The outbreak, which brought daily life to a standstill, was a financial storm for households across the globe. In Germany, many employees went to short-time work, while others suffered from unemployment during the pandemic lockdown. Thanks to relatively cautious private consumption compared to household income during regular times, German households are financially resilient to income shocks by and large. Besides, high saving rates and generous unemployment and short-time work benefits help many Germans to overcome income shock triggered by the first corona shutdown. That said, single parents in Germany are particularly vulnerable and will be able to cover their expenses like in regular times up to four months at most if they face short-time work or unemployment.

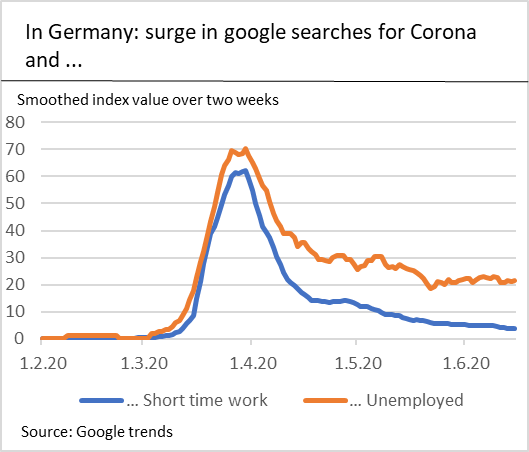

The sudden and dramatic downturn in economic activity due to shutdowns, stringent social distancing measures, or border closures hit real economy hard in Germany, like anywhere else. To avoid potential bankruptcies, many firms reduce staff costs by sending employees to short-time work. To be specific, more than 750 thousand companies introduced short-time work, and a total of 10 million employees were sent home in Germany. Comparing this with around 1 million employees, which went to short-term work during the financial crisis or about 1.7 million after the German reunification, reveals the magnitude of the current crisis well. Even more, estimates point out that one in five companies had already reduced their headcount since the corona outbreak. The unemployment rate increased by 0.7 pp to 5.8% in April and to 6.1% in May. Put differently, an additional 490 thousand people become unemployed just in two months. Google searches present this trend from the employees’ side well. In March and April, there was a massive jump in combined searches for Corona and short-time work, as well as Corona and unemployment. While short-time work searches are normalized somewhat, the unemployment searches related to Corona are persistently high. Several households are in the middle of the aftershock, most probably. The unimaginable bump to job market resulted in considerably less disposable income in months and years to come for many Germans. Even without an external shock, some German families have a hard time making-ends-meet and are vulnerable to income fluctuations. Now, the sudden nature of the outbreak gave some very little time to adjust to the new normal, and financial resilience of German households require a closer look.

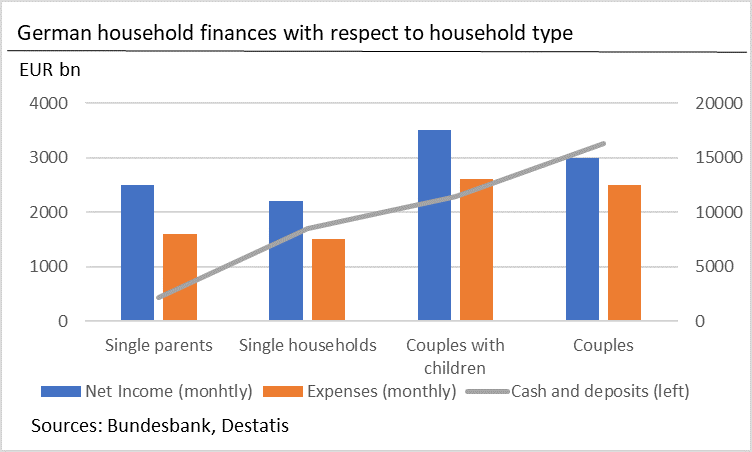

In short, financial resilience is “the ability to cope financially when faced with a sudden fall in income or unavoidable rise in expenditure through ill-health, job loss, etc.” (ONS, 2020). A quick look to average monthly income in this vein provides first insights on the viability of German household finances to external shocks. Survey responses point to significant differences concerning household type (Federal Statistical Office, 2018). In 2018, single households in Germany had a net income of EUR 2,200 on average. Single parents meanwhile had some EUR 2,600 of net income. Couples without and with children had around EUR 4,400 and EUR 5,600 per month, respectively. For a complete view of financial resilience, income, and private consumption should be evaluated together.1 In 2018, the monthly expenditure of single Germans was at around EUR 1,700. For single parents, the same figure stood at EUR 2,200. Single parents especially seem to have a small buffer to a sudden fall in their income. Couples spend EUR 3,800 per month on average if they have children in the household. Still, significantly higher expenses of German couples seem to be compensated by higher incomes.

