This policy brief, based on the paper Leitner et al (2023), analyses banks’ ability to use capital buffers in the euro area, taking into account overlapping capital requirements between the risk-based capital framework and the leverage ratio capital framework from 2016 to 2022. We show that buffer usability was partially constrained in the period examined and is expected to remain so under the current regulatory framework, especially for global systemically important institutions (G-SIIs) that rely largely on internal modelling approaches to calculate risk-based capital requirements. We also provide new insights into the relationship between banks’ risk profile and buffer usability and perform a counterfactual analysis that investigates how different measures would have changed buffer usability.

Macroprudential buffers are regulatory capital requirements that are applied on top of minimum capital requirements. Buffers are intended to be used by banks in times of stress to absorb unexpected losses, so that they are not forced to cut back their vital services to the broader economy. Furthermore, capital buffers should generally increase the resilience of the banking system and certain elements of the framework also aim at dampening the financial cycle. Thereby, capital buffers’ overarching objective is to safeguard the stability of the financial system. Different types of buffer requirements are collectively called Combined Buffer Requirements (CBR) in EU law.1

Over the years, the regulatory framework has been adjusted to account for the lessons learned from the global financial crisis. Banks now have to comply not only with capital buffers that are part of the risk-weighted (RW) capital requirements, but also with the leverage ratio (LR) framework and resolution requirements (minimum requirement for own funds and eligible liabilities, MREL) which apply in parallel.2 These changes made the banking sector more resilient overall by limiting excessive leverage in the banking system and by ensuring banks have sufficient resources to guarantee their resolvability if they fail.

To some extent, banks can use the same capital to comply with these parallel requirements. Therefore, part of the capital that constitutes the risk-based macroprudential buffer may actually be needed to fulfil the LR or MREL requirements. In such cases, banks cannot fully use the capital buffers to absorb losses, as doing so would imply violating these parallel requirements which can eventually lead to severe consequences for the bank.3 Limited usability of buffers may in particular be the case for banks with low risk weighs for which the LR may represent a more binding constraint.

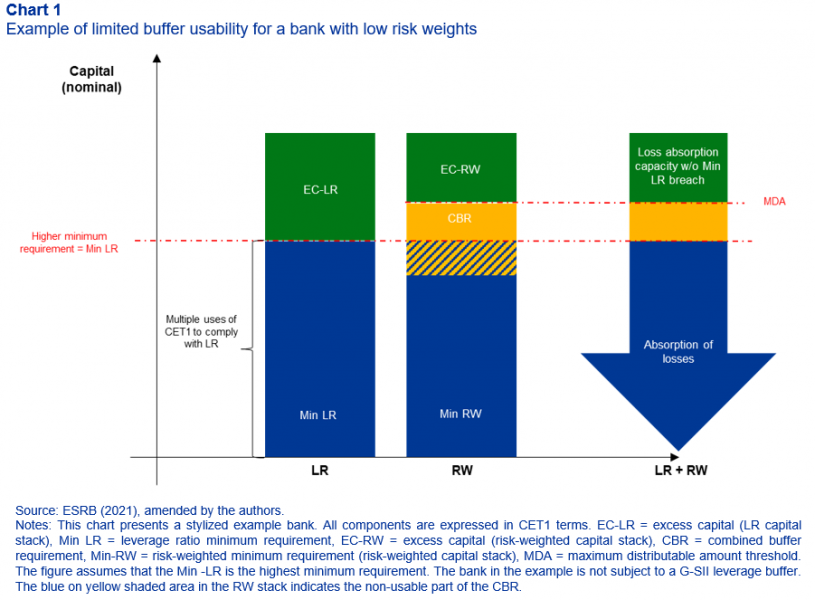

Chart 1 illustrates the limited usability of buffers presented by the LR for a stylised bank. The vertical axis depicts the common equity tier 1 (CET1)4 amount used to comply with the LR and RW frameworks. The blue shaded area of the CBR may not fulfil its buffer role, as the bank is not able to deplete it without breaching the LR minimum requirement. If banks cannot use their buffers, macroprudential policy would be less effective in cushioning shocks.

The here presented analysis extends earlier analytical contributions on banks’ ability to use capital buffers5 by examining for the first time how buffer usability with respect to the LR evolved in the euro area from 2016 to 2022, using a multi-country and multi-year bank-level dataset.6 We do not focus on MREL due to its later phase-in and resulting data limitations.

