This policy brief is based on Di Casola, P., Habib, M. M., and Tercero-Lucas, D. “Global and local drivers of Bitcoin trading vis-à-vis fiat currencies”, ECB Working Paper, 2868. The views expressed in this article belong to the authors and do not necessarily reflect those of the European Central Bank.

This note argues that there is evidence of a speculation-driven global crypto cycle in Bitcoin transactions against fiat currencies in the largest peer-to-peer crypto exchanges. Moreover, the evidence points towards potential financial stability risks from cryptoisation in emerging and developing economies (EMDEs) with low levels of financial development and relatively unstable fiat currencies, since in these countries trading increases when the value of the domestic currency is unstable. EMDEs with lower banking depth, level of digitalisation and median age of the population feature higher currency loadings on the global crypto factor.

The popularity of Bitcoin and other cryptocurrencies, despite their apparent lack of a fundamental value, has morphed into a global phenomenon that sees emerging and developing economies (EMDEs) at the forefront (Chainanalysis, 2022). Initially, the usage of Bitcoin, the most popular cryptocurrency, has been associated with the black market of illegal goods and services and with gambling (Foley et al., 2019). However, more recently, the usage of Bitcoin seems to have been driven by speculative motives (Baur et al., 2018) and, possibly, also by its potential use for cross-border transactions (Graf von Luckner et al., 2023; Makarov and Schoar, 2021), although the high volatility of its price makes Bitcoin impractical as a medium of exchange (Baur and Dimpfl, 2021).

To what extent is Bitcoin usage a global phenomenon driven by speculative demand? To what extent can country-specific factors explain the use of Bitcoin? These are important questions for policy makers, both to assess the potential risks from cryptoassets and to decide how to regulate the crypto ecosystem, that so far have received only partial answers (Makarov and Schoar, 2020; Feyen et al., 2022), largely due to the difficulty to trace who owns and trades cryptocurrencies.

To answer these questions, in a recent study (Di Casola et al. 2023), we address the challenge of limited country-by-country cryptocurrency data by examining trading volumes of Bitcoin against the fiat currencies of 14 advanced economies (AEs) and the currencies of 30 emerging and developing economies (EMDEs). Our analysis covers data from the largest peer-to-peer (P2P) exchanges, namely LocalBitcoins and Paxful, spanning from January 2018 to April 2022.

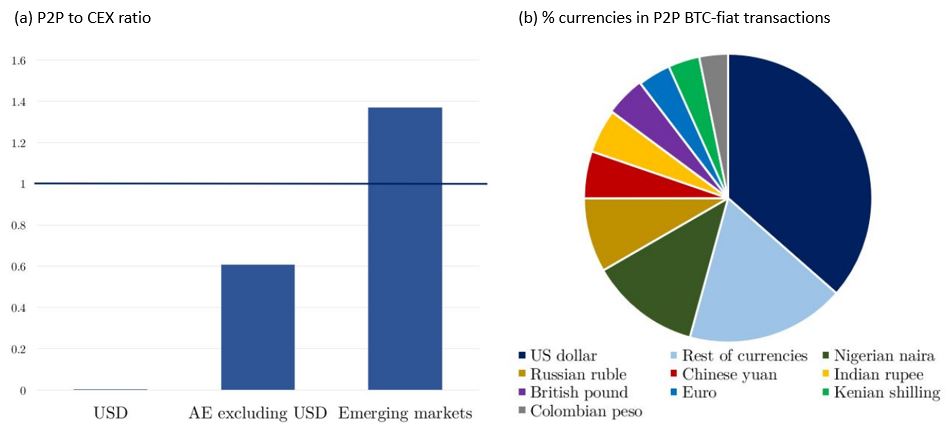

P2P exchanges perform transactions outside the blockchain network (off-chain) in a decentralised manner, target mainly small retail users and are usually not affected by the problem of market manipulation, such as wash trading, typical of centralised exchanges, thus making the transactions we analyse more reliable. Chart 1a shows that Bitcoin trading volumes against the currencies of advanced economies are primarily conducted on centralized exchanges, with the extreme case represented by Bitcoin vs. US dollar transactions. Conversely, transactions involving currencies of emerging and developing economies are concentrated within these P2P exchanges. Excluding the US dollar, Bitcoin transactions against EMDE currencies, including those of Nigeria, Russia, China, and India, comprise the majority of P2P transactions (Chart 1b).

Chart 1: P2P Bitcoin-fiat currency transactions. Average 2020-21

Sources: LocalBitcoins, Paxful and authors’ calculations.