Low-income individuals might face difficulties in adjusting their expenses in response to an income-related liquidity constraint, i.e., they cannot reduce sticky costs quickly (Misra and Surico, 2014). Therefore, the composition of expenses sheds further light on the financial resilience. Of the total expenses of singles and single parents, around 60-65% are on food, health, telecommunications, and rent in Germany. These expenses cannot be adjusted easily to encounter an income shock. For couples, the same figure is at around 50-55%. Therefore, the question is whether German households will be able to cover these expenses during short-time work or unemployment. Short-time working compensation and unemployment benefits come directly from the state. They are both 60-67% of employees’ net wages and are available for up to one year. This implies that couples might still have some flexibility in their finances for up to twelve months as they still have a 10-15% income buffer for unexpected expenses during short-time work or unemployment.2 On the contrary, especially single parents might only be able to cover necessary expenses such as rent, food, etc. During this time, savings can be used to support spending, and to offset potentially unanticipated costs (i.e., health, repairs, etc.).

The absolute value of savings indicates German households’ ability to survive through a prolonged downturn. Median cash holdings of Germans stood at EUR 1,800 and deposits at EUR 9,900 per capita in 2017 (latest date available, Bundesbank, 2019). Put differently, half of the Germans have more than EUR 11,700 in cash and deposits, whereas the other half have less. By contrast, on average, the household’s own EUR 34,700 in cash and deposits. The massive disparity between the median and the average points to significant inequality in savings. Taking the median as a reference, a quick look to savings of different types of households provides further interesting insights. Single parents have only EUR 2,200 cash and deposits, whereas singles have EUR 8,500. Couples with children have EUR 11,400, while couples without children have EUR 16,300 in cash and deposits. The main takeaway is that single parents in Germany might find it particularly challenging to compensate for the loss of income via their savings. To put these arguments into numbers, single parents can cover their expenses like in regular times up to four months at most if they face short-time work or unemployment. After that, they will only be able to cover the essential expenses. Even in short-time employment or unemployment, all other household types might be able to maintain their previous living standards, relying on their high savings, up to twelve months.

All in all, German households are financially resilient to income shocks by and large thanks to relatively cautious private consumption compared to household income during regular times and precautionary savings that they put aside. With generous short-time work and unemployment benefits, they might be able to bridge their finances for up to twelve months. That said, single parents are particularly vulnerable to income shocks. Considering that every fifth person with children is a single parent in Germany, policy measures especially addressing their needs during the lockdown, are essential, i.e., higher unemployment or short-time work benefits for them. In the long run, a prolonged downturn will probably impact the saving behavior of Germans as well. With fear of losing jobs or the rising living costs, households will potentially increase their saving rates and adjust their expenditures downwards in years to come.

Bundesbank (2019). Household wealth and finances in Germany: results of the 2017 survey. Monthly Report, April 2019, pp. 13-43.

Federal Statistical Office (2018), “Income, consumption and living conditions of Germans”.

Misra, K. and Surico, P. (2014). “Consumption, income changes, and heterogeneity: Evidence from two fiscal stimulus programs”. American Economic Journal: Macroeconomics, 6(4): 84–106.

ONS (2020) “Financial resilience of households; the extent to which financial assets can cover an income shock”.

Private consumption does not include expenses such as voluntary contributions to statutory pension and insurance schemes, other transfers made (e.g., cash donations, membership fees), and loan interests. Therefore, the difference between income and private consumption is not per se saving.

Obviously for homeowners, (with or without a mortgage), the income shock is much more manageable as rent makes a large share of monthly expenses.