This policy brief summarizes the main findings of a recently published paper: S. Lazaretou and G. Palaiodimos (2025), “The long record of inflation shocks in Greece: drivers and impacts”, Bank of Greece, Economic Bulletin, 61, 63-86, July. The views expressed here are of the authors and do not necessarily reflect those of the Bank of Greece. Any remaining errors and omissions are solely ours. Economic Analysis and Research Directorate. Email to: slazaretou@bankofgreece.gr; gpalaiodimos@bankofgreece.gr

Abstract

Recent years have seen a considerable escalation in global geopolitical tensions. The repercussions of this phenomenon have been predominantly evident in the domain of commodity prices. Consequently, global inflation has increased in the aftermath of geopolitical shocks. Given the higher energy and food price shares in the consumer basket, Greek inflation has also risen significantly. Over the past 50 years, global supply-side shocks have triggered cost-push inflation in Greece, which was often accommodated by expansionary policies. Our empirical analysis examines both domestic demand and supply shocks, as well as global supply shocks driven by geopolitical tensions in an attempt to identify the underlying forces that drove inflation in Greece from the early 1970s to the present. We find that there is a direct interplay between inflation, domestic demand and supply shocks, and geopolitical risks.

The question of whether post pandemic inflation was primarily driven by demand or supply shocks has been the subject of debate among both academic researchers and policymakers (see Ha et al. 2022; Bernanke and Blanchard 2024; Caldara et al. 2024). This debate is critically important when setting monetary policy. It has been argued that monetary policy should respond forcefully enough to demand driven shocks arising from large fiscal programmes (Blanchard 2021; Summers 2021) and have a less forceful response to supply shocks (Forbes et al. 2024; Reifschneider and Wilcox 2022). In an earlier paper (Lazaretou and Palaiodimos 2023), we conclude that an evidence-based view of the typology of Greek inflation shocks is important for properly addressing their short-to-medium term effects on fiscal outcomes as well as on public debt sustainability. In our new analysis, we take a historical perspective of the driving forces of Greek headline inflation over the past 50 years. In particular, we focus on how uncertainty emanating from both global geopolitical shocks and country-specific shocks, either demand- or supply-driven, have affected headline inflation.

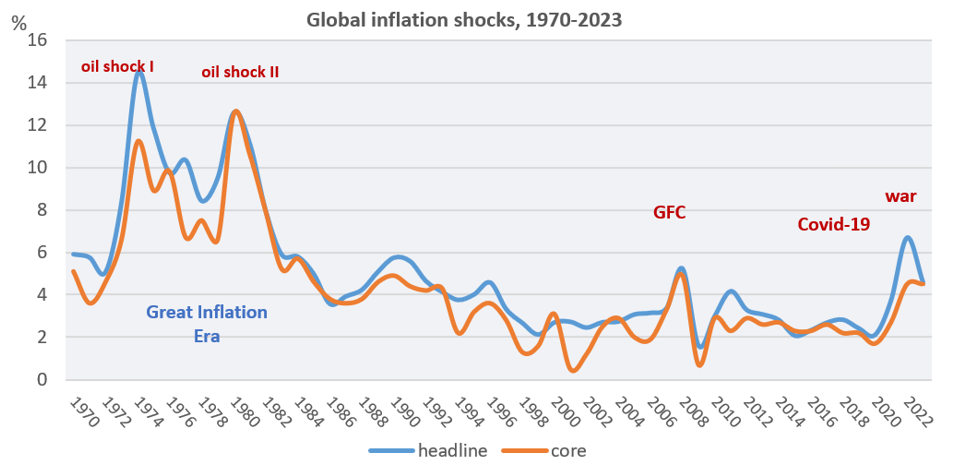

It is evident from Figure 1 that global shocks have, on average, played a prominent role in explaining variation in global inflation. They encompass demand shocks accommodated by loose monetary policy and inflation surprises – this was the case of the GFC in 2007-08 and the inflation surge after lockdowns in the second half of 2021. However, global shocks frequently encompass supply shocks, as evidenced by OPEC I and OPEC II oil price shocks in the 1970s, the global supply chain disruption due to the pandemic of 2020-21 and the energy shock due to the outbreak of the war in Europe in 2022.

Figure 1.

Source: Google trends, Eurostat, own calculations. Source: Ha et al. (2023), April 2024 update.

Notes: Headline CPI and core global inflation rate, GDP-weighted average, annual averages.

