References

Albertazzi, U., Barbiero, F., Marqués-Ibáñez, D., Popov, A., d’Acri, C. R. and Vlassopoulos, T. (2020), “

Monetary policy and bank stability: the analytical toolbox reviewed”,

Working Paper Series, No 2377, ECB.

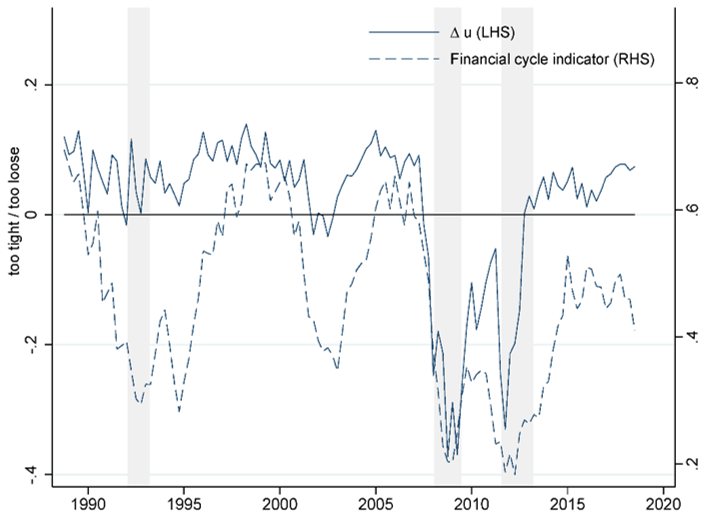

Ampudia, M., Duca, M. L., Farkas, M., Peréz-Quirós, G., Pirovano, M., Rünstler, G. and Tereanu, E. (2021), “

On the effectiveness of macroprudential policy”,

Working Paper Series, No 2559, ECB.

Bittner, C., Bonfim, D., Heider, F., Saidi, F., Schepens, G. and Soares, C. (2022), “The augmented bank balance-sheet channel of monetary policy”, ECB, mimeo.

Bubeck, J., Maddaloni, A. and Peydró, J.-L. (2020), “Negative monetary policy rates and systemic banks’ risk-taking: evidence from the euro area securities register”, Journal of Money, Credit and Banking, Vol. 52(S1), pp. 197-231.

Chavleishvili, S., Engle, R. F., Fahr, S., Kremer, M., Manganelli, S. and Schwaab, B. (2021), “

The risk management approach to macro-prudential policy”,

Working Paper Series, No 2565, ECB.

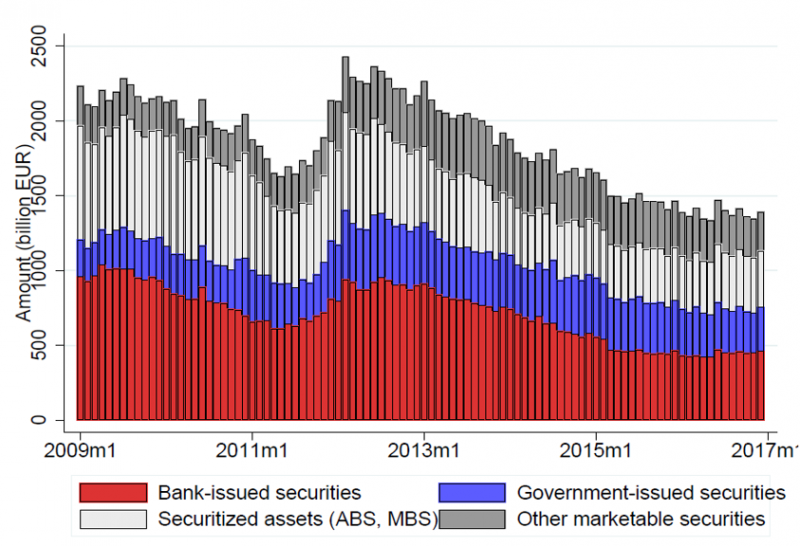

Corradin, S., Eisenschmidt, J., Hoerova, M., Linzert, T., Schepens, G. and Sigaux, J.-D. (2020), “

Money markets, central bank balance sheet and regulation”,

Working Paper Series, No 2483, ECB.

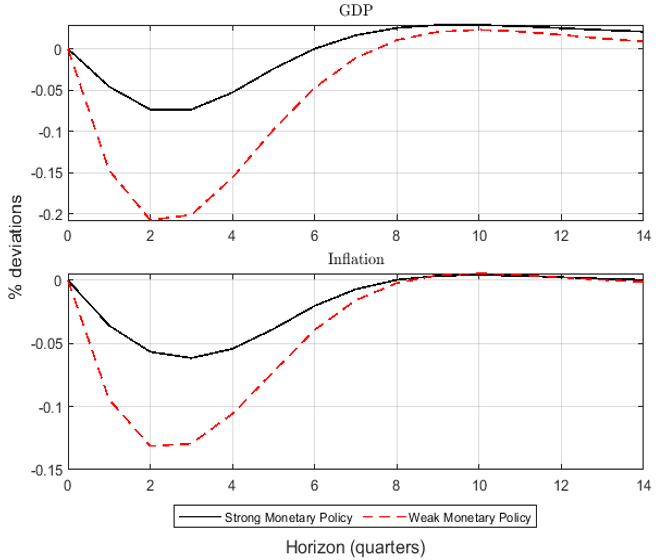

Cozzi, G., Darracq Pariès, M., Karadi, P., Körner, J., Kok, C., Mazelis, F., Nikolov, K., Rancoita, E., Van der Ghote, A. and Weber, J. (2020), “

Macroprudential policy measures: macroeconomic impact and interaction with monetary policy”,

Working Paper Series, No 2376, ECB.

Heider, F., Saidi, F. and Schepens, G. (2019), “Life below zero: bank lending under negative policy rates”, The Review of Financial Studies, Vol. 32(10), pp. 3728-3761.

Jasova, M., Mendicino, C. and Supera, D. (2021), “Policy uncertainty, lender of last resort and the real economy”, Journal of Monetary Economics, Vol. 118, pp. 381-398.

Jasova, M., Laeven, L, Mendicino, C., Peydró, J.-L. and Supera, D. (2022), “Systemic risk and monetary policy: the haircut gap channel of the lender of last resort”, Working Paper Series, ECB, forthcoming.

Karadi, P. and Nakov, A. (2021), “Effectiveness and addictiveness of quantitative easing”, Journal of Monetary Economics, Vol. 117, pp. 1096-1117.

Mendicino, C., Nikolov, K., Suarez, J. and Supera, D. (2020), “Bank capital in the short and in the long run”, Journal of Monetary Economics, Vol. 115, pp. 64-79.

Mendicino, C., Puglisi, F. and Supera, D. (2022), “Beyond zero: are policy rate cuts still expansionary?”, Working Paper Series, ECB, forthcoming.

Schuler, Y., P. Hiebert, and T. A. Peltonen (2020), “Financial cycles: Characterisation and real-time measurement”, Journal of International Money and Finance 100, 82–102.

Van der Ghote, A. (2021) “Interactions and Coordination between Monetary and Macroprudential Policies”, American Economic Journal: Macroeconomics, Vol. 13(1), pp. 1-34.