Disclaimer: This Policy Brief summarises the key results from Baskaya et al (2024) published as BIS Working Paper no 1158. The views expressed in this Brief are those of the authors and do not necessarily represent the views of the Bank for International Settlements.

We analyse how domestic credit and cross-border capital flows respond to price- and quantity-based macroprudential policy (MaPP) measures and capital flow management measures (CFMs) in 39 economies in 2000–2013, and if the level of financial development matters in explaining policy effectiveness. Quantity-based MaPP measures affect total credit and its components, but the effects fade away beyond a certain level of financial development, suggesting that highly developed financial markets provide opportunities to circumvent MaPP measures imposed on banks. Both price- and quantity-based CFMs are effective in slowing down bank inflows with the former effective at all levels of financial development and the latter effective at relatively high levels. Finally, leakage effects exist. For example, tighter overall MaPP measures are associated with larger bond inflows, and tighter quantity-based MaPP measures with larger bank inflows.

After the Global Financial Crisis (GFC) in 2007−09, a large number of central banks and financial regulators in both advanced economies (AEs) and emerging market economies (EMEs) acknowledged the importance of macroprudential policy (MaPP) in securing both domestic financial stability and external stability. In particular, the role of the macroprudential policy has been characterised as increasing the financial system’s resilience by identifying the sources of systemic risk and taking appropriate policy actions. In addition, many central banks and other financial authorities in EMEs have paid attention to capital flow management measures (CFMs) to mitigate the adverse effects of excessive capital flow or exchange rate volatility and secure external stability. Since then, significant progress has been made in designing and implementing MaPP by both AEs and EMEs. Some EMEs continued to use various types of CFM to reduce the volatility of capital flows or exchange rates.

The increased use of MaPP measures and CFMs naturally brought in the question of whether such policy measures were effective in taming excessive growth in credit, asset prices and capital inflows. However, we think that there are still important gaps in research on this question for several reasons. First, many countries implement MaPP measures, in addition to CFMs, which aim at taming excessive capital flows as well as at excessive growth in credit and asset prices. In contrast, the general approach in the literature is to estimate the effectiveness of MaPP measures on financial stability-related outcomes such as credit growth and asset prices without considering the potential effects of CFMs. This, however, potentially generates omitted variable bias for the effects of MaPP measures. Second, despite the acknowledgement of the potential implications of excessive capital flows for financial instability and the potential use of MaPP to mitigate such financial instability risks, the number of studies assessing the effectiveness of MaPP measures is limited. More importantly, such studies usually do not account for different types of CFM.

Using a very detailed cross-country dataset on MaPP measures and CFMs at quarterly frequency, we consider how domestic credit variables and capital flow variables respond to MaPP measures and CFMs. This contrasts with the general practice in the literature which focuses on the policy impact on the dynamics of either domestic credit or capital flows.

Our approach differs from the rest of the literature in that our empirical model simultaneously accounts for the effect of MaPP measures and CFMs on credit dynamics and capital inflows, which is guided by the policy practice, especially in many EMEs. In particular, this approach has the following merits. First, both MaPP measures and CFMs affect total credit as well as the domestic financial conditions of an economy. Therefore, any analysis considering the effectiveness of one type of policy without considering the other has a potential to produce biased results on the effect of policies. Second, when we only consider the effect of CFMs on capital inflows without considering the potential effects of MaPP measures, we may obtain biased results especially for countries which use MaPP to deal with challenges from too much capital inflows or outflows by affecting domestic asset prices or the amount of domestic credit. Finally, although this is an indirect channel, CFMs are often used to moderate the volatility of exchange rates which not only affects capital inflows by non-residents but also indirectly affect domestic credit because change in exchange rates tend to affect domestic financial conditions such as long-term bond yields. All these suggest that a more accurate approach on identifying the effect of CFMs and MaPP measures on credit growth and capital flows requires including both type of policies simultaneously in the regressions. In contrast, in our best knowledge, except Bruno, Shim and Shin (2017) and Das, Kalemli-Ozcan and Gopinath (2022) who focus on different outcomes and/or mechanisms from our analysis, the papers in the literature evaluate the effectiveness of CFMs without considering MaPP measures, or the effectiveness of MaPP measures without considering CFMs.

