This Policy Brief is based on Banque de France Working Paper #938. The views expressed in this paper are those of the authors and do not necessarily represent those of the Banque de France or the Eurosystem.

Consumer price reactions to supply shocks and monetary policy are heavily influenced by inflation volatility, with significant differences emerging between high and low volatility periods. We show empirically that increased inflation volatility amplifies the impact of such shocks on consumer prices. These findings challenge conventional metrics like inflation levels or shock size in explaining price response variability, suggesting producers invest in price flexibility based on the prevailing inflation volatility regime.

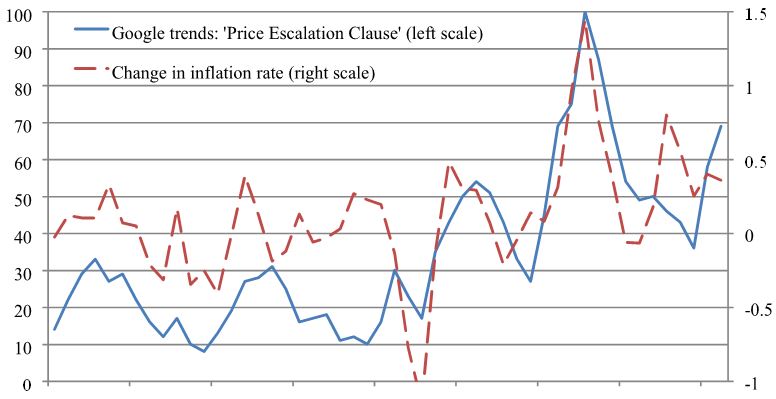

Traditional monetary policy relies on stable relationships between producer prices and consumer inflation, but policymakers have long harbored doubts about the consistency of these dynamics. In fact, previous research has found this link to vary over time (e.g., Bank for International Settlements, 2022; Bobeica et al., 2021; Galeone and Gros, 2023; De Santis and Tornese, 2023). Real-world practices among firms further support these findings: as shown in Figure 1, the surges in inflation volatility coincide with an increased interest in price escalation clauses, proxied by Google search data. These clauses allow firms to automatically pass on changes in input costs to the contracted final price—resulting in a higher pass-through of producer price changes. Motivated by this anecdotal evidence, our recent study (Arndt and Enders, 2024) provides new insights into how changing inflation regimes affect the transmission of supply shocks, with significant repercussions for central bank actions and inflation targeting.

Figure 1: Index for Google searches of ‘Price escalation clause’ (left axis) and monthly change in annualized s.a. CPI inflation rate in percentage points (right scale)

By applying a Markov-switching model to U.S. inflation data, we reveal the existence of two distinct inflation regimes: one characterized by high volatility, and another with more muted fluctuations. Importantly and different from the previous literature, our approach allows the data to endogenously determine regime switches without imposing arbitrary thresholds. Through this lens, we find that when monthly inflation deviates significantly—annualized by more than 5 percent—we can expect an economy to enter a high-volatility state.

We rely on a state-dependent local projections instrumental variable approach to identify the effects of supply shocks. Our instrument is based on outliers in the three stages of processing producer price indices (PPI), provided by the Bureau of Labor Statistics: crude materials, intermediate goods, and finished products PPI (see Weinhagen, 2016, 2002). That is, we assume that these outliers are often caused by supply shocks.