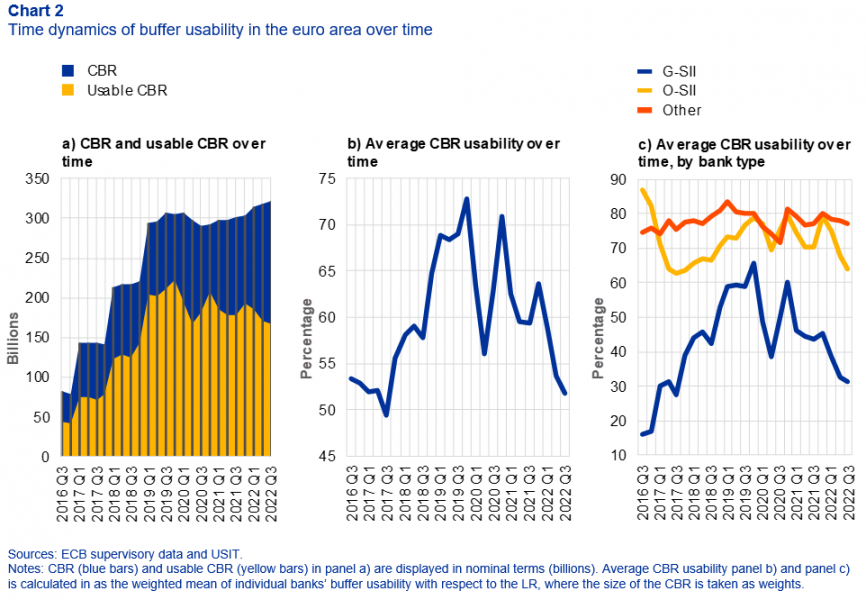

Chart 2 below summarizes the main results of the analysis of buffer usability7 over time, and allows to draw three important conclusions:

First, constraints on the usability of capital buffers due to overlaps with the LR are persistent: On average across all years, only about 60% of the CBR was usable. Second, limited buffer usability is particularly pronounced for G-SIIs and much less prominent for O-SIIs and other banks, as highlighted in panel c). One important reason for this is that larger and more complex banks – and especially G-SIIs – tend to rely more strongly on modelling approaches to calculate their capital requirements, whereas smaller and less complex banks mainly rely on standardised approaches.8 Modelling approaches tend to produce lower risk weights than standardised approaches. Third, buffer usability is particularly volatile for G-SIIs, compared to O-SIIs and other banks. Overall, the pattern in aggregate usability is strongly driven by the pattern observed for G-SIIs, given their large market share in the euro area banking sector.

