In this policy brief, we present the results of a two-pronged assessment of the impact of the fiscal expansion in response to the COVID-19 pandemic on the Slovenian economy through the lens of a structural VAR model and a calibrated large-scale DSGE model for Slovenia. The results show that government consumption has a stronger and more persistent effect on the domestic business cycle than other fiscal variables. Since the non-tradable sector is comprised of services that are provided by the government sector, the effect of fiscal stimulus on the non-tradable sector is larger than on the tradable sector. The fiscal stimulus has a positive impact on private consumption and imports, and an insignificant effect on investments and exports. The reason behind this result is that government expenditure stimulates aggregate demand and consist mostly of imported goods.

The outbreak of COVID-19 represents novel challenges for the economy and policy-makers, as such an environment provides a textbook example of a large-scale countercyclical fiscal policy intervention. In the Arigoni et al. (2023) paper, we model the impact of fiscal policy intervention on the Slovenian economy during the COVID-19 outbreak by analyzing the effects of different fiscal shocks on the Slovenian economy by disentangling the source of fiscal variation into (1) government investments, (2) government consumption, (3) direct taxes, (4) indirect taxes, and (5) social benefits. The focus on fiscal measures is motivated by the fact that these are the main instruments of Slovenian national authorities for monitoring and shaping the trajectory of the business cycle.

The paper provides two main contributions. First, we present the empirical results of the structural VAR model. Second, the impact of the fiscal stimulus packages on the Slovenian economy is simulated by applying three fiscal package scenarios in a calibrated fiscal version of the Euro Area and Global Economy model1 for Slovenia (Clancy, Jacquinot and Lozej; 2016).

The results show that government consumption has a stronger and more persistent effect on the domestic business cycle than other fiscal variables. As the non-tradable sector is comprised of services that are provided by the government sector, the effect of the fiscal stimulus on the non-tradable sector is larger than on the tradable sector. The fiscal stimulus positively affects private consumption and imports, and almost insignificantly investments and exports. The reason behind this result is that government consumption and investments stimulate aggregate demand and consist mostly of imported goods. Finally, we find that the fiscal stimulus increases the nominal variables with a lower magnitude which is longer-lasting than for the real variables.

The Slovenian government introduced the first set of measures worth around EUR 1 billion on 9 March 2020. These measures aimed at providing liquidity to companies facing difficulties in settling their liabilities due to a lack of revenue. State guarantees and the possibility of deferring taxes were also envisaged at the time. As the pandemic situation quickly deteriorated, the government prepared the “Act on Emergency Measures to Curb the COVID-19 Epidemic and Mitigate its Implications for Citizens and the Economy,” which was approved by the National Assembly on 2 April. The additional measures were estimated at EUR 2 billion (4% of GDP), primarily providing financial aid to preserve jobs. Additionally, the second package included measures to improve corporate liquidity, measures to assist agriculture, and measures to improve people’s social status and other measures.

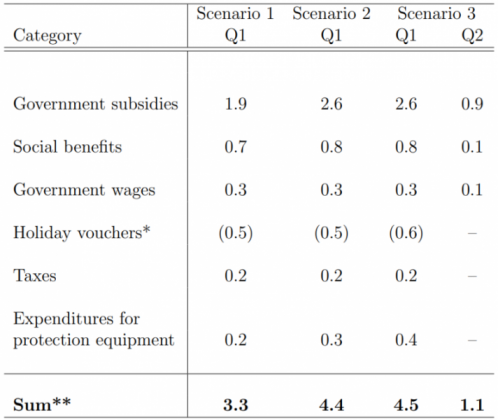

Based on the publicly available information and the official Macroeconomic projections of the Bank of Slovenia in 2020 we provide three possible scenarios of the fiscal takeaway given the length of the COVID-19 lock-down. We rescale the estimated amounts to nominal GDP and merge the categories into (1) Government Subsidies, (2) Social Benefits, (3) Government Wages, (4) Holiday Vouchers, (5) Taxes, and (6) Expenditures for Protection Equipment. Only the shocks to government subsidies, social benefits, and government wages in scenario 3 last more than one quarter. Shocks to taxes and expenditures for protection equipment last only for one quarter in all scenarios. Table 1 presents the rescaled shocks.

Table 1: Normalized shocks to nominal GDP 48 billion EUR (in p.p.)