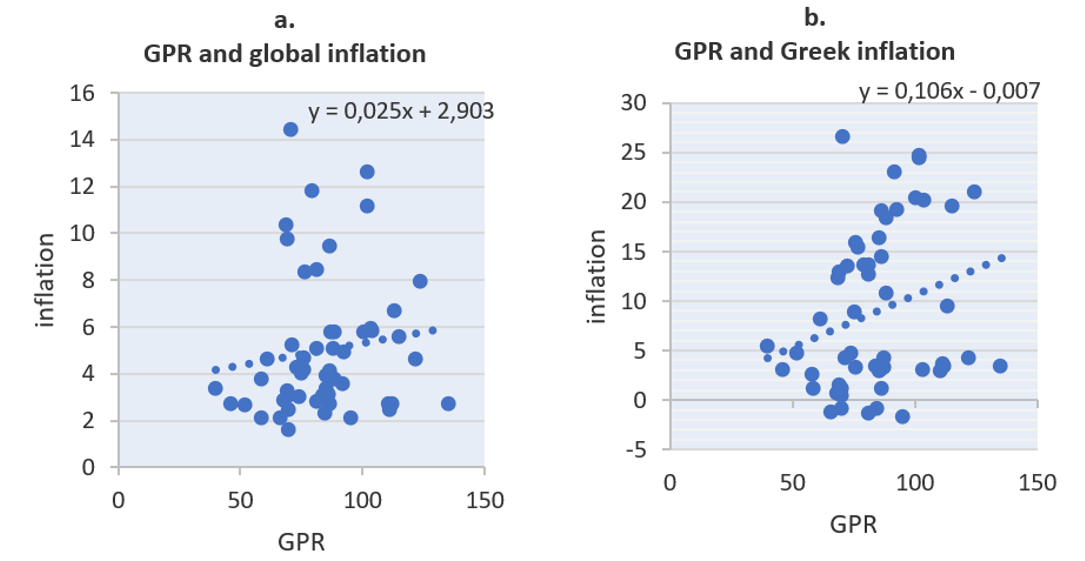

A prime example of global supply shocks are geopolitical shocks. They are defined as dramatic and unanticipated events of violence, leading to supply chain disruptions and regulatory changes. These events are purely exogenously driven and largely unanticipated adverse shocks that increase geopolitical risks for economic activity. Global geopolitical uncertainty is measured by the global GPR index, developed by Caldara and Iacoviello (2022). Historical and empirical evidence shows that geopolitics is the common thread underlying all major inflation shocks. Cases of a positive correlation are evidenced at the global level (see Figure 2, panel a) and even more so at the country level (see Figure 2, panel b), with Greece serving as an example.

Figure 2.

Source: Google trends, Eurostat, own calculations. Sources: Ha et al. (2023), April 2024 update; Caldara and Iacoviello (2022), https://www.matteoiacoviello.com/gpr.htm

Notes: Headline CPI inflation; GPR= global geopolitical risk index.

