European firms have to drastically reduce their greenhouse gas emissions to reach the EU target of 55% emission reduction by 2030 and carbon neutrality by 2050. In this policy brief, we examine the interplay between debt finance and changes in emissions over the period 2013-2019 for around 4,000 firms subject to the EU Emissions Trading System (ETS) and responsible for 22% of the EU’s emissions. We find that leverage is a double-edged sword. Up to a certain point, firms with higher leverage or who increase their leverage – possibly to finance green investment – have lower emissions in subsequent years. But when leverage exceeds about 50%, further increases are associated with worse transition performance. Our analysis also sheds light on the existence of a group of firms that appear too indebted to transition towards low-carbon technology, even following a steep increase in the cost of their emissions. We discuss the policy implications of our findings in relation to the EU ETS and the availability of green debt finance.

With the European Green Deal and the Fit-for-55 plan, the European Commission set the goal to reduce the EU’s greenhouse gas emissions (GHG) by 55% by 2030 and to reach carbon neutrality by 2050. Financing is central to achieving such emission reductions. In this regard, it is important to understand how European firms can finance investment in the adoption of low-carbon technologies, recognising that debt is their primary source of external financing and that they may already be highly leveraged.

This is especially relevant for carbon-intensive firms subject to the EU Emissions Trading System (ETS), which was introduced in 2005 as a key policy tool for reducing emissions. This system imposes a cap on emissions of carbon-intensive economic activities in Europe and incentivises emissions reduction by decreasing the cap every year, thereby putting a price on the emission allowances which can be traded across firms. Firms subject to the EU ETS therefore need finance to invest in clean technologies to reduce emissions without compromising their economic activity or paying large amounts for emission allowances. Since firms subject to the EU ETS are mostly non-listed and heavily reliant on debt financing, understanding the firm-level relationship between debt dynamics and carbon emissions is crucial.

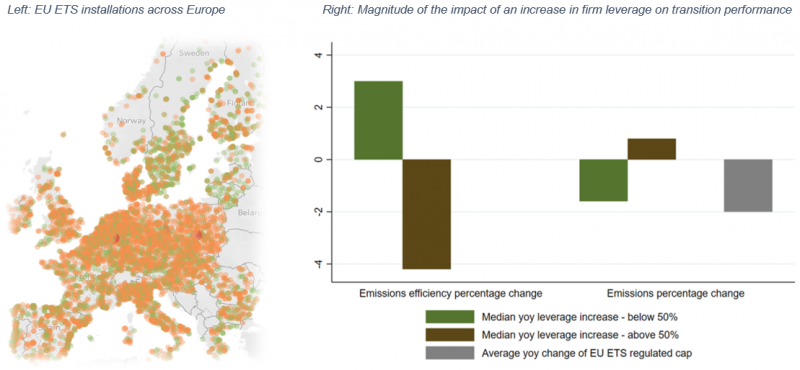

Our research (Carradori et al, 2023) investigates this relationship empirically over the period 2013-2019 for nearly 4,000 firms subject to the EU ETS and representing 22% of the EU’s total GHG emissions. We construct a novel firm-level dataset using observations of the European Union Transaction Log (EUTL) on the verified GHG emissions of installations subject to the EU ETS. The emissions of each installation subject to the EU ETS are verified by a third party; hence they are more reliable than the self-reported or estimated emissions used in much of the green finance literature. We map installations (see Figure 1 left-hand panel) to their owners through national identification and trade registry numbers to obtain our final sample of firms.

We find that leverage – as measured by the debt to assets ratio – is a double-edged sword. Up to a leverage ratio of around 50%, firms with higher leverage or who increase their leverage have both lower emissions and higher emission efficiency (i.e., revenues per unit of emission) in subsequent years. But beyond that point, further increases in leverage are associated with worse transition performance. We also exploit the introduction of the new ETS directive in March 2018 and the related increase in carbon prices to show that there is a group of firms that appears too indebted to transition to low-carbon technology, even following a steep increase in the cost of their emissions. Overall, our results highlight an important role of debt finance in facilitating firms to reduce their carbon emissions. From a policy perspective, this potentially points to the value of deepening green bond and green loan markets so that highly indebted firms can still obtain funding to invest in low-carbon technology.

