Opinions are strictly those of the authors and do not necessarily reflect the official viewpoint of the Oesterreichische Nationalbank, the Joint Vienna Institute, the Národná banka Slovenska or the Eurosystem. The authors would like to thank Lea Silbernagl for the excellent research assistance. The abstract was written with the help of a generative artificial intelligence chatbot based on the GPT-4 series of large language models.

Abstract

This policy brief explores how macroprudential policy in Central, Eastern, and South-Eastern Europe (CESEE) adapted to the post-pandemic environment of high inflation and rising interest rates. Using the updated, intensity-adjusted Macroprudential Policy Index (MPPI), first developed by Eller et al. (2020), we find a general tightening of macroprudential measures, reversing the easing observed during the COVID-19 pandemic. This tightening was largely driven by increased capital buffers. In particular, the countercyclical capital buffer (CCyB) has been used in response to growing vulnerabilities in residential and commercial real estate markets. Despite elevated interest rates, most countries did not loosen borrower-based measures (BBMs), reflecting their role as structural safeguards for financial stability.

The post-pandemic surge in inflation starting in 2021, aggravated by the energy price shock resulting from the Russian war of aggression against Ukraine, ended a long period of low inflation and highly accommodative monetary policy in Europe, including the countries in Central, Eastern and South-Eastern Europe (CESEE). During the low-inflation and low-interest period preceding the recent surge in inflation, macroprudential policy (MPP) was increasingly used to counter increases in systemic risks in the banking sector. The rapid transformation of the macro-financial environment since 2021, however, raised fundamental new questions about how to conduct this policy appropriately.1

In this policy brief we use an update of an intensity-adjusted Macroprudential Policy Index (MPPI), first developed and published in 2020 (Eller et al., 2020) to see how macroprudential authorities in the CESEE countries responded to this largely unprecedented challenge. Being pioneers in applying macroprudential policy, the CESEE countries had some experience with using these tools during previous crises, in particular the Global Financial Crisis and the Covid-19 pandemic, but the specific nature of the post-pandemic inflation shock was unprecedented and required new approaches.

In the remainder of this brief, we are first looking at the channels through which elevated interest rates affect financial vulnerabilities and thus, the conduct of macroprudential policy. This is followed by a description of changes of the macroprudential stance in the CESEE EU countries based on the MPPI. In particular, we are looking at changes in real estate-related macroprudential policy tools, given that the appropriated calibration of this type of macroprudential tools is especially challenging during high-inflation, high-interest and low-growth periods. The final section of the policy brief concludes.

The surge in inflation from mid-2021 triggered an aggressive monetary-policy tightening cycle across the eleven EU members in Central, Eastern and South-Eastern Europe (CESEE-11). Between 2021 Q3 and 2023 Q1, policy rates were raised by 400–700 basis points in Czechia, Poland and Romania and by more than 1,200 basis points in Hungary, before a gradual retreat began in the second half of 2023. The CESEE euro area members – comprising the Baltic States, Slovenia, Slovakia and, from January 2023, Croatia – and Bulgaria, which operates a currency board pegged to the euro, experienced the least severe rate increases. Nevertheless, the ECB’s main refinancing operations rate peaked at 4.5% in September, marking the highest level in more than two decades.2

Higher policy rates, assuming that they are effectively transmitted to corporate and household interest rates, slow credit growth, cool housing markets and push up debt-service burdens – effects that help curb inflation but can also expose latent vulnerabilities in highly leveraged sectors and bank balance sheets. Evidence from earlier hiking episodes shows that such turning points often coincide with rising credit losses, especially where variable-rate lending is widespread, and property prices serve as main collateral anchor during the low-rate era (for a broader discussion, see ECB, 2023).

