This non-technical brief summarizes research results in the working papers “A Theory of Economic Coercion and Fragmentation” and “Geoeconomic Pressure”, available on the GCAP Lab website. We refer interested readers to the paper for further technical details.”

Abstract

A defining characteristic of the modern global system is that major powers increasingly use economic and financial power for geopolitical ends. We explain how anti-coercion policies, enacted to counteract this rise in geoeconomics coercion from hegemonic powers like the United States and China, operate at an individual country level and impact the global economy at large. We quantify sources of geoeconomic power for the U.S. and China, demonstrating that China’s power is derived primarily from goods trade, while U.S. power additionally comes from control over the financial system. We leverage recent advances in large language models (LLMs) to identify the areas of the global economy that are particularly vulnerable to geoeconomic pressure and examine how targeted entities respond and apply the methodology to track firm responses to the 2025 trade war. The GCAP Geoeconomic Monitor (Figure 1), an interactive data exploration tool, is available to explore our estimates in real time.

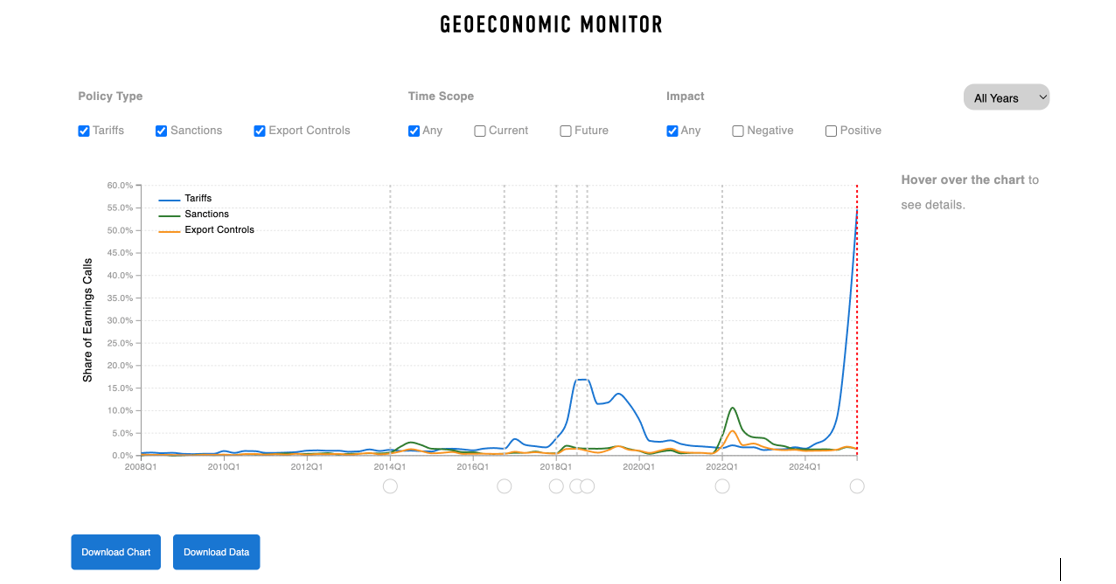

Figure 1. Geoeconomic Monitor

Governments use their countries’ economic strength from existing financial and trade relationships to achieve geopolitical and economic goals, a practice referred to as “geoeconomics”. Great power competition between the U.S. and China has made geoeconomics part of daily news and an active policy choice in democracies and autocracies alike.

The rise of China as a global power, the U.S.’s increasing use of sanctions and economic coercion, and major technological changes are driving governments to reassess their economic security and global integration policies. The European Commission has introduced a European Economic Security Strategy including the Anti-Coercion Instrument to address risks like the weaponization of economic dependencies and coercion. China, Russia, and the other BRICS countries are actively working on creating an alternative financial system architecture outside of the dollar-centric Western controlled system.

We develop a theoretical model to understand when and why there is scope for government intervention to combat economic coercion. Moreover, we characterize optimal intervention policies and warn about the danger that such policies might be counterproductive. This work builds on our previous paper “A Framework for Geoeconomics” (non-technical brief).

