Due to the massive purchases of securities in the last 15 years central banks incur substantial losses likely to persist for several years. On the other hand, the banking sector gains large profits from interest payments on their excess reserves holdings. Central banks and fiscal authorities must now bear the flip side consequences of their bond purchase programs. Populist demands to limit bank profits by drastically increasing minimum reserve ratios in the Eurosystem are creating new severe problems. Instead, a consistent and faster normalisation of central bank balance sheets would be desirable. Central banks should also no longer be central players in government bond markets to restore the lost boundaries between fiscal and monetary policy.

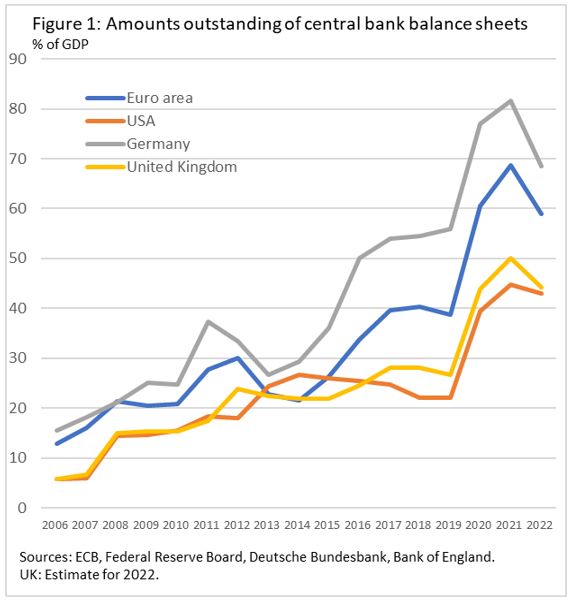

Major central banks must bear losses due to their inflated balance sheets (Figure 1) from securities purchases and loans to the banking system over the past 15 years and the monetary policy interest rate turnaround. On the other hand, banks earn high interest income for their large excess liquidity. Relief for government budgets through lower financing costs during the long phase of a highly expansionary monetary policy is now being partially offset by consequential costs that were foreseeable unless one believed in permanently low inflation rates and therefore very low nominal interest rates.

For the Eurozone, academics, journalists and different interest groups called for a drastic increase in minimum reserve ratios to lower “unfair” profits of the banking system. Such demands, which would apply to all banks and to all member states of the Eurosystem, should be rejected for several reasons. It would lead to structural distortions in the banking sector and affect savers and borrowers, as the minimum reserve is a special tax on banking transactions that is ultimately passed on to customers.

Instead, quantitative tightening by reducing bond holdings of central banks would be appropriate to bring the inflation rate down to the Eurosystem’s target for a long time. This would also allow key interest rates to be lowered again sooner and the interest payments of the national central banks on the excess reserves would therefore shrink from two sides.

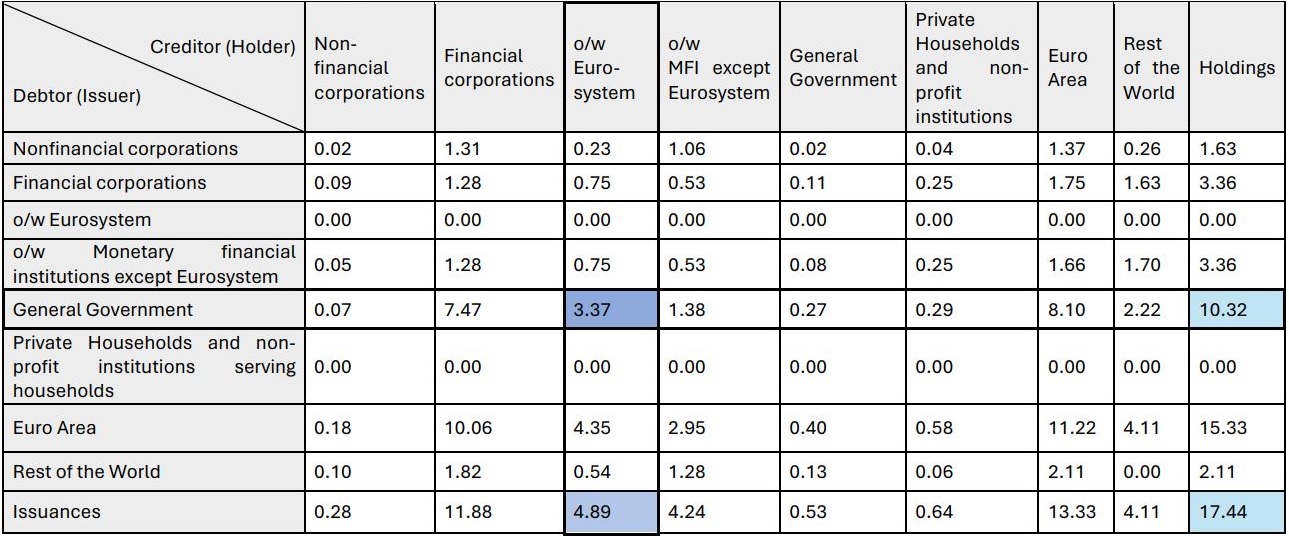

Taking a closer look at the Euro area`s debt securities held for monetary policy purposes (€ 4.9 tln) by mid-2023 they were mainly issued by general government (€ 3.4 tln) but also by (financial and nonfinancial) corporations (€ 1 tln). Approximately an amount of € 0.5 tln refers to debt securities issued by nonresidents (Table 1). As further reflected in Table 1, about one third of total debt securities (€4.9 of €17.4 tln) and of general government debt securities (€3.4 of €10.3 tln) were held by the Eurosystem. This is by far more than the debt securities holdings of all other EMU sectors – except the commercial banks (MFIs except Eurosystem). Compared to the Eurosystem (33%) the Fed held significantly less government debt securities (25% of total US general government debt securities issues) by end-2022. The Fed had only bought bonds issued by the central government and not the US states.

Table 1: From-whom-to-whom table of Euro area debt securities

(€ trillions, amounts outstanding, mid 2023)

Source: ECB.

The Eurosystem’s ultra-expansive monetary policy with its massive purchases of government bonds has therefore blurred the boundaries between fiscal policy and monetary policy and thus narrowed the scope for monetary policy in the future. Central banks became central players in some markets in which they have no place and, in any case, should not play a leading role: in those for government debt securities (in the EMU also those of all its member states), in those for corporate bonds and in parts of equity markets (Table 1). The greater their weight, the more they determine directly or indirectly the price of time and risks and the yield curve on these markets with distortionary repercussions on related market segments and thus determine the success or failure of market players.

No central bank has a mandate for such an interventionistic role, and rightly so. A politicisation of central bank policy would be unavoidable, central bank independence would be lost, and the primary goal of central bank policy – ensuring monetary stability – would be the victim if this trend is not stopped. For these reasons, a continuous but consistent normalisation of central bank balance sheets would have been highly desirable. In this respect, the central bank losses and the associated discussion in the media and politics may also contribute to a critical comprehensive judgement of the past QE-dominated monetary policy strategy and the involved limits, cost and risks – and lessons to be drawn for the future.

Jost, T. and Mink, R. (2024). Central Bank Losses and Commercial Bank Profits – Unexpected and Unfair? Institute for Monetary and Financial Stability, Goethe University Frankfurt. Working Paper Series No. 199 (2024).