This policy brief is based on S&P Global Ratings Economic Research September 2025.

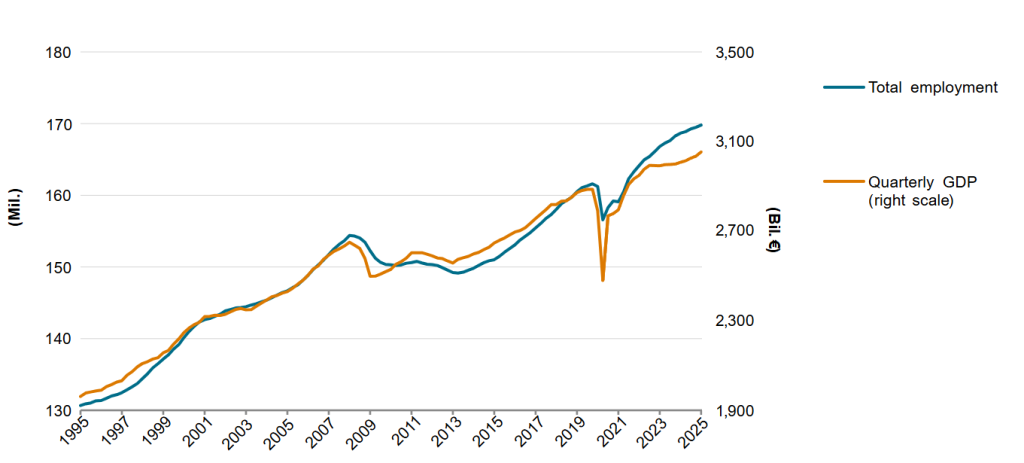

Europe’s labor market continues to show remarkable resilience. More than 169 million people were employed in the eurozone in the first quarter–a new record–while the unemployment rate dropped to a multi-decade low of 6.3% in June. However, economic growth remained subdued amid external headwinds. Ultimately, job creation closely follows wealth creation, but a gap between the two has built up in Europe since late 2022 (see chart below). Initially, we explained this gap as an anomaly, a disequilibrium to be resolved (see “2024: Two recovery anomalies, 2025: Three policy pivots,” published Dec. 18, 2024). As this has not yet occurred, we are investigating why employment dynamics have consistently outperformed economic activity in Europe over the past three years. We aim to assess the risk of a hard landing for the labor market and to identify the implications of a higher labor share in economic growth for interest rates and monetary policy.

Figure 1. The gap between employment and GDP is narrowing, but remains abnormally high

Eurozone GDP versus employment levels

Source: Eurostat, S&P Global Ratings.

Copyright © 2025 by Standard & Poor’s Financial Services LLC. All rights reserved.

