This policy brief is based on the research paper: Nuño, G., Renner, P., & Scheidegger, S. (2025). Monetary Policy with Persistent Supply Shocks. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=5005047. Note: The views expressed in this policy brief are those of the authors and do not necessarily represent the views of the Banco de España or the Eurosystem.

Abstract

Recent years have highlighted the challenge of persistent supply shocks (e.g., from wars, geopolitical fragmentation) for monetary policy. This brief analyzes policy responses using a New Keynesian model where the economy can switch between ‘normal times’ and ‘bad times’ marked by sustained cost increases. We show that standard Taylor rules struggle because these persistent shocks alter the economy’s underlying ‘natural’ interest rate via household saving behaviour, leading to systematic inflation deviations. Optimal policy under discretion suffers from an inflationary bias during bad times, as policymakers are tempted to stimulate the economy. Optimal policy under commitment avoids this long-term bias. In response to these persistent supply shocks, the central bank adopts a ‘lean-against-the-wind’ approach on impact, accepting a permanent rise in the price level from persistent shocks, implying ‘bygones are bygones’.

The global economy has recently faced significant inflation primarily driven by supply-side factors, such as disruptions from the pandemic, energy price surges following the war in Ukraine, and signs of geopolitical fragmentation (including tariffs). Unlike the temporary supply disturbances often assumed in standard macroeconomic models, these shocks may prove highly persistent, potentially lasting years or even decades. This raises a critical question: how should monetary policy respond to sustained increases in production costs that fundamentally alter the economic landscape?

Standard monetary policy prescriptions, often based on models assuming small, temporary shocks, may no longer be adequate. This policy brief summarizes research by Nuño et al. (2024), who investigate monetary policy in a New Keynesian framework explicitly incorporating persistent, regime-switching supply shocks. Our model features an economy that can transition between ‘normal times’ and ‘bad times’, the latter characterized by a persistent shock increasing firms’ production costs. We explore the failures of standard policy rules and analyze optimal policy responses under different scenarios, including the constraint imposed by the Zero Lower Bound (ZLB) on interest rates.

A key finding is that persistent supply shocks significantly impact the economy’s natural rate of interest – the real interest rate consistent with stable inflation and output at its potential level in the absence of price rigidities. In our model, the transition between ‘normal’ and ‘bad’ regimes alters the natural rate through a precautionary savings channel.

When the economy is in ‘normal times’, households anticipate the possibility of future ‘bad times’ where their income and consumption might fall due to higher production costs. To smooth consumption, they increase their desire to save today. With a fixed supply of savings instruments (like government bonds in the model), this higher demand pushes down the natural interest rate. Conversely, when the economy enters ‘bad times’, consumption falls, but households anticipate an eventual return to ‘normal times’ with higher consumption. This reduces their immediate need to save, pushing the natural interest rate up.

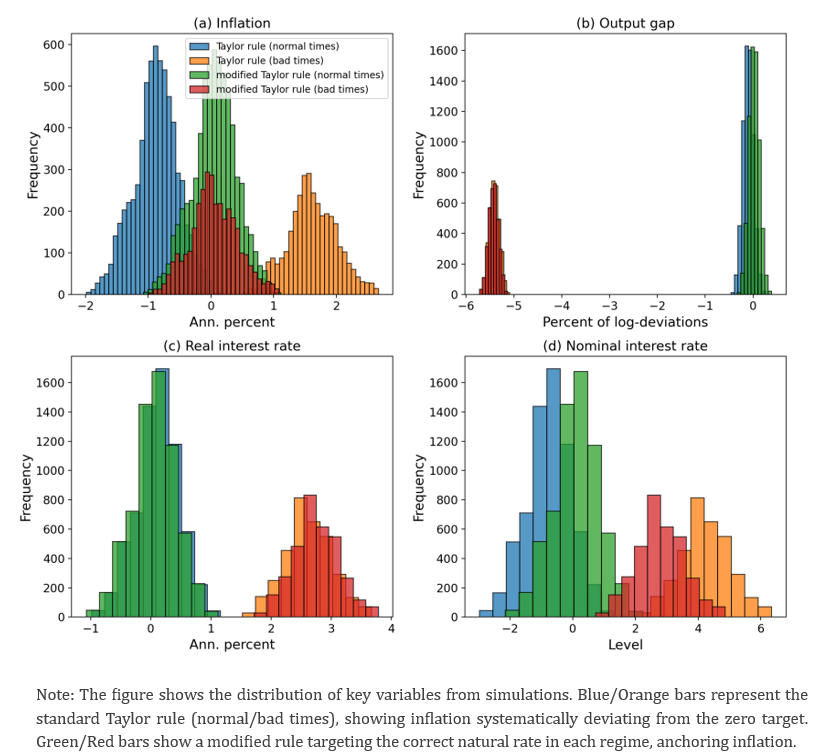

This regime-dependent natural rate poses a major problem for standard monetary policy rules, like the Taylor rule, which typically target a constant long-run real interest rate (often assumed to be the average natural rate across regimes). Such rules become systematically too tight during normal times (leading to below-target inflation) and too loose during bad times (resulting in above-target inflation). Figure 1 illustrates this: under a standard Taylor rule, the economy exhibits two distinct clusters (‘bimodality’) for inflation and interest rates, centered around different levels in each regime, with inflation deviating persistently from the target (assumed here to be zero).

