References

Blanchard, O., G. Dell’ Ariccia and P. Mauro (2010), “Rethinking macroeconomic policy”, IMF Staff Position Note No. 2010/03.

CEPR (2022), “Inflation and Europe’s public finances”, VoxEU Talk, 24 June.

Di Bartolomeo, G., P. Tirelli and N. Acocella (2015), “The comeback of inflation as an optimal public finance tool”, International Journal of Central Banking, 11(1), 43-70.

Gibson, H. and S. Lazaretou (2001), “Leading inflation indicators in Greece”, Economic Modelling, 18(3), 325-348.

Heer, B., V. Polito and M. R. Wickens (2020), “Population aging, social security and fiscal limits”, Journal of Economic Dynamics and Control, 116, July: 103913.

Hondroyiannis, G. and S. Lazaretou (2007), “Inflation persistence during periods of structural change: an assessment using Greek data”, Empirica, 34(5), 453-475.

Jump, R.C. and K. Kohler (2022), “A history of aggregate demand and supply shocks for the United Kingdom, 1900 to 2016”, Explorations in Economic History, 85, July: 104448.

Kalyvitis, S. and S. Lazaretou (1997), “Persistence of nominal and real variables under fixed and floating exchange rates: Evidence from Greece, 1954-1992”, Bulletin of Economic Research, 49(2), 153-168.

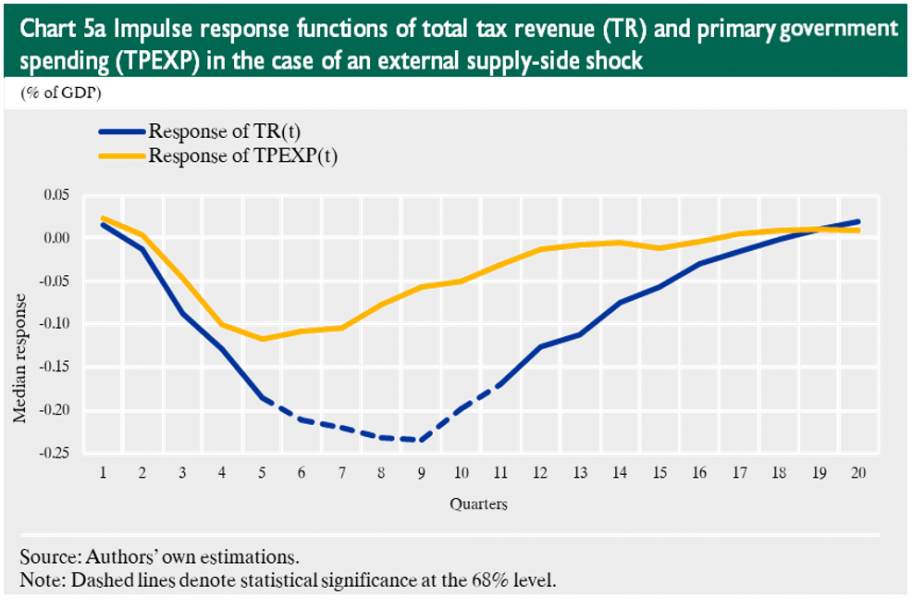

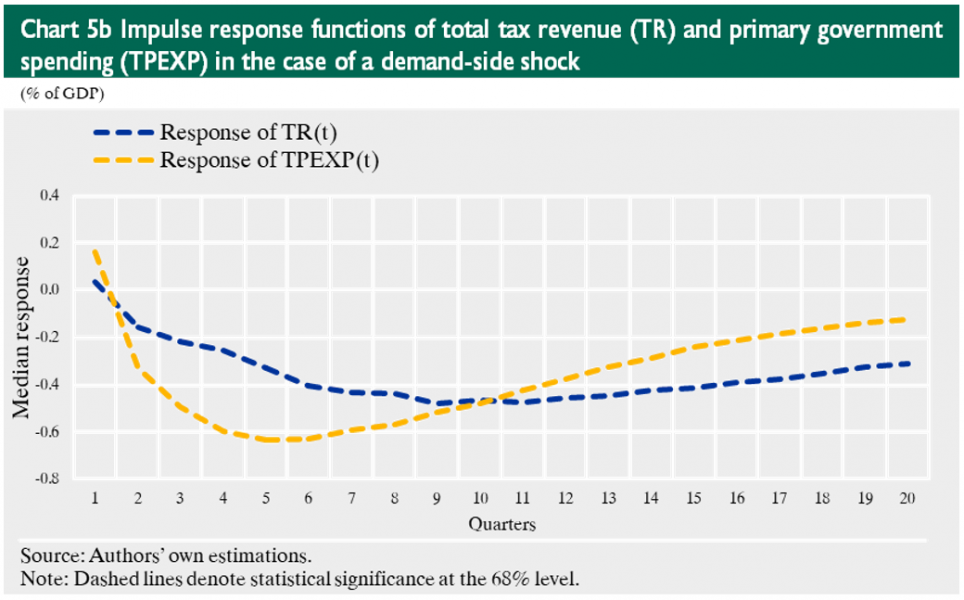

Lazaretou, S. and G. Palaiodimos (2023), “An assessment of the impacts of inflation on Greek public finances: Macroeconomic effects and policy implications”,

Economic Bulletin, Bank of Greece, 57, 7-30, July,

https://doi.org/10.52903/econbull20235701.

Phelps, E. (1973), “Inflation in the theory of public finance”, Swedish Journal of Economics, 75(1), 67-82.