This policy brief is based on Nagengast, Rios-Avila, and Yotov “The European Single Market and Intra-EU Trade: An Assessment with Heterogeneity-Robust Difference-in-Differences Methods”, Economica (forthcoming), as well as Deutsche Bundesbank, Discussion Paper No 26/2025 (working-paper version). The views expressed in this brief are those of the authors and do not necessarily reflect the views of the Deutsche Bundesbank or the Eurosystem.

Abstract

Using heterogeneity-robust difference-in-differences methods and a new estimation command (jwdid) that account for the staggered nature of European Union (EU) enlargement, we find that the Single Market has delivered strong and persistent trade gains exceeding those of other regional trade agreements. According to our estimates, the European Single Market has increased bilateral trade between member states by 52%. These findings underscore the success of European economic integration.

The European Union is the world’s largest cross-country single-market area, with more than 50% of exports for 25 of its 27 members directed to other EU countries. Recent geopolitical concerns have triggered renewed interest in the impact of the Single Market on intra-EU trade (e.g., Fontagné and Yotov, 2024; Adilbish et al., 2025).

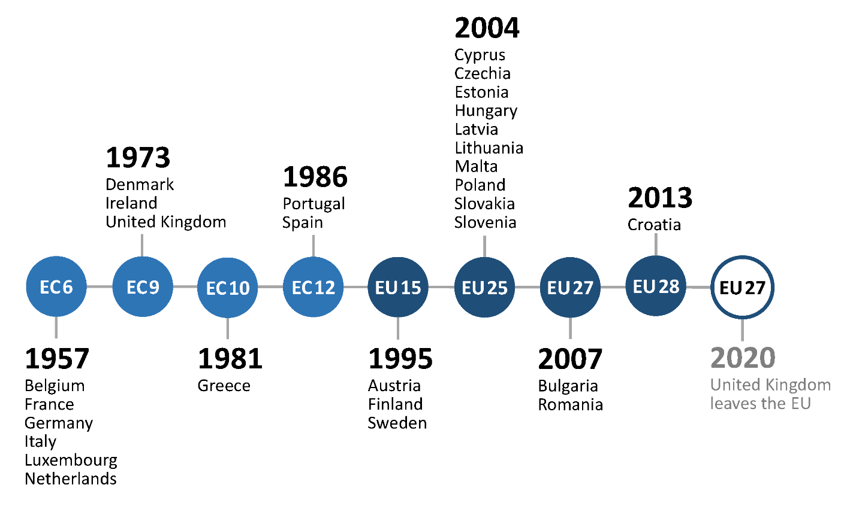

In a new study (Nagengast, Rios-Avila, and Yotov, 2025), we propose a new Stata estimation command jwdid that enables us to employ cutting-edge econometric techniques to re-evaluate the trade effects of EU membership that takes the staggered nature of EU accession into account (Figure 1).1 Our analysis reveals that the Single Market has been even more successful than previously thought, delivering substantial and lasting benefits to all member states.

Figure 1. EU accession timeline

Source: Nagengast et al. (2025). The figure traces the accession timeline for new European Union members. EC denotes the European Community, which was the predecessor of the European Union (EU).

The layout and style of the figure is based on the corresponding figure from the German Federal Statistical Office at https://www.destatis.de/Europa/EN/Country/EU-Member-States/_EU_EZ_Zeitverlauf_en.html.

Our analysis shows that EU membership increased bilateral trade between member states by 52% on average. This is substantially larger than what traditional econometric approaches suggest, which we find to be downward biased by 13 percentage points. The EU effect significantly exceeds recent estimates for other regional trade agreements, reinforcing the EU’s status as the world’s most successful economic integration project.

While recent discussions have focussed on the size of remaining barriers (Adilbish et al., 2025; Head and Mayer, 2025), this magnitude reflects the depth of EU integration. Unlike standard free trade agreements that primarily reduce tariffs, the Single Market reduces non-tariff barriers, harmonizes regulations, ensures free movement of goods, services, capital, and labor, and provides strong legal enforcement. These deeper integration measures have paid substantial dividends in increased trade flows among member states.

