The views expressed are those of the authors and not necessarily those of the institutions the authors are affiliated with.

Abstract

When countries slide into recession, what matters is not just how much the government owes or how high the cost is on that debt—it is the combination of the two. Looking at most of the advanced economies since the 1870s, our research shows that this “total debt burden” (the size of the debt times the cost for servicing it) impacts on how deep a downturn becomes and how long it lasts.

Traditionally, empirical analysis of the sustainability of sovereign debt and its impact on the economy has used the level of public debt as a proxy for the stability of public finances. However, recent research has argued that the cost of servicing the debt, defined as the difference between the interest rate and the output growth rate (r – g), plays an important role.

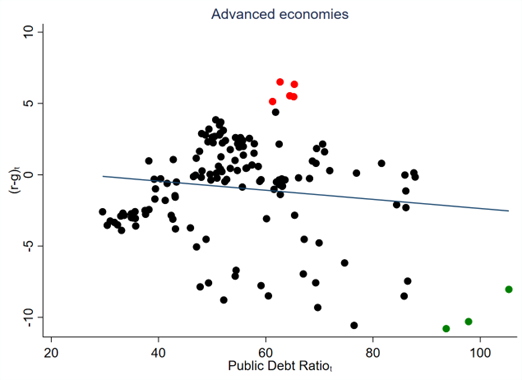

In this paper, we document that, for 18 advanced economies over a span of 150 years, the level of public debt and the interest-growth differential convey distinct information about public finances conditions. This is illustrated in Figure 1 where the average value of both public debt and (r – g) exhibit a lack of systematic positive correlation. Building on this evidence, our new approach to analysing the relationship between economic downturns and sovereign debt risks considers the total public debt burden (TB), that is, the interaction between the level of debt and (r – g).

Figure 1. Public Debt and r-g. Sample: 1870–2017

In our first empirical analysis, we demonstrate that arguments put forward in the literature suggesting that the view of financial crises as primarily rooted in weak public finances is not generally supported by historical evidence for advanced economies. Our analysis reveals that neither episodes of high (r – g), nor high public debt level, nor episodes of high TB are significantly associated with the future probability of a financial crisis. Therefore, the data does not support the hypothesis that periods of vulnerabilities in the public sector translate systematically into future periods of financial instability.

However, does the total debt burden impact on the depth and duration of financial and non-financial crises? The answer is yes. To address this issue, our empirical approach examines whether the evolution of key macroeconomic outcomes such as economic growth, inflation, investment and credit, during economic recessions, that is, after the business cycle has peaked, are affected by the total debt burden (TB) at the peak of the business cycle.