In the largely low-inflation, low-interest environment of the 2010s, tight macroprudential policy (MPP) played an important role in complementing accommodative monetary policy (MP) by curbing excessive risk-taking and making sure that banks remained well capitalized. In fact, by making the banking sector more resilient and by dampening asset price increases, macroprudential policy allowed monetary easing to support demand for longer (see Albertazzi et al., 2021; Laeven, Maddaloni, and Mendicino, 2022). With elevated policy rates however, the question arose whether – and under what conditions – a selective easing of MPP could mitigate adverse side-effects of monetary tightening, or, conversely, whether further macroprudential tightening remained warranted to guard against emerging risks.

Detken, Klacso and Martin (2023) argued qualitatively that – given the considerable uncertainties facing the materialization of macro-financial vulnerabilities and the macroeconomic outlook – there is no general first-best approach. Regarding capital-based measures, it was seen as paramount to assess the state and outlook of banking sector resilience at the time. The situation regarding borrower-based measures (BBMs) was seen in a more nuanced manner, given that the mortgage and real estate cycle in European countries, including the CESEE countries, was clearly turning as a result of the interest hikes. Loosening BBMs was, however, not seen as the most appropriate course of action because they may generate challenges to financial stability in the medium term.

Recent empirical evidence for the CESEE EU countries suggest diverse patterns, depending on the starting position of the macroprudential stance as well as the monetary policy regime. De Luigi, Eller and Stelzer (2025) show that in flexible-exchange-rate countries monetary tightening shocks were frequently followed by macroprudential easing when the pre-existing macroprudential stance was already stringent, partly cushioning credit dynamics. By contrast, in fixed-rate regimes the transmission of interest-rate shocks relied more heavily on consistent MPP support, reflecting the narrower set of policy instruments in those economies.

To assess in more detail how macroprudential policy in the CESEE EU countries has reacted to the recent high-interest rate environment, we use the updated, intensity-adjusted macroprudential policy index (MPPI) developed by Eller et al. (2020). This quarterly index aggregates “classic” macroprudential instruments (i.e., capital-, liquidity- and borrower-based measures) and other requirements motivated by macroprudential objectives (i.e., system-wide minimum capital and reserve requirements) for the CESEE countries, weighting every action by its expected macro-financial impact and considering the measures’ bindingness.3 The series is anchored at zero in the late 1990s, when macroprudential tools were largely absent, so the starting point represents a comparatively neutral stance. Consistently reapplying the original weighting scheme across countries and over time allows us to compare the tightness of policy both longitudinally and cross-sectionally.