The literature on corporate debt and investment documents two opposing forces shaping the relationship between leverage and investment. Firms can benefit from corporate debt financing through tax advantages and reduced agency costs (Modigliani, Miller, 1958, 1963; Ross, 1977; Grossman and Hart, 1982). This incentivises firms to take on more debt to finance profitable investments. At the same time, high levels of existing indebtedness may constrain a firm’s capacity to invest. This is because highly leveraged firms may find it more difficult or costly to raise new external financing and because they may need to direct a higher share of any debt financing, they receive towards covering debt servicing costs (Myers, 1977). These two opposing forces suggest an inverted U-shape relationship between leverage and investment. But given that investment in the adoption of clean technologies is central to the emission reduction of firms subject to the EU ETS, this would imply that there is also an inverted U-shape relationship between the leverage of firms subject to the EU ETS and their transition performance. In particular, highly indebted firms may struggle to make the necessary investments in low-carbon technologies to reduce their emissions.

We test the relationship between leverage and transition performance empirically by relying on two proxies for the latter: absolute emissions and emission efficiency, defined as revenue generated for each unit of emissions (the inverse of emission intensity). We examine the period 2013 to 2019 – prior to the onset of the Covid-19 pandemic which distorted both firms’ emissions and their leverage. Results from panel regressions suggest that there is indeed an inverted U-shape relationship between the level of transition performance of a firm and its leverage, with leverage ratios beyond about 50% starting to be associated with higher emissions and worse emission efficiency. We also find that an increase in leverage is associated with an increase in transition performance in subsequent years when leverage is below 50% but a reduction in transition performance beyond that point. These results are economically significant. For example, increases in leverage corresponding to median yearly leverage changes are associated with emissions of firms with leverage below 50% decreasing by 1.6% on average and those of firms with leverage above 50% increasing by 0.8%. These results are illustrated in Figure 1 (right-hand panel), which also shows the corresponding results for emission efficiency and compares these results to the yearly average change of the EU ETS cap.

Figure 1: EU ETS installations across Europe and Magnitude of the impact of an increase in firm leverage on transition performance

Notes: Left hand side: Location of installations subject to EU ETS carbon market in 2019 studied in the sample across Europe. Green dots are installations with free EUAs in excess of their emissions, vice versa for orange and red dots. Right hand side: Economic magnitude of the relationship between transition performance and an increase in leverage equal to the median yearly leverage change computed over the subsample of highly indebted firms between 2013 and 2019, in brown, and between transition performance and an increase in leverage equal to the median yearly leverage change computed over the subsample of firms with leverage below 50% between 2013 and 2019, in green, compared to the yearly average reduction in the emissions’ cap imposed by the EU ETS between 2013 and 2019, in grey.

If high indebtedness constrains firms’ ability to reduce their emissions, we should observe that after a quasi-exogenous shock that increases the cost of emissions, highly indebted firms should struggle more than other firms to improve their transition performance. We investigate firms’ response to the steep increase in the cost of emission allowances which quickly followed the introduction of the March 2018 amendment of the EU ETS Directive that set the ground for phase 4 of the ETS (2021 to 2030).1 This introduced a more stringent cap on emissions and increased the credibility of the EU ETS. Prior to this regulatory shock, emission allowance prices had remained close to their previous medium-term average levels, supporting the assumption that the policy change was largely unexpected.