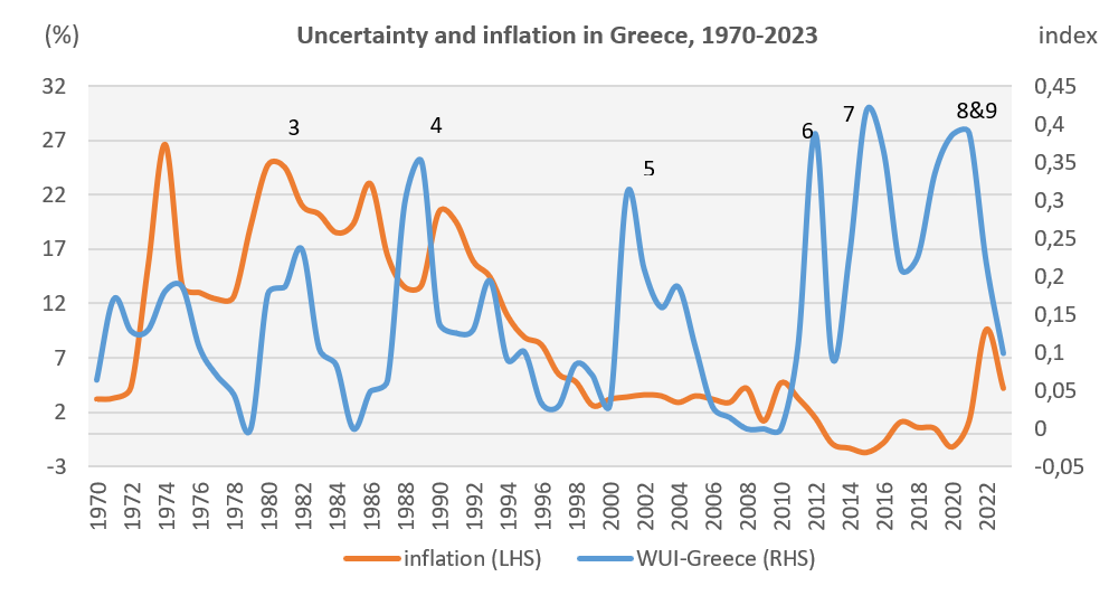

In the absence of a county-specific geopolitical risk index, the World Uncertainty Index for Greece (WUI-Greece) developed by Ahir et al. (2022) is utilised. It functions as a critical indicator for measuring uncertainty, emanating from local, idiosyncratic, political and economic events. Figure 3 plots headline inflation in Greece and the WUI-Greece index. It is evident that recurrent escalations in uncertainty precipitate inflationary shocks.

To assess the impact of uncertainty on inflation and real output, a structural modification of a Bayesian vector autoregression model is employed, based on quarterly Greek data from 2001 to 2024. The World Uncertainty Index for Greece (WUI-Greece) and the Global Geopolitical Risk (GPR) Index are the two key independent variables of the model. The incorporation of these variables, and their treatment as exogenous influences, is aimed at addressing better inflation dynamics in the context of uncertainty stemming from both global geopolitical events and unanticipated country-specific events.

To address the extent to which domestic supply- or demand-driven shocks have important implications for inflation, a sign restrictions identification scheme is employed. This identification scheme is utilised to differentiate between domestic demand- and supply-driven shocks to inflation and real output growth. Adverse domestic supply-driven shocks may be attributed to several factors, including natural disasters such as floods or earthquakes. On the other hand, during the period under study, domestic demand shocks could relate to changes in spending preferences, which for instance have been impacted by the pandemic. The model also implicitly assumes a responsive monetary policy in view of a rising inflation that results from a domestic demand or a supply shock.

Figure 3.

Sources: Headline CPI Greece: Ha et al. (2023), April 2024 update; WUI-Greece: Ahir et al. (2022), April 2024 update.

Notes: Headline inflation. Major country-specific political and economic events are depicted. 1&2: 1973 Turkish invasion of Cyprus; 1974 Athens Polytechnic uprising; 3: 1981 Political change; 4: 1989 Hung parliament, threat of a sovereign default; 5: 2000-01 Athens Stock Exchange bubble; 6: 2012 Economic and political uncertainty related to sovereign debt sustainability, bank solvency and Grexit; 7: 2015 Uncertainty related to Greece’s euro area membership; 8&9: 2020 Covid-19, 2022: War in Europe. The WUI-Greece has been computed by counting the frequency of the word “uncertainty” or its variants in the Economist Intelligence Unit country reports. The index is normalised by the total number of words and rescaled by multiplying by 1000. A higher number means higher uncertainty and vice versa.

