This policy brief is based on Schmidt and Yeşin (2022). The views, opinions, findings, and conclusions or recommendations expressed in this document are strictly those of the author(s). They do not necessarily reflect the views of the Swiss National Bank (SNB). The SNB takes no responsibility for any errors or omissions in, or for the correctness of, the information contained in this document.

This policy brief summarizes the findings of my joint research with Richard Schmidt. We document the growing importance of investment funds in international capital flows and the potential implications of this trend for global financial stability. For 33 advanced and emerging market economies, we show that portfolio investment flows have increasingly been channeled by foreign-domiciled investment funds. Furthermore, we show empirical evidence that countries with higher external exposure to investment funds tend to exhibit higher exchange rate volatility. We argue that countries with high exposures to investment funds may be subject to sudden capital outflows and high exchange rate volatility in the event of a global macro-financial shock. We also add to the growing policy discussion on sustainability-themed investment funds. In particular, we develop sustainability indicators for each country over time that measure the share of Environmental, Social and Governance (ESG) funds in total funds. While their levels are still relatively small, these sustainability indices are currently growing at a striking pace. We show that “sustainable” investment via investment funds has mostly a domestic investment nature in advanced economies, while for emerging market economies it mainly comes from foreign-domiciled funds.

Numerous regulatory reforms in the banking sector triggered by the global financial crisis have contributed to a remarkable rise in nonbank financial intermediation in recent years. In 2021, nonbank financial intermediaries (NBFIs) – such as pension funds, insurance corporations and investment funds1 – held about 50 percent of global financial assets (FSB, 2022).2 Among the different types of NBFIs, investment funds have exhibited the strongest growth (FSB, 2022). During the last five years, assets under management (AUM) of equity and bond investment funds doubled to almost USD 40 trillion as of February 2022.

While investment funds make it easier and cheaper for small and large investors to diversify their portfolios, they also shape international capital flows. Indeed, the importance of investment funds in propagating macro-financial shocks became evident when redemptions of investment fund shares amplified capital outflows from EMEs during the market turmoil in March 2020 (FSB, 2020).

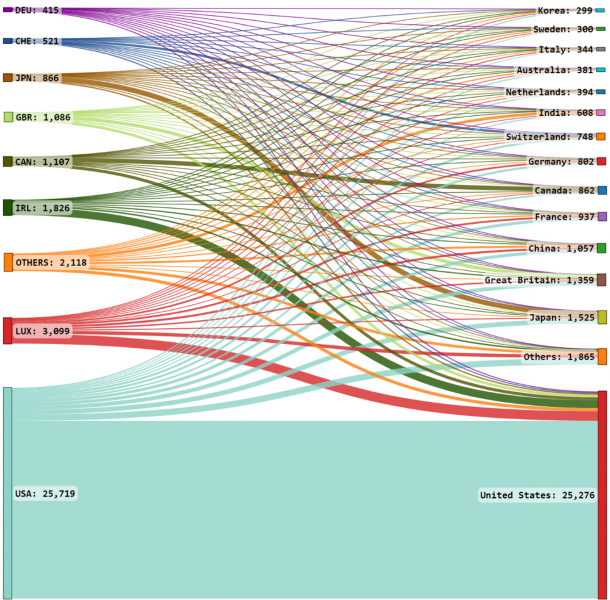

Yet, not all investment fund flows are capital flows, because funds also invest domestically as illustrated in Figure 1. The figure illustrates AUM of equity and bond funds by their domicile country on the left hand side and the countries in which they invest on the right hand side as of February 2022. Investment funds are clustered in relatively few advanced economies (AE), such as the United States, Luxembourg, Ireland and Canada. Their investments, in contrast, reach a far more diverse set of countries, ranging from the United States to Korea including also many emerging market economies (EMEs). Furthermore, there is significant inbound investment for the United States, while less so for some of the other countries such as Japan and Switzerland. The figure unambiguously shows that it would be incorrect to use the terms and the corresponding data of fund flows and capital flows interchangeably, as inbound investment can be sizeable.