A modified, regime-contingent Taylor rule that explicitly adjusts its interest rate target to track the shifting natural rate can, in principle, stabilize inflation around the target in both regimes (Green/Red bars in Figure 1). This highlights the importance for policymakers of understanding and tracking movements in the natural rate driven by persistent structural changes.

Figure 1. Economic Outcomes under a Standard Taylor Rule

(cf. Figure 1 in Nuño et al., 2025)

What is the best way for a central bank to respond, going beyond simple rules? We analyze optimal monetary policy under two scenarios:

Discretion: The Inflation Bias Returns

If the central bank operates under discretion, meaning it cannot credibly commit to future actions, a familiar problem resurfaces, but in a state-contingent way. During ‘normal times’, optimal policy can keep inflation anchored at the target. However, when a persistent supply shock hits (‘bad times’), the shock distorts the economy (e.g., by effectively increasing markups). The central bank then faces an incentive to create surprise inflation to temporarily stimulate output and counteract these distortions. Anticipating this, firms and households raise their inflation expectations, resulting in a persistent inflationary bias, specifically during the ‘bad times’ regime, even under optimal policy.

Commitment: Leaning Against the Wind, but Bygones are Bygones

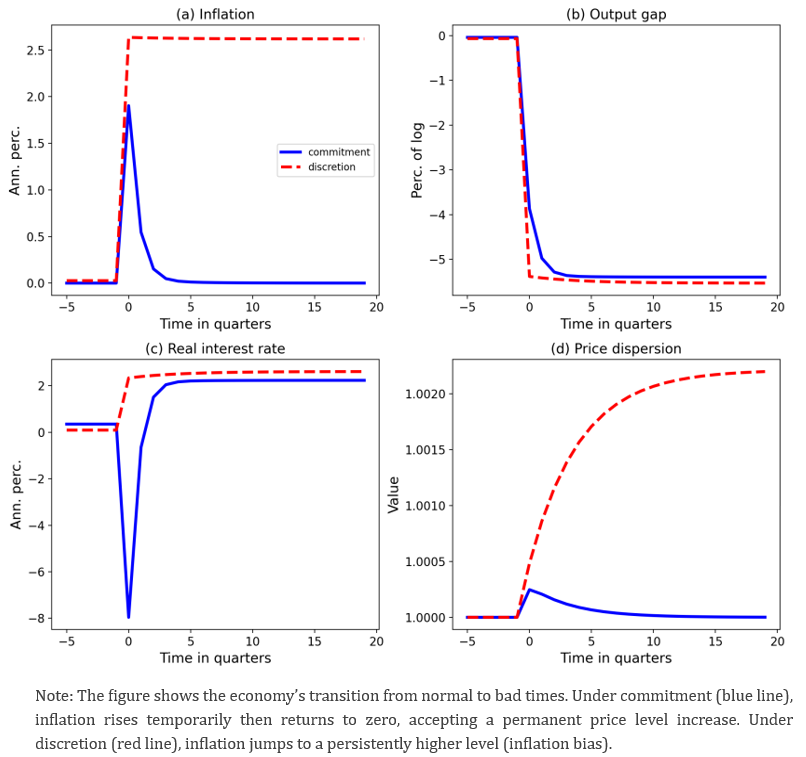

If the central bank can credibly commit to a future policy path, it can overcome the inflation bias and anchor long-run inflation expectations at the target in both regimes. However, the optimal response to the arrival of a persistent supply shock differs significantly from the textbook response to temporary shocks.

When faced with a persistent adverse supply shock, the optimal commitment policy involves ‘leaning against the wind’. It allows inflation to rise temporarily upon the shock’s arrival to partially cushion the negative impact on economic activity (the output gap). Monetary policy is then tightened gradually to bring inflation back to the zero target over several quarters (see Figure 2).

Crucially, unlike the optimal response to temporary cost-push shocks (which often involves engineering a future period of deflation to bring the price level back to its original path – i.e., price-level targeting), the optimal response to a persistent shock does not involve such a reversal. The initial rise in the price level is accepted as permanent. In this context, “bygones are bygones”. This finding challenges the applicability of strict price-level targeting strategies in environments dominated by persistent structural shocks.

Figure 2. Response to a Persistent Supply Shock: Commitment vs. Discretion

(cf. Figure 6 in Nuño et al., 2025)

Our analysis offers several key takeaways for policymakers navigating an environment potentially characterized by more persistent supply shocks:

In conclusion, designing effective monetary policy requires distinguishing between temporary disturbances and persistent, regime-shifting supply shocks. The latter fundamentally alter the macroeconomic landscape, requiring adaptive strategies that account for shifts in the natural rate and recognize the limits of traditional policy frameworks.

Nuño, G., P. Renner, and S. Scheidegger (2024): “Monetary policy with persistent supply shocks”.