This Policy Brief is based on ECB Working Paper Series No 3025. The views expressed are those of the author and do not necessarily reflect those of the European Central Bank.

Abstract

This Policy Brief summarises recent findings on the effectiveness of redemption restrictions in open-ended bond funds, focusing on the March 2020 market turmoil. Using supervisory data on alternative investment funds investing in bonds, the analysis shows that redemption restrictions, particularly notice periods, significantly reduced investor outflows during the stress episode, without prompting increased redemptions thereafter. Second, funds with stricter redemption terms engaged less in procyclical cash hoarding during this period, even after controlling for the size of outflows. Third, over the full sample period, while redemption restrictions had no significant effect on the sensitivity of inflows to good performance, they significantly reduced outflows in response to weak performance. These findings suggest that redemption restrictions can mitigate fragility in open-ended investment funds.

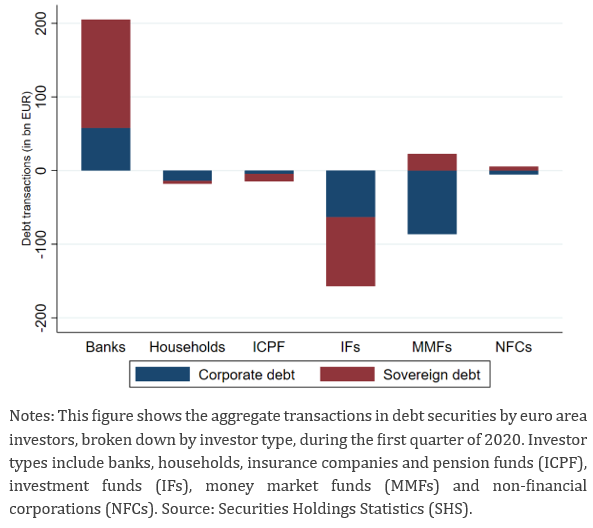

Open-ended investment funds often invest in illiquid assets while offering more generous liquidity terms to investors. This liquidity mismatch can give rise to run dynamics, as investors may seek to redeem ahead of others to avoid losses associated with costly asset sales (Chen et al., 2010; Goldstein et al., 2017). These vulnerabilities became evident in March 2020, when the outbreak of the COVID-19 pandemic triggered unprecedented redemptions from bond funds, exceeding even those seen during the Global Financial Crisis of 2007/08 (Falato et al., 2021; Lewrick and Schanz, 2023). Many funds responded by hoarding cash and selling large volumes of bonds. In the euro area, for example, investment funds were the largest net sellers of debt securities in the first quarter of 2020 (see Figure 1). This procyclical behaviour amplified valuation losses and contributed to stress in underlying bond markets (Jiang et al., 2022; Huang et al., 2025), highlighting the systemic risks that can emanate from the bond fund sector.

Figure 1. Transactions of Debt Securities during the March 2020 Market Turmoil

Policymakers and academics have investigated ways to address the risk of procyclical redemption behaviour and associated fire-sales. For instance, the Financial Stability Board (2023) recommended that funds investing in assets that are susceptible to illiquidity, such as certain corporate bonds, should adopt (i) anti-dilution tools, such as swing pricing, or (ii) stricter redemption restrictions, through notice periods or reduced redemption frequency.1 While there is a now relatively large literature on the effectiveness of anti-dilution tools in bond funds,2 little is known about the extent to which bond funds utilise redemption restrictions and their efficacy during periods of market stress.

This Policy Brief summarises the findings of the first comprehensive assessment of how redemption restrictions in bond funds affect investor outflows and fund managers’ liquidity management, focusing on the March 2020 market turmoil (Molestina Vivar, 2025). The analysis draws on supervisory data of 2,174 alternative investment funds investing in bonds, with around EUR 1.2 trillion in assets under management. The dataset includes granular fund-level information on the type and duration of redemption restrictions, such as notice periods, lockup periods and redemption frequency. Combined with the exogenous shock from the COVID-19 crisis, this provides a unique setting to assess the role of redemption restrictions in mitigating fragility in bond funds during a period of market stress.

By limiting short-term withdrawals, redemption restrictions provide fund managers with more time to manage outflows, thereby reducing the pressure to sell assets quickly or at depressed prices. This can help protect the value of the fund for remaining investors, reducing the incentives to redeem early, particularly in comparison with funds offering daily liquidity. Moreover, redemption restrictions may introduce greater uncertainty regarding the value of future payouts, especially during periods of heightened market stress, which may further discourage investor withdrawals.