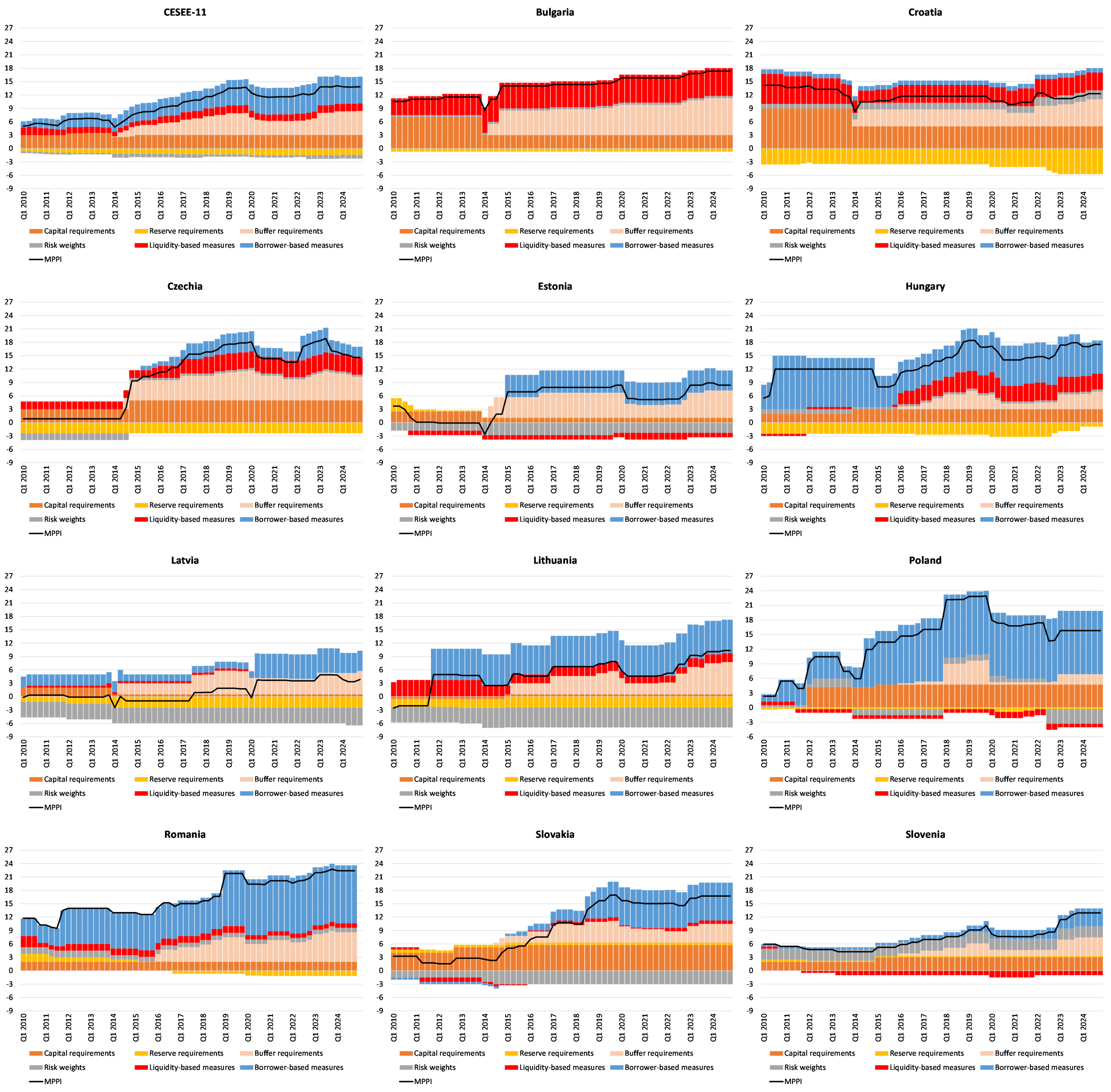

Chart 1 tracks the overall MPPI level and its sub-components from 2010 to end-2024. An upward movement denotes a net tightening of the macroprudential stance, a downward movement, a net easing. The MPPI clearly shows that the region experienced a steady tightening between 2014 and 2019, driven mainly by new capital buffers and a broader application of borrower-based limits. The comparatively tight pre-pandemic stance at the end of 2019 gave authorities leeway for a sharp easing in 2020, one of the most pronounced in the history of CESEE macroprudential policy. This easing was particularly strong in Poland, Czechia, Estonia, Lithuania and Hungary, whereas Latvia and Bulgaria registered a marginal net tightening (for a broader discussion, see Eller, Martin and Vashold, 2021). After a pause in 2021, the surge in post-pandemic inflation and subsequent policy rate hikes triggered a pronounced macroprudential tightening wave from late 2022 through 2023. Countries mostly reinstated or increased capital buffers, and a few also tightened borrower-based limits. By early 2024 the average regional stance had returned to its pre-pandemic level.

Chart 1. Evolution of macroprudential policy intensity by instrument, CESEE-11 (2010–2024)

Notes: Intensity-adjusted MPPI based on implementation dates; CESEE-11 = unweighted country average.

Source: authors’ update of Eller et al. (2020).