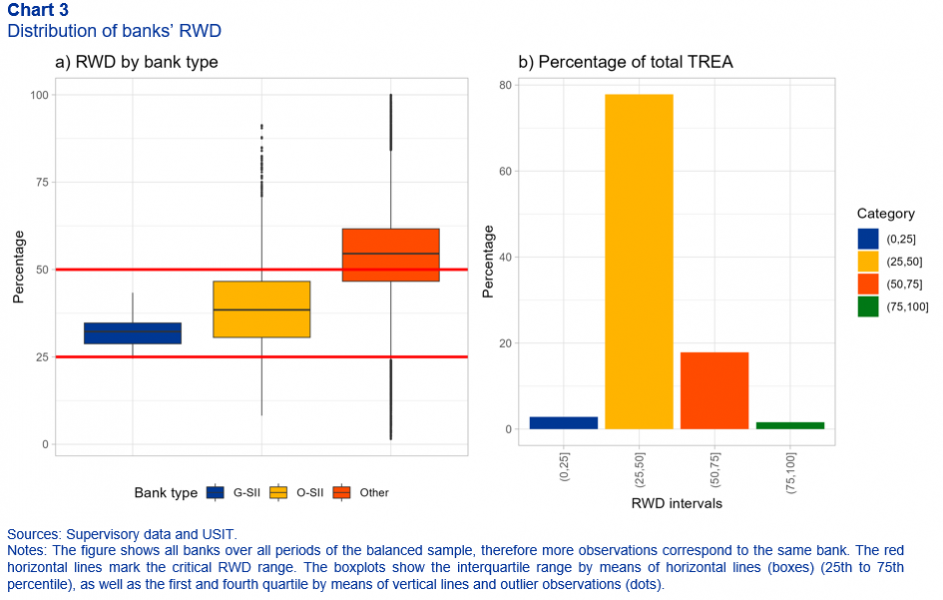

The relative bindingness of the RW and LR capital frameworks and hence buffer usability is mainly determined by the risk profile of the bank, which can be described analytically by the risk weight density (RWD). The RWD expresses, in percentage terms, the relationship between risk-weighted a non-risk weighted assets. The higher the RWD, the more constraining the RW framework is. A closer look at this relationship reveals that banks which operate with low average risk weights have their buffers completely restricted by the LR minimum requirement. Conversely, banks with high average risk weights have buffers fully usable. A numerical analysis of this aspect showed that these RWD levels appear to be between 25% and 50% respectively. We observe that buffer usability is generally limited and volatile for banks with RWD in this range. Conversely, for banks outside the critical range, buffer usability is stable, either at 0% or 100%.

Panel a) of Chart 3 illustrates the RWD distribution for different bank types. The red horizontal lines mark the critical RWD range of 25% and 50%. Especially G-SIIs operate in this range, with almost all G-SII data points being located within the red lines.

Banks that operate in the critical RWD range represent almost 80% of the banking system’s RWA in the euro area.9 This is because most of the large institutions (G-SIIs and O-SIIs)10 operate within the critical RWD range (panel b) in Chart 3). From a banking system perspective, the vast majority of exposures are therefore held by banks that might already have somewhat limited buffer usability which is also very sensitive to changes in RWD.

Overall, the development of buffer usability over time can be categorised into three phases (panel b, Chart 2). First, buffer usability initially briefly decreased, mainly due to a decrease in RWD. Afterwards, from early 2017 until the end of 2019, buffer usability steadily increased, which appears to be mainly driven by the phasing-in of buffer requirements, which increased the CBR and is especially relevant for G-SIIs and O-SIIs. Afterwards, at the onset of the COVID-19 pandemic in Europe in early 2020, buffer usability entered a volatile state, which started with a very sharp decrease in buffer usability. This drop was mainly driven by a sharp decrease in RWD. The reason for this was first the monetary policy stimulus undertaken in response to the market turmoil caused by COVID-19 which significantly increased banks’ leverage while keeping risk weights at a low level, and also the different fiscal support measures which also reduced the average risk weights. The high volatility observed in the subsequent periods can be explained by different aspects for which an in-depth discussion can be found in the underlying paper (Leitner et al 2023).

Lastly, we found substantial country heterogeneity in buffer usability levels and their evolution over time. We can roughly divide the countries into three groups: i) low but increasing buffer usability ii) high and stable buffer usability iii) high but decreasing buffer usability. These differences, mainly depend on (i) whether G-SIIs and other large complex banks are present and (ii) whether the country was severely affected during the Global Financial Crisis and its aftermath.11

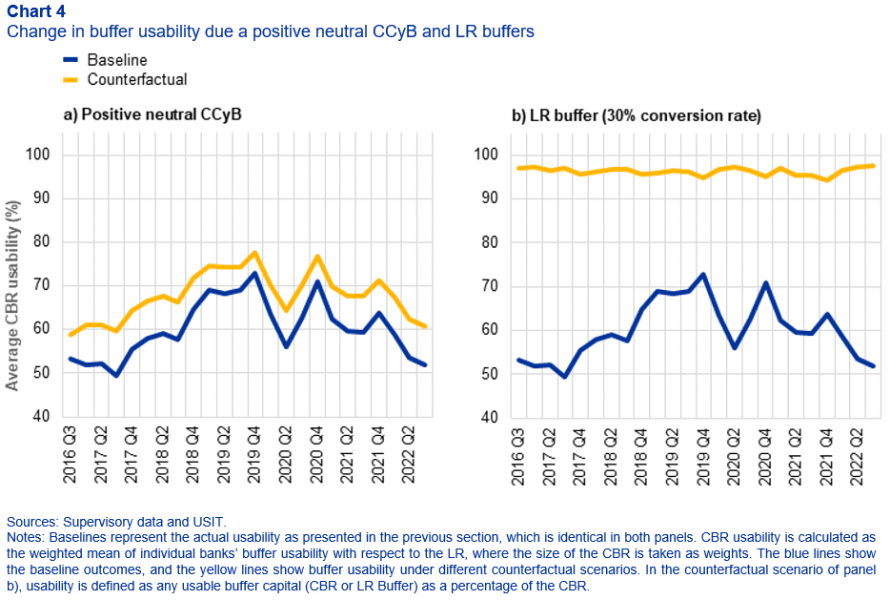

The ESRB (2021) discussed and analysed different options that would increase CBR usability. Our analysis extends this work by assessing how some of these options would have changed the observed trajectory of buffer usability by means of counterfactual analysis. We refrain however from providing an in-depth policy discussion or voicing preferences.12

First, a positive neutral countercyclical capital buffer (CCyB) of 1% would have increased CBR and thus also buffer usability throughout the observed period, as shown in panel a) of Chart 4. However, the overall time pattern in buffer usability remains broadly unchanged.

