References

Alessandri, P. and H. Mumtaz (2019). Financial regimes and uncertainty shocks. Journal of Monetary Economics 101, 31–46.

Basu, S. and B. Bundick (2017). Uncertainty shocks in a model of effective demand. Econometrica 85 (3), 937–958.

Bloom, N. (2009). The impact of uncertainty shocks. Econometrica 77(3), 623–685.

Blanchard, O. (2009). (Nearly) nothing to fear but fear itself. The Economist. Jan 29th 2009.

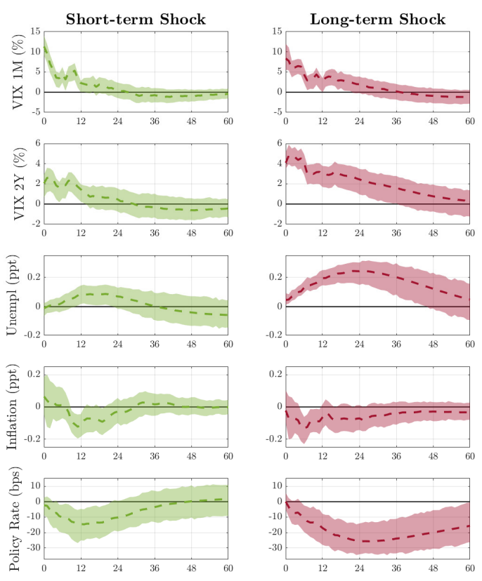

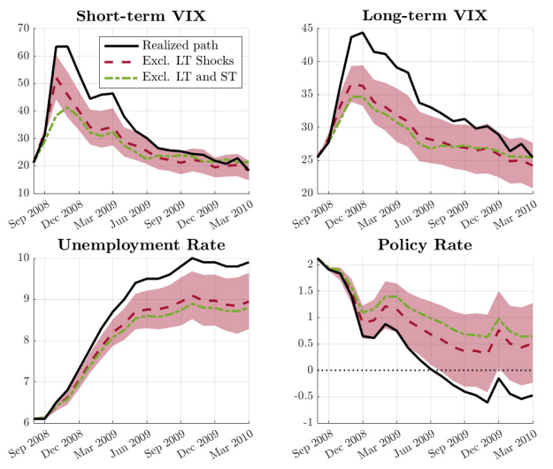

Krogh, M., and G. Pellegrino (2024). Real Activity and Uncertainty Shocks: The Long and the Short of It. Marco Fanno Working Paper No. 310, University of Padova.

Leduc, S. and Z. Liu (2016). Uncertainty shocks are aggregate demand shocks. Journal of Monetary Economics 82, 20–35.

Ludvigson, S. C., S. Ma, and S. Ng (2021). Uncertainty and business cycles: Exogenous impulse or endogenous response? American Economic Journal: Macroeconomics 13(4), 369–410.

Wu, J. C. and F. D. Xia (2016). Measuring the macroeconomic impact of monetary policy at the zero lower bound. Journal of Money, Credit, and Banking 48(2-3), 253–291.