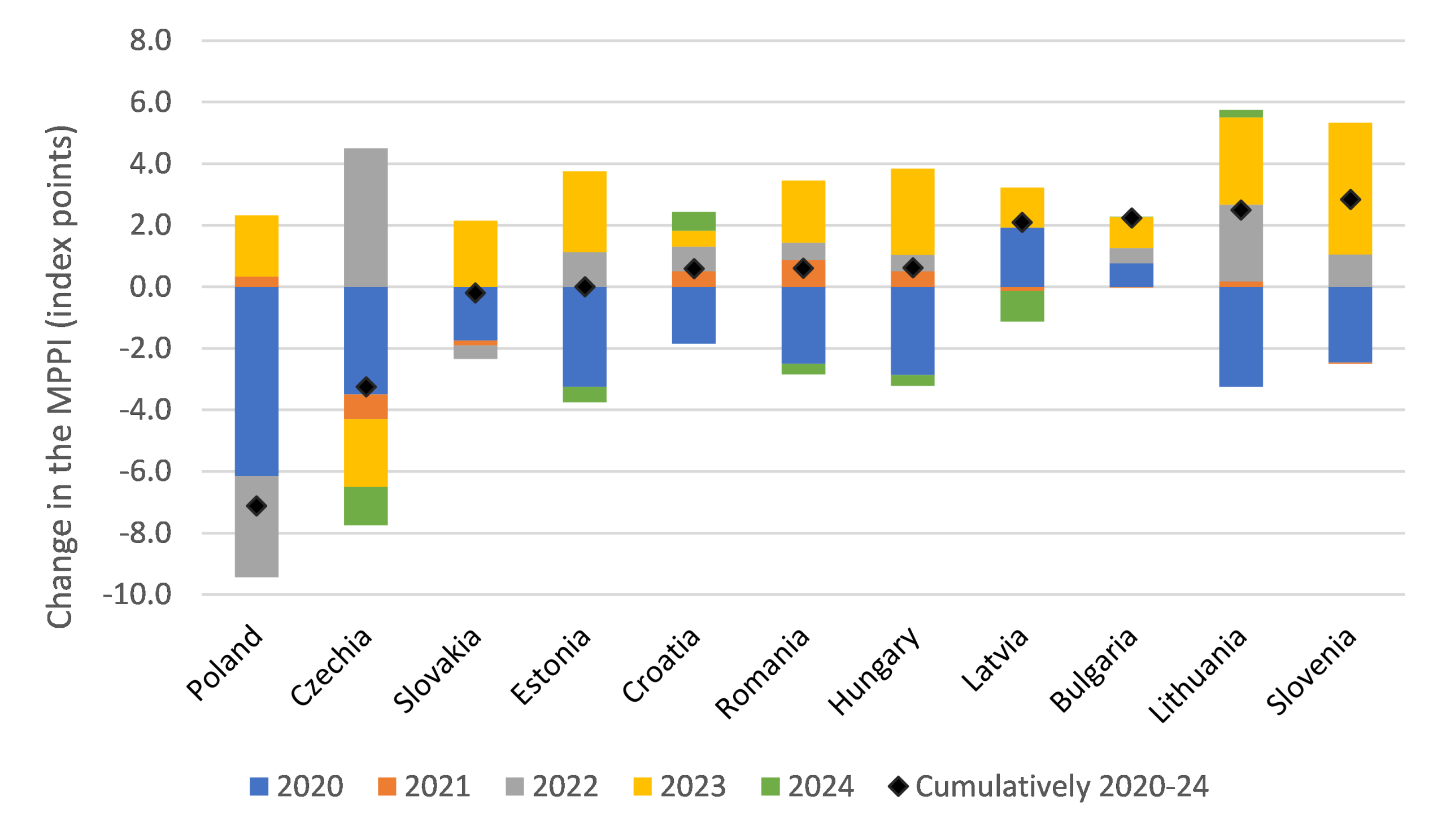

Chart 2, which sums quarter-on-quarter MPPI changes within each calendar year, highlights the cross-country dispersion behind these common trends. On a cumulative basis, the 2022-23 tightening was strongest in Slovenia (also due to reinforced borrower-based limits) and Lithuania, followed by Estonia and Hungary. Poland, by contrast, is the only country that eased macroprudential policy in 2022 – chiefly by reducing risk weights – and only partially offset this loosening with stricter capital-buffer requirements in 2023. On the other hand, Czechia recorded the sharpest tightening in 2022, driven mainly by stricter borrower-based measures, but partly unwound these steps in 2023 and in 2024 when borrower-based limits were relaxed again.

