References

Abadie, A. and Gardeazabal, J. (2003). The economic costs of conflict: A case study of the basque country. American economic review, 93(1):113–132.

Abadie, A., Diamond, A., and Hainmueller, J. (2010). Synthetic control methods for comparative case studies: Estimating the effect of california’s tobacco control program. Journal of the American statistical Association, 105(490):493–505.

Alessi, L., Ossola, E., Panzica, R. (2021). What greenium matters in the stock market? the role of greenhouse gas emissions and environmental disclosures. Journal of financial stability, 54(100869).

Ardia, D., Bluteau, K., Boudt K., and Inghelbrecht, K. (2020). Climate change concerns and the performance of green versus brown stocks. Management science, forthcoming.

Bauer, M., Huber, D., Rudebusch, G. and Wilms, O. (2023). Where is the carbon premium? Global performance of green and brown stocks. CESifo working paper no. 10246.

Bolton, P. and Kacperczyk, M. (2019). Do investors care about carbon risk? Journal of financial economics, 142(2):517–549.

Claessens, S., Tarashev N. and Borio C. (2018), “Finance and climate change risk: Managing expectations”, VoxEU.org, 7 June.

Choi, J. J., Jo, H., and Park, H. (2018). Co2 emissions and the pricing of climate risk. Social Science Research Network: Rochester, NY, USA.

Fama, E. F. and MacBeth, J. D. (1973). Risk, return, and equilibrium: Empirical tests. Journal of political economy, 81(3):607–636.

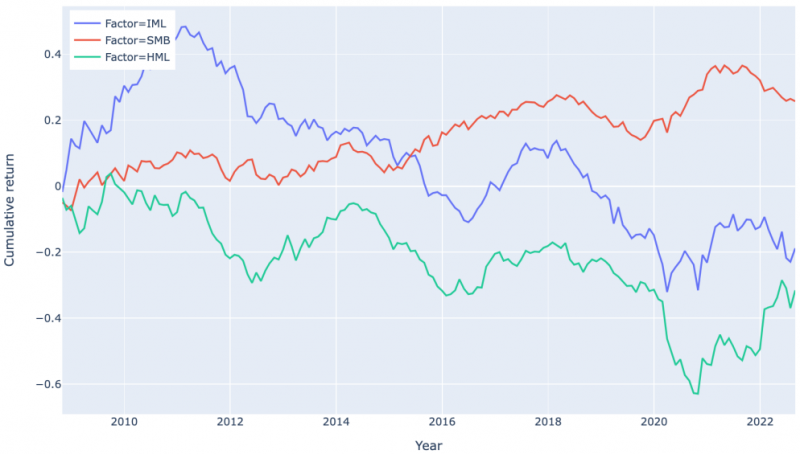

Gimeno, R. and Gonzalez, C. I. (2022). The role of a green factor in stock prices. When Fama & French go green. Banco de Espana working paper (2207).

Hsu, P.-H., Li, K., and Tsou, C.-Y. (2022). The pollution premium. Journal of Finance, Forthcoming.

Ilhan, E., Sautner, Z., and Vilkov, G. (2021). Carbon tail risk. The Review of Financial Studies, 34(3):1540–1571.

In, S.Y, Park, K.Y. and Monk, A. (2017). Is “being green” rewarded in the market? An empirical investigation of decarbonization risk and stock returns. International Association for Energy Economics (Singapore Issue), 46(48).

Janssen, A., Dijk, J., Duijm, P., et al. (2021). Misleading footprints. Inflation and exchange rate effects in relative carbon disclosure metrics. Technical report, DNB.

Klaassen, S. (2021). Harmonizing corporate carbon footprints. Nature communication, 12 (6149).

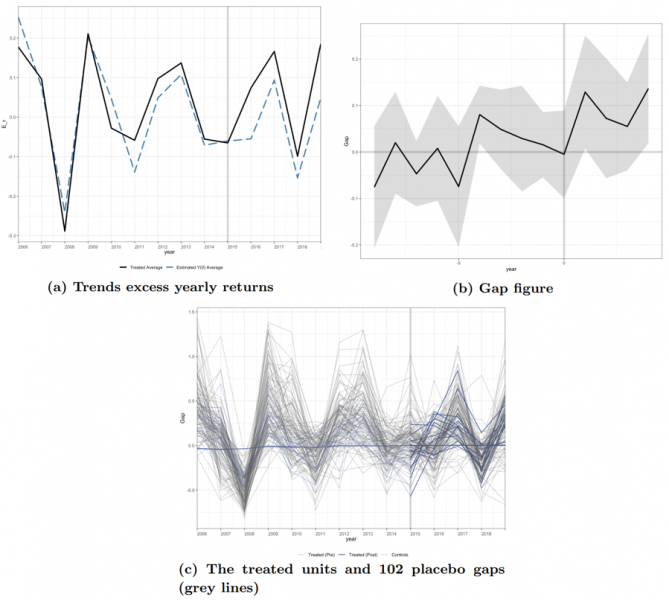

Loyson, P., Luijendijk, R., Wijnbergen, S. van (2023). The pricing of climate transition risk in Europe’s equity market. Working paper, DNB.

Pastor, L., Stambaugh, R. F., and Taylor, L. A. (2022). Dissecting green returns. Journal of Financial Economics, 146(2):403–424.

Rohleder, M., Wilkens, M., and Zink, J. (2022). The effects of mutual fund decarbonization on stock prices and carbon emissions. Journal of Banking & Finance, 134:106352.

Wooldridge, J. M. (2010). Econometric analysis of cross section and panel data.