Our model helps understand recent geopolitical developments. Countries anticipate that great powers like the U.S. and China may threaten to suspend access to inputs, so they choose policies that attempt to strike a balance between generating gains from integration and limiting economic coercion.

Hegemons maximize their power by worsening a foreign entity’s outside option (increasing the repercussions of rejecting the hegemon’s demand) or improving its inside option (making it more beneficial to comply). Conversely, foreign governments aim to increase the value of their outside options via anti-coercion policies, often leading to over-fragmentation and global welfare losses when governments do not sufficiently internalize the benefits of integration.

We use our model as a guide for examining the sources of geoeconomic power around the world and identifying key vulnerabilities for target countries. We estimate that China derives most of its coercive power from controlling manufacturing inputs, the U.S. has a much higher share of power coming from financial services.

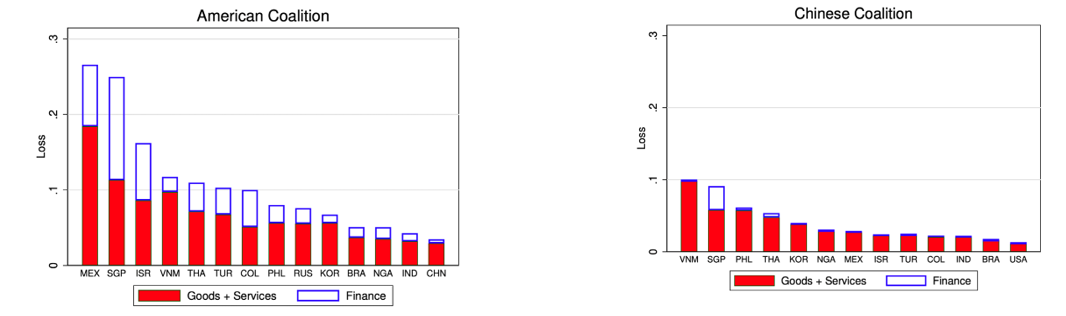

Our framework provides a measure of a hegemon’s power over a given country, which we define as the economic loss to the firms in that country of losing access to the hegemon-controlled inputs. Our power measure allows us to consider not only cases in which the hegemon only cuts off supply of its own inputs, but also cases in which the hegemon coordinates a punishment coalition. We study the American Coalition1 and the Chinese Coalition2.

Figure 2 plots our power measure of a given coalition over individual countries around the world in 2019. Power is expressed as the profit loss to firms in percentage points. We divide the sources of power by separately plotting the loss arising from losing access to the goods and services trade controlled by a given coalition and the loss arising from losing access to financial services controlled by the same coalition.

Figure 2. American and Chinese coalition geoeconomic power

The difference between the sources of U.S. and China’s power is stark. The overwhelming share of China’s power comes from the goods trade, with financial power only playing a significant role in Singapore. In contrast, the financial sector is an important source of U.S. power over most countries.

Our paper highlights the nonlinear nature of power: when a country controls nearly all of a sector, its power is much greater than if it only controls a high share. Since the U.S.-led coalition controls a dominant share of global financial services, often exceeding 80 or 90 percent in many countries, this near-total control of the global financial system enables the U.S. coalition to frequently use finance as a tool of coercion.

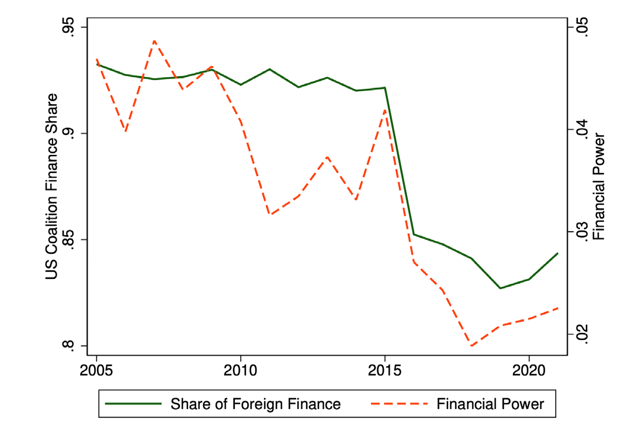

However, this near-total control is susceptible to very small changes. Moving the share from 95 percent to 85 percent can dissipate a lot of power, sometimes as much as moving from 85 to 50 percent.