By 2024 the macroprudential stance stabilized in most CESEE economies, with only modest additional adjustments taking place during the year (notably easings in Czechia and Latvia). This recent stabilization likely reflects a combination of subdued credit dynamics, elevated uncertainty and a deliberate wait-and-see attitude as supervisors evaluate the impact of earlier tightening amid a still challenging macro-financial backdrop.

Chart 2. Macroprudential policy easing during COVID-19 pandemic followed by tightening in 2022-2023

Notes: Annual sum of quarter-on-quarter MPPI changes (index points). Positive values = net tightening, negative values = net easing.

Source: authors’ update of Eller et al. (2020).

By 2024 the macroprudential stance stabilized in most CESEE economies, with only modest additional adjustments taking place during the year (notably easings in Czechia and Latvia). This recent stabilization likely reflects a combination of subdued credit dynamics, elevated uncertainty and a deliberate wait-and-see attitude as supervisors evaluate the impact of earlier tightening amid a still challenging macro-financial backdrop.

As discussed already in Detken, Klacso and Martin (2023), the housing market is a particularly difficult terrain to navigate for macroprudential policy makers during high-inflation, high-interest rate periods. Many CESEE jurisdictions implemented early in the macroprudential tightening cycle real estate-related policy measures to safeguard financial stability. In this section, we analyse how the countries responded to the increase in interest rates in terms of changes in real estate-related macroprudential policies.

The risks associated with real estate financing are highly sensitive to changes in interest rates. As real estate loans are often characterized by a high share of variable-rate financing, changes in the policy rates directly translate into changes in the borrowing costs of firms and households – if the interest rate risk is not hedged.4 In addition, changes in interest rates also affect the risks to real estate financing indirectly through the effect on property prices. As high interest rates reduce the overall real estate market activity, price growth for properties dampen or prices may even decline.5 From a bank’s risk management perspective, this is worrisome. Higher borrowing costs lead to increases in the probability of default (PD) and lower property values result in a higher loss given default (LGD), i.e., increasing the expected loss via two channels. For commercial real estate, the property value channel is even more important. As shown by Barmeier, Liebeg and Rötzer (2024), the reduction of property values does not only increase the LGD due to the lower value of the collateral, but also the PD as the revenue from selling properties decreases for real estate firms.