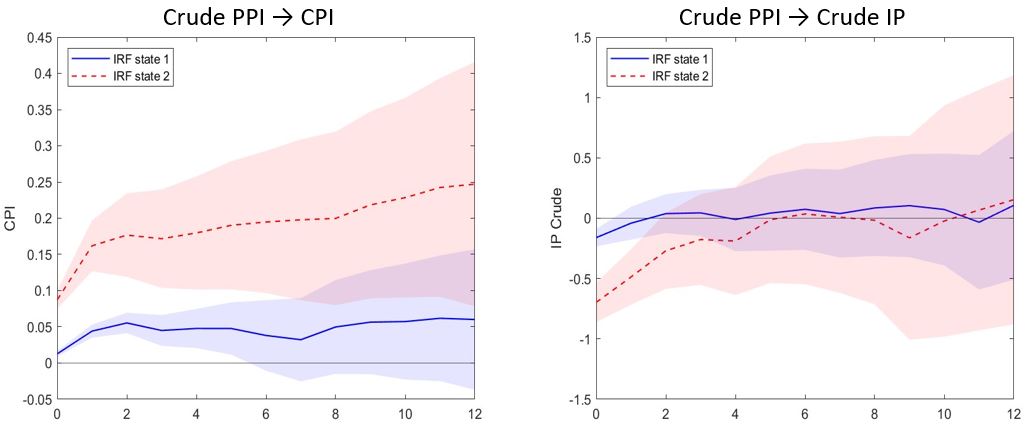

Examining the state-dependent impulse response functions depicted in Figure 2, we find substantial differences between our identified regimes. A shock to crude materials’ PPI has a stronger and more persistent effect on CPI inflation and industrial production in times of high inflation volatility compared to periods of stable inflation. We observe this state dependency on impact also for shocks to Intermediate and Finished PPI. Substituting our rather broad-based supply shocks with oil price shocks confirms our previous findings.

Additionally, we analyze the effect of a producer price shock on its downstream stages of processing price indices, namely the effect of a shock to Crude PPI on Intermediate and Finished PPI and the effect of Intermediate on Finished PPI. Again, we find a significantly stronger response in the high inflation volatility regime.

Figure 2: Impulse responses in Regime 1 (low volatility, solid blue lines) and Regime 2 (high volatility, dashed red lines) of CPI to a shock to Crude PPI (left) and corresponding industrial production response (right)

Note: Horizontal axes denote months. Shaded areas represent 68% confidence intervals.

While our investigation confirms explicitly how integral a role volatility plays in defining these regimes, we also test alternative explanatory variables like CPI levels or crude PPI fluctuations for their potential influence as regime discriminators. However, none exhibited comparable predictive power compared to the distinctive tell-tale signs offered up by classifying regimes along inflation volatility.

Similarly revealing is our observation that consumer price reactions to monetary policy interventions diverge considerably depending on whether an economy resides in a high or low volatility state at that moment—a phenomenon particularly evident in short-term analyses following policy shocks. The CPI responds noticeably faster under conditions of heightened volatility following monetary shocks than it does in low-volatility time frames. A robust response from central banks during volatile bouts may hence help steer economies back toward a lower-volatility regime.

Regarding economic theory, our results speak in favor of models in which prices react quicker to shocks in the face of higher inflation volatility. We, therefore, propose a model based on Devereux (2006) in which price setters can invest in the flexibility of their prices. In the presence of strategic complementarities in price setting, the payoff of being able to react quickly to new developments is higher in times of elevated inflation volatility. This increases the incentive to invest in price flexibility, explaining our finding of a more substantial pass-through of cost and monetary policy shocks during periods of volatile inflation. The model further predicts that inflation targeting by central banks leads to a lower pass-through of shocks to inflation through the traditional direct channel of altering demand, but also indirectly and additionally via reducing optimal price flexibility. For example, reacting in a relatively dovish way to supply shocks increases this flexibility and fosters a stronger and faster reaction of consumer prices to future supply shocks, increasing volatility even further.

Our research suggests that central banks should be more mindful not only of current consumer price levels but also of upstream pricing pressure during volatile periods. By enacting decisive policy swiftly and effectively during spikes in volatility–—one could argue–—a swift return trajectory towards lower-volatility conditions can be encouraged.

Arndt, S. and Enders, Z. (2024). The transmission of supply shocks in different inflation regimes. Banque de France Working Paper No. 938.

Bank for International Settlements (2022). Annual economic report. Chapter II.

Bobeica, E., Ciccarelli, M., and Vansteenkiste, I. (2021). What we know about the wage inflationary channel. SUERF Policy Brief, No 198.

De Santis, R. A. and Tornese, T. (2023). Energy supply shocks’ nonlinearities on output and prices. ECB Working Paper No. 2834.

Devereux, M. B. (2006). Exchange rate policy and endogenous price flexibility. Journal of the European Economic Association, 4(4):735–769.

Galeone, P. and Gros, D. (2023). Regime shifts and the last mile of disinflation. Vox.EU, 13 December.

Weinhagen, J. (2002). An empirical analysis of price transmission by stage of processing. Monthly Labor Review, 125:3.

Weinhagen, J. C. (2016). Price transmission within the producer price index final demandintermediate demand aggregation system. Monthly Labor Review, 139:1.