This implies that U.S. geoeconomic power is not as resilient to the presence of small alternatives in financial services as is commonly understood. Even a small decrease in share of financial services controlled by the U.S. can cause disproportionate losses in power and is convenient for governments since it does not necessarily imply shifting to an equally coercive hegemon (e.g., China). Diversifying inputs overall increases economic security.

For instance, Russian leaders actively reduced the country’s financial dependence on the American Coalition before the 2022 invasion of Ukraine. Figure 3 shows that the share of Russian financial services imports controlled by the American Coalition dropped from 94% to 84%. The American Coalition’s financial power over Russia was approximately halved, contributing to the muted effect of the imposed financial sanctions.

Figure 3. American coalition financial power over Russia

As the U.S. has increasingly exercised its financial power (e.g, financial sanctions on Iran and Russia or pressuring HSBC to reveal business transactions with Huawei), BRICS countries are actively working on economic security policies. Russia developed the SPFS messaging system after being hit by sanctions in 2014, helping it cope with SWIFT disconnections in 2023. China is expanding its CIPS payment system to reduce reliance on U.S.-controlled networks, while India has launched its own system, SFMS (Structured Financial Messaging System). Indeed, then President-elect Trump announced that he would push back against the BRICS moving away from the dollar.

These alternative systems serve both to insulate BRICS countries from potential U.S. coercion and to create an alternative global financial system architecture. While they will not displace the U.S. role as the primary global payment system provider, they could soon provide enough of an alternative to the U.S. to significantly impact the U.S.’ ability to exercise financial power and contribute to global fragmentation that harms the world economy.

Measuring geoeconomic pressure is inherently challenging because many threats never materialize once the targeted party complies, leaving little visible evidence. Moreover, the nuanced phrasing often obscures the measure, making it more difficult for traditional NLP approaches to capture these subtle signals.

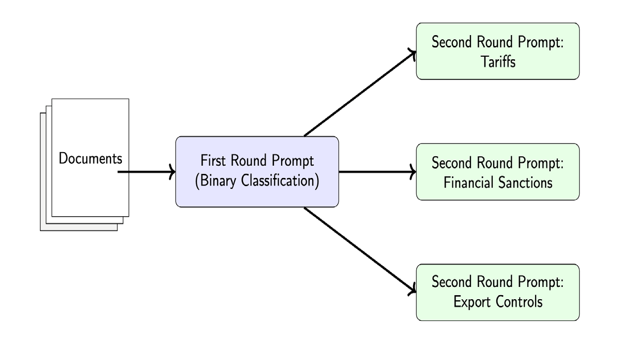

LLMs are more suited to this task as they can provide sophisticated analysis of temporal distinctions and discussions of context. We take a multi-step approach in measuring whether firms are affected by geoeconomic pressure, the nature of the pressure, and, finally, how they respond to this pressure (Figure 4).

A first-stage prompt is applied to the entire text corpora to identify the subsample of firms that are affected by geoeconomic pressure at all. A second-stage prompt is only evaluated on the subsample identified by the first-stage prompt—to avoid running the more computationally heavy inference on hundreds of thousands of firm-level documents.

Running the first-step procedure with Llama 3.3, we identify around 30,000 documents where these issues are discussed. In the second step, we run more detailed second-stage prompt on the documents flagged in the first stage. We use three versions of this longer second-stage prompt, which are all run independently: one for export controls, one for tariffs, and one for financial sanctions.