To test these mechanisms empirically, I examine whether redemption restrictions mitigated investor runs during the March 2020 stress period. While lower redemption frequencies and lock-up periods had no statistically significant effect, stricter notice periods were associated with significantly lower outflows. Based on a multivariate regression model, I find that an additional week of notice period reduced outflows during the March 2020 turmoil by around 1.3 percentage points (in terms of lagged total assets). This implies that a one-week notice period could have largely absorbed the average additional outflows observed during the crisis, indicating a sizeable mitigating effect.

This finding is robust to including a broad set of control variables, including the liquidity of the funds’ assets and investor composition, as well as matching funds with redemption restrictions to funds without redemption restrictions based on pre-crisis covariates. Importantly, I find no evidence that redemption restrictions led to higher outflows in the post-crisis period, suggesting that redemption restrictions disincentivised withdrawals rather than merely delaying them.

I also examine the impact of redemption restrictions on the flow-performance relationship over the full sample period from 2016-Q1 to 2023-Q2. Based on a multivariate flow-performance regression model that interacts negative relative returns with funds’ redemption restrictions, I find that an additional week of notice period reduces outflows by nearly one third. However, I find no evidence that redemption restrictions significantly affect the sensitivity of investor inflows to good performance. This asymmetric response supports the interpretation that redemption restrictions reduce fragility stemming from costly asset sales, thereby disincentivising investor withdrawals.

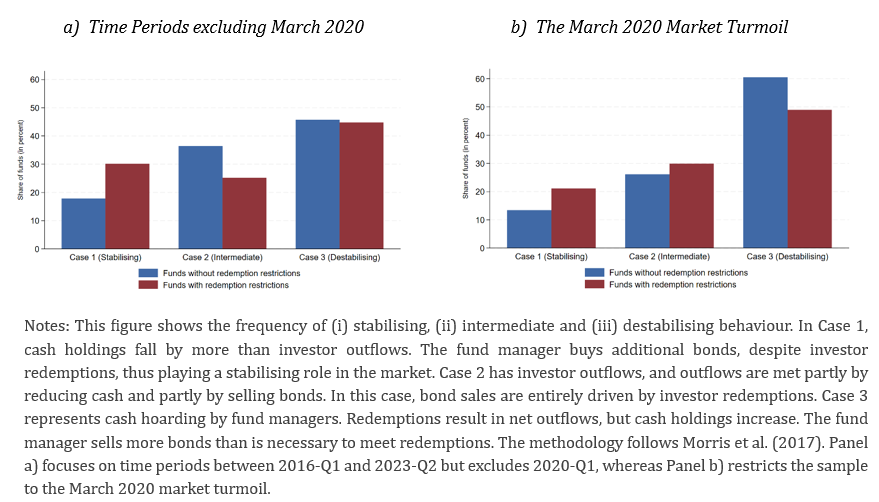

Fund managers may respond to investor outflows by hoarding cash to preserve liquidity for future redemptions, particularly during periods of market stress (Morris et al., 2017; Shek et al., 2018). By reducing the pressure to sell assets quickly, redemption restrictions may reduce such procyclical behaviour. I thus hypothesise that redemption restrictions mitigate cash hoarding by fund managers, thereby playing a stabilising role during periods of market stress.

Following Morris et al. (2017), I define cash hoarding as instances in which redemptions result in net outflows but cash holdings increase, implying that fund managers sell more bonds than strictly necessary to meet redemptions. From a financial stability perspective, this behaviour can be destabilising as it may reinforce the impact of redemptions by amplifying the sales of the underlying assets. Alternatively, fund managers may follow a “pecking-order” strategy, drawing on cash first and selling underlying assets once cash runs out. Conversely, fund managers may respond to redemptions by purchasing additional bonds, suggesting a stabilising role.

Figure 2 shows the frequency of each liquidity management strategy, distinguishing between funds with and without redemption restrictions. During normal periods (Panel a), funds without redemption restrictions engaged in cash hoarding behaviour in around 46% of instances involving net outflows (Case 3). While this figure is only slightly lower for funds with redemption restrictions, the latter were substantially more likely to buy bonds despite net outflows, suggesting more stabilising behaviour (see Case 1). During the March 2020 market turmoil (Panel b), the share of cash hoarding cases among funds without redemption restrictions increased to 61% (Case 3). However, funds with redemption restrictions were notably less likely to hoard cash during this period, suggesting that they contributed less to fire-sale externalities compared to funds without redemption restrictions.