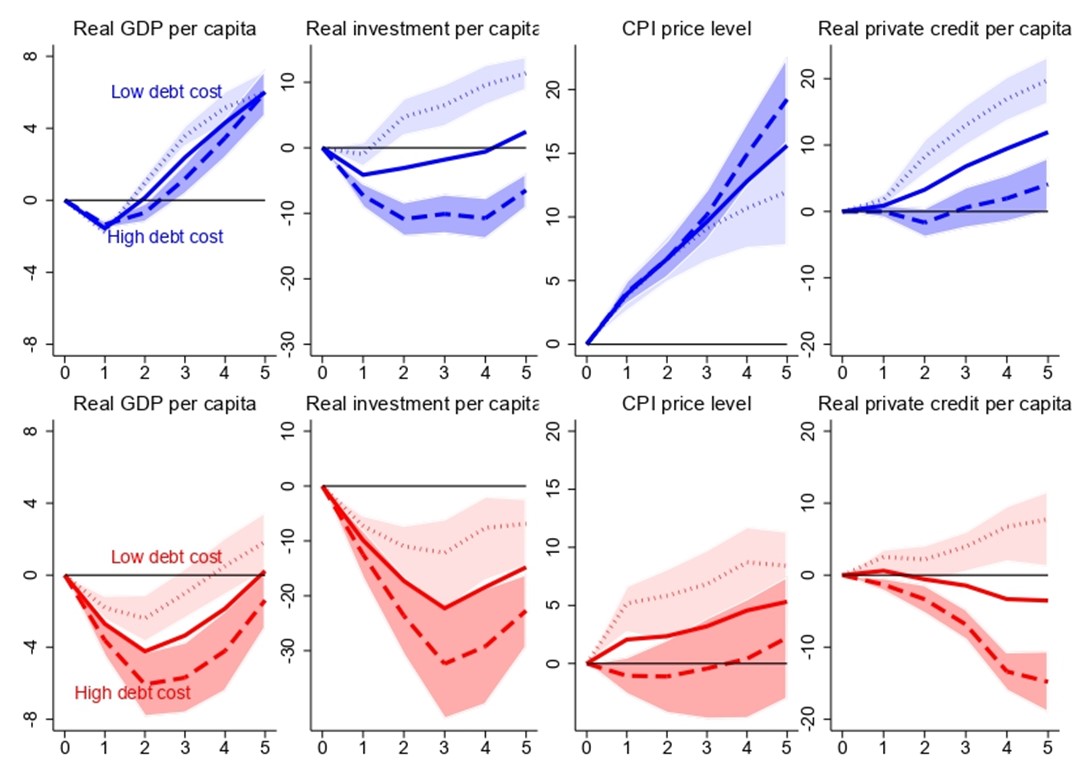

Figure 2 displays the average outcome path in normal versus financial crisis recessions, depending on the size of TB at the business cycle peak (high TB versus low TB). The top panel indicates that the conditional cumulative change in most selected variables of interest from the onset of a normal recession is influenced by initial public debt sustainability risks. In particular, when the pre-crisis debt burden is considered high, the severity of the crisis is worsened.

Figure 2. State-Dependent Crises Severity

Notes: Normal versus Financial Recessions. Average cumulative path from the start of the recession of selected macroeconomic variables, depending on the total cost of servicing the debt at the peak. Sample 1870-2017. Results are displayed by type of recession: normal versus financial crises. Each graph shows local projections of the cumulative change relative to peak for years 1–5 of the recession/recovery period under different scenarios. Three scenarios: (i) the country-specific initial total cost of servicing the debt is +1sd below its mean, low debt cost scenario (dotted line), (ii) the country-specific initial total cost of servicing the debt is at its mean (solid line), (iii) the country-specific initial total cost of servicing the debt +1sd above its mean, high debt cost scenario (dashed line). 68% confidence bands for high debt cost scenarios (dark red and blue) and low debt cost scenarios (light red and blue) are displayed. The top panel refers to normal recessions. The bottom panel refers to financial crisis recessions. These results are conditional on the full set of lagged macroeconomic aggregates, with paths evaluated at the means. Two world wars and 5-year windows around wars are excluded (1909-20; 1934-47).

The severity of crises, based on the public debt burden at the peak, is more pronounced during financial crisis recessions, as shown in the bottom panel of Figure 2. Our findings demonstrate that a high public debt burden is associated with deeper economic contractions, sharper declines in investment, deflationary pressures, and pronounced credit contractions during recessions. For instance, when the total cost of servicing the debt is low, the economy recovers to its peak level four years after the crisis. However, when the total cost of servicing the debt is high, output stays severely depressed for longer and is below the previous peak even five years following the financial crisis.

We conjecture that these results could be attributed to the limited fiscal space available to governments when the total sovereign debt burden prior to the crisis is relatively high. In particular, deteriorated public debt conditions at the beginning of the crisis may prevent governments from using countercyclical fiscal policies to foster private and public demand. Limiting, therefore, the government’s ability to mitigate the downturn.