The commonly used data sources for capital flows and fund flows, however, do not make this key distinction. In particular, a sectoral breakdown of the holders of portfolio liabilities of countries is not available in the conventional balance of payments and international investment position data. Indeed, if such sectoral exposure data were available, they could help policymakers assess risks and vulnerabilities and shape policy response.

Schmidt and Yeşin (2022) partially fill this data gap by complementing the traditional capital flows data with the real time fund flows data. By doing so, the share of portfolio equity and bond liabilities to foreign-domiciled investment funds can be estimated for each country. Our analysis focuses on 20 AEs and 13 EMEs, determined by the availability of the data.

Figure 1: Domicile and destination countries of investment funds (USD billion)

Source: EPFR; authors’ own calculations in Schmidt and Yeşin (2022). Notes: The figure shows the AUM of equity and bond funds in our sample of countries as of February 2022. The countries on the left-hand side are those where investment funds are domiciled. The countries on the right-hand side are those where the funds invest. The group “Others” on the left-hand side includes, in order of decreasing AUM, India, France, Australia, Sweden, China, Spain and the Netherlands, among others.

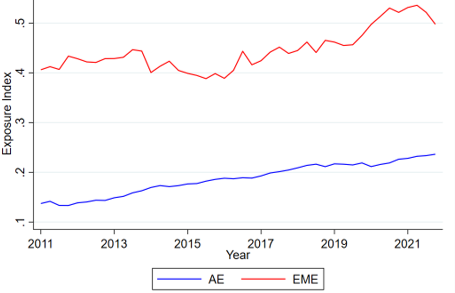

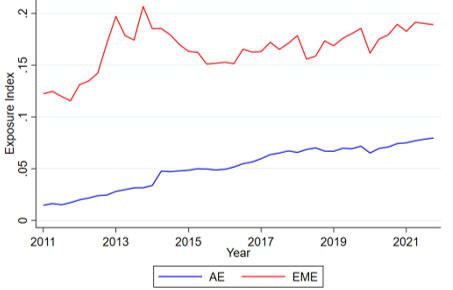

In Schmidt and Yeşin (2022), we construct various indicators to quantify countries’ external exposure to investment funds. The indicators measure the share of portfolio liabilities to foreign-domiciled funds. They take values between 0 and 1. Higher values indicate higher external exposure to investment funds. Figures 2 and 3 illustrate the external exposure index of AEs and EMEs to equity and bond funds, respectively.3 Both figures show that countries’ external exposure to equity and bond funds have been on an increasing trend.

Figure 2: External exposure index to equity funds

Source: EPFR; IMF BOPS; authors’ own calculations in Schmidt and Yeşin (2022). Notes: The figure shows the external exposure index to equity funds, i.e. the share of portfolio equity liabilities of AEs and EMEs to foreign-domiciled equity funds. EMEs are Brazil, Chile, China, Czech Republic, Indonesia, Korea, Mexico, Russia, South Africa and Thailand. AEs are Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Italy, Japan, the Netherlands, Norway, Singapore, Spain, Sweden, Switzerland, the UK and USA.

Three striking observations can be made in these two figures. First, portfolio liabilities channeled by foreign-domiciled investment funds has been steadily growing over time for both AEs and EMEs. Second, the external exposure index to bond funds is smaller than the one to equity funds for both groups of countries. This may be driven by the greater role investment funds can play in the diversification of equity portfolios relative to bond portfolios. Third, EMEs are significantly more exposed to investment funds than AEs in both equity and bond markets. About half of all portfolio equity liabilities of EMEs are towards foreign-domiciled equity funds, while only a quarter of portfolio equity liabilities of AEs are towards foreign-domiciled equity funds. The higher external exposure of EMEs to funds may be driven by various factors, such as the home bias of AE investors as well as barriers to investing in EMEs for retail investors. In other words, it may be easier, cheaper and less risky for foreign investors to invest in EMEs via investment funds.