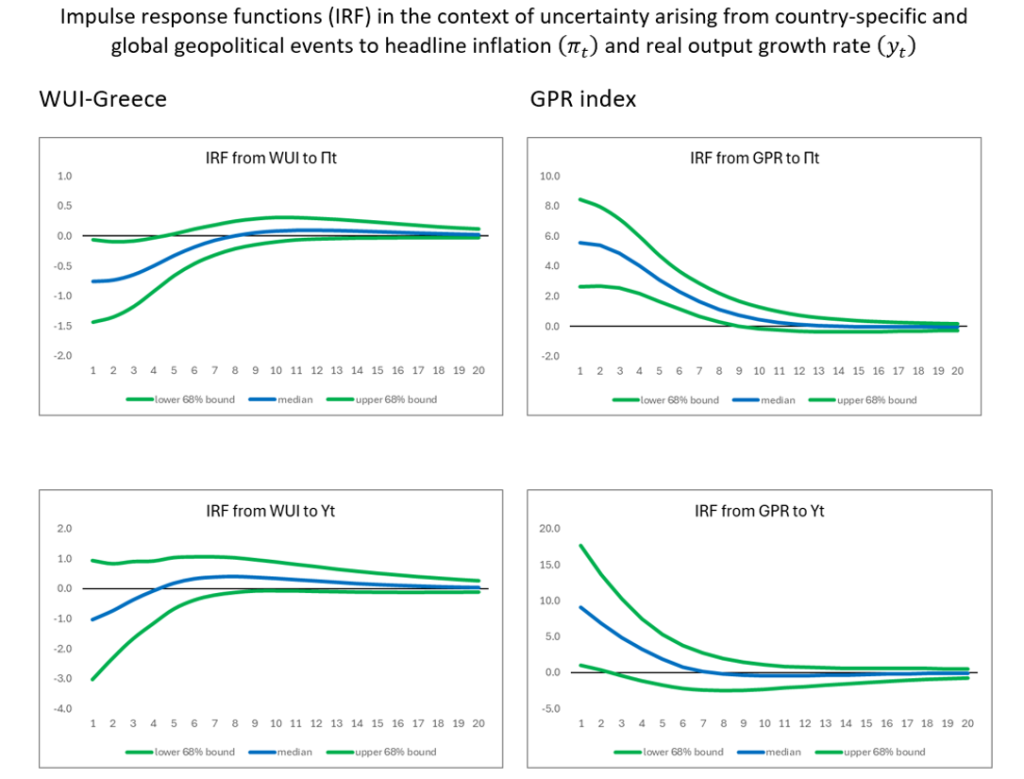

The case study of Greece demonstrates that uncertainty arising from both global geopolitical shocks measured by the global GPR index, and country-specific events measured by the WUI-Greece index, exerts a substantial influence on domestic headline inflation (Figure 4). In the presence of a global geopolitical shock (top right-hand panel), the impact is more enduring and substantial. This finding is in line with previous findings in the empirical literature (see, inter alia, Caldara and Iacoviello 2022 and Caldara et al. 2024 for the global inflation; Anttonen and Lehmus 2024 for the euro area). It is anticipated that this increase will persist for a duration of up to two years following the occurrence of the shock compared to the shorter-term impact of the country-specific elevated uncertainty (top left-hand panel).

Furthermore, albeit the weak initial response, the medium-term effect of the global geopolitical risk turns out to be negative in relation to its impact on real output growth (see Figure 4, bottom right panel). Multiple studies have shown a statistically significant negative correlation between uncertainty shocks and real output (see, for example, Ahir et al. 2022 and Liu and Gao 2022 for the US; EC 2024 and Gieseck and Rujin 2020 for the eurozone). However, our finding for the Greek case seems to be more muted. We attribute this to the significant role played by coordinated fiscal and monetary policy responses in supporting the real economy in the aftermath of a global geopolitical shock (e.g., fiscal measures employed to offset the rising energy costs experienced by households and firms).

Figure 4.

Source: Google trends, Eurostat, own calculations. Source: authors’ estimations.

Notes: IRF=impulse response function. Country-specific events are captured by the WUI-Greece index; left hand-side graphs. Global events are captured by the GPR index; right hand-side graphs. The size of the shock is equal to one standard deviation of the exogenous error process.