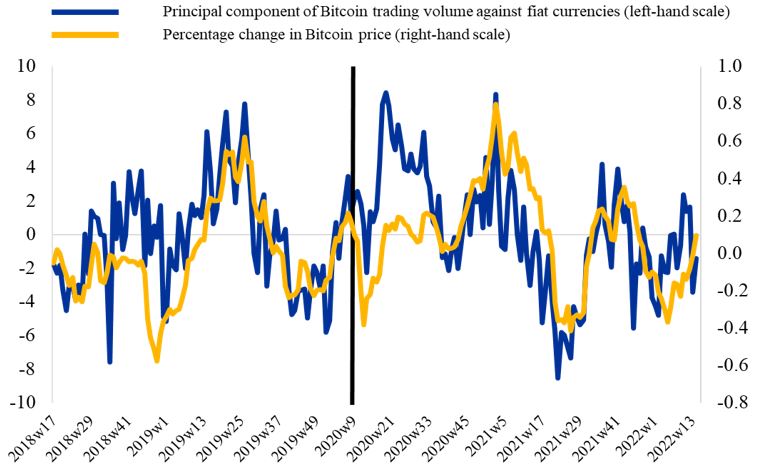

In our empirical analysis, we find that momentum and volatility in the cryptoasset market as well as global financial market volatility and liquidity do matter for Bitcoin trading against different fiat currencies, including those of advanced economies. However, these cryptoasset and global drivers fail to capture the full extent of co-movement in Bitcoin trading over time and across currencies. In particular, our empirical analysis identifies a single global factor that on average explains up to around 40% of the variance of Bitcoin trading across different currencies in the COVID-19 period. There is hence suggestive evidence of a global crypto cycle in Bitcoin transactions, echoing similar patterns identified in the global financial cycle literature for conventional asset markets (Miranda-Agrippino and Rey, 2022). Chart 2 shows that this global factor, in turn, is correlated with the Bitcoin price. While this result reinforces the hypothesis prevailing in the literature that Bitcoin trading is driven by speculative motives, our analysis shows that this is truly a global phenomenon, involving AEs as well as EMDEs.

Chart 2: A global factor in Bitcoin trading volumes against fiat currencies is correlated with the Bitcoin price

Notes: The figure shows the first factor extracted from the trading volume of Bitcoin transactions against fiat currencies (blue line) and the change in the Bitcoin price (yellow line). Trading volumes and the Bitcoin price are detrended with the log difference with respect to the past 15-week moving average. Source: Author’s calculations.

Bitcoin seems to offer also some transactional benefits, in particular in EMDEs. The depreciation of the domestic currency of EMDEs – notably not of the currencies of AEs – induces more Bitcoin trading, in particular since the onset of the COVID-19 pandemic. This implies that Bitcoin, despite its extreme price volatility, might have been appreciated also as a store of value or medium of exchange in countries which experienced a loss in the purchasing power of their local currency. Consequently, this indicates that macroeconomic instability might fuel a greater utilization of cryptoassets. This result is important for the asset pricing theory of cryptoassets (Biais et al. 2023) because it suggests that the fundamental value of Bitcoin may be substantially different between AEs and EMDEs, since its transactional services are probably more elevated in the latter group of countries. We also find that EMDEs with a lower share of digital payments tend to have a higher currency loading on the global factor, hinting that crypto usage may be a substitute for the lack of an efficient payment system. Moreover, the number of ATMs, a proxy of the domestic development of the banking system is negatively associated with the currency loadings on the global factor, indicating that, indeed, cryptocurrencies could cater for the absence of a developed banking system. Finally, a larger presence of a younger population is associated with a larger factor loading of each currency, echoing a recent finding by Auer and Tercero-Lucas (2022).

Our findings clearly point to potential financial stability risks in EMDEs with low levels of financial development and unstable fiat currencies. The intrinsic price volatility of Bitcoin may discourage its use as a store of value or means of payment. However, in the future, other cryptoassets, such as stablecoins that pledge to ensure a parity to the US dollar or other reserve currencies, might become more widely used by individuals and firms in order to compensate for the lack of financial alternatives, raising the risk of cryptoisation, i.e. the substitution of the domestic currency with a cryptocurrency – representing a threat to the implementation of capital flow management policies in these countries (He et al.,2022).

Auer, R. and D. Tercero-Lucas (2022), “Distrust or Speculation? The Socioeconomic Drivers of U.S. Cryptocurrency Investments,” Journal of Financial Stability, (101066).

Baur, D. G. and T. Dimpfl (2021), “The Volatility of Bitcoin and its Role as a Medium of Exchange and a Store of Value,” Empirical Economics, 61 (5), 2663–2683.

Baur, D. G., K. H Hong, and A-D Lee (2018), “Bitcoin: Medium of Exchange or Speculative Assets?,” Journal of International Financial Markets, Institutions and Money, 54, 177–189.

Biais, B., C. Bisiere, M. Bouvard, C. Casamatta, and A. J. Menkveld (2023), “Equilibrium bitcoin pricing,” The Journal of Finance, 78 (2), 967–1014.

Chainanalysis (2022), “The 2022 Geography of Cryptocurrency Report”.

Di Casola, P., M. M. Habib and D. Tercero-Lucas (2023), “Global and local drivers of Bitcoin trading vis-à-vis fiat currencies”, ECB Working Paper 2868.

Foley, S., J. R. Karlsen, and T. J. Putninš (2019), “Sex, Drugs, and Bitcoin: How Much Illegal Activity is Financed Through Cryptocurrencies?”, The Review of Financial Studies, 32 (5), 1798–1853.

Graf von Luckner, C., C. M. Reinhart, and K. S. Rogoff (2023), “Decrypting New Age International Capital Flows,” Journal of Monetary Economics, 138, 104-122.

He, D., A. Kokenyne, X. Lavayssière, I. Lukonga, N. Schwarz, N. Sugimoto, and J. Verrier (2022), “Capital Flow Management Measures in the Digital Age: Challenges of Crypto Assets,” IMF Fintech Notes, (5).

Feyen, E. H., Y. Kawashima, and R. Mittal (2022), “Crypto-Assets Activity around the World”, World Bank Policy Research Working Paper 9962.

Makarov, I. and A. Schoar (2021), “Blockchain Analysis of the Bitcoin Market,” NBER Working Paper, (29396).

Miranda-Agrippino, S and H Rey (2022), “The Global Financial Cycle,” in G Gopinath, E Helpman, and K Rogoff, eds., Handbook of International Economics: International Macroeconomics, Vol. 6, Elsevier, pp. 1–43.