Source: Authors’ calculations, Bank of Slovenia (2020), Agency of the Republic of Slovenia for Commodity Reserves. Note: * For the holiday vouchers we assume that the takeaway will take place in Q2 and Q3 from the first fiscal shocks taking place. ** Without holiday vouchers.

We estimate a small-scale SVAR model in order to assess the effects of the fiscal stimulus in Slovenia. The model comprises a set of four endogenous variables, namely government expenditure (G), government revenues (T), private expenditure (C) and trade balance (TB)2. In identifying structural shocks, we follow the general path of Blanchard and Perotti (2002) with model adaptations for small open economies in the spirit of Ravn and Spange (2014), Beetsma, Giuliodori and Klaassen (2006), Deskar-Škrbić and Šimović (2017), and others.

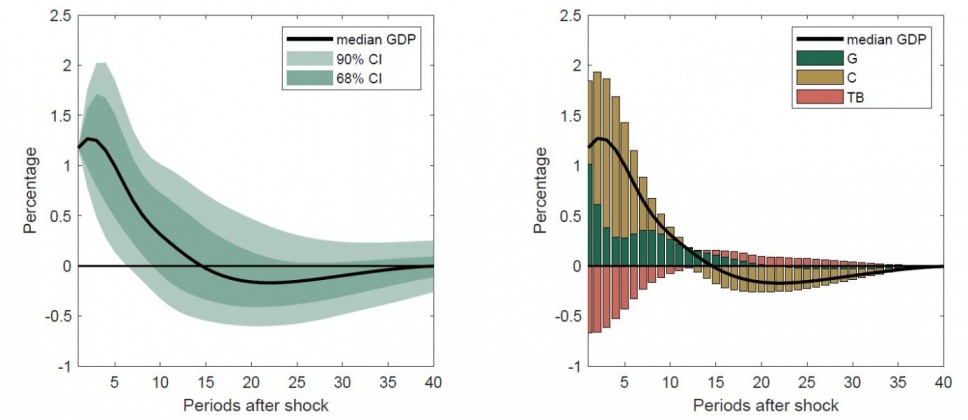

The response of the GDP to a government expenditure shock is shown in Figure 1. Government expenditure shock (1% of GDP) increases the GDP on impact by 1.2% and the effect remains positive and statistically significant for the period of 6 quarters. On the right hand side of Figure 1, we see the decomposition of the effect on the GDP. Government expenditure response to the own shock is transitory as the effect fades out after approximately three quarters, but the response of private expenditure is stronger and lasts approximately three years. As expected, we see that a significant share of contribution to GDP outflows through the foreign trade channel as Slovenia imports a significant share of the finally consumed and invested goods and services. The outflow through the foreign trade therefore decreases impact multiplier by approximately 0.7 p.p. Results are broadly in line with the theoretical large-scale DSGE model (the EAGLE model) as the response stands somewhere between the government consumption shock and the government investment shock.

Figure 1: The response of real GDP to a positive government expenditure shock (1% of GDP)

Source: Authors’ calculations. Note: 90% and 68% confidence intervals are estimated by the nonparametric bootstrap with 10000 replications. Quarterly impulse response functions are smoothed by the restriction on the annual impulse response which remain intact.