Second, introducing non-risk based buffers in capital regulation e.g. by mirroring the entire CBR in the LR framework and putting them also on top of the LR minimum requirement would have the potential to substantially improve buffer usability.13 Such an addition would, however, lead to increased capital requirements for banks constrained by the LR. The effect of the LR buffers depends on the applied factor with which the CBR rate is transferred to the LR framework (the conversion rate). In particular, if the conversion rate is above the average RWD, the LR buffer will be more likely to increase buffer usability but also raise capital requirements. The average RWD across our sample lies at 38%. With a conversion rate of 30%, buffer usability would increase to 96% (see panel b of Chart 4), and with a 40% conversion rate buffer usability would be almost 100%.

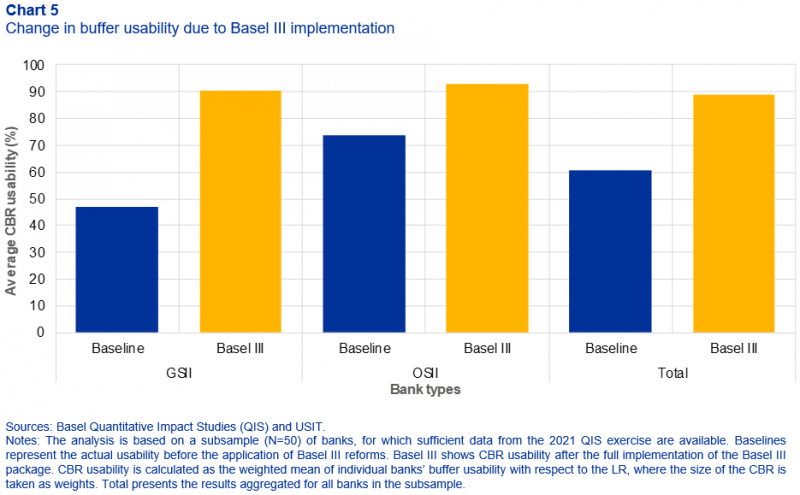

Finally, we also assess the expected effects of the implementation of Basel III proposals on buffer usability. In general, measures that increase banks’ risk weights, such as the output floor or other proposals of Basel III, will also increase buffer usability.14 It can be expected that the implementation of Basel III reforms, besides strengthening bank resilience and promoting financial stability, would also improve buffer usability. Our estimations presented in Chart 5 suggest that full and faithful Basel III implementation would substantially increase average buffer usability in particular for G-SIIs relative to O-SIIs. Less stringent implementation would improve buffer usability to a smaller extent.

In summary, buffers were found not fully usable throughout the observed period, especially for G-SIIs, with significant variation over time, but also at the level of euro area countries. Furthermore, buffer usability is primarily determined by a bank’s RWD, and there is a critical range of 25% to 50% where buffer usability tends to be limited and prone to volatility.

Beyond loss absorption, buffers also provide important incentives for banks, and higher levels of buffer usability support the effective functioning of the macroprudential framework. In the absence of policy changes or substantial adjustments to banks’ balance sheets and RWDs, limited buffer usability is likely to prevail in the long term as well. This highlights the need to closely monitor the impact of various policy measures and regulatory reforms. In this regard, the assessments presented in the underlying paper can contribute to a better understanding of the impact of various measures on the usability of buffers without compromising the objectives of leverage requirements.

Going forward, the final phasing-in of MREL by 2024 implies that this element of the capital framework will also become binding for many banks and will interact with risk-based capital buffers. Furthermore, the literature is so far missing analytical methods to assess the resulting consequences of the observed limitations on buffer usability for the practical functioning of the macroprudential framework, that go beyond conceptual considerations. In this regard, further research is needed to assess how limited buffer usability might influence the loss-absorbing capacity of the buffer framework.