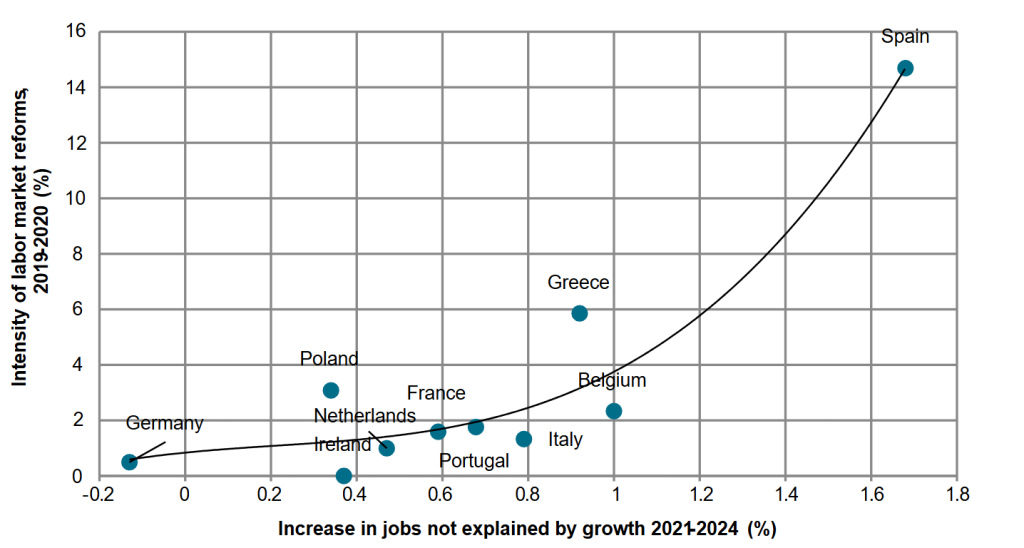

There are several factors contributing to the success of the European labor market. The first of these is structural, largely thanks to reforms undertaken in several European countries in recent years. These reforms are being implemented in anticipation of a more-prevalent ageing population in Europe over the next decade. Financial incentives under the NEXTGEN EU plan, particularly the Recovery and Resilience Facility (RRF), have encouraged reforms. The European Court of Auditors estimates that labor reforms passed by member states recently addressed 40% of EU recommendations fully or mostly. The recommendations cover a broad range of policy areas such as frameworks for contracts and undeclared work, wages and wage settings, skills, vocational education and training, and incentives to work, as well as social inclusion and protection. For example, Spain and Greece’s labor market reforms (both with higher unemployment than the European average) under the RRF, increased job creation in 2021-2024 (see chart).

Figure 2. Labor market reforms passed recently have substantially helped reduce structural unemployment in Spain

Source: S&P Global Ratings. Note: The increase in jobs that cannot be explained by growth is the residual of a standard Okun’s law. We calculated the intensity of labour market reforms as a synthetic indicator, based on the number of reforms implemented in a country and the extent to which these reforms address the issue, as assessed by the European Court of Auditors (see their 2025 report).

Copyright © 2025 by Standard & Poor’s Financial Services LLC. All rights reserved.

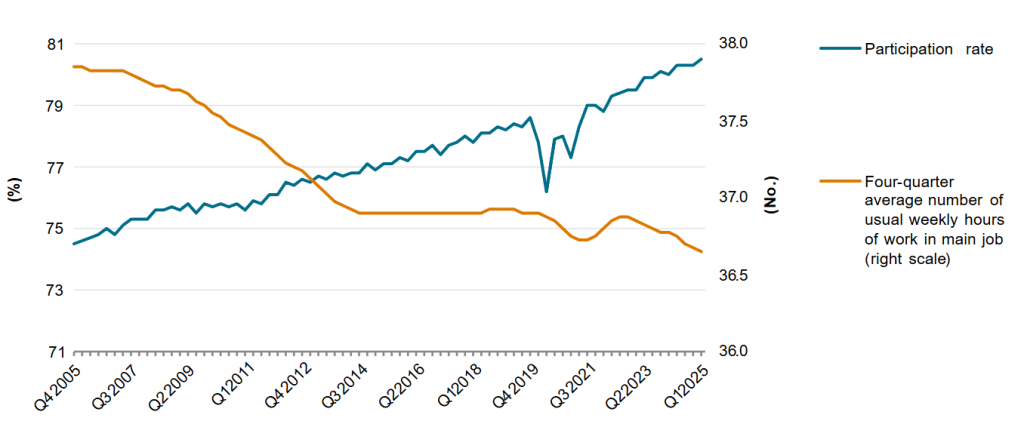

Overall, these labor market reforms have increased the participation of the working-age population. The activity rate (the share of persons aged 20-64 employed and unemployed of the total population in this age group) in the eurozone is at a record 80.6% as of first-quarter 2025. According to an ECB research article, this increase in participation is being driven by seniors and women, particularly in jobs requiring tertiary qualifications (see “Explaining the resilience of the euro area labour market between 2022 and 2024,” ECB website, 2024). Between fourth-quarter 2019 and first-quarter 2025, the employment rate for women increased more than for men. The employment rate for 60-64 year olds (women and men) notably increased.

This participation rate increase in Europe primarily represents a catch-up with other economies, particularly the U.S. and U.K., where it is much higher. It is also taking place against a backdrop of a continuous decline in the number of hours worked per person (see chart below), with a rise in voluntary part-time jobs since the pandemic.

Figure 3. Labor participation rates and number of Hours worked are diverging

Q- Quarter. Source: Eurostat, S&P Global Ratings.

Copyright © 2025 by Standard & Poor’s Financial Services LLC. All rights reserved.