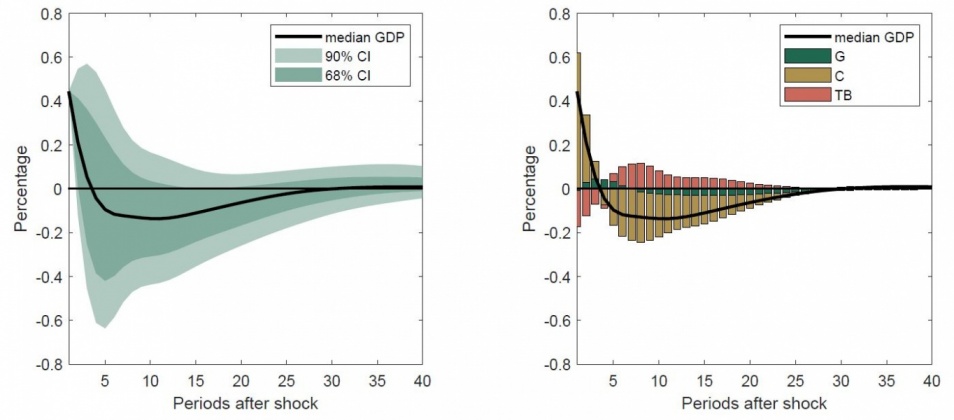

We also show a negative government revenues shock (1% of the GDP tax reduction), which increases GDP on impact by approximately 0.4% (see Figure 2). The main driver of the positive effect is the private expenditure, which contributes approximately 0.6 p.p. to the GDP growth on the impact. The positive impact is once again offset by the negative response of the trade balance. The response of GDP to the changes in the government revenues is insignificant already in the second quarter after the impact. This result is also consistent with Jemec et al. (2011).

Figure 2: The response of real GDP to a negative government revenues shock (1% of GDP)

Source: Authors’ calculations. Note: 90% and 68% confidence intervals are estimated by the nonparametric bootstrap with 10000 replications. Quarterly impulse response functions are smoothed by the restriction on the annual impulse response which remain intact.

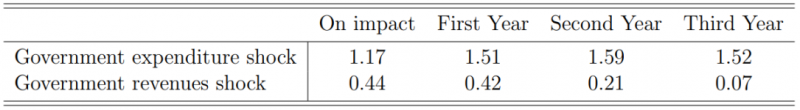

To obtain the cumulative elasticity of the GDP to the isolated government intervention we follow Alloza et al. (2020). Cumulative elasticity is computed as a fraction of the cumulative response of the GDP and the response of relevant government intervention variable to its own shock. In order to measure the pure effect of a fiscal variable, we compute the cumulative counterfactual impulse responses. In the Table 2, we report the cumulative multipliers for the three-year period. Estimated cumulative impulse responses are comparable to the cumulative impulse response functions from the EAGLE model.

Table 2: Cumulative domestic fiscal multipliers in the small scale VAR model

Source: Authors’ calculations.

By utilizing the EAGLE model with the fiscal extension3 we show the estimated effects of the fiscal policy packages on key national economic variables under the three different scenarios of the actual takeaway from Table 1.

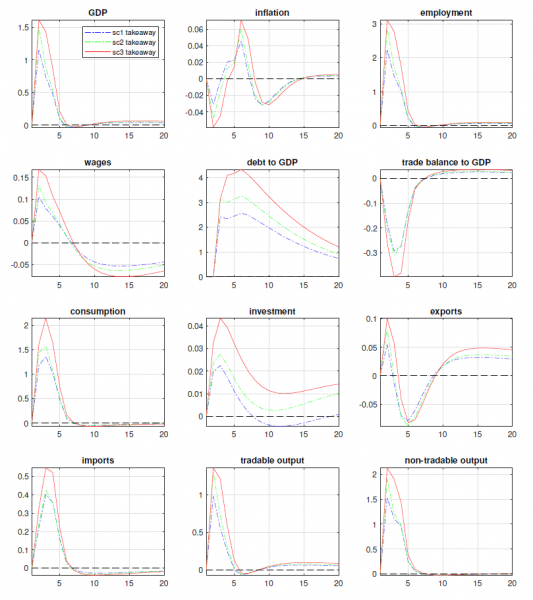

In Figure 3, we can see that the proposed fiscal stimulus (again, the size of the effects depends on the scenarios from Table 1) has a positive effect on the Slovene economy. The immediate fiscal stimulus shock affects the GDP the most at the beginning (in period 1). The peak responses vary from 1.1 to 1.6 percentage points depending on the scenarios. Since we assume the one-off type of shocks with zero persistence parameters the dynamics of most real variables quickly declines back to the steady-state after 4 to 5 quarters. It is also clear that the effect of the fiscal stimulus on the non-tradable sector is larger than on the tradable sector. The annual effects of the fiscal stimulus packages depending on the scenario vary between 2.5 and 4.1% of GDP and are also consistent with the projection done for the Slovene economy (Bank of Slovenia, 2020). In the second year, mainly due to the assumption of zero persistence of fiscal shocks, the effects of the fiscal stimulus packages disappear. For robustness check, we calculate the fiscal multiplier from the DSGE model. The size of the fiscal multiplier from the DSGE model is in line with the multiplier obtained from the SVAR model above and with the literature, such as Bayer et al. (2020), who estimated the fiscal transfer multiplier.