Figure 4. Multi-step LLM prompting procedure

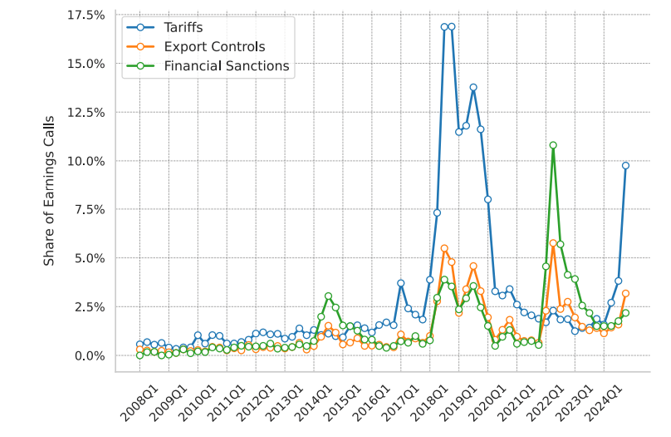

Figure 5 plots the results of the first-stage prompt: the share of earnings calls which discuss an impact of export controls, financial sanctions, or tariffs on firm business or firm decisions. We observe spikes for each of the three tools around well-known episodes when geoeconomic pressure was applied or anticipated. There is a noticeable increase in tariff discussion during the U.S.-China trade war of 2018-19, with an even greater spike during the current trade war. Export controls and financial sanctions are most elevated around the 2022 invasion of Ukraine. We also see smaller spikes in sanctions prevalence following Russia’s invasion of Crimea in 2014 and a spike in tariffs discussion around Trump’s first election in late 2016.

Figure 5. Geoeconomic pressure: aggregate trends in earnings calls

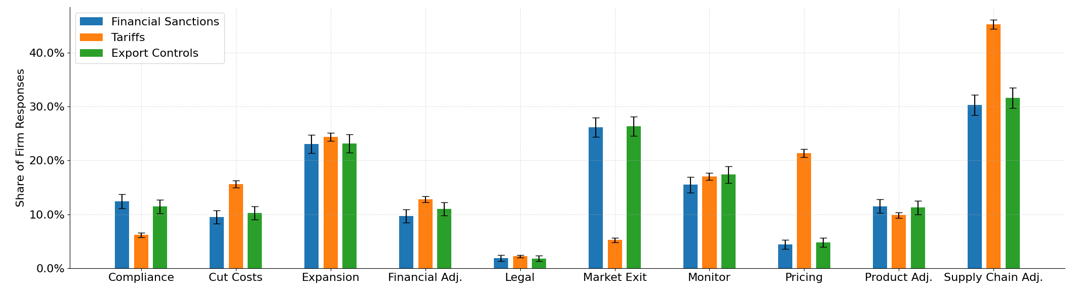

We observe firms’ self-reported responses to different types of pressure. Figure 6 plots firm responses, categorized into ten distinct actions, for every earnings call in which firms report being affected by either current or anticipated geoeconomic pressure. Firms are most likely to exit a market under financial sanctions and export controls but are far less likely to exit in response to tariffs. By contrast, changing pricing strategy and supply chain adjustment is more common under tariffs than under financial sanctions or export controls. Other responses, like monitoring geoeconomic conditions and expanding business activities, have similar magnitudes of firm response across types of pressure.

Figure 6. Firm responses to pressure, by instrument

We track the ongoing trade war to analyze how firms based in the United States and those in the rest of the world adjusted their business decisions in response to tariffs in 2025. We consider all firms holding earnings calls during this period, combining responses related to both current and anticipated future tariffs.