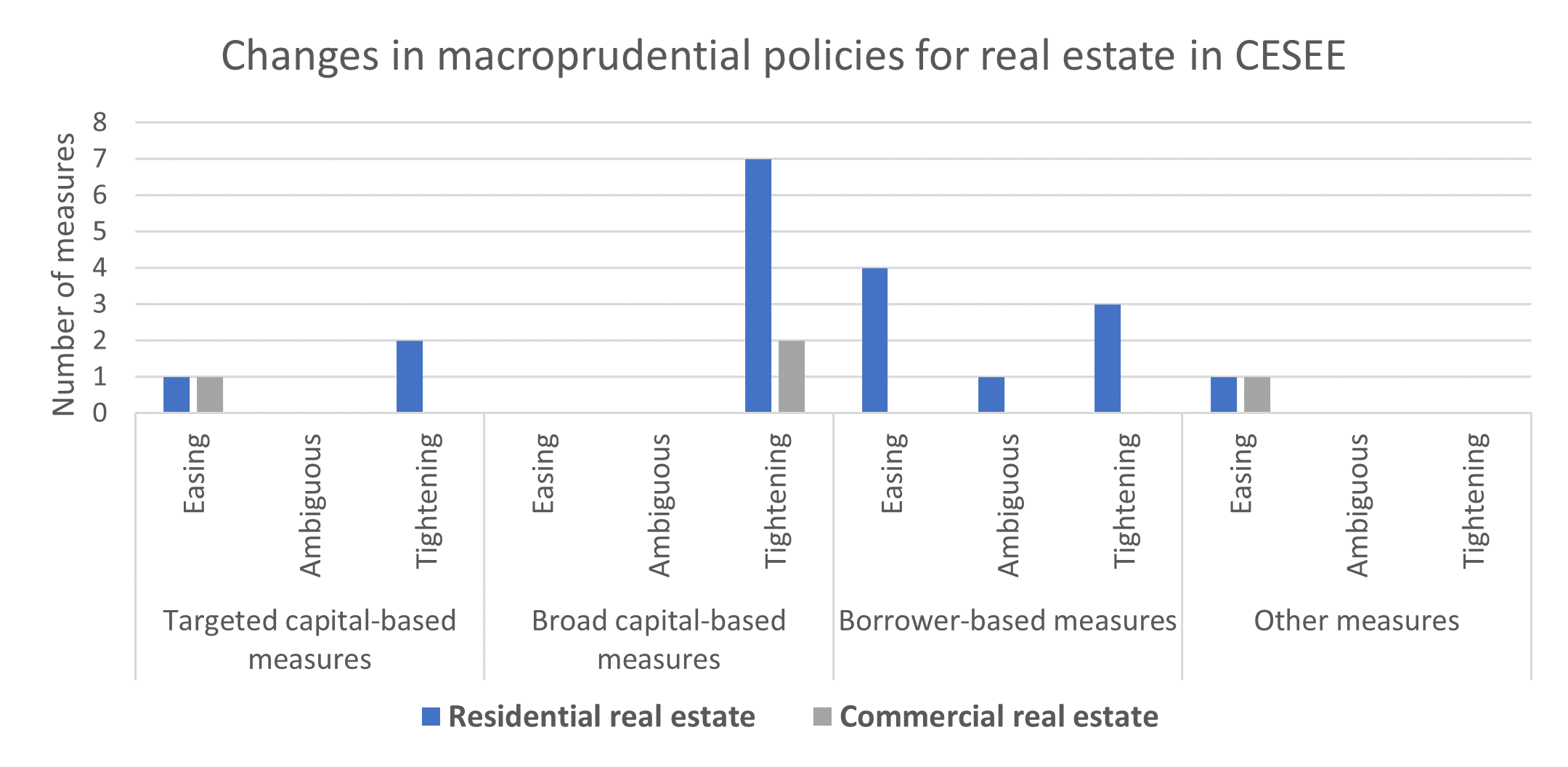

Chart 3. Changes in real estate-related macroprudential policies in CESEE between 2022 and 2024

Notes: Annual sum of quarter-on-quarter MPPI changes (index points). Positive values = net tightening, negative values = net easing.

Source: authors’ update of Eller et al. (2020).

Chart 3 shows changes in macroprudential policies for residential (RRE) and commercial (CRE) real estate categorized by the type of policy measure implemented. A number of observations are noteworthy.

Firstly, the number of policy measures applied for RRE is much higher (19 measures) than for CRE (4 measures). One of the potential reasons for this observation is related to the relatively higher relevance of residential real estate financing in the CESEE countries. As shown by OECD (2021), the homeownership rates in CESEE countries are comparatively high, indicating a high relevance of residential mortgage loans in the book of banks in this region. Furthermore, the missing experience with implementing borrower-based measures for CRE may have limited the available policy options. ESRB (2023) shows that BBMs for CRE had been implemented only in selected cases in Europe. There are different reasons for this, for example missing national legal frameworks for such measures as well as the heterogeneity in the financing of CRE markets, which is typically much less dependent on bank financing than RRE markets.

Secondly, more tightening (14 measures) than easing measures (8 measures) were implemented. This is particularly driven by increases in the countercyclical capital buffer (CCyB) in Bulgaria, Czechia, Croatia, Hungary, Lithuania, Slovenia and Slovakia. While the changes in these buffer rates were not only driven by real estate-related risks, the tightening countries justified their decisions by emphasising elevated risks in RRE (all countries) and CRE (three countries). Targeted capital-based measures, e.g. adjusting risk weights for exposure secured by RRE or CRE, were of minor relevance in CESEE during this period. Notably, Poland and Latvia reduced the risk weights for RRE and CRE, respectively, while Lithuania and Slovenia introduced a sectoral systemic risk buffer for RRE.

