This policy brief is based on Bonelli, Palazzo and Yamarthy (2025). Good Inflation, Bad Inflation, and the Dynamics of Credit Risk. The views expressed in this paper are the authors’ own and do not necessarily reflect those of Banco de España, Eurosystem, Federal Reserve Board or the Federal Reserve System.

Abstract

We study how movements in expected inflation on macroeconomic announcement days affect firm-level credit spreads. We uncover evidence of a time-varying inflation sensitivity: in times of “good inflation,” when investors perceive inflation to signal positive economic growth, movements in expected inflation substantially reduce corporate credit spreads. Meanwhile, in times of “bad inflation,” these effects are attenuated, and the opposite can occur. To better understand these findings, we design a theoretical asset pricing model that generates a time-varying inflation sensitivity in credit spreads and demonstrates the amplifying role of persistent macroeconomic expectations. Both empirically and theoretically, our findings have implications for how investors and policymakers interpret expected inflation dynamics in real time.

Following the post-COVID surge in global price levels, inflation is back at the center of macroeconomic and financial market debates. Yet, its implications for financial markets remain ambiguous. While historical inflationary episodes have been associated with supply constraints and macroeconomic stress (e.g., oil shocks of the 1970s), recent decades have shown that inflation can signal strong demand and improving fundamentals. Financial markets appear to recognize these differences, responding more favorably when inflation is perceived as growth-friendly and more cautiously when inflation is seen as eroding real activity.

As macroeconomic variables are backward-looking and largely available on a monthly or quarterly basis, it can be challenging to measure the inflation cyclicality directly in real time. Alternatively, one can use financial market data – namely, the correlation of risk-free bond and stock returns – to derive a real-time proxy. When this correlation is negative, increased inflation is associated with strong growth prospects because higher expected inflation coincides with falling bond prices. Analogously, when the correlation is positive, inflation is more likely viewed as a threat to growth. The dynamic behavior of this correlation provides an informative signal for the prevailing inflation-growth regime (e.g., Cieslak and Pflueger (2023)).

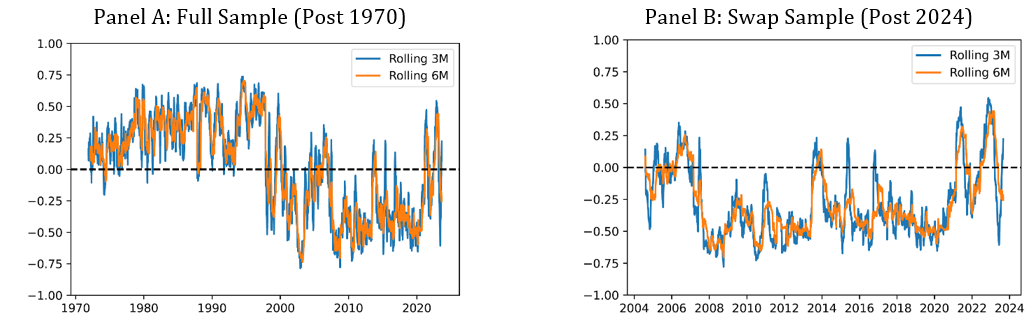

Figure 1 illustrates the rolling three- and six-month correlation between daily U.S. stock returns and five-year zero-coupon Treasury bond returns. In the full sample (Panel A), the correlation shifted from strongly positive in the late 1990s to persistently negative, consistent with a prolonged “good inflation” regime. However, temporary reversals occurred in 2021–2022, suggesting episodes of renewed stagflationary concerns. Panel B zooms in on the 2004–2023 period used in our empirical analysis.

Figure 1. Bond-Stock Return Correlation Over Time

Using this correlation as a real-time proxy for the inflation-growth relationship, we examine how the effect of inflation expectation revisions on credit spreads depends on the broader macroeconomic context in which they occur. Identical inflation expectation movements can lead to very different responses in credit spreads depending on how markets interpret their implications for future growth and risk.

We study how movements in inflation expectations affect credit spreads and how these sensitivities might vary over time. To do so, we design an empirical strategy that focuses on changes in inflation swaps during U.S. macroeconomic announcement days – dates when market participants are most likely to update their inflation views in response to new information.

Analyzing daily CDS spreads around macroeconomic releases from 2004 to 2023, we first document that a positive inflation surprise (i.e., a positive change in inflation swaps) typically reduces CDS spreads by approximately 1 basis point, representing about 12% of their average daily standard deviation on announcement days. This average result aligns with the predominantly negative bond-stock correlation observed since the early 2000s, suggesting markets frequently perceive inflation as pro-cyclical.

That said, the direction and size of the response depend critically on the stock–bond correlation. In periods characterized by a negative bond-stock correlation (indicating positive growth accompanying inflation), the same inflation surprise generates roughly double the response in CDS spreads. Conversely, when the correlation turns positive—such as observed during stagflationary episodes in 2021 and 2022—the beneficial impact is substantially weaker or reversed.