Figure 2. Fund Managers’ Liquidity Management Strategies

A multivariate regression model corroborates these results. I find that funds with redemption restrictions were significantly less likely to engage in cash hoarding compared to those without such restrictions. Instead, they relied more on existing cash holdings to accommodate outflows during the March 2020 market turmoil. This effect is primarily driven by notice periods and is economically meaningful: an additional week of notice period is associated with an average additional reduction in cash holdings of around 2 percentage points (in terms of funds’ lagged total assets). In other words, a fund with a one-week notice period would have used around 22% more of its cash buffer to meet redemptions than a comparable fund without restrictions.

Crucially, I control for the magnitude of outflows during this period to rule out the possibility that funds with redemption restrictions acted less procyclically simply because they faced lower outflows. These findings suggest that redemption restrictions not only impact investor behaviour, but also directly affect fund managers’ liquidity management decisions.

This Policy Brief summarises key findings from a recent working paper assessing the effectiveness of redemption restrictions in open-ended bond funds, with a focus on the March 2020 market turmoil (Molestina Vivar, 2025). Using granular supervisory data on 2,174 funds and their contractual redemption terms, I find that redemption restrictions, particularly notice periods, significantly reduced investor outflows during the March 2020 stress period. Importantly, they did not lead to higher outflows in subsequent periods, suggesting that redemption restrictions discouraged withdrawals rather than simply postponing them. In addition, funds with redemption restrictions were less likely to hoard cash in response to net outflows and instead relied more on existing cash buffers, thereby reducing the need for procyclical asset sales. Over the full sample period, the analysis also shows that redemption restrictions dampen the sensitivity of outflows to poor performance, without significantly affecting inflows in response to good performance. Overall, these findings highlight the potential of redemption restrictions to enhance the resilience of open-ended bond funds. By mitigating investor outflows and fund managers’ procyclical behaviour, redemption restrictions can play a key role in reducing fund fragility and supporting financial stability during episodes of market stress.

Capponi, A., Glasserman, P., and Weber, M. (2020). Swing pricing for mutual funds: Breaking the feedback loop between fire sales and fund redemptions. Management Science, 66(8):3581–3602.

Capponi, A., Glasserman, P., and Weber, M. (2023). Swing pricing: Theory and evidence. Annual Review of Financial Economics, 15(1):617–640.

Chen, Q., Goldstein, I., & Jiang, W. (2010). Payoff complementarities and financial fragility: Evidence from mutual fund outflows. Journal of Financial Economics, 97(2), 239–262.

European Systemic Risk Board (2023). Issues note on policy options to address risks in corporate debt and real estate investment funds from a financial stability perspective.

Falato, A., Goldstein, I., & Hortacsu, A. (2021). Financial fragility in the COVID-19 crisis: The case of investment funds in corporate bond markets. Journal of Monetary Economics, 123, 35–52.

Financial Stability Board (2023). Revised Policy Recommendations to Address Structural Vulnerabilities from Liquidity Mismatch in Open-Ended Funds.

Goldstein, I., Jiang, H., & Ng, D. T. (2017). Investor flows and fragility in corporate bond funds. Journal of Financial Economics, 126(3), 592–613.

Jiang, H., Li, Y., Sun, Z., and Wang, A. (2022). Does mutual fund illiquidity introduce fragility into asset prices? Evidence from the corporate bond market. Journal of Financial Economics, 143(1):277–302.

Jin, D., Kacperczyk, M., Kahraman, B., and Suntheim, F. (2022). Swing pricing and fragility in open-end mutual funds. The Review of Financial Studies, 35(1):1–50.

Lewrick, U., & Schanz, J. (2023). Towards a macroprudential framework for investment funds: swing pricing and investor redemptions. International Journal of Central Banking, 19(3), 229-67.

Malik, S. and Lindner, P. (2017). On swing pricing and systemic risk mitigation. IMF Working Paper, 17/150.

Molestina Vivar, L. (2025). Mitigating fragility in open-ended investment funds: the role of redemption restrictions. ECB Working Paper Series, No. 3025.

Morris, S., Shim, I., & Shin, H. S. (2017). Redemption risk and cash hoarding by asset managers. Journal of Monetary Economics, 89, 71–87.

Shek, J., Shim, I., and Shin, H. S. (2018). Investor redemptions and fund manager sales of emerging market bonds: how are they related? Review of Finance, 22(1):207–241.

Also the European Systemic Risk Board (2023) highlighted that an enhanced framework for investment funds could require funds to have minimum notice periods.

See, for example, Malik and Lindner (2017); Capponi et al. (2020); Jin et al. (2022); Capponi et al. (2023); Lewrick and Schanz (2023) on swing pricing.