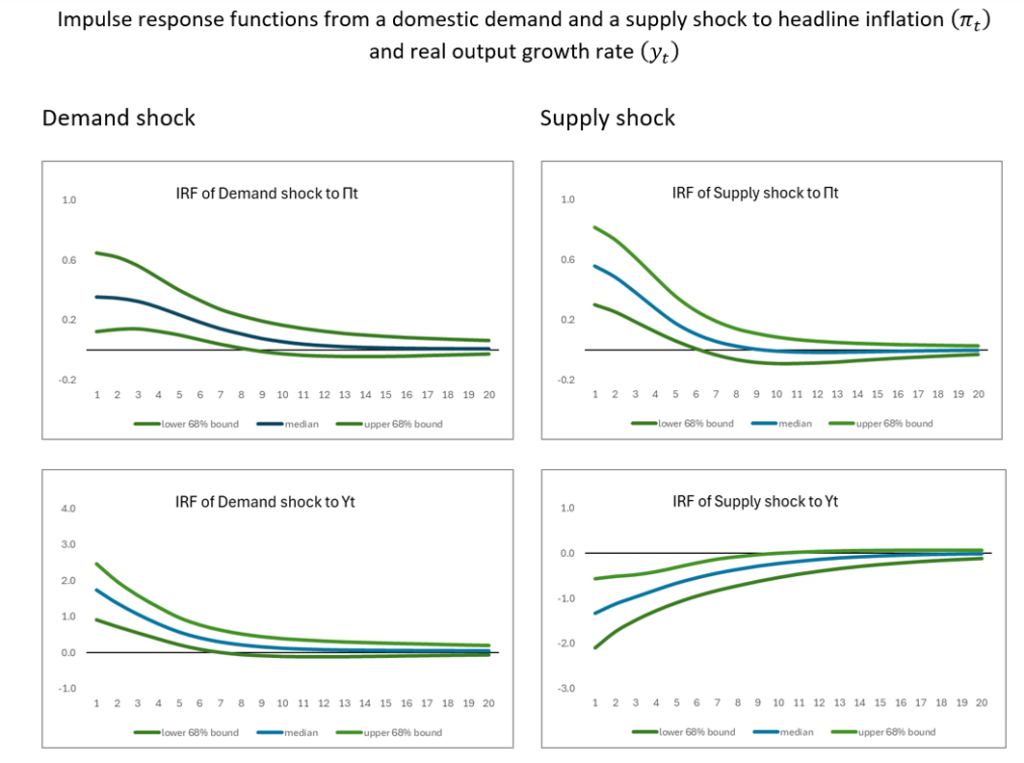

The empirical analysis also suggests (Figure 5, top panels) that domestic demand-driven shocks (e.g. a domestic fiscal shock) exert more persistent inflationary pressures compared to those produced by domestic supply-driven shocks (e.g. a natural disaster). Finally, regarding the impact on real output growth, the estimated impulse responses validate the assumed sign restrictions for a domestic demand and a supply shock.

Figure 5.

Source: Google trends, Eurostat, own calculations. Source: authors’ estimations.

Note: The size of the shocks is equal to one standard deviation of the exogenous error process.

Ahir, H., N. Bloom and D. Furceri (2022), “The world uncertainty index”, Centre for Economic Performance, Discussion Paper Νo. 1842, April.

Antonnen, J. and M. Lehmus (2024), “Impact of geopolitical surprises on euro area inflation varies case by case”, Bank of Finland, Bulletin, November.

Bernanke, B. and O. Blanchard (2024), “An analysis of the pandemic-era inflation in 11 countries”, PIIE Working Paper no 24-11, May.

Blanchard, O. (2021), “In defense of concerns over the $1.9 trillion relief plan”, PIIE, Real Time, Economics Blog, 18 February.

Caldara, D. and M. Iacoviello (2022), “Measuring geopolitical risk”, American Economic Review, 112, 1194-1225.

Caldara, D., S. Conlisk, M. Iacoviello and M. Penn (2024), “Do geopolitical risks raise or lower inflation?”, Board of Governors, Federal Reserve System, Available at SSRN http://dx.doi.org/10.2139/ssrn.4852461.

European Commission (EC) (2024), “The cost of uncertainty: new estimates”, Economy and Finance, 15 November.

Forbes, K., M. A. Kose and J. Ha (2024), “Demand versus supply: drivers of the post pandemic inflation and interest rates”, Vox EU/Columns, 9 August.

Gieseck, A. and S. Rujin (2020), “The impact of the recent spike in uncertainty on economic activity in the euro area”, ECB, Economic Bulletin, 6/2020.

Ha, J., M.A. Kose and F. Ohnsorge (2022a), “From low to high inflation: implications for emerging market and developing economies”, CEPR, Policy Insight No. 115.

Ha, J., M.A. Kose, and F. Ohnsorge (2023), “One-stop source: A global database of inflation”, Journal of International Money and Finance, 137, Νο. 102896.

Lazaretou and Palaiodimos (2023), “An assessment of the impacts of inflation on Greek public finances: macroeconomic effects and policy implications”, Bank of Greece, Economic Bulletin, No. 57, 7-30.

Liu, N. and F. Gao (2022), “The world uncertainty index and GDP growth rate”, Finance Research Letters, 49, No. 103137, October.

Reifschneider, D. and D. Wilcox (2022), “The case for a cautiously optimistic outlook for US inflation”, PIIE, Policy Brief Νο. 22-3, March.

Summers, L.H. (2021), “The Biden stimulus is admirably ambitious. But it brings some big risks, too”, The Washington Post, 4 February.