Figure 3: External exposure index to bond funds

Source: EPFR; IMF BOPS; authors’ own calculations in Schmidt and Yeşin (2022). Notes: The figure shows the external exposure index to equity funds, i.e. the share of portfolio equity liabilities of AEs and EMEs to foreign-domiciled equity funds. EMEs are Argentina, Brazil, Chile, China, Czech Republic, Egypt, India, Indonesia, Korea, Mexico, Russia, South Africa and Thailand. AEs are Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Italy, Japan, the Netherlands, Norway, Singapore, Spain, Sweden, Switzerland, the UK and USA.

In Schmidt and Yeşin (2022), we also conduct a few empirical exercises to gauge the impact of fund flows on exchange rates and asset prices. We find that larger exposure to funds is coincident with higher exchange rate volatility. Furthermore, larger fund flows are coincident with asset price increases. The latter result becomes stronger for fund flows arising from foreign-domiciled funds.

In recent years, the urgency of transforming the world economy toward growth that is also sustainable has led to a surge in Environmental, Social and Governance (ESG) funds.4 During the last five years, the AUM of ESG equity and bond funds has grown an impressive tenfold, not only as a result of valuation changes but also due to strong and stable new investment. As of February 2022, 5% of all funds’ AUM was managed by an ESG fund. Consequently, in Schmidt and Yeşin (2022), we zoom in to ESG funds.

Interestingly, ESG funds exhibit different domicile and destination patterns from conventional funds. In particular, the United States, the country with the largest fund sector, does not dominate as a domicile country of ESG funds. Instead, Luxembourg is the most prominent domicile country for ESG funds.

For all countries in our sample, we construct sustainability indicators over time. In particular, we measure the share of AUM invested in each country that is labeled ESG by domestic funds and by foreign-domiciled funds, separately, as well as in total. The first two indicators we call domestic and foreign sustainability indices, respectively. We show that domestic and foreign sustainability indices show a wide variation both within and across countries. It is also remarkable that the foreign sustainability index is significantly higher for countries that are not among the main fund domicile countries. In fact, for countries that do not host any ESG funds – such as several EMEs, all ESG flows are coming from foreign-domiciled investment funds and thus have a cross-border nature. In contrast, European countries like Sweden, Switzerland and Austria exhibit higher values in the domestic sustainability index than they do in the foreign sustainability index.

In Schmidt and Yeşin (2022), we provide evidence that foreign-domiciled investment funds are becoming increasingly prevalent in portfolio investment. Our findings should be considered within the context of policy discussion concerning NBFI regulation and disclosure requirements on climate-related issues. Investment funds – both conventional and ESG – will continue to play an important role in cross-border propagation of macro-financial shocks and upcoming regulation changes.

FSB – Financial Stability Board (2020), Holistic Review of the March Market Turmoil, November.

FSB (2022), Global monitoring report on non-bank financial intermediation 2022, December.

Schmidt, R., and P. Yeşin (2022), The growing importance of investment funds in capital flows, Swiss National Bank Working Paper No. 2022-13.

Pástor, Ľuboš, M. Blair Vorstaz, and Jeffrey Pontiff (2020), Mutual Fund Performance and Flows during the COVID-19 Crisis, Review of Asset Pricing Studies 10 (4), pp. 791-833.

An investment fund, also known as collective investment scheme or mutual fund, is a financial vehicle that pools money contributed by a group of investors to invest in securities and other financial instruments.

In other words, NBFIs’ balance sheet was the same size as that of central banks, banks and public financial institutions put together.

External exposure indices for individual countries are listed in Schmidt and Yeşin (2022).

Greenwashing remains a major concern. In particular, any investment fund could use the label ESG or SRI in its prospectus, signaling to investors that it invests in sustainable companies. However, there are no international disclosure standards or external certification by a third party to assess this label yet.