This policy brief is based on HKUST Business School Research Paper No. 2025-193. The views expressed in this paper are those of the authors and do not necessarily represent those of the Bank for International Settlements (BIS).

Abstract

Active exchange-traded funds (AETFs) provide a unique disciplinary mechanism for investors, enabling them to more effectively remove underperforming portfolio managers than traditional mutual funds, primarily due to their distinct feature of allowing short selling of shares. The ability to short AETF shares results in over five times greater flow-performance sensitivity compared to mutual funds, indicating that AETF managers face harsher penalties for poor performance. This mechanism facilitates a more efficient allocation of capital from underperforming to high-performing managers. Our findings suggest that AETFs enhance market efficiency by improving the price informativeness of the underlying stocks and driving poorly performing managers out of the active fund management industry. We also document that AETFs perform significantly better than passive ETFs and mutual funds.

The rapid rise of active exchange-traded funds (AETFs) has transformed the landscape of asset management, with assets under management in equity AETFs skyrocketing from under US$20 billion in 2020 to approximately US$300 billion in 2024. Looking ahead, BlackRock projects that this growth will continue, with assets expected to reach US$4 trillion by 2030. This remarkable growth has prompted inquiries into the factors fuelling the popularity of AETFs and their comparative advantages over traditional investment vehicles like mutual funds (MFs) and passive ETFs (PETFs).

AETFs offer distinct benefits, including tax efficiency and enhanced liquidity, but their unique short-selling feature provides an additional mechanism for disciplining underperforming fund managers. Unlike mutual fund shares, which are not traded on the open market, AETF shares can be shorted, allowing any market participant to take a position against poorly performing managers. This key difference holds AETF managers more accountable for their performance, as any investor can short the AETF and create outflows. This additional, market-based tool for disciplining fund managers contributes to a more efficient fund management landscape.

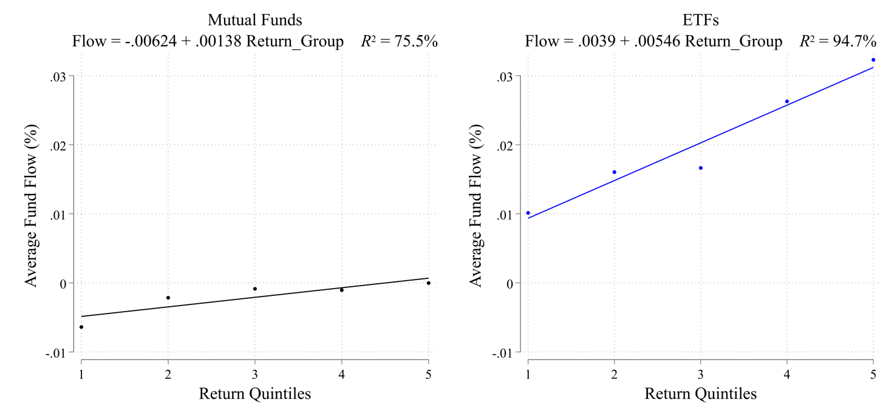

The disciplining mechanism of AETFs operates through short selling, where investors can sell shares short when they anticipate poor future performance. This activity creates outflows from the fund, leading to a decrease in returns. Our research reveals that AETFs exhibit significantly higher flow-performance sensitivity than MFs, with poorly performing AETFs experiencing larger outflows due to the short-selling capability, making the flow-performance sensitivity steeper for AETFs relative to MFs, as shown in Figure 1 where returns are defined as the Fama-French-Carhart four-factor model alphas.

Figure 1. Flow-performance sensitivity of active MFs and AETFs

Note: Authors’ own computations. This figure examines the relationship between average monthly fund flows and portfolio return quantiles for actively managed equity exchange-traded funds (ETFs) and actively managed equity mutual funds (MFs). We classify funds according to Fama-French-Carhart 4-factor alphas where we report the fitted regression lines, accompanied by their respective slope coefficients and intercepts, thereby elucidating the dynamics of fund flows in relation to various performance metrics.

