This work represents the authors’ personal opinions and does not necessarily reflect the views of the Deutsche Bundesbank, the ECB, the IMF, or the Eurosystem.

Systemic risk has two separate dimensions: First, the buildup of systemic vulnerabilities (cyclical dimension) and second, the propagation of risk (cross-sectional dimension). But in practice, these dimensions of systemic risk are not independent. The severity of systemic risk materialization is hardly divorced from the buildup of macro excesses in financial credit and asset prices. In this paper, we propose a new method – the CoJPoD – for linking these two dimensions. We show that combining the two dimensions into a conditional measure of financial market implied banking sector distress is particularly useful for signaling the onset of crises – when information on their potential severity is scarce. In this sense, explicitly linking the two dimensions of systemic risk may contribute to improving the precision with which macroprudential policies are set. Specifically, such a perspective may well indicate when core macroprudential instruments, such as countercyclical capital buffers, should be released – thereby enabling policy makers to take timely actions to mitigate the severity of financial crises.

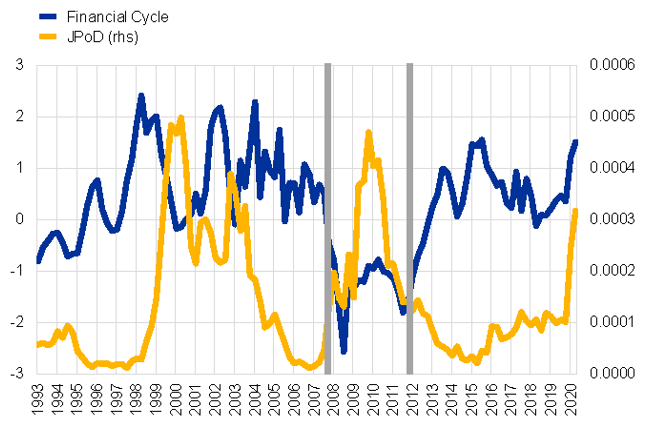

Notes: The financial cycle is estimated using the method of Schüler et al. (2015, 2020). The JPoD follows the method of Segoviano (2006) and Segoviano and Goodhart (2009). Horizontal black lines correspond to the first and last quarter as given by Laeven and Valencia (2018).

Overall, we find that our integrated empirical treatment of the cross-sectional and cyclical dimension of systemic risk sharpens the identification of crisis regimes and, in particular, their onsets. Neither the JPoD nor the financial cycle individually signal the onset of crises with great precision, with the financial cycle performing worse than the JPoD. For the selected jurisdictions (euro area, United Kingdom, United States), we find that the ΔCoJPod significantly outperforms the JPoD in signaling the onsets of crises, improving on the JPoD’s capacity by up to 24 percentage points. But also regarding the identification of crises, more generally, we find that the ΔCoJPod significantly improves on the capacities of the JPoD. The intuition behind our result is that financial cycle downturns amplify banks’ joint probability of default. Similarly, financial cycle upturns dampen banks’ joint probability of default. Therefore, linking these measures increases the precision with which one can distinguish systemic events from non-systemic events.