedged against interest rate changes, central banks can focus solely on price stability and macroeconomic objectives when setting interest rate policy. Raising interest rates to address inflation is unlikely to cause significant financial stability concerns because existing buffers are large enough that the financial sector’s liquidity and solvency risks are minimal. The appropriate interest rate policy in this context depends on policymakers’ mandates, their assessment of the monetary policy stance relative to the neutral interest rate, and the trade-offs they face between price stability and output stability, which hinge on the sources of shocks hitting the economy.

If financial stress is modest, central banks may avoid trade-offs between price and financial stability. As tighter financial conditions would imply a more restrictive environment if the policy rate path remained unchanged, the central bank may recalibrate its stance to keep inflation and output on the same path as before financial conditions tightened. Repos and the use of standing facilities can address liquidity-related stress.

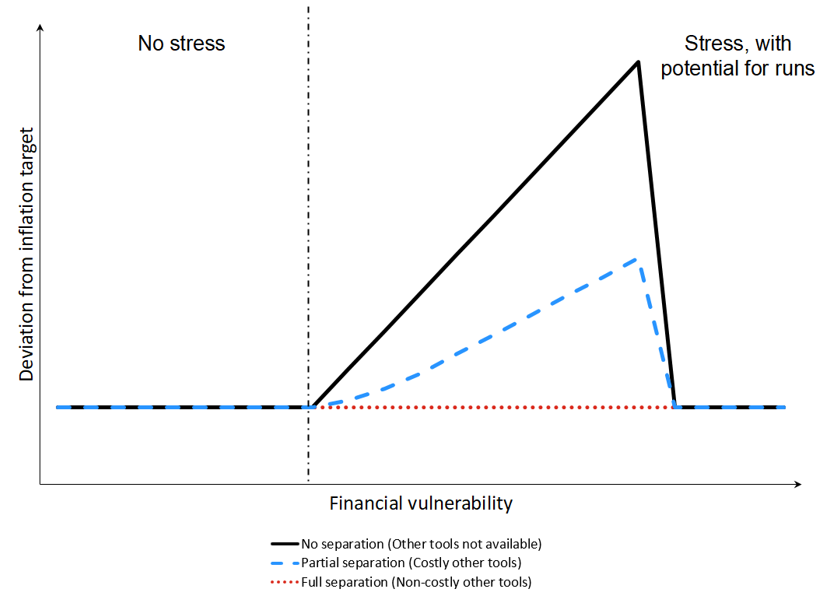

When central banks are confronted with a difficult situation in which high inflation is coupled with financial stress, they should strive to achieve “separation,” so that the financial stress does not force them to ease up on their price stability goal and allow a slower return of inflation to target. Whether central banks can succeed in doing so depends on the costs of using non-interest rate tools (such as, central bank liquidity, asset purchases, prudential, fiscal, and/or resolution tools) and the degree of financial stress. Figure 1 shows how the optimal inflation response deviates from the medium-run target (shown on the Y axis) as financial stress rises (captured on the X axis) and depending on the costs of non-interest rate tools.

Figure 1. Optimal deviation from inflation target

One extreme case is when non-interest rate tools are costless (dotted red horizontal line). Non-interest rate tools are deployed to the extent necessary to resolve financial stress so that the interest rate policy can focus on the price stability objective. Full separation can be achieved with inflation at the medium-run target. In some situations, the costs of using non-interest rate tools may be low enough so that the central bank can come quite close to achieving separation: for instance, this was arguably the case of the Fed’s intervention during the March 2023 collapse of SVB.

When non-interest rate tools entail costs (represented by the dashed blue line in the figure) full separation may not be optimal when stress is heightened, and it is instead optimal for interest rate policy to take financial stability into greater account by tightening less aggressively. This comes at the expense of a temporary deviation of inflation from the medium-run target. The greater the degree of financial stress and the higher the costs of other tools, the more central banks may need to tolerate deviations of inflation from their medium-term target. In such circumstances, central bank communication will play a key role. To avoid losing credibility and keep inflation expectations anchored, central banks should emphasize their commitment to price stability and the temporary nature of deviations.

If financial stress becomes so intense that a full-blown financial crisis occurs, the trade-off disappears as the fall in economic activity is so large that inflation falls. This is illustrated by the lines returning to the x-axis on the rightmost part of the chart and the deviation from target disappearing.

The framework underscores how financial stress can impede the central bank’s ability to achieve price stability if non-interest rate tools are unavailable or costly to use and highlights the importance of flexibility in an inflation targeting regime.

Policymakers can take action to limit trade-offs and reduce the costs of using non-interest rate tools —which our paper discusses comprehensively— to achieve separation. Strong prudential policy and supervisory frameworks with adequate capital and liquidity buffers (ideally in place before stress emerges to reduce vulnerabilities and increase resilience) are critical for limiting the financial stability risks associated with monetary tightening, and hence for achieving separation (as well as for containing potential moral hazard effects stemming from a perceived “central bank put”). In addition to robust frameworks for resolution and financial safety nets, sound fiscal policies are essential to build fiscal buffers in normal times and ensure that the authorities have the capacity to act when needed. Enhanced regulatory and supervisory frameworks for nonbanks are a precondition for central banks to be able and willing to provide liquidity support to such intermediaries in situations of heightened stress in a way that keeps the risks to central banks contained and minimizes political economy risks (“picking winners and losers”). Once this essential precondition is met, central banks should contemplate expanding their toolkit to be able to lend to these entities under certain conditions.

In emerging markets and small open economies with low central bank credibility, high exposure to exchange rate risk, and limited fiscal space, trade-offs between price and financial stability can be starker and more difficult to navigate. In these economies pursuing a tight monetary policy stance could not only exacerbate financial stress but also trigger capital flight if investors anticipate a financial crisis. Conversely, a less aggressive policy stance could further undermine central bank credibility, leading to capital outflows and exchange rate depreciations that would worsen stress. These economies thus might have to use foreign exchange interventions, macroprudential measures, and capital flow management measures, guided by the IMF’s Integrated Policy Framework. Trade-offs faced by these economies can also be mitigated through liquidity support from multilateral institutions such as the IMF.

Bouis, Romain, Damien Capelle, Giovanni Dell’Ariccia, Christopher Erceg, Maria Soledad Martinez Peria, Mouhamadou Sy, Ken Teoh, and Jerome Vandenbussche. 2025. “Navigating Trade-Offs between Price and Financial Stability in Times of High Inflation.” IMF Staff Discussion Note 2025/003, International Monetary Fund, Washington, DC.

Capelle, Damien, and Ken Teoh. 2025. “Optimal Interest Rate Tightening with Financial Fragility.” IMF Working Paper No. 2025/035, International Monetary Fund, Washington, DC.

Gertler, Mark, Nobuhiro Kiyotaki, and Andrea Prestipino. 2020. “A Macroeconomic Model with Financial Panics.” Review of Economic Studies 87 (1): 240–88.