Further on, the fiscal stimulus positively affects private consumption and imports, and almost insignificantly investments and exports. The economic rationale is that government consumption and investments stimulate aggregate demand and consist mostly of imported goods. On the other hand, private investments and exports are less affected. Higher imports and lower exports worsen the Slovenian balance of trade.

Finally, in Figure 3 we plot the evolution of inflation and real wage variables. The fiscal stimulus increases wages through several quarters. The wages increase due to government direct subsidies to households and firms. On the other hand, the effect of fiscal stimulus on inflation is negligible.

Figure 3: The impulse response of the main macroeconomic variables to fiscal packages in three scenarios

Source: Authors’ calculations. Note: The charts in Figure 3 depict a p.p. response of the main macroeconomic variables to fiscal packages shocks.

We assess the impact of the fiscal policy using two approaches, a theoretical and an empirical approach. To this end, we use The EAGLE model and a structural VAR model. We find strong evidence that fiscal stimulus affects GDP, private consumption, and import-related variables, while it has a small effect on private investments and exports. The fiscal stimulus slightly increases inflation and real wages. Government subsidies to households and firms, as well as the direct fiscal stimulus, increase wages across several quarters. We show that the fiscal stimulus increases nominal variables to a lesser extent, although it is more persistent for real variables.

Alloza, M., Ferdinandusse, M., Jacquinot, P., and Schmidt, K. (2020). Fiscal Expenditure Spillovers in the Euro Area: an Empirical and Model-Based Assessment. ECB Occasional Paper Series No 240.

Arigoni, F., Breznikar, M., Lenarčič, Č., and Maletič, M. (2023). Impact of fiscal measures in response to the COVID-19 pandemic on small-open economies: lessons from Slovenia. Banka Slovenije Working Papers, no. 2.

Bank of Slovenia. (2020). Macroeconomic Projections for Slovenia, June 2020. Bank of Slovenia.

Bayer, C., Born, B., Luetticke, R., and Müller, G.J. (2020). The Coronavirus Stimulus Package: How large is the Transfer Multiplier? CEPR DP 14600.

Beetsma, R., Giuliodori, M., and Klaassen, F. (2006). Trade Spill-overs of Fiscal Policy in the European Union: a Panel Analysis. Economic policy, 21 (48), 640-687.

Blanchard, O., and Perotti, R. (2002). An Empirical Characterization of the Dynamic Effects of Changes in Government Spending and Taxes on Output. Quarterly Journal of Economics, 117(4), 1329-1368.

Clancy, D., Jacquinot, P., and Lozej, M. (2016). Government Expenditure Composition and Fiscal Policy Spillovers in Small Open Economies within a Monetary Union. Journal of Macroeconomics, 48, 305-326.

Deskar-Škrbić, M., and Šimović, H. (2017). The Effectiveness of Fiscal Spending in Croatia, Slovenia and Serbia: the Role of Trade Openness and Public Debt Level. Post-Communist Economies, 29 (3), 336-358.

Gomes, S., Jacquinot, P., and Pisani, M. (2010). The EAGLE. A Model for Policy Analysis of Macroeconomic Interdependence in the Euro Area. ECB Working Paper, no. 1195.

Gomes, S., Jacquinot, P., and Pisani, M. (2012). The EAGLE. A Model for Policy Analysis of Macroeconomic Interdependence in the Euro Area. Economic Modelling, 29(5), 1686-1714.

Jemec. N., Strojan Kastelec, A., and Delakorda, A. (2011). How do Fiscal Shocks Affect the Macroeconomic Dynamics in the Slovenian Economy. Bank of Slovenia Prikazi in Analize 2/2011.

Ravn, S.H., and Spange, M. (2014). The Effects of Fiscal Policy in a Small Open Economy with a Fixed Exchange Rate. Open Economies Review, 25 (3), 451-476.

The fiscal version of the EAGLE model adds a fiscal extension of the baseline EAGLE model developed by Gomes, Jacquinot and Pisani (2012).

The inclusion of the trade balance is crucial as Slovenia is a small open economy and we need to account for the possibility of the outflow of fiscal expenditure through the imported goods.

For the theoretical derivation of the model in detail see appendix in Gomes, Jacquinot and Pisani (2010) and Clancy, Jacquinot and Lozej (2016).