Thirdly, most EU CESEE countries did not relax BBMs for RRE in the high-interest environment. In fact, BBMs are in place across all countries in the region, except for Bulgaria, which introduced the relevant legal framework only recently. While only Czechia and Hungary eased BBMs substantially (specifically, through the abolition of income-based limits and an increase of the loan-to-value limit), other modifications are of minor relevance and include adaptions to the scope of application and the treatment of ‘green’ loans, used for example to increase the energy efficiency of existing housing stock. Overall, the experience of CESEE countries supports the view of many countries in the Single Supervisory Mechanism: BBMs are considered as “structural measures in the nature of a back stop” (see Lang et al., 2022).

The high-inflation and high-interest rate period starting at the end of 2021 changed the macro-financial environment for macroprudential policy in the CESEE EU countries substantially. The way how macroprudential authorities in the CESEE countries would react to these changes was hard to predict upfront, given the lack of practical experience with macroprudential policy during high-inflation periods.

Based on the development of an updated, quarterly intensity-adjusted macroprudential policy index, covering the period until the end of 2024, some interesting cross-country observations emerge. First, on balance and notwithstanding substantial heterogeneity across countries, the macroprudential stance in the CESEE EU countries was tightened rather than loosened. Second, many of the tightening measures were justified in particular by heightened risks in the residential and commercial real estate sector due to higher interest rates. Third, despite the focus on real estate-related risks, the majority of the measures were capital-based, in particular increases in the CCyB rates in a number of countries.

An overall tightening of the macroprudential stance during the high-inflation, high-interest rate period was not a foregone conclusion. Given the countercyclical nature of macroprudential policy, an overall loosening of the macroprudential policy stance in order to stimulate lending and support the slowing economy may have been an alternative outcome. It appears, however, that authorities’ decisions were mostly guided by the risk of a materialization of the macro-financial vulnerabilities accumulated during the extended low-interest rate period prior to 2021 and concerns about the state and outlook of banking sector resilience. As regards the preference for capital-based over borrower-based measures when addressing real estate-related risk, a combination of various reasons has probably played a role. One key reason is the broader experience with capital-based measures, especially for risks related to commercial real estate and in countries where borrower-based measures have only recently been underpinned by legal frameworks. Additionally, although borrower-based measures are generally considered more effective – and in this context would have more directly targeted the emerged risks – they tend to be politically sensitive due to potentially unfavourable distributional effects. Their implementation therefore often requires careful planning and may involve long lead times between announcement and enforcement.

It is beyond the scope of this policy brief to assess whether the direction of macroprudential policy in the CESEE countries during the recent high-inflation period and the selection of instruments was optimal from an economy-wide welfare perspective. It is clear, however, that macroprudential policy makers have remained focused on their primary mandate to ensure financial sector resilience. Over time, however, a stronger focus on strengthening financial sector resilience – rather than actively smoothing the financial cycle – could contribute to a structural tightening bias in macroprudential policies. This may have unwarranted consequences such as limiting the countercyclical capacity of macroprudential policy.

The intensity-adjusted macroprudential policy index (MPPI) for the eleven CESEE EU countries was first developed and published in 2020 (Eller et al., 2020). We have updated this index for macroprudential policy measures that have been implemented since then, primarily relying on the most recent ESRB Macroprudential Measures Database. The data underlying the updated MPPI are available from the authors upon request.

It should be recalled that the compilation of this intensity-adjusted index (MPPI) involves several important caveats. First, one may question whether it is appropriate to combine classic macroprudential measures with broader system-wide prudential tools within a single index. The rationale for including instruments such as minimum capital and reserve requirements lies in their historical use: before the introduction of more targeted macroprudential instruments, these measures were frequently employed for macroprudential purposes in the region. That said, in recent years, such requirements have changed infrequently and thus have had only a marginal impact on the dynamics of the MPPI.

