References

Bank of Italy, Annual report on 2008.

Bank of Italy, Annual report on 2021.

Bank of Italy, Financial Stability Report, n. 1, 2014.

Bank of Italy, Financial Stability Report, n. 2, 2014.

Bank of Italy, Financial Stability Report, n. 2, 2020.

Bank of Italy, Financial Stability Report, n. 1, 2021.

Bank of Italy, Financial Stability Report, n. 1, 2023.

Carletti, E., De Marco, F., Ioannidou, V., and E. Sette (2021). Banks as patient lenders: Evidence from a tax reform. Journal of Financial Economics, Volume 141, Issue 1, July 2021, pp. 6–26.

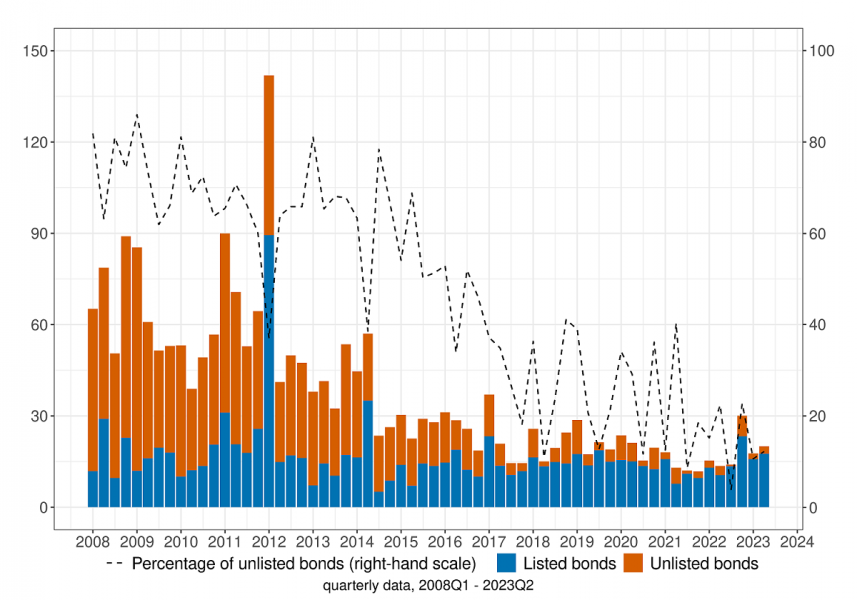

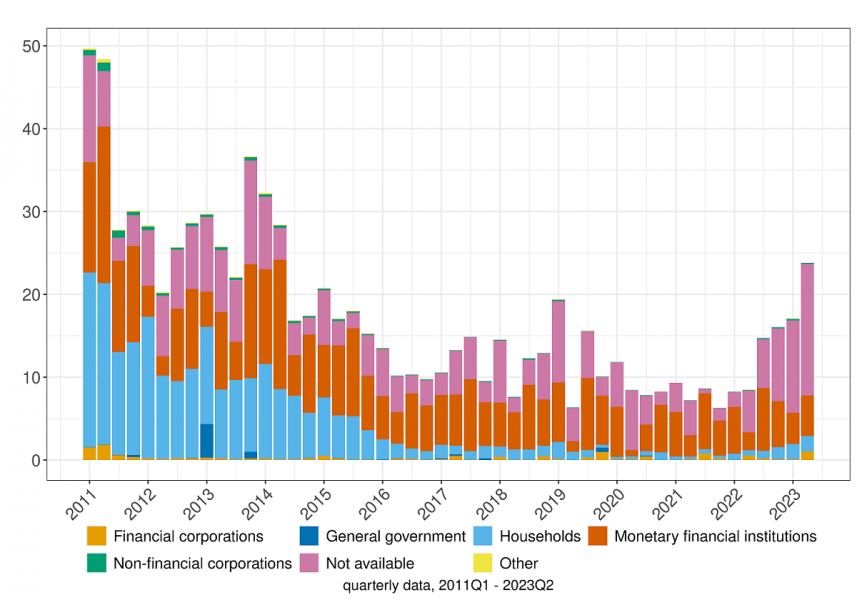

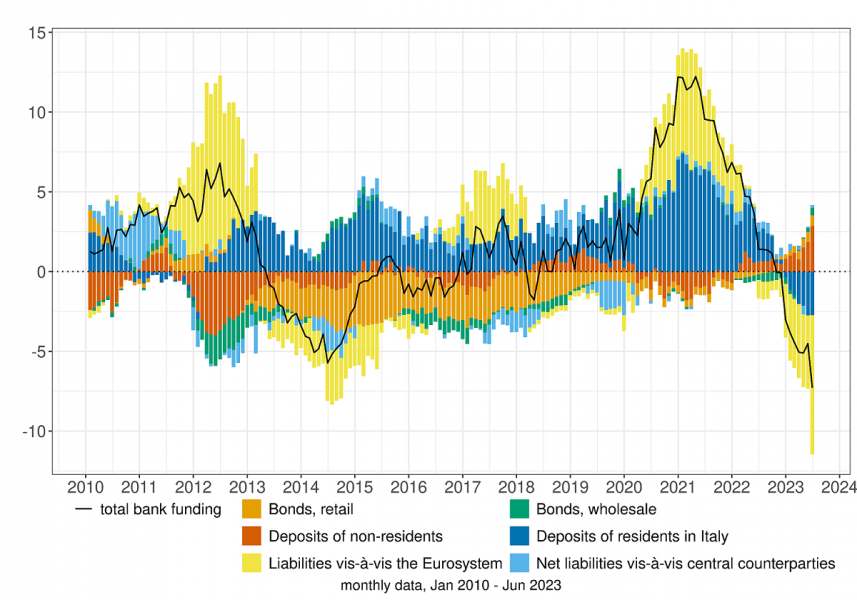

Ceci, D., Montino, A., Pinoli, S., and A. Silvestrini (2023). Gross bond issuance by Italian banks: key trends in times of crisis and unconventional monetary policy, Banca d’Italia Occasional paper 778.

Van Rixtel, A., and G. Gasperini (2013). Financial crises and bank funding: recent experience in the euro area, BIS Working Papers 406, Bank for International Settlements.