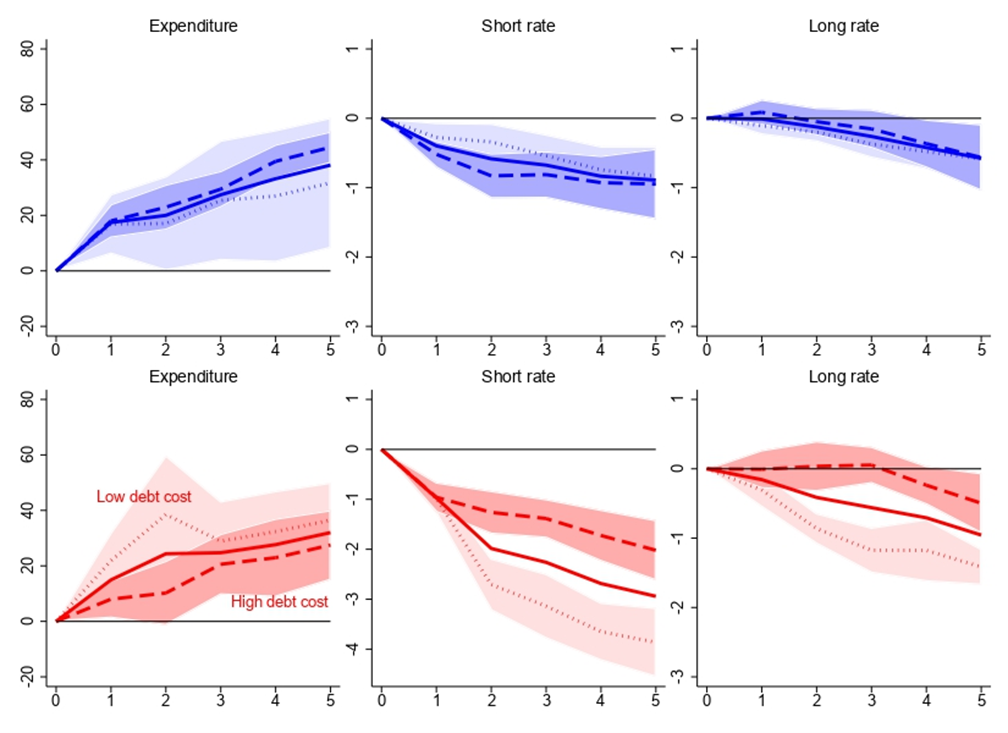

Our empirical analysis suggests that, in the case of financial recessions, which are on average deeper and longer than normal ones, the results are consistent with the view that policymakers adopt more limited lax fiscal policies through public expenditure when public finances are worse off (Figure 3). For normal recessions, although government expenditure shows little variation in the fiscal stance, tax revenues are, on average, lower. This pattern is consistent with a more accommodative fiscal policy when governments have stronger public finances at the peak of the business cycle.

Figure 3. Plausible Transmission Channels

Notes: Average cumulative path from the start of the recession of selected macroeconomic variables, depending on the total cost of servicing the debt at the peak. Sample 1870-2017. Results are displayed by type of recession: normal versus financial crises. Each graph shows local projections of the cumulative change relative to peak for years 1–5 of the recession/recovery period under different scenarios. Three scenarios: (i) the country-specific initial total cost of servicing the debt is +1sd below its mean, low debt cost scenario (dotted line), (ii) the country-specific initial total cost of servicing the debt is at its mean (solid line), (iii) the country-specific initial total cost of servicing the debt +1sd above its mean, high debt cost scenario (dashed line). 68% confidence bands for high debt cost scenarios (dark red and blue) and low debt cost scenarios (light red and blue) are displayed. The top panel refers to normal recessions. The bottom panel refers to financial crisis recessions. These results are conditional on the full set of lagged macroeconomic aggregates, with paths evaluated at the means. Two world wars and 5-year windows around wars are excluded (1909-20; 1934-47).