Second, and arguably the most critical caveat, concerns the aggregation methodology. The weighting rules used to combine the effects of various instruments depend heavily on their nature – particularly their complexity – and rely on a mix of face-value, formula-based, and dummy approaches (see the original paper and its online supplement for the details). While the aggregation accounted for quantitative impact assessments and country-specific bank balance-sheet analysis to enhance objectivity, expert judgement remains an unavoidable element of the process.

Third, although the MPPI distinguishes between legally binding acts and recommendations, it does not account for whether announced or implemented measures were actually binding in practice. Constructing a consistent and objective indicator to capture this dimension across countries and time remains highly challenging, given the wide array of relevant factors – such as specific balance sheet positions or liquidity conditions – that would need to be considered.

Albertazzi, U., A. Martin, E. Assouan, O. Tristani, G. Galati, and T. Vlassopoulos. 2021. The role of financial stability considerations in monetary policy and the interaction with macroprudential policy in the euro area. ECB Occasional Paper Series No. 272.

Barmeier, M., D. Liebeg, and S. Rötzer. 2024. Systemic risks from commercial real estate lending of Austrian banks. OeNB Financial Stability Report No. 48. 31–39.

De Luigi, C., M. Eller and A. Stelzer. 2025. Conditional dynamics of monetary policy shocks: the mitigating role of macroprudential policy in CESEE. OeNB Bulletin Q1/25. 22–49.

Detken, C., J. Klacso and R. Martin. 2023. Macroprudential policy in the high inflation environment: Sailing uncharted waters. SUERF Policy Brief No. 626. July 2023.

ECB. 2023. Financial Stability Review. November 2023.

Eller, M., R. Martin, H. Schuberth and L. Vashold. 2020. Macroprudential policies in CESEE – an intensity-adjusted approach. OeNB Focus on European Economic Integration Q2/20. 65–81.

Eller, M., R. Martin, and L. Vashold. 2021. CESEE’s macroprudential policy response to Covid-19. SUERF Policy Brief No. 71. April 2021.

ESRB. 2023. Vulnerabilities in the EEA commercial real estate sector. January 2023.

Hildebrandt, A. 2024. CESEE Property Market Review Housing market trends in Q4 2023 and Q1 2024. OeNB Report 2024/15. July 2024.

Laeven, L., A. Maddaloni and C. Mendicino. 2022. Monetary and macroprudential policies: trade-offs and interactions. ECB Research Bulletin No. 92. February 2022.

Lang, J.H., M. Behn, B. Jarmulska, and M. Lo Duca. 2022. Real estate markets, financial stability and macroprudential policy. ECB Macroprudential Policy Bulletin No. 19. October 2022.

Martin, R. and P. Nagy Mohácsi. 2024. Fighting Inflation within the Monetary Union and Outside: The Case of the Visegrad 4. Financial and Economic Review 23(4). 102–119.

OECD. 2021. Brick by Brick: Building Better Housing Policies, OECD Publishing.

Detken, Klacso and Martin (2023) look at these questions from a conceptual perspective.

For a more detailed look at developments in the Visegrad Four countries (Czechia, Hungary, Poland and Slovakia) see Martin and Nagy Mohácsi (2024).

More details on the compilation of the index and related caveats are discussed in the annex.

The risk is particularly pronounced if the increases in income cannot keep up with the increases in borrowing costs. For lending to households, this is the case when salary increases do not cover the increases in living expenses and borrowing costs. For lending to firms, earnings from income-producing real estate would need to cover higher borrowing costs.

Hildebrandt (2024) provides a detailed picture on the housing price development in CESEE countries. After an above-EU-average growth in house prices prior to increase in interest rates, housing price growth significantly decreased in 2023. For Slovakia and Czechia, a reduction in house prices is observed in 2023.