References

Allinger, K., S. Barisitz and A. Timel. 2022. Russia’s large fintechs and digital ecosystems – in the face of war and sanctions. In: Focus on European and Economic Integration Q3/22. OeNB. 47−65.

Chainalysis. 2020. The 2020 Geography of Cryptocurrency Report − Analysis of Geographic Trends in Cryptocurrency Adoption, Usage, and Regulation. September 2020.

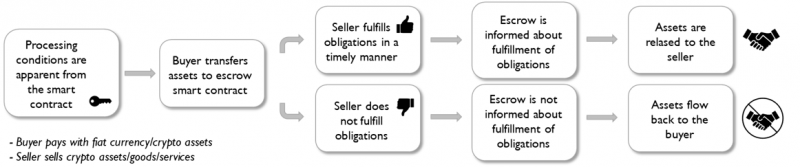

Hu, X., Z. Lin, A. B. Whinston and H. Zhang. 2004. Hope or Hype: On the Viability of Escrow Services as Trusted Third Parties in Online Auction Environments. Information Systems Research 15(3). 236−249.

Jiang, X., S. Liu, X. Liu and C. Tse. 2021. Knowledge Discovery in Cryptocurrency Transactions: A Survey. In: IEEE Access.

Medentseva, E. & M. Tokmanov. 2017. Escrow International Experience and Perspectives of Application in Russia. Journal of Advances Research in Law and Economics. ASERS Publishing. Vol 8(3). 906-909.