In addition, we offer two observations regarding the trajectory of interest rates. First, interest rates decline more sharply during financial recessions than during normal recessions. Second, in financial recessions, interest rates demonstrate greater flexibility to decrease further in scenarios with lower total debt burdens. This result is consistent with arguments suggesting that better public finances allow governments to finance their debt at a more reduced cost due to lower risk and/or liquidity premia.

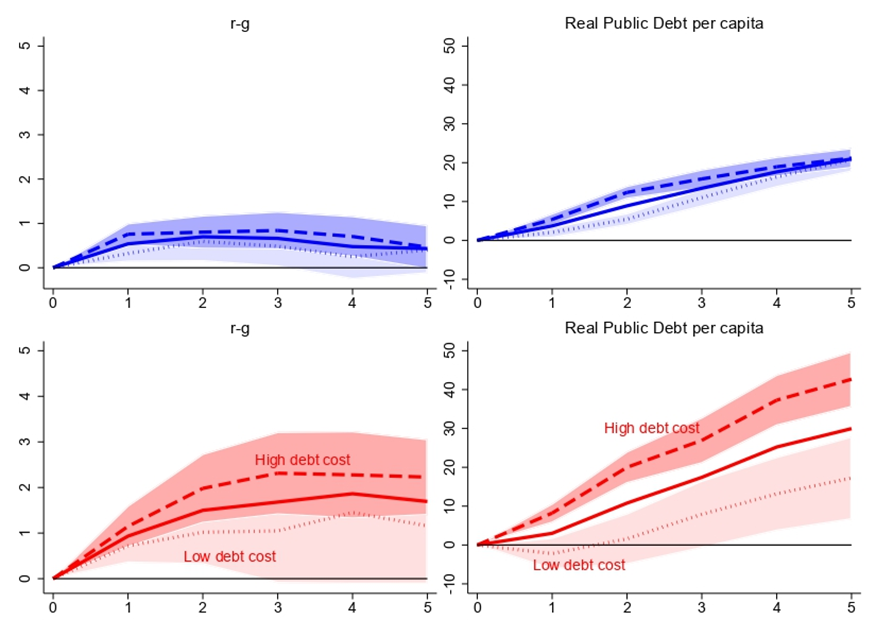

We investigate whether a self-reinforcing feedback mechanism exists between weakened public debt conditions at the onset of a crisis and an increased likelihood of sovereign debt crises in its aftermath. Figure 4 presents our estimated evolution of public debt and its “net” cost (r – g) in the aftermath of normal versus financial recessions relative to the peak of the business cycle. Our findings extend the empirical evidence on the economic costs of financial crises by showing that the aftermath of highly leveraged financial disasters is characterised by meaningful jumps in both public debt and (r – g). This explosive cocktail following financial recessions with initial vulnerabilities in the public sector heightens public debt sustainability risks, increasing, consequently, the likelihood of sovereign debt crises after the onset of a financial crisis.

Figure 4. Public debt and r-g in the aftermath of normal and financial crises

Notes: Average cumulative path from the start of the recession of selected macroeconomic variables, depending on the total cost of servicing the debt at the peak. Sample 1870-2017. Results are displayed by type of recession: normal versus financial crises. Each graph shows local projections of the cumulative change relative to peak for years 1–5 of the recession/recovery period under different scenarios. Three scenarios: (i) the country-specific initial total cost of servicing the debt is +1sd below its mean, low debt cost scenario (dotted line), (ii) the country-specific initial total cost of servicing the debt is at its mean (solid line), (iii) the country-specific initial total cost of servicing the debt +1sd above its mean, high debt cost scenario (dashed line). 68\% confidence bands for high debt cost scenarios (dark red and blue) and low debt cost scenarios (light red and blue) are displayed. The top panel refers to normal recessions. The bottom panel refers to financial crisis recessions. These results are conditional on the full set of lagged macroeconomic aggregates, with paths evaluated at the means. Two world wars and 5-year windows around wars are excluded (1909-20; 1934-47).