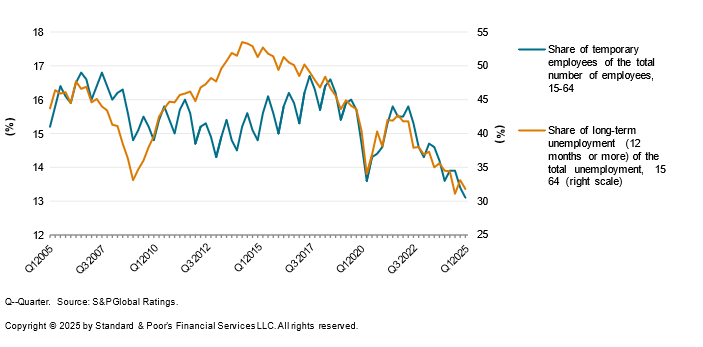

Finally, these labor market reforms are also helping improve the quality of job contracts. The share of employed persons with temporary contracts has decreased. The share of involuntary part-time jobs in total part-time employment is also down and long-term unemployment as a portion of total unemployment has decreased in the eurozone (see chart).

Figure 4. The quality of jobs has increased

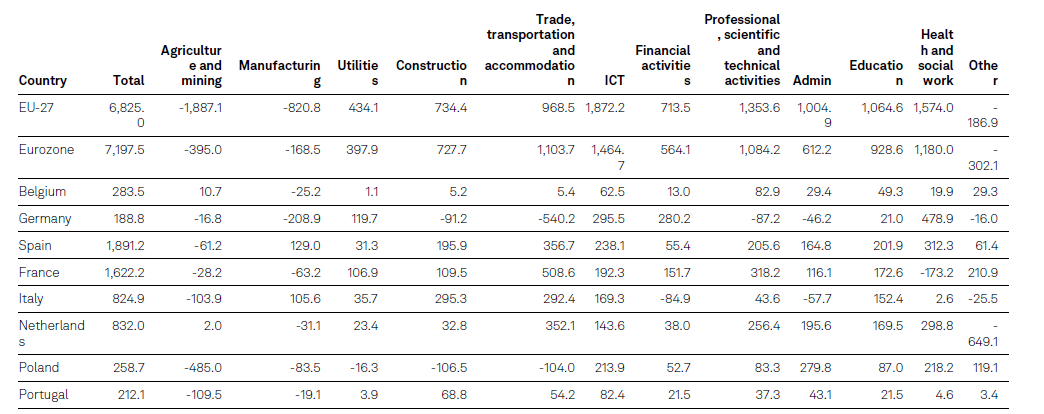

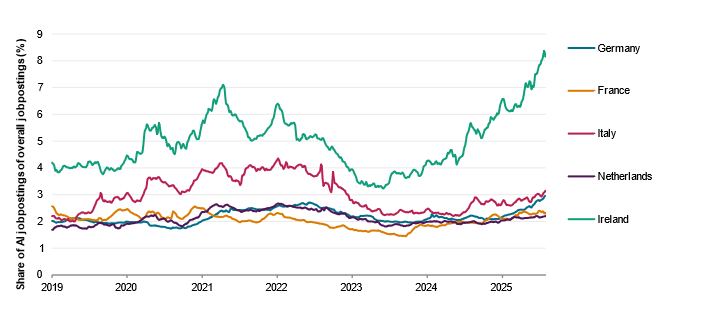

The composition of the labor market is another factor that explains its resilience. Between fourth-quarter 2019 and fourth-quarter 2024, around 7 million additional jobs were created in the eurozone (see table). One in five new jobs is in the information and communication sector, which has created the most jobs in Europe since before the pandemic (1.4 million). In this sector, computer programming, consultancy, and related activities in particular drove the increase. Similarly, according to Indeed Job Postings data, the share of job postings related to AI increased (see chart below). While employees in the euro area’s ICT sector represent around 4% of total employees, jobs related to AI represent between 2% (Netherlands) and 7% (Ireland, an economy with a large ICT sector) of jobs posted online.

Figure 5. Net change in employment since 2019 by country and sector

Absolute change in employment between Q4 2019 and Q4 2024, in thousand persons

Source: S&P Global Ratings.

Copyright © 2025 by Standard & Poor’s Financial Services LLC. All rights reserved.

Figure 6. The share of job postings related to AI is on the rise, especially in Ireland

Source: Indeed Hiring Lab, S&P Global Ratings.

Copyright © 2025 by Standard & Poor’s Financial Services LLC. All rights reserved.

The boom in AI-related jobs in Europe has more than offset the decline in traditional manufacturing jobs (down 169,000 in the eurozone and 82,000 in the EU-27) caused by increased competition from China, especially in the auto sector, and the energy price shock triggered by the war in Ukraine, which led a few manufacturers to relocate some production out of Europe. Some traditional manufacturing jobs have been relocated within Europe—for example, some have moved from Germany to Spain and Italy, two countries with lower labor and energy costs.