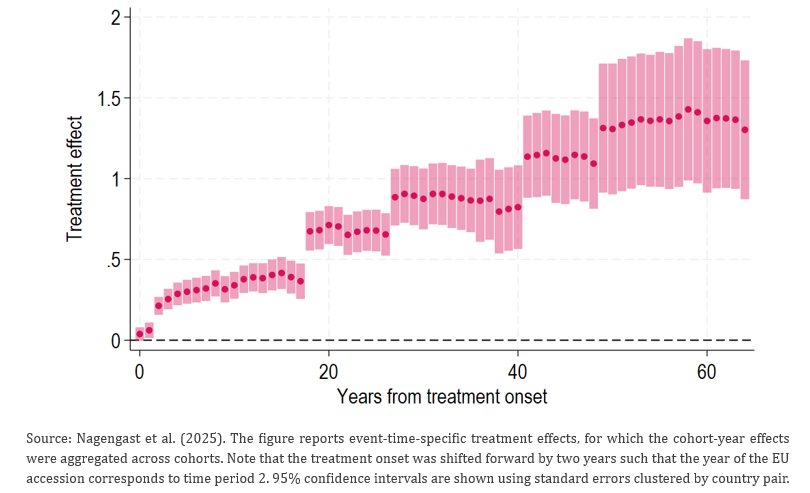

The dynamics of EU trade effects reveal sustained growth that distinguishes the Single Market from typical trade agreements. We find small anticipation effects two years before formal accession, potentially related to the signing of accession treaties and economic actors’ forward-looking behavior. Upon accession, trade effects increase rapidly and continue growing over decades, which contrasts sharply with most free trade agreements where benefits plateau after 10-15 years (Figure 2). This long-term dividend likely reflects the EU’s evolving nature, with continuous deepening through initiatives like the Single European Act, the eurozone, and ongoing regulatory harmonization.

Figure 2. Event-time-specific EU effects

The founding members of 1957 as well as the cohorts of 1973 (Denmark, Ireland, United Kingdom) and 1986 (Portugal, Spain) recorded particularly strong trade effects. The cohorts from 1995 onwards tend to show somewhat smaller trade effects, while Croatia (2013) in turn also exhibits strong effects. These differences may partly reflect varying starting points and that many later entrants had already achieved some trade liberalization through association agreements.

Trade has increased in all directions within the enlarged EU. Exports from previous to newer members rose by 62%, flows from new to previous members increased by 20%, and trade among new members expanded by 50%. The asymmetry may reflect that newer members face stronger competition in established markets, while previous members’ firms can more easily leverage their experience and established brands to penetrate new markets. Despite these differences, all member states have benefited from increased trade volumes following accession.

Our findings differ from earlier studies because we employ heterogeneity-robust difference-in-differences methods addressing critical flaws in traditional approaches. Standard two-way fixed effects estimators produce biased results when countries join at different times, which is precisely the case for EU enlargement. In such settings, these methods inadvertently create “forbidden comparisons” by using already-treated units as controls.

Our approach allows treatment effects to vary flexibly across accession cohorts and time periods. To implement it, we developed and released a new Stata command jwdid. The command combines recent advances in difference-in-differences literature with techniques for handling complex fixed effects structures in gravity models. Beyond evaluating EU membership, researchers can use this tool to study other policy interventions in gravity settings from currency unions to sanctions. The paper includes complete code examples to facilitate implementation by other researchers.

The European Single Market stands as a remarkable success in economic integration. According to our paper, it generates trade benefits that are larger, more persistent, and more widespread than previously recognized. With average trade increases of 52% between member states, the Single Market has delivered substantial economic gains to all participants.

These findings arrive at a crucial moment. In an era of rising geopolitical tensions and trade fragmentation, the EU’s internal market provides a foundation for European prosperity and resilience. Our results are particularly relevant for ongoing debates about the future of the EU’s internal market and European integration. For example, recent research by Dorn et al. (2024) indicates that completing the Single Market for services could generate welfare gains up to 5% of GDP for some member states.

Adilbish, O. E., D. A. Cerdeiro. R. A. Duval, G. H. Hong, L. Mazzone, L. Rotunno, H. H. Toprak, and M. Vaziri (2025). Europe’s Productivity Weakness: Firm-Level Roots and Remedies. IMF Working Papers 2025/040, International Monetary Fund.

Dorn, F., L. Flach, and I. Gourevich (2024). Building a Stronger Single Market: Potential for Deeper Integration of the Services Sector within the EU. EconPol Policy Report 52, ifo Institute – Leibniz Institute for Economic Research at the University of Munich.

Fontagné, L., and Y. V. Yotov (2024). Reassessing the impact of the Single Market and its ability to help build strategic autonomy. School of Economics Working Paper Series 2024-7, LeBow College of Business, Drexel University.

Head, K., and T. Mayer (2025). No, the EU does not impose a 45% tariff on itself. VoxEU.org, 13 November, 2025.

Nagengast, A. J., F. Rios-Avila and Y. V. Yotov (2025). The European Single Market and Intra-EU Trade: An Assessment with Heterogeneity-Robust Difference-in-Differences Methods. Deutsche Bundesbank Discussion Paper No 26/2025.

Nagengast, A. J., F. Rios-Avila and Y. V. Yotov (forthcoming). The European Single Market and Intra-EU Trade: An Assessment with Heterogeneity-Robust Difference-in-Differences Methods. Economica.

Strictly speaking, the European Single Market was formally established in 1993. However, in this study we use “Single Market” and “EU membership” interchangeably as shorthand for participation in the evolving institutional framework of European economic integration, including its earlier precursors such as the European Economic Community.