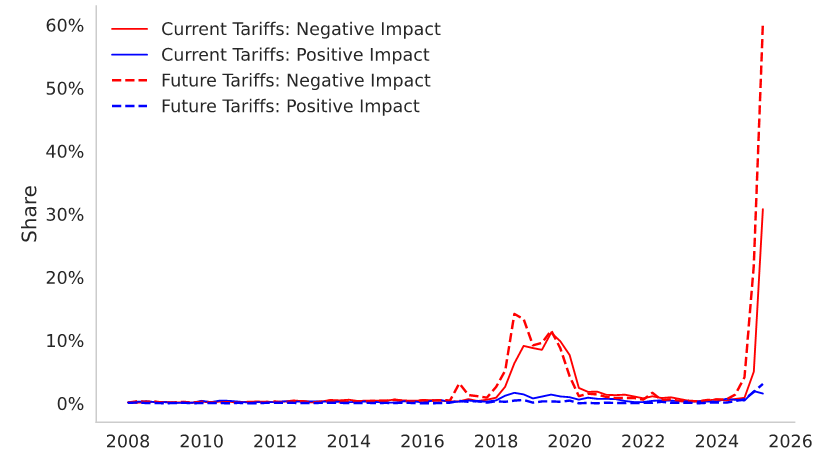

In Figure 7, we first decompose the share of American firms reporting effects from current or anticipated tariffs into firms which report a negative impact and firms which report a positive impact. In the second quarter of 2025, following the “Liberation Day” tariff announcement, about 60% of American firms report being negatively affected by the prospect of future tariffs—a level substantially above the 10-15% of American firms negatively affected during the peak of the U.S.–China trade conflict in 2018–19. In the same quarter, over 30% of American firms report negative effects from tariffs currently in place.

Figure 7. Self-reported effects of tariffs on American firms

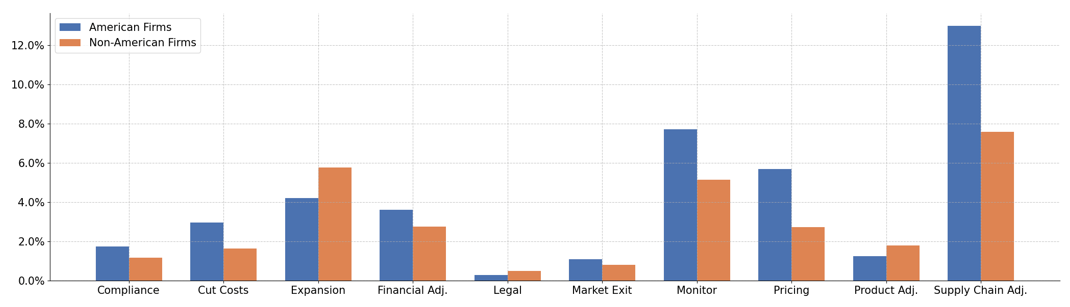

Figure 8 highlights some key takeaways about firm actions in response to the trade war. Nearly 15% of U.S. firms reported plans to adjust their supply chains due to tariffs, a higher proportion than among non-U.S. firms. Similarly, a greater share of American firms indicated intentions to adjust pricing strategies in response to tariffs. By contrast, non-American firms were more likely to report expanding in response to tariffs in 2025.

Figure 8. Responses to tariffs of American and non-American firms, 2025

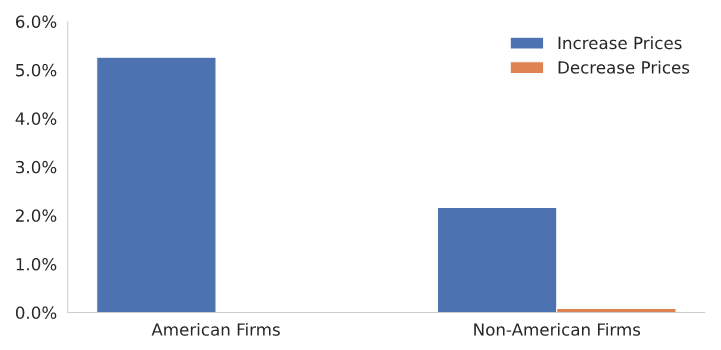

Figure 9 gives the direction of these pricing adjustments. Over 5% of U.S. firms reported plans to raise prices in response to current or anticipated tariffs, compared to just above 2% of firms from other countries. This is a large outlier value, as less than 0.1% of firms reported changing their prices for any reason in the two years prior to 2025. Conversely, only a negligible share of firms, regardless of location, indicated intentions to lower prices. Further research is ongoing to identify the underlying factors driving these pricing decisions, and we plan to update these results with high frequency to track ongoing developments in the trade war.

Figure 9. Price changes by American and non-American firms, 2025

We provide an interactive and frequently updated version of our results and data on the GCAP Data Hub. Visit the Geoeconomic Monitor to track firms reporting being affected by various types of geoeconomic pressure.

U.S., all Euro Area countries, Canada, Australia, New Zealand, Japan, Sweden, Norway, Great Britain, Denmark, Switzerland, Taiwan, and Korea.

China, Russia, Belarus, Syria, and Iran.