Using techniques from the credit risk literature, we also decompose CDS spread movements into a component measuring the compensation for pure default risk and an additional risk premium component capturing the co-movement between investor sentiment and default risk. This decomposition suggests that variation in risk premia account for most of the observed credit market sensitivity to inflation news – both in terms of the average response as well as the time-varying response. We also investigate credit spreads across firm and display heterogeneity in the firm-level response. In particular, higher risk firms, identified by their ex-ante CDS spreads, display a time-varying sensitivity to expected inflation movements that is ten times larger than that of the safest of firms.

Headline surprises associated with macroeconomic announcements are a key driver of inflation expectations, but they do not fully explain the variation in inflation swaps, suggesting a non-surprise component present in inflation expectations. We decompose daily and intraday inflation swap movements into a component directly attributable to macroeconomic news and a residual component capturing broader, less explicit updates to inflation expectations.

Using a regression-based decomposition of daily swap movements, we show that the residual component of inflation expectations explains the bulk of the variation in credit spread responses, both on average and across different inflation-growth regimes. We confirm this pattern with intraday data: applying a heteroskedasticity-based identification approach, we extract a latent factor in intraday swaps, that is priced in a time-varying manner in CDS movements. Put together, these results highlight that the inflation sensitivity in credit markets is largely driven by the overall formation of inflation expectations — not just through surprise announcements.

A second exercise we conduct to better understand the source of the inflation sensitivity, is focused on better measuring inflation expectations. As inflation swap movements technically reflect risk neutral expectations they might be influenced by inflation risk premia. To focus on the physical inflation expectation component of swaps, we test two decompositions (i) following the estimates from D’Amico et al. (2018) and (ii) using the results of a Principal Component Analysis incorporating relevant data (in particular, real yields). Both approaches indicate that expected inflation is primarily responsible for observed credit spread reactions.

Why do financial markets react differently to the same inflation surprise depending on the economic environment? To answer this question, we design and study an equilibrium asset pricing model with persistent macroeconomic expectations and a time-varying relationship between shocks to expected inflation and shocks to economic growth.

In some periods, higher expected inflation coincides with stronger expected growth, as rising prices signal robust demand. In others, inflation reflects supply shocks or rising costs that constrain output. In the first case, inflation is priced as good news; in the second, as a warning. The same inflation shock can thus generate very different reactions in asset prices (credit spreads and equity returns) depending on how it is perceived.

The model formalizes this idea by allowing the covariance between shocks to expected inflation and expected real growth to vary over time. This regime-switching inflation–growth covariance affects both expected cash flows and discount rates, altering valuations for risky assets. When inflation is positively correlated with growth, a rise in expected inflation supports expected earnings and reduces default risk, leading to higher equity prices and narrower credit spreads. When the correlation is negative, inflation raises discount rates without improving fundamentals, depressing asset values.

A key implication of the model is that the stock–Treasury bond return correlation acts as a sufficient statistic for the inflation–growth covariance. When inflation is perceived to signal stronger future growth, equity prices rise while Treasury bond prices fall, resulting in a negative correlation. Conversely, when inflation is seen as a sign of weaker growth, both equities and Treasury bonds fall, generating a positive correlation. The sign of this correlation reflects how markets interpret inflation in relation to expected economic activity. Finally, our model highlights the importance of persistent expectations. When the long-run mechanism in expected growth is attenuated, the bond-stock correlation becomes less volatile, and expected inflation shocks are less relevant for asset prices.

Inflation shocks are not inherently good or bad for financial markets — what matters is how they are perceived by market participants. Our findings suggest that the key is not just measuring inflation surprises but understanding what they signal about the growth outlook.

The stock–bond correlation provides a real-time window into these financial market interpretations. When the correlation is negative, inflation tends to be seen as growth-supportive, and financial conditions ease. When it turns positive, markets treat inflation as a headwind, and conditions tighten.

From a policy perspective, interpreting inflation through a growth-sensitive lens is critical for designing timely responses. Monitoring how markets interpret inflation — rather than just its level — can help central banks and investors make more informed, context-sensitive decisions.

Cieslak, A. and C. Pflueger (2023). Inflation and asset returns. Annual Review of Financial Economics 15(1), 433–448.

D’Amico, S., D. H. Kim, and M. Wei (2018, February). Tips from tips: The informational content of treasury inflation-protected security prices. Journal of Financial and Quantitative Analysis 53(1), 395–436.

Gürkaynak, R. S., B. Kısacıkoğlu, and J. H. Wright (2020, December). Missing events in event studies: Identifying the effects of partially measured news surprises. American Economic Review 110(12), 3871–3912.