We also differ from most studies in the literature in the sense that we look at the effectiveness of price-based and quantity-based MaPP measures and CFMs, rather than considering jointly all MaPP measures and CFMs. To our knowledge, very few papers have investigated the issue of the relative effectiveness of price-based and quantity-based measures. Regarding the desirability of price- versus quantity-based tools, Shin (2012) points out that a levy on wholesale/FX-denominated liabilities have the advantage of a price-based measure, but a leverage cap has the drawback of being not price-based and thus being open to circumvention. Recently, Cizel et al (2019) find that quantity-based macroprudential measures have stronger cross-sector substitution effects (from bank to non-bank credit) in AEs.

Finally, we also account for potential differences in the effectiveness of CFMs and MaPP measures with respect to the level of financial development of countries. This is an important margin that needs to be considered for assessing the effectiveness of different policies. As low levels of financial development as typically characterised with a dominant role of the banking sector in the financial system and few alternative ways of finance, one may expect that policies aiming at slowing down credit growth may be more effective compared to a case with higher levels of financial development. In contrast, high levels of financial development may be associated with alternative ways of finance, as a result of which MaPP measures may be circumvented and therefore become ineffective in taming credit growth. Moreover, tighter macroprudential policies can also trigger capital inflows in economies with higher financial development and financial openness. Therefore, given the possibility that a higher level of financial development increases the likelihood of MaPP measures being ineffective because domestic bank credit is substituted with alternative sources of finance, it is important to document whether and how the effectiveness of CFMs and MaPP measures change with the degree of financial development.

We use quarterly data for a sample of 37 economies over the period from Q1 2000 to Q4 2011. The 37 economies include 20 AEs and 17 EMEs. We focus on the impact of various types of MaPP measure and CFM on private non-financial sector credit growth, that is, the increase in borrowing by households and corporates in an economy in the form of loans or bonds and from domestic financial institutions or foreign lenders/investors.

We consider the following six credit variables: (1) total credit to the private non-financial sector; (2) total credit to private non-financial corporates; (3) domestic bank credit to the private non-financial sector; (4) domestic banks’ lending to households; (5) domestic banks’ lending to households who purchase houses; and (6) domestic bank lending to consumers. We call them total credit, total corporate credit, domestic bank credit, household loans, housing loans and consumer loans, respectively.

Then, we consider the following three capital inflow variables: (1) non-resident banks’ lending to all residents in an economy; (2) the amount outstanding of domestic debt securities in US dollars purchased by non-residents; and (3) the amount outstanding in US dollars of international debt securities issued by banks and corporations residing in an economy. We call their growth rate bank inflows. bond inflows and offshore bond issuances, respectively.