More health and social work jobs represent the final aspect of the changing composition of the European labor market. This sector has shown the second highest increase in jobs after ICT since 2019. However, this trend started before the onset of the pandemic. It can largely be explained by the need to reinforce the health system in the context of an ageing population, but other reasons may also be at play. For instance, the development of social work in Germany and Poland could be due to the particular efforts made to integrate migrants after the strong inflows seen in recent years.

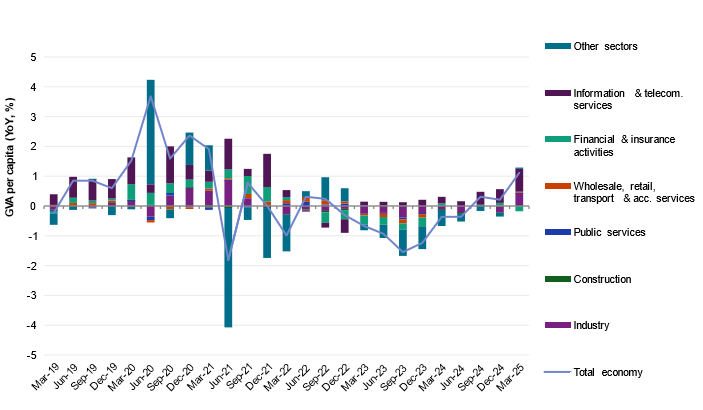

Trying to explain the resilience of the European labor market, we can also look at the employer side. One of the explanations is that employers have been hoarding labor since 2022; in other words, they have hired or retained more people than they need. Our first observation is that such hoarding, which we approximate using fluctuations in apparent labor productivity, is a common feature of the European economy. A trend decline in productivity is common to all sectors of the European economy except ICT (see chart below). The ICT sector differs in that it has added jobs over the past five years while experiencing a continuous increase in productivity.

Figure 7.Eurozone-hourly productivity

Contribution by sector

GVA- Gross value added. Source: Eurostat, S&P Global Ratings.

Copyright © 2025 by Standard & Poor’s Financial Services LLC. All rights reserved.

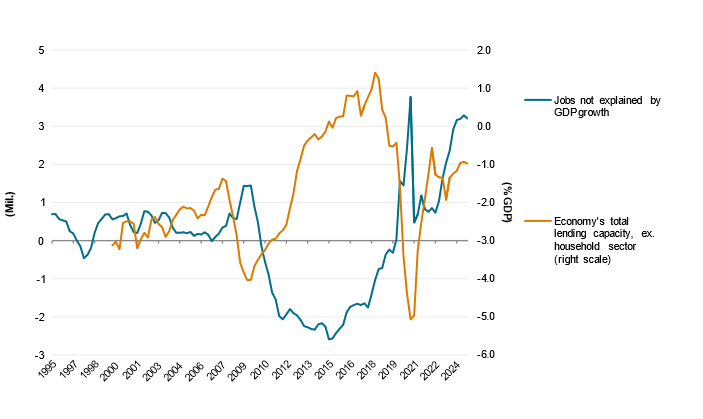

Based on the usual relationship between overall GDP growth and job creation – Okun’s famous law – we estimate that 3.2 million jobs out of 169 million (2%) cannot currently be put down to GDP growth. Our econometrics suggests that these hoarded jobs can largely be explained by the strength of European employers’ balance sheets (see chart below). European companies were able to increase their share of profits (understood macroeconomically as the difference between the gross value added [GVA] deflator and unit labor costs) during the pandemic and the energy price shock of 2022. They were also able to hoard labor in a context of post-pandemic labor shortages, skills mismatches induced by technological change, and an ageing workforce.

This development contrasts with 2010-2015, following the global financial and eurozone debt crises. After being a weak point during these crises – when European companies and governments consolidated balance sheets by putting pressure on the share of wages in costs – the labor market has now become an attractive feature of the European economy. Labor market reforms and the recent drop in real wages have probably contributed to this change in the labor share in the European economy.

Figure 8. The labor market has become a strength of the European economy

Source: Eurostat, S&P Global Ratings.

Copyright © 2025 by Standard & Poor’s Financial Services LLC. All rights reserved.