Abad, J. and Garcia Pascual, A. (2022), “Usability of Bank Capital Buffers: The Role of Market Expectations”, IMF Working Papers, No 21, International Monetary Fund, January.

Basel Committee on Banking Supervision (2021), “Early lessons from the Covid-19 pandemic on the Basel reforms”, June.

Basel Committee on Banking Supervision (2022), “Buffer usability and cyclicality in the Basel framework”, October.

Behn, M., Rancoita, E. and Rodriguez d’Acri, C. (2020), “Macroprudential capital buffers – objectives and usability”, Macroprudential Bulletin, No 11, ECB, Frankfurt am Main, October.

European Central Bank (2022a), “ECB response to the European Commission’s call for advice on the review of the EU macroprudential framework”, March.

European Central Bank (2022b), “Enhancing macroprudential space in the banking union. Report from the Drafting Team of the Steering Committee of Macroprudential Forum”, March.

European Systemic Risk Board (2021), “Report of the Analytical Task Force on the overlap between capital buffers and minimum requirements”, December.

European Systemic Risk Board (2022), “Review of the EU Macroprudential Framework for the Banking Sector: Response to the call for advice”, March.

Leitner, G.; Dvořák M.; Magi, A.; Zsámboki, B (2023): “How usable are capital buffers? – An empirical analysis of the interaction between capital buffers and leverage ratio since 2016.” Occasional Paper Series, No. 329, ECB, Frankfurt am Main, September.

The CBR contains the capital conservation buffer (CCoB), capital buffers for global and other systemically important institutions (G-SIIs and O-SIIs), the systemic risk buffer (SyRB) and the countercyclical capital buffer (CCyB). Each of these buffers is set separately with a different purpose but with the same macroprudential nature. Further information on the buffers can be found on the ESRB website.

A comprehensive description of the EU prudential framework for banks can be obtained from Box 1 of the underlying paper (Leitner et. al 2023).

Minimum capital requirements are to be met at all times. Breaching any of them can result in severe supervisory measures, culminating in the withdrawal of their banking licence.

Given that the regulation requires banks to meet the CBR with the highest capital quality, i.e. with Common Equity Tier 1 (CET1) capital, one must focus specifically on CET1 capital to determine buffer usability.

See Leitner et al (2023) and ESRB (2021) for a review of literature. The analysis on banks willingness to use capital buffers is out of scope of this paper. See on that for instance: Abad and Garcia Pascual (2022), BCBS (2021), BCBS (2022), Behn et al. (2020) and ECB (2022b).

The LR has been a binding requirement since June 2021; however, it was also reported and publicly disclosed by banks beforehand, which allows for the extension of the time series backward. Furthermore, one could argue that public disclosure rules encouraged banks to comply with the LR requirement via market discipline and peer pressure even before it became formally binding. Our data show that the vast majority of banks would have complied with the LR requirement before it became legally binding.

For the empirical analysis we used the buffer usability simulation tool (USIT) of ESRB (2021).

The largest part of risk-weighted assets comes from the exposure to credit risk. Since Basel II, banks are allowed to determine their risk weights for credit risk using two approaches. First, there is the internal ratings-based (IRB) approach, which allows banks to use internal models that rely on historical data to estimate the probability of default (and possibly also loss-given-default) for a given exposure, which feeds into a formula to derive the final risk weight. Second, there is the standardised approach (SA), which directly attributes specific risk weights set out in the regulation for a given asset class, sometimes based on external credit ratings.

The simplified critical range of 25-50% is considered here. It should be noted that the critical RWD range can also be considered bank-specific, as discussed in the paper.

On average, G-SIIs and O-SIIs together accounted for around 75% of the euro area banking system’s total assets.

Risk weights reflect severity of the past crisis experience. Severe crises translate to higher risk weights for exposures in the given country. However, this effect gradually fades over time as the importance of these observations in the calculation diminishes.

Such a discussion, also comprehensively taking into account the perspective of limited buffer usability due to banks’ unwillingness to use buffers, including an analytical cost-benefit analysis, can be found in the ECB’s or the ESRB’s reply to the EU Commission’s call for advice on the EU’s comprehensive macroprudential review (see ECB, 2022a, ECB, 2022b, and ESRB 2022).

A detailed discussion of the mechanics of LR buffers can be obtained from Box 2 of Leitner et al 2023.

Increased risk weights automatically translate into a higher RWA, which makes the risk-based capital framework more binding relative to the LR and hence directly increases buffer usability.