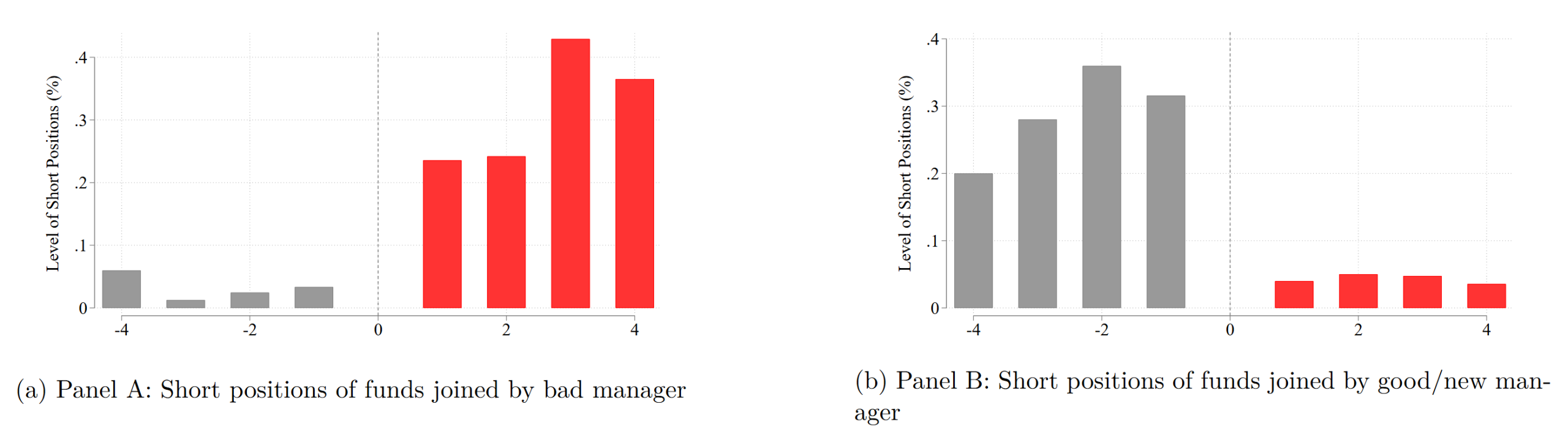

Moreover, we find that short interest in AETFs increases when a poorly performing manager joins the fund and decreases when a better-performing manager takes over, as shown in Figure 2. This active response from investors indicates that AETFs effectively discipline underperforming managers, leading to a higher likelihood of their exit from the industry. Consequently, the overall quality of fund managers improves, as higher-performing managers are more likely to remain in the market.

Figure 2. Dynamics of short positions around manager turnovers

Note: Authors’ own computations. This graph plots the average levels of short positions around portfolio manager turnovers. Portfolio managers are classified as either good or bad based on the median of the three-months accumulated Fama-French-Carhart 4-factors alpha, weighted by the total net assets (TNA) of the funds they managed prior to the turnover event. Notably, a majority (73%) of the joining managers are new managers who have not managed active funds in the past, and investors generally have a non-negative prior about these new managers. Consequently, we group good and new managers together to compare the trend of short positions between good/new managers and bad managers. The figure presents short positions within a ±4-month window surrounding the turnover of managers with distinct panels for bad (Panel A) and good/new (Panel B) managers who are joining.

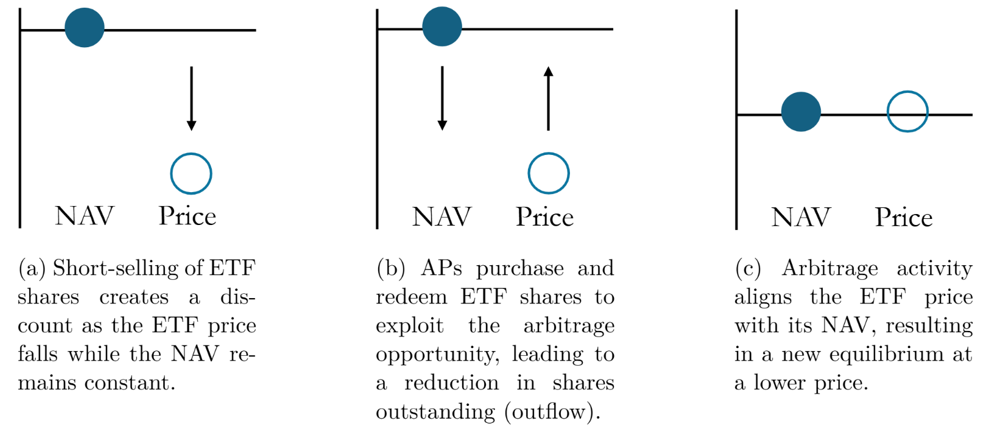

The unique structure of AETFs allows for a more dynamic interaction between market participants and fund managers. When short-sellers predict lower future returns for an AETF, they sell short its shares, which creates outflows from the fund through the ETF arbitrage channel. This process can push ETF prices below their net asset value (NAV), prompting authorized participants (APs) to redeem ETF shares to correct the mispricing, further contributing to the outflows and enhancing the disciplinary effect on managers. This process may be summarised in Figure 3.

Our findings suggest that AETFs not only serve as a disciplinary tool but also enhance market efficiency. Stocks held within AETFs exhibit improved price informativeness, as AETF ownership is positively associated with stock price efficiency. The ability of investors to short-sell AETF shares allows for quicker incorporation of information about the underlying stocks, facilitating a more efficient allocation of capital. This mechanism also helps resolve frictions in active fund management, allowing for a more fluid transfer of capital from underperforming to high-performing managers.

Additionally, our research indicates that AETF managers outperform both mutual fund and passive ETF managers even when accounting for fee structures and other differences. This performance advantage can be attributed to the heightened accountability and discipline imposed by the short-selling feature, which incentivizes managers to achieve better results.

Figure 3. The impact of short positions on fund flows in AETFs

Note: This figure illustrates the impact of short-selling on AETFs and the subsequent arbitrage process leading to outflows and lower returns. The panels depict the sequence of events: (a) Short-selling of ETF shares reduces the ETF price while the net asset value (NAV) remains unchanged, creating a discount. (b) Authorized Participants (APs) exploit this arbitrage opportunity by redeeming ETF shares, resulting in a decrease in shares outstanding (i.e., an outflow). (c) The arbitrage activity drives convergence of the ETF price and NAV to a new equilibrium at a lower price level.

The unique structure of AETFs positions them as effective disciplinary devices within the asset management industry. By enabling investors to short-sell shares, AETFs enhance accountability among fund managers and contribute to the overall efficiency of the active fund management landscape. This dynamic encourages a higher standard of performance among managers and allows for a more responsive market environment. As the popularity of AETFs continues to grow, understanding their role as a market-based solution for disciplining underperforming managers will be crucial for investors and industry participants alike.