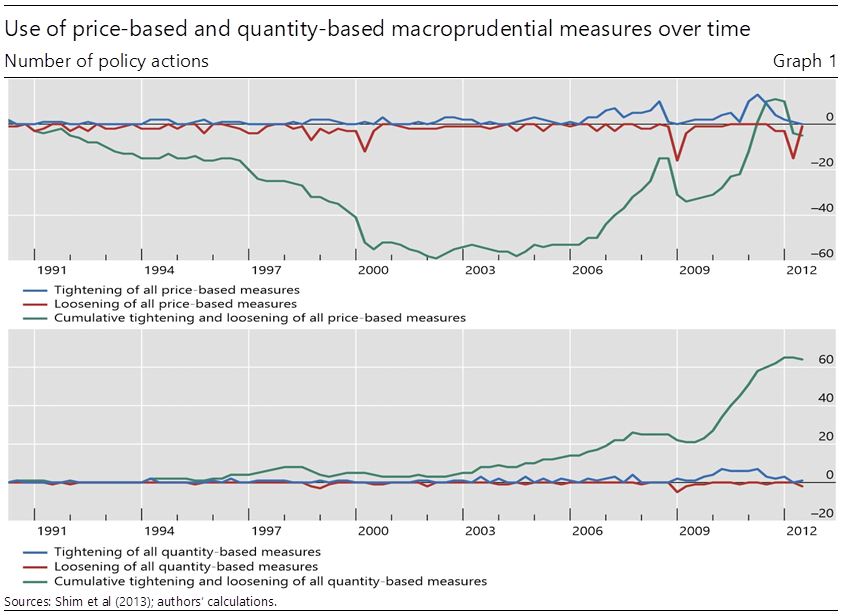

Domestic MaPP measures are obtained from the database in Shim et al (2013), where each tightening action is assigned value +1, each loosening action value –1, and no action value zero. The eight types of policy action recorded in the database can be classified into price- and quantity-based measures. In particular, reserve requirements, liquidity requirements, risk weights, and provisioning requirements are price-based measures, while credit growth limits, loan-to-value limits, debt service-to-income limits, and exposure limits are quantity-based measures. We define an indicator for all price-based MaPP measures as the sum of the indicators for the four price-based tools, and an indicator for all quantity-based MaPP measures as the sum of the indicators for the four quantity-based tools. Between 2003 and 2008, there were more tightening actions than loosening actions. After a sharp increase in loosening actions during the peak of the global financial crisis, these economies overall took more tightening actions than loosening ones after 2009 (Graph 1). By contrast, the economies overall had taken more tightening quantity-based measures than loosening measures from 1990 to 2012, except two brief periods of more loosening actions immediately after the Asian financial crisis of 1997 and during the peak of the GFC.

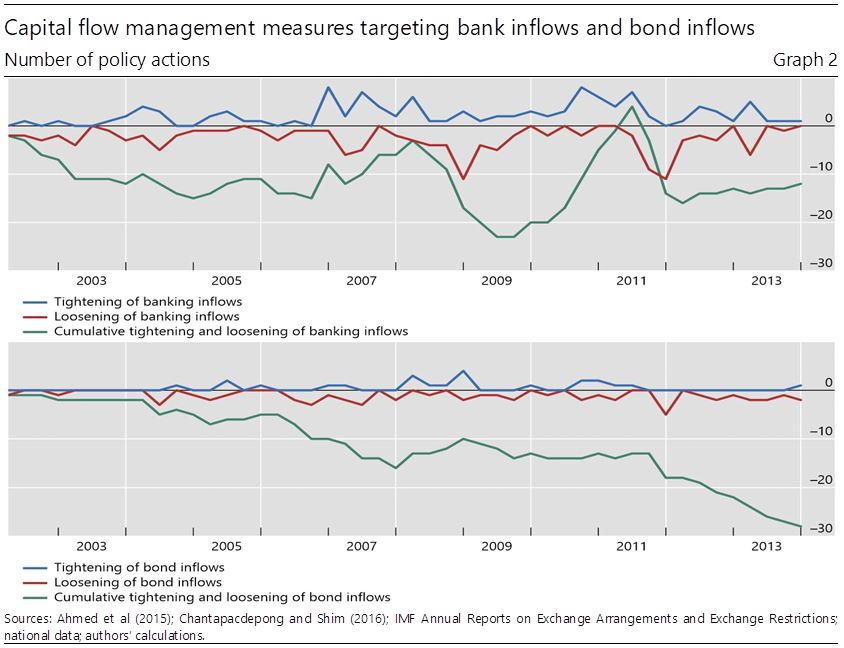

CFMs taken by the economies between Q1 2002 and Q4 2012 are obtained partly from the CFM database on Asia-Pacific economies by Chantapacdepong and Shim (2016) and the authors’ collection of CFM data from various sources. Since we are interested in credit provided by non-residents, we focus on CFMs targeting resident banks’ borrowing from abroad and non-residents’ investment in local or foreign currency bonds issued by residents.

In the quarterly CFM dataset, each tightening action is assigned value +1, each loosening action value –1, and no action value zero (Graph 2). The cumulative tightening and loosening of bank CFMs tend to follow global cycles of risk-on and risk-off phases. By contrast, the cumulative tightening and loosening of bond CFMs tend to show a general trend of loosening over the sample period (with ups and downs reflecting global risk-on risk-off cycles) mainly due to the continuous efforts of domestic bond market liberalisation.

The four types of bank CFMs can be classified into price-based and quantity-based bank CFMs. In particular, quantitative bank CFMs and qualitative bank CFMs are quantity-based measures, while tax-style bank CFMs and holding period-style requirements on bank borrowing are price-based measures. Similarly, the four types of bond CFMs can be classified into price-based and quantity-based bond CFMs. Quantitative bond CFMs and qualitative bond CFMs are quantity-based measures, while tax-style bond CFMs and holding period-style requirements on bonds are price-based measures. When we sum up the indicators for price-based bank CFMs and price-based bond CFMs, we obtain an indicator for all price-based CFMs. Similarly, when we sum up the indicators for quantity-based bank CFMs and quantity-based bond CFMs, we obtain an indicator for quantity-based CFMs.

Finally, to measure a country’s level of financial development in a comprehensive way, we construct our own composite financial development indicators. We first normalise 13 World Bank Financial Development indicators by subtracting mean and dividing by the standard deviation, and then take first principal components. In particular, we consider all three categories of the indicators, ie, depth, efficiency and stability, and construct a composite variable for the level of financial development.

Our four key findings can be summarised as follows.

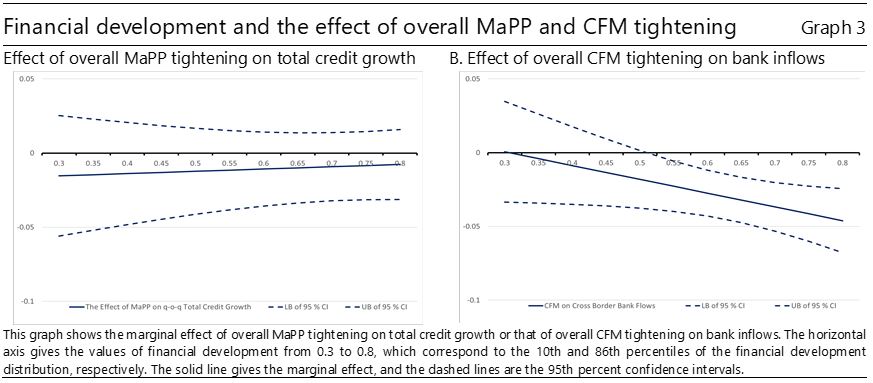

First, the overall MaPP measures (that is, combined measures including both price- and quantity-based MaPP measures) are ineffective in slowing down credit growth for all levels of financial development, whereas the overall CFMs (that is, combined measures including both price- and quantity-based CFMs) are effective on slowing down banking inflows when the level of financial development is higher than the median (Graph 3).

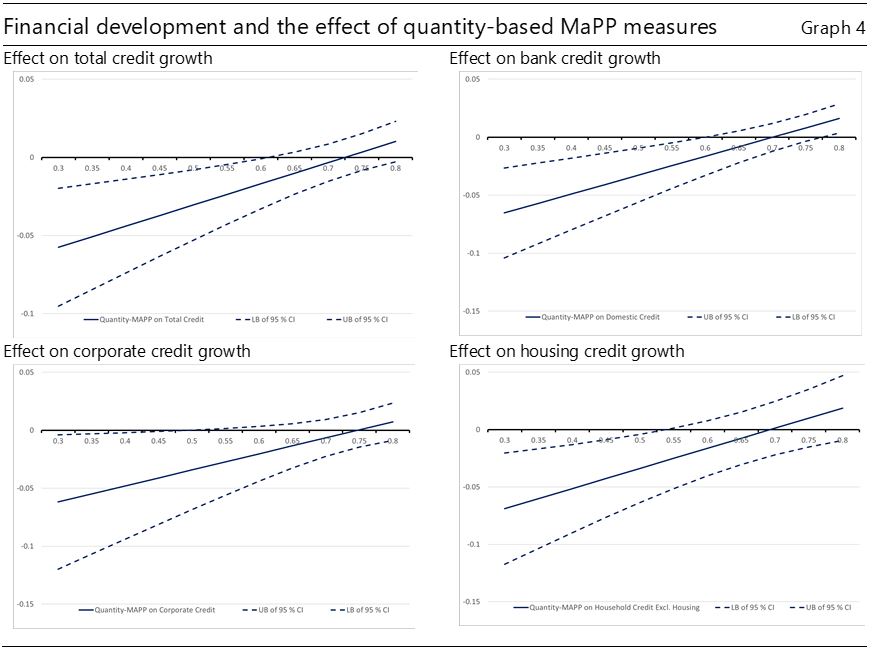

Second, when we consider the impact on credit growth of price- and quantity-based measures separately, we find that tightening quantity-based MaPP measures slows down growth in total credit, domestic bank credit, total credit to the non-financial corporates and housing credit in economies with relatively low financial development, while price-based MaPP are ineffective in moderating the credit growth (Graph 4). In contrast, price-based CFMs are effective in slowing down total credit and total credit to the non-financial corporate sector in economies with high levels of financial development, mainly via its effect on non-domestic bank credit.

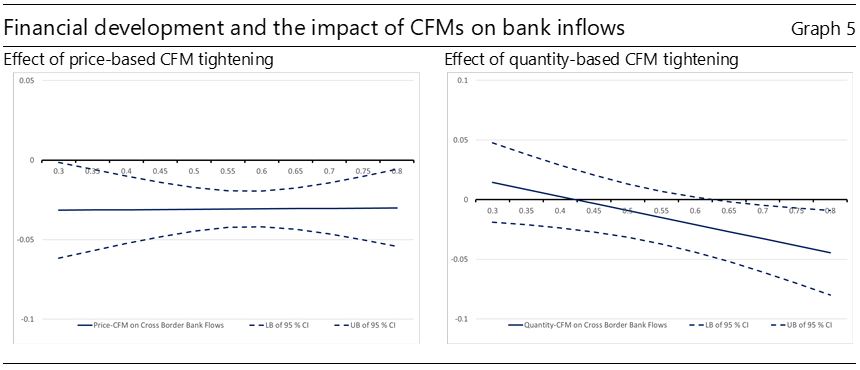

Third, regarding the impact on capital inflows, both price- and quantity-based CFMs are effective in slowing down bank inflows. However, while the effect of the former is independent from the level of financial development, the latter is effective in slowing down bank inflows in economies with relatively high levels of financial development (Graph 5). We further find that the price-based CFMs slow down capital inflows due to offshore issuance of debt securities, yet only if the level of financial development is high.

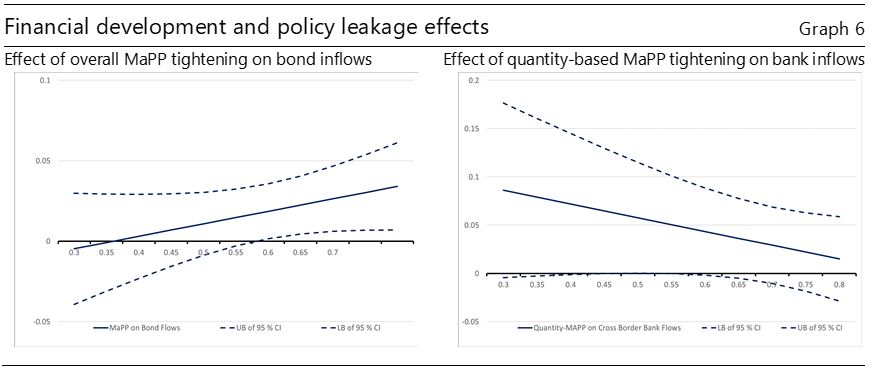

Finally, we find some evidence of policy leakages. In particular, tightening the overall MaPP measures increases bond inflows when the level of financial development is high. This is possibly because a higher degree of financial development is associated with the utilisation of alternative ways of finance, including access to bond financing from abroad which can allow for substituting for domestic credit during times of tighter MaPP measures (Graph 6, left-hand panel). In addition, tightening quantity-based MaPP measures leads to larger bank inflows, which suggests that domestic credit and credit from non-resident banks may have some degree of substitutability (right-hand panel).

Ahmed, S., Curcuru, S., Warnock, F. and Zlate, A. (2015): “The two components of international capital flows”, manuscript.

Bruno, V., Shim, I. and Shin, H. S. (2017): “Comparative assessment of macroprudential policies”, Journal of Financial Stability, 28(C), 183–202.

Chantapacdepong, P. and Shim, I. (2016): “Correlations across Asia-Pacific bond markets and the impact of capital flow measures”, BIS Working Papers, no 472.

Cizel J., Frost, J., Houben, A. and Wierts, P. (2019): “Effective macroprudential policy: cross‐sector substitution from price and quantity measures”, Journal of Money, Credit and Banking, 51(5), 1209–1235.

Das, M., Gopinath, G. and Kalemli-Ozcan, S. (2022): “Pre-emptive policies and risk-off shocks in emerging markets”, IMF Working Papers, no 22/003.

Shim, I., Bogdanova, B., Shek, J. and Subelyte, A. (2013): “Database for policy actions on housing markets”, BIS Quarterly Review, September, 83–95.

Shin, H. S. (2012): “Adapting macroprudential policies to global liquidity conditions”, Central Bank of Chile Working Papers, no 671.