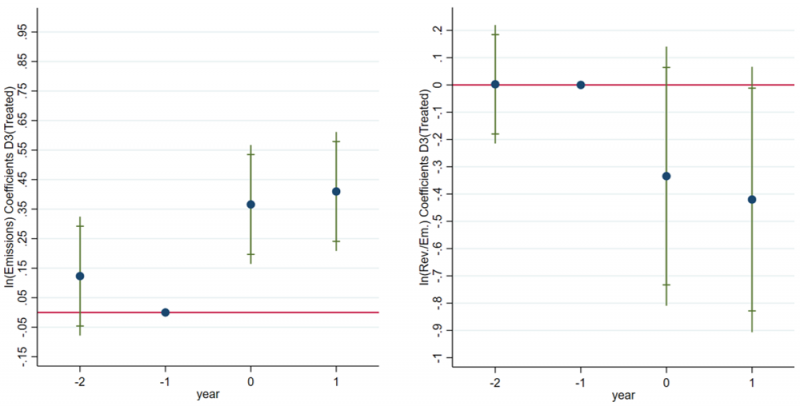

We apply a difference-in-differences approach with the treatment group in our more conservative specification including firms with leverage above 75% and a negative cumulative EU Allowances (EUA) balance in the year prior to the event, implying that they would need to buy additional EUAs in 2018 to cover their excess emissions. The control group comprises firms that also had a negative cumulative EUA balance in the year prior to the event but with leverage below 25%. This setup allows us to exclude possible confounding effects around the 50% leverage threshold implied from the panel regressions. We find that following the 2018 event, highly leveraged firms exposed to the price increase saw worse transition performance than other firms, despite both groups exhibiting similar emission trends prior to the shock (see Figure 2). This finding, which is highly robust to different specifications, provides strong identification that high leverage does indeed hamper firms’ efforts to cut their carbon emissions.

Figure 2: Visual inspection of validity of parallel trend assumption showing the change in emissions (left panel) and emission efficiency (right panel) of treated firms between 2016 and 2019 relative to control firms, and relative to the year prior to the event (2017) with 90% and 95% confidence bands.

Our results are consistent with the narrative that firms invest in the adoption of green technologies to reduce their emissions. But they may also align with the narrative that carbon pricing encourages firms to invest to relocate emissions outside the EU ETS (carbon leakage). To assess this, we exploit a list of firms identified by the European Commission deemed to be at risk of carbon leakage. We find that almost all of our main results continue to hold in both sub-samples and, in particular, in the subsample of firms not deemed to be at risk of carbon leakage. This suggests that our results are unlikely to be driven by firms who invest to relocate their plants outside the EU ETS rather than in the adoption of low-carbon technologies to improve their transition performance.

Previous research has shown that economies receiving relatively more funding from stock markets than credit markets tend to generate lower carbon emissions (de Haas and Popov, 2023). But debt is the main source of external finance for European firms and it remains vital for investment. Our research highlights that debt financing is important in facilitating the low-carbon transition of firms in high emitting sectors. We show that increasing emission costs under the EU ETS as a cap-and-trade policy instrument is effective in encouraging firms with manageable leverage to undertake the necessary investments to reduce their emissions. Therefore, to achieve emissions reduction in Europe at a more sustained pace, extending and further strengthening the EU ETS mechanism is indispensable. At the same time, the EU ETS is not a self-sufficient tool to push all firms on the path of low-carbon transition: instead, there appears to be a group of European firms that is too leveraged to transition.

Given the key role of debt as a source of transition finance, developing and deepening green bond and green loan markets, including via greater transparency and implementation of standards and labels, should help to support the low-carbon transition. This may be especially important for highly indebted companies. Firms with high leverage and low growth prospects may still have to cede the market to more emission-efficient firms. But greater availability of green debt instruments could allow firms with high leverage and high growth prospects to access necessary transition finance more easily, under the commitment that the proceeds are used to invest in low-carbon technology.

Carradori, O., Giuzio, M., Kapadia, S., Salakhova, D., & Vozian, K. (2023). Financing the low-carbon transition in Europe. ECB Working Paper Series No 2813.

De Haas, R., & Popov, A. (2023). Finance and green growth. The Economic Journal, 133(650), 637-668.

Grossman, S. J. and Hart, O. D. (1982). Corporate financial structure and managerial incentives. In The economics of information and uncertainty, pages 107–140. University of Chicago Press.

Modigliani, F. and Miller, M. H. (1958). The cost of capital, corporation finance and the theory of investment. The American economic review, 48(3):261–297.

Modigliani, F. and Miller, M. H. (1963). Corporate income taxes and the cost of capital: a correction. The American economic review, 53(3):433–443.

Myers, S. C. (1977). Determinants of corporate borrowing. Journal of financial economics, 5(2):147–175.

Nordhaus, W. D. (1991). To slow or not to slow: the economics of the greenhouse effect. The economic journal, 101(407):920–937.

Ross, S. A. (1977). The determination of financial structure: the incentive-signalling approach. The bell journal of economics, pages 23–40.

Directive (EU) 2018/410 of the European Parliament and of the Council of 14 March 2018 amending Directive 2003/87/EC to enhance cost-effective emission reductions and low-carbon investments, and Decision (EU) 2015/1814 (OJ L 76, 19.3.2018, p. 3).