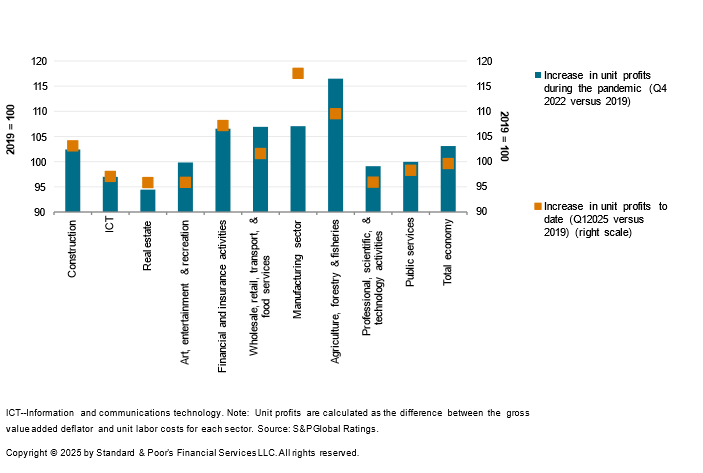

The extraordinary profits built up by European companies during the pandemic and the energy price shock are gradually but unevenly waning (see chart below). Unit profits have diminished by 3.5 percentage points (ppts) since the record highs of early 2022 and are now back to pre-pandemic levels. Other metrics are consistent with this: the gross operating surplus of eurozone non-financial corporates was 38.9% of GVA in fourth-quarter 2024, just 1 ppt below the pre-pandemic long-term average and down from the peak of 41% in 2022-2023. This profit normalization suggests that job creation will be more closely aligned with GDP growth than it was in 2022-2024. Available surveys suggest that profits are only one reason for hoarded labor (see “Bundesbank, monthly report, May 2025: The German economy,” Bundesbank publications). What’s more, the profit buffer remains comfortable, and aggregate demand is expected to rise faster in the coming years, not least because of the German fiscal stimulus and the recent decline in interest rates. This suggests that a soft landing for European labor remains the most likely scenario.

Figure 9. Extraordinary unit profits accumulated during the pandemic and energy price shock are gradually but unevenly waning

Data for the Eurozone economy

An external shock to profitability could derail our baseline scenario. Our corporate research team believes that U.S. tariffs will have a manageable influence on most European companies’ profits (see “The EU-U.S. Trade Deal Reduces But Does Not Eliminate Uncertainty For European Corporates,” Aug. 6, 2025). At a macro level, the impact of U.S. tariffs is smaller than the energy price shock of 2022—and even that did not lead to widespread layoffs. Disappointing returns on AI investment could be another potential risk to watch, given that ICT has accounted for one in five jobs in Europe since 2019.

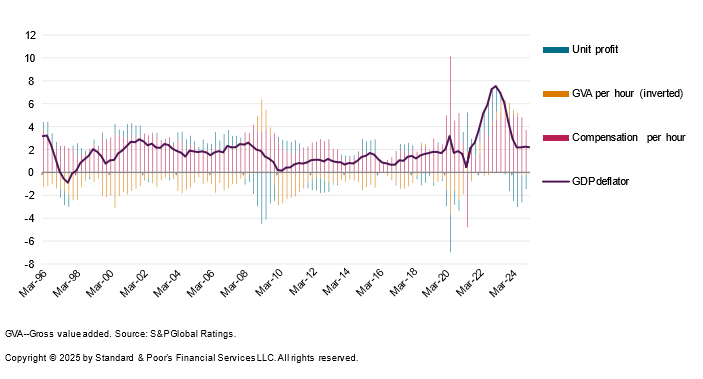

Finally, we have concluded that the ECB has probably finished cutting rates, and that a return to zero or negative interest rates is highly unlikely, absent a severe shock to the system. A high employment rate compared to economic activity suggests wages comprising a higher proportion of gross national income and therefore fueling inflation. the chart below shows that the contribution of wages to inflation has doubled since 2022 compared to the pre-pandemic period.

Figure 10.Wages are contributing twice as much to European inflation than in the decade before the pandemic

Eurozone implicit GDP deflator and contributors

Research contributor: Camille Legrée-Hagbarth

Economic Research: 2024: Two recovery anomalies 2025: Three policy pivots, Dec. 18, 2024.

See, The EU-U.S. Trade Deal Reduces But Does Not Eliminate Uncertainty For European Corporates, Aug. 6, 2025.

“Explaining the resilience of the euro area labour market between 2022 and 2024,” ECB website, 2024.

Bundesbank, monthly report, May 2025: The German economy,” Bundesbank publications).

Labor Market reforms in the national recovery and resilience plans, European